LayerZero Acquires Stargate as DAO Approves $110 Million Deal

- Main event brings leadership changes and key financial shifts.

- Tokens converted to LayerZero’s $ZRO.

- $ZRO experiences market volatility after the acquisition.

LayerZero’s acquisition of Stargate was approved by nearly 95% of DAO members, marking a $110M deal that dissolves the Stargate DAO. $STG tokens are converted to $ZRO, indicating a shift in DeFi cross-chain governance.

The acquisition of Stargate by LayerZero, approved by nearly 95% of Stargate DAO participants, represents a landmark $110 million deal within the decentralized finance (DeFi) ecosystem. The decision results in the conversion of $STG tokens to LayerZero’s $ZRO, marking significant changes in DeFi governance.

Led by LayerZero Labs and its CEO, Bryan Pellegrino, the initiative sees all Stargate governance tokens converted to $ZRO, with LayerZero assuming full operational control. This shift includes a reallocation of protocol revenues and governance structures. Bryan Pellegrino noted, “Stargate is an immediate revenue-generating asset… [The deal is] a historic milestone accelerating value transfer across chains.”

Impacts of the acquisition extend through the DeFi sector, as institutional interest in blockchain interoperability grows, evidenced by rival offers such as Wormhole’s $120M bid. The speed of the process attracted criticism from some stakeholders. Hart Lambur, Co-founder of Across, commented, “Rushing benefits no one.”

This transaction prompts shifts in total value locked within DeFi platforms, as Stargate’s liquidity transitions to LayerZero. Analysts anticipate changes in liquidity provider strategies, reflecting new governance dynamics in cross-chain infrastructures.

The transition also affects $STG and $ZRO market activities, with $ZRO experiencing volatility following the announcement. The deal sets a new precedent in decentralized protocol acquisitions, underlining DAO governance power in financial decisions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

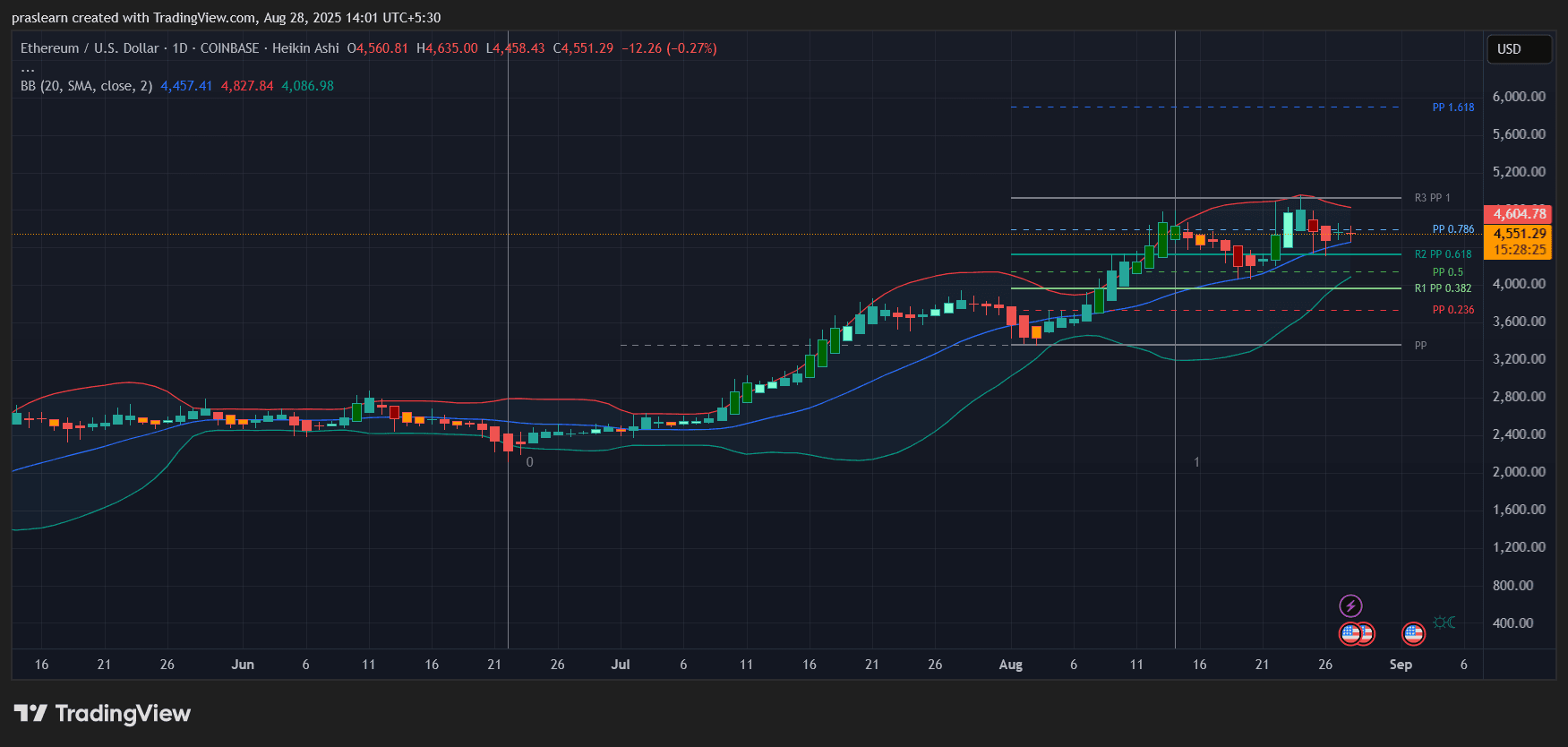

ETH Inflows Smash Bitcoin: Price Breakout Coming?

INJ +217.72% in 24Hr Amid Volatile Short-Term Price Fluctuations

- INJ surged 217.72% in 24 hours to $13.62 on Aug 28, 2025, followed by a 747.79% seven-day drop. - Analysts attribute volatility to on-chain activity, tokenomics changes, and shifting market sentiment. - Despite a 310.61% monthly gain, INJ fell 3063.2% annually, highlighting speculative momentum over intrinsic value. - Technical indicators confirm high volatility, with sharp spikes and reversals typical of leveraged crypto assets.

S Coin's Strategic Position in the Altcoin Recovery Amid Fed Easing

- Fed's dovish pivot boosts risk assets as rate cuts loom, with 50% chance of September 2025 easing. - Ethereum's 41% August surge and Dencun upgrades drive altcoin momentum, with S Coin (S) emerging as strategic play. - S Coin's $650M TVL surge, FeeM model, and Ethereum alignment position it for capital inflows amid macro-driven crypto reallocation. - Institutional ETFs holding 8% ETH supply and S Coin's $0.3173 price consolidation highlight market structure shifts. - Technical indicators suggest S Coin c

Solana News Today: Solana's Rocket Ride: Why Bulls Are Betting Big on the Next $250 Push

- Solana (SOL) surges past $208, hitting 13.8% weekly gains with $112.66B market cap and record $13.08B open interest. - Technical indicators (RSI 57.93, positive MACD) and DEX volume spikes ($7.1B) signal strong bullish momentum and ecosystem growth. - Robinhood micro futures and Pantera's $1.25B Solana-focused fund drive retail/institutional liquidity and price stability. - Bulls target $213-$250+ as key resistance, but risks include potential pullbacks below $200 and delayed SEC ETF approvals.