Ethereum Whales Buy $280M in ETH Amid Market Correction

- Ethereum whales purchased $280M in ETH during market correction.

- Institutional and retail behaviors diverged sharply.

- Short positions saw $100 million liquidated amid volatility.

In August 2025, three major Ethereum whale addresses bought $280 million worth of ETH amid a market correction, highlighting a strategic move to capitalize on lower prices.

This activity underscores confidence in Ethereum’s long-term potential, suggesting a bullish sentiment and influencing market dynamics, as reflected in the liquidation of short positions and institutional asset allocations.

In mid-August 2025, Ethereum whales purchased approximately $280 million worth of ETH during a market correction . This significant investment highlighted their continued confidence amid a volatile market. Institutional inflows showed strong support for further accumulation.

Reports confirm three major whale addresses executed these substantial purchases, confirming ongoing market faith. Acknowledged crypto analyst Crypto Rover shared evidence of the transaction, emphasizing the strategic acquisition during a period of price retracement.

The purchase had immediate effects on market sentiment, pulling retail sentiment towards cautious optimism. Institutional confidence contrasted with retail caution, as seen in on-chain activity and institutional fund inflows .

Financial markets experienced heightened activity, with aggressive buying positions. The liquidation of $100 million short positions marked a volatile trading phase, indicating strong buy-side action and consequent liquidity shifts in Ethereum markets.

The large-scale whale purchases suggest potential long-term market stabilization and price resilience due to ongoing investor confidence. Historical trends suggest such activities often precede market recoveries post-correction.

This whale activity may also influence capital deployment strategies into emerging digital assets, reinforcing Ethereum’s robustness. Regulatory outlook remains unperturbed with no negative statements from key financial authorities, reinforcing market optimism.

Nicolai Sondergaard, Analyst, Nansen – “A short-term retracement after a strong pump is normal. A 4–5% pullback is healthy and may prepare the market for further gains.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Rise in Fed and interest rate chatter may pose risks to crypto, Santiment warns

Share link:In this post: Santiment has stated that the increase in social media chatter surrounding the Fed and interest rates could pose risks to digital assets. More than 75% of market participants are predicting a rate cut in September after Powell’s speech. Analysts are divided over the short and long-term effects on digital assets if a rate cut happens in September.

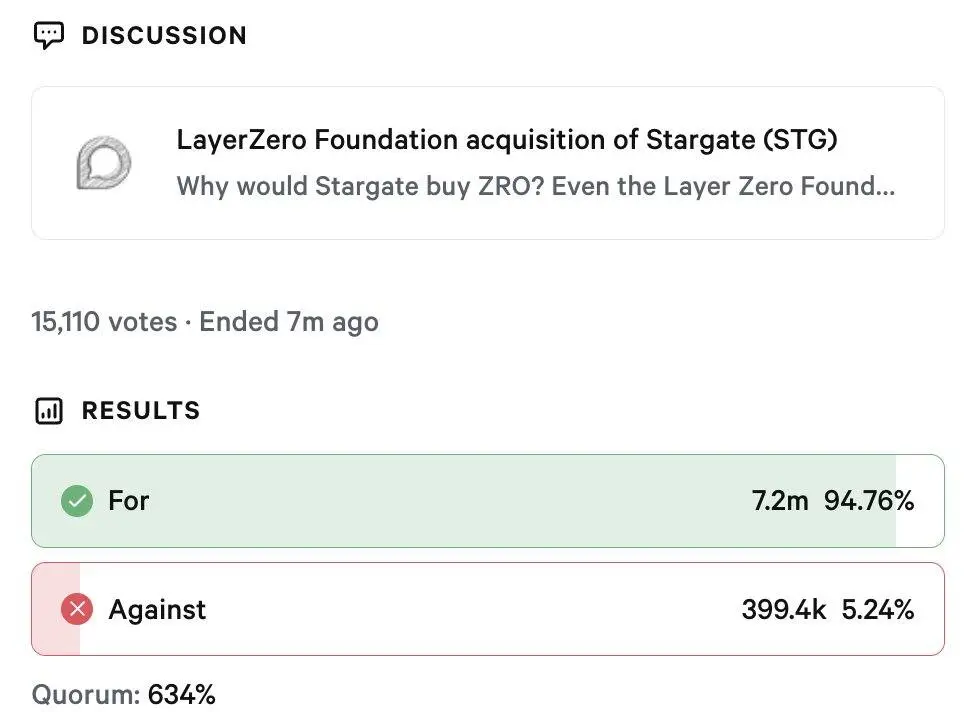

LayerZero wins Stargate takeover with 94% DAO approval in rare $120 million deal

Share link:In this post: LayerZero announced its acquisition of Stargate Finance in a $120 million deal. The deal will bring Stargate under LayerZero’s ecosystem, with ZRO becoming the sole token. ZRO and STG are down today despite the deal, as holders hope for a resurgence.

Why emerging markets will beat developed economies in 2025

Share link:In this post: Emerging markets are projected to outperform developed economies due to looser U.S. monetary policy, tighter fiscal control in EMs, and increasing investor flows. Fed rate cut expectations are boosting EM appeal, with funds like iShares Core MSCI EM ETF attracting billions since April. Strong fundamentals support EM assets, including lower inflation surprises, attractive equity valuations, and selective currency strength like the Brazilian real.

US Fed Signals Rate Cut: Crypto Shorts Liquidated