Public Firms Hold 979,333 Bitcoin Worth $111 Billion

- Institutional Bitcoin adoption reaches record levels, marking increased corporate trust.

- Public companies hold 979,333 BTC, valued at $111 billion.

- Michael Saylor and Strategy lead corporate Bitcoin portfolios.

Public companies have amassed 979,333 Bitcoin, valued at $111 billion, as of August 2025, representing 4.66% of the total Bitcoin supply.

This surge in corporate acquisition reflects a growing confidence in Bitcoin as a strategic asset, potentially influencing market stability and investor behavior.

Public companies collectively managing 979,333 BTC, valued over $111 billion, now own 4.66% of Bitcoin’s supply. This trend reflects heightened institutional interest in Bitcoin as a corporate asset.

Major players like Strategy, led by Michael Saylor , have aggressively accumulated Bitcoin, demonstrating strong confidence in its role as a long-term treasury asset.

The shift marks intensified corporate involvement in cryptocurrency, influencing traditional finance perceptions and Bitcoin’s valuation dynamics. Corporate Bitcoin accumulation sends ripples through the market.

Financial implications include potential asset stabilizing effects and increased liquidity demands. This trend underscores Bitcoin’s evolution from a niche asset to a corporate-financial staple.

As corporates increase their holdings, Bitcoin’s role within institutional portfolios is reshaped. This wave of adoption may see regulatory interest intensify.

“Corporate adoption of Bitcoin is the next great wave of institutional investment. Every quarter, we set new benchmarks for treasury allocation.” – Michael Saylor, Founder & Chairman, Strategy.

Historical patterns suggest a link between institutional purchases and short-term Bitcoin price growth. Stakeholder sentiment remains positive, although some raise concerns about centralization risks due to aggregated holdings.

For example, Tesla’s Bitcoin investments, as detailed in their 2024 Annual Report , highlight this pivotal shift within corporate finance strategies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Rise in Fed and interest rate chatter may pose risks to crypto, Santiment warns

Share link:In this post: Santiment has stated that the increase in social media chatter surrounding the Fed and interest rates could pose risks to digital assets. More than 75% of market participants are predicting a rate cut in September after Powell’s speech. Analysts are divided over the short and long-term effects on digital assets if a rate cut happens in September.

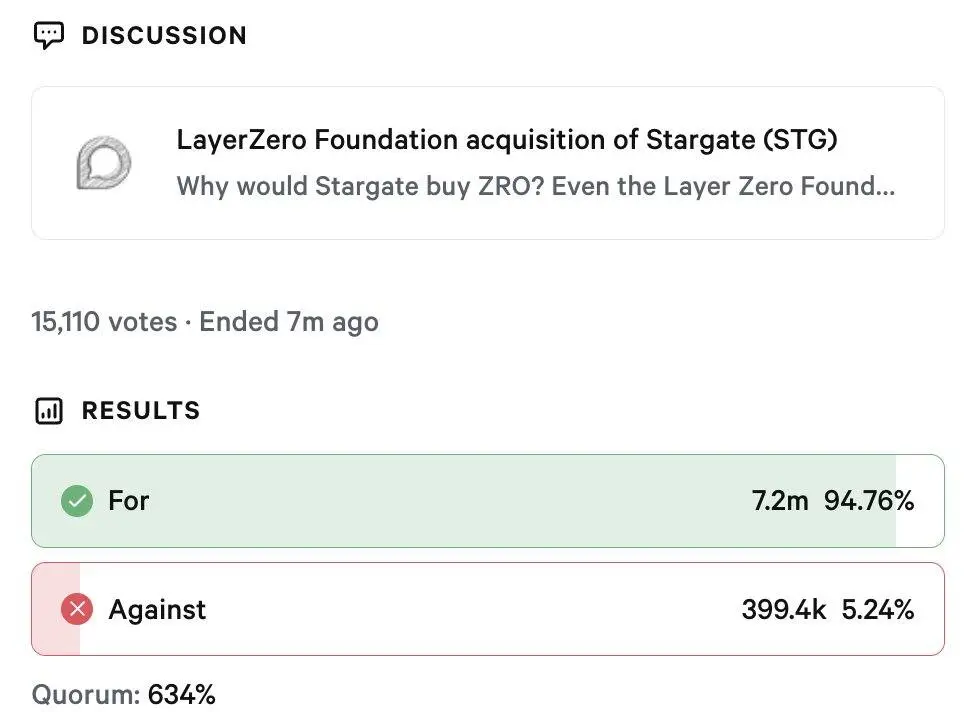

LayerZero wins Stargate takeover with 94% DAO approval in rare $120 million deal

Share link:In this post: LayerZero announced its acquisition of Stargate Finance in a $120 million deal. The deal will bring Stargate under LayerZero’s ecosystem, with ZRO becoming the sole token. ZRO and STG are down today despite the deal, as holders hope for a resurgence.

Why emerging markets will beat developed economies in 2025

Share link:In this post: Emerging markets are projected to outperform developed economies due to looser U.S. monetary policy, tighter fiscal control in EMs, and increasing investor flows. Fed rate cut expectations are boosting EM appeal, with funds like iShares Core MSCI EM ETF attracting billions since April. Strong fundamentals support EM assets, including lower inflation surprises, attractive equity valuations, and selective currency strength like the Brazilian real.

US Fed Signals Rate Cut: Crypto Shorts Liquidated