Metaplanet Acquires 775 BTC, Holding Now 18,888 BTC

- Metaplanet increases BTC holdings to 18,888, largest in Asia.

- Purchased 775 BTC at $93M.

- Marked as one of the top global BTC holders.

Metaplanet, a Tokyo-listed firm, purchased an additional 775 Bitcoin for approximately $93 million, increasing its holdings to 18,888 BTC as of August 18, 2025.

The acquisition solidifies Metaplanet’s status as the leading Bitcoin holder in Asia, reflecting growing institutional interest and influencing the cryptocurrency market dynamics.

Metaplanet has bolstered its Bitcoin treasury, acquiring 775 BTC for approximately $93 million. This move solidifies its position as the most significant public Bitcoin holder in Asia, with a total holding of 18,888 BTC.

Metaplanet Inc., a Tokyo-listed company, has executed this strategy. The purchase was made at an average price of $120,006 per BTC, enhancing their presence significantly among global Bitcoin holders.

This acquisition places Metaplanet as a leader in corporate Bitcoin holdings within Asia. “Metaplanet’s cumulative Bitcoin investment reflects significant confidence in the asset as a treasury strategy,” says a Market Analyst from Trading View.

The expansion largely affects the digital asset market, demonstrating growing corporate interest in Bitcoin as a reserve, potentially impacting the industry and similar firms seeking to adopt similar strategies.

Metaplanet’s move may catalyze further corporate Bitcoin acquisitions. This highlights a potential trend among Asian companies following similar treasury strategies.

Historical trends show firms like MicroStrategy in the US pioneering such strategies. The implications span financial impact, regulatory framework shifts, and technological advancements, suggesting an evolving landscape for corporate crypto assets. Expert Analyst from Coin Central commented, “Metaplanet’s strategy echoes the playbook of MicroStrategy, signaling an unprecedented level of Bitcoin accumulation among public firms.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Rise in Fed and interest rate chatter may pose risks to crypto, Santiment warns

Share link:In this post: Santiment has stated that the increase in social media chatter surrounding the Fed and interest rates could pose risks to digital assets. More than 75% of market participants are predicting a rate cut in September after Powell’s speech. Analysts are divided over the short and long-term effects on digital assets if a rate cut happens in September.

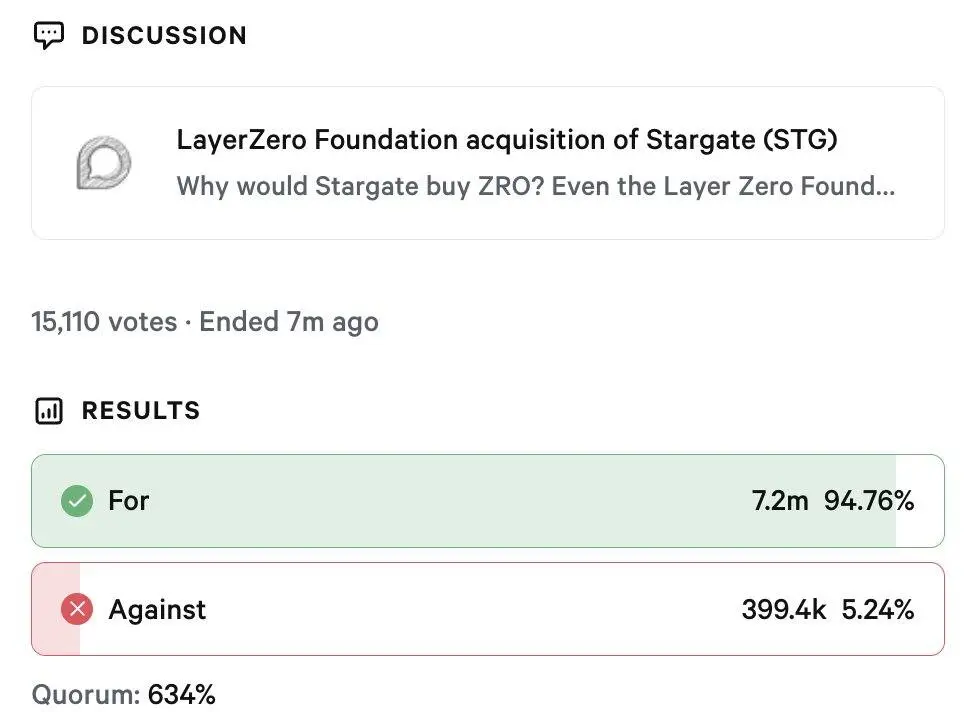

LayerZero wins Stargate takeover with 94% DAO approval in rare $120 million deal

Share link:In this post: LayerZero announced its acquisition of Stargate Finance in a $120 million deal. The deal will bring Stargate under LayerZero’s ecosystem, with ZRO becoming the sole token. ZRO and STG are down today despite the deal, as holders hope for a resurgence.

Why emerging markets will beat developed economies in 2025

Share link:In this post: Emerging markets are projected to outperform developed economies due to looser U.S. monetary policy, tighter fiscal control in EMs, and increasing investor flows. Fed rate cut expectations are boosting EM appeal, with funds like iShares Core MSCI EM ETF attracting billions since April. Strong fundamentals support EM assets, including lower inflation surprises, attractive equity valuations, and selective currency strength like the Brazilian real.

US Fed Signals Rate Cut: Crypto Shorts Liquidated