Ethereum’s Resilience Amid Short-Term Price Volatility

- Ethereum shows stability despite market fluctuations around $4,100.

- Institutional interest supports potential rally if current trends persist.

- Whale accumulation bolsters Ethereum’s trading volume and liquidity.

Ethereum is experiencing short-term volatility between $4,100 and $4,350, potentially leading to a significant rally by maintaining key support levels as of August 21–22, 2025.

Short-term volatility could drive a substantial Ethereum rally if key support holds, amid speculative ETF momentum and whale accumulation supporting price resilience.

Ethereum’s Resilience Amid Short-Term Price Volatility

Ethereum faces short-term volatility around the $4,100–$4,350 price. Despite technical risks of a dip, it maintains a resilient structure with institutional interest. Key support levels could signal a significant rally.

Key players include Vitalik Buterin, though silent on this issue. Arthur Hayes and other market leaders discuss broader crypto cycles. Crypto Caesar analyzes price potential if Ethereum holds key ranging levels.

Price fluctuations influence institutional behavior, drawing capitol inflows when approaching all-time highs. Whale activities indicate an attempt to stabilize the market around pivotal price points.

These movements affect trading strategies, with emerging fintech like Remittix exhibiting ongoing ecosystem funding activities. Ethereum’s resilience amidst speculation highlights broader market dynamics.

Market reactions to these developments reveal cautious optimism among investors and stakeholders. Traders remain attentive to ETH’s capacity to sustain pivotal pricing while the broader ETF narrative continues.

Historical trends suggest whale buy-ins may indicate a pattern leading to potential rallies. The presence of influential market players supports sentiment if key support holds under current conditions.

“Ethereum price sits near $4,335, a dip from its recent highs…should ETH maintain prices above this range, the next resistance is around the $4,800 mark. A surge beyond that range would revive bullish sentiment…” — Crypto Caesar

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Rise in Fed and interest rate chatter may pose risks to crypto, Santiment warns

Share link:In this post: Santiment has stated that the increase in social media chatter surrounding the Fed and interest rates could pose risks to digital assets. More than 75% of market participants are predicting a rate cut in September after Powell’s speech. Analysts are divided over the short and long-term effects on digital assets if a rate cut happens in September.

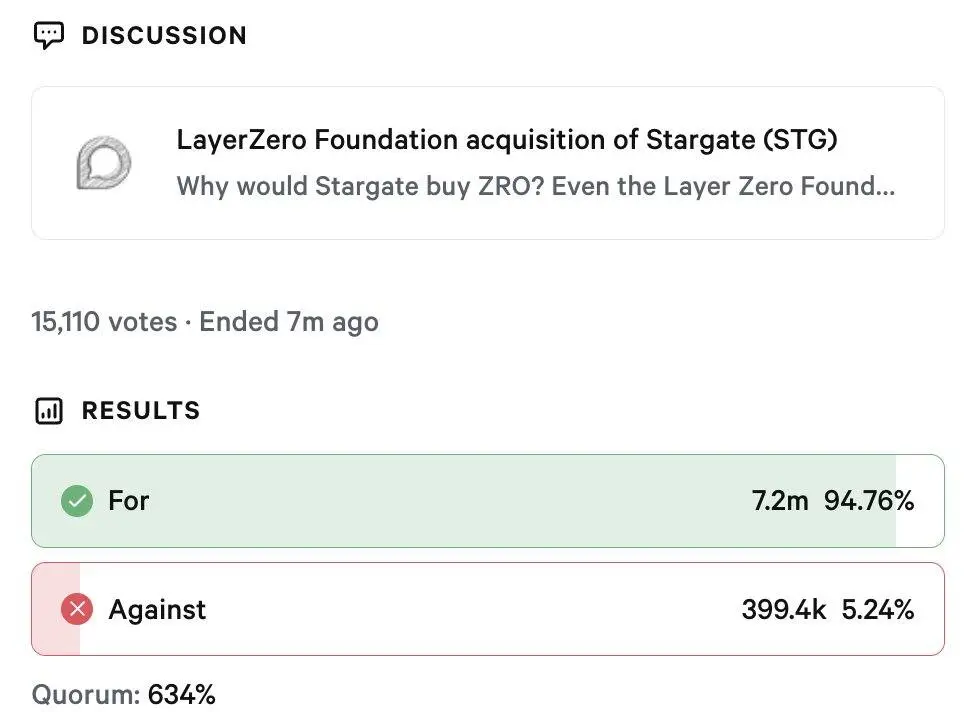

LayerZero wins Stargate takeover with 94% DAO approval in rare $120 million deal

Share link:In this post: LayerZero announced its acquisition of Stargate Finance in a $120 million deal. The deal will bring Stargate under LayerZero’s ecosystem, with ZRO becoming the sole token. ZRO and STG are down today despite the deal, as holders hope for a resurgence.

Why emerging markets will beat developed economies in 2025

Share link:In this post: Emerging markets are projected to outperform developed economies due to looser U.S. monetary policy, tighter fiscal control in EMs, and increasing investor flows. Fed rate cut expectations are boosting EM appeal, with funds like iShares Core MSCI EM ETF attracting billions since April. Strong fundamentals support EM assets, including lower inflation surprises, attractive equity valuations, and selective currency strength like the Brazilian real.

US Fed Signals Rate Cut: Crypto Shorts Liquidated