Metaplanet Acquires 775 BTC, Expands Holdings to 18,888

- Metaplanet’s Bitcoin acquisition strategy strengthens its market position.

- Expansion marks a significant BTC holding milestone for Asia.

- Financial implications underscore confidence in digital assets.

Metaplanet Inc. has acquired 775 more Bitcoin, increasing its holdings to 18,888 BTC, reinforcing its position as Japan’s leading corporate Bitcoin holder.

This acquisition highlights the company’s aggressive treasury strategy, aligning with global trends in using Bitcoin as a reserve asset.

Metaplanet Inc. has expanded its Bitcoin holdings to 18,888 BTC following an acquisition of 775 Bitcoin worth approximately $93 million. This move reinforces its commitment to integrating digital assets into its corporate treasury strategy.

The acquisition positions Metaplanet as Japan’s leading Bitcoin holder, emulating strategies employed by companies like MicroStrategy. The purchase reflects a broader trend of corporations accumulating Bitcoin as a reserve asset, impacting investor confidence. You can explore Metaplanet’s Bitcoin treasury holdings overview for more insights into their strategy.

This significant increase in Bitcoin holdings is expected to influence investor sentiment positively, highlighting Metaplanet’s commitment to digital asset integration. The acquisition aligns with the company’s broader Web3 and blockchain innovation strategy. “Metaplanet’s total BTC is valued at approximately $2.18B after this buy.”

The financial ramifications of Metaplanet’s strategy include a substantial increase in its market capitalization. Market analysts view this as a potential catalyst for further corporate investment in Bitcoin, which could support Bitcoin’s value stability.

Metaplanet’s goal to amass 21,000 BTC by 2026 may bolster its strategic market advantage. This initiative, influenced by historical precedents, underscores a shift towards Bitcoin’s prominence as a corporate treasury asset, impacting the broader digital asset market.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

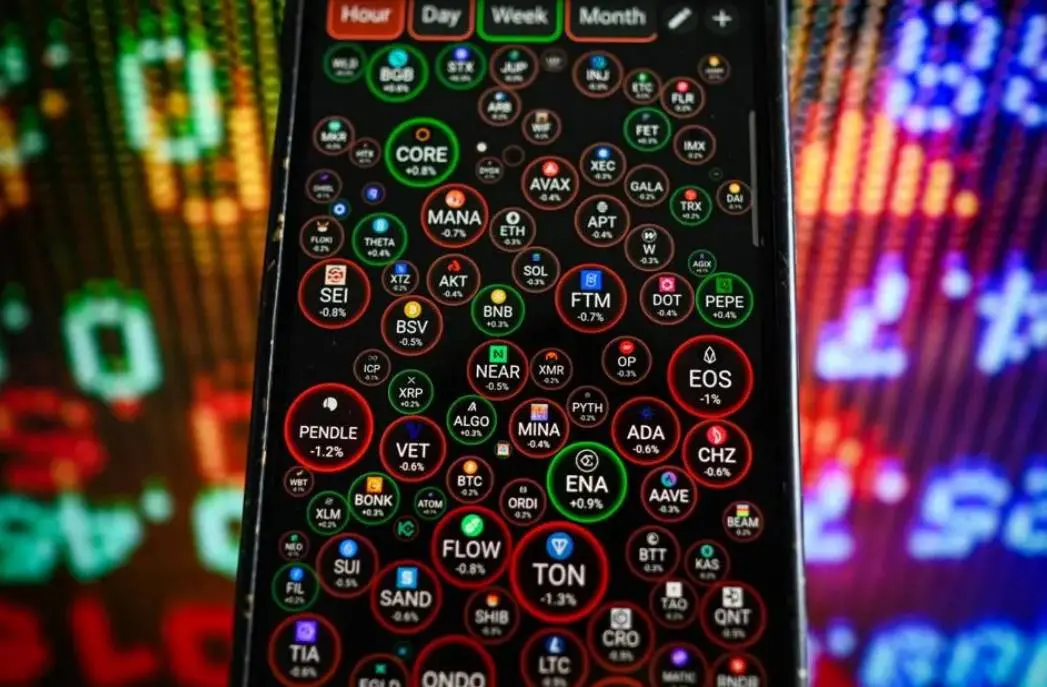

From "flood irrigation" to a differentiated landscape, will the altcoin season repeat the glory of 2021?

The altcoin season of 2021 erupted under a unique macro environment and market structure, but now, the market environment has changed significantly.

a16z In-Depth Analysis: How Do Decentralized Platforms Make Profits? Pricing and Charging Strategies for Blockchain Startups

a16z points out that a well-designed fee structure is not at odds with decentralization—in fact, it is key to creating a functional decentralized market.

OpenSea unveils final phase of pre-TGE rewards, with $SEA allocation details due in October

Bitcoin Mining Difficulty Reaches New Record High