Bitcoin Options Expiry Could Influence Market Trends

- $13.8B Bitcoin options expiry could affect market trends.

- Increased demand for hedging with put options.

- Traders monitor potential implications for volatility.

Bitcoin’s $13.8B options expiry on August 29 could significantly affect its price due to recent market trends. An increase in put options for Bitcoin and Ethereum signals heightened hedging against further downturns, monitored by institutional players.

The event is significant due to its potential effects on asset volatility, particularly for BTC and ETH. Increased defensive positioning by investors highlights market caution.

Market Dynamics and Investor Strategies

Bitcoin and Ethereum are facing a major options expiry on August 29. Investor demand for put options illustrates hedging against further market declines. The CME Group and Derive.xyz are key players providing this data. Such events historically affect market volatility as traders adjust their strategies accordingly.

The CME Group, Institutional Marketplace, confirms that August 29, 2025, is a quarterly Bitcoin futures and options expiry date, providing traders with institutional-grade risk management tools.

The demand for put options suggests anticipation of further market decline. The CME Group and Derive.xyz are influential in tracking these options. Historically, significant expiries have led to temporary volatility spikes for BTC and ETH.

Investor Sentiment and Market Stability

These crypto options expiries are closely monitored by both institutional and retail traders. Broad investor interest in hedging reflects concerns about market stability, which may result in consequential price movements around the expiry date.

Implied volatility changes suggest ETH might experience larger fluctuations than BTC. Analysts believe historical trends indicate that expiry events can intensify market movements. Conservative positioning is prevalent, likely dampening speculative activities in the short term.

Potential outcomes may include altered liquidity and market behavior shifts, impacting broader crypto trends. Historical patterns suggest that derivatives activity around such expiry events often presage tactical changes in market sentiment, leading to notable volatility across portfolios.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Rise in Fed and interest rate chatter may pose risks to crypto, Santiment warns

Share link:In this post: Santiment has stated that the increase in social media chatter surrounding the Fed and interest rates could pose risks to digital assets. More than 75% of market participants are predicting a rate cut in September after Powell’s speech. Analysts are divided over the short and long-term effects on digital assets if a rate cut happens in September.

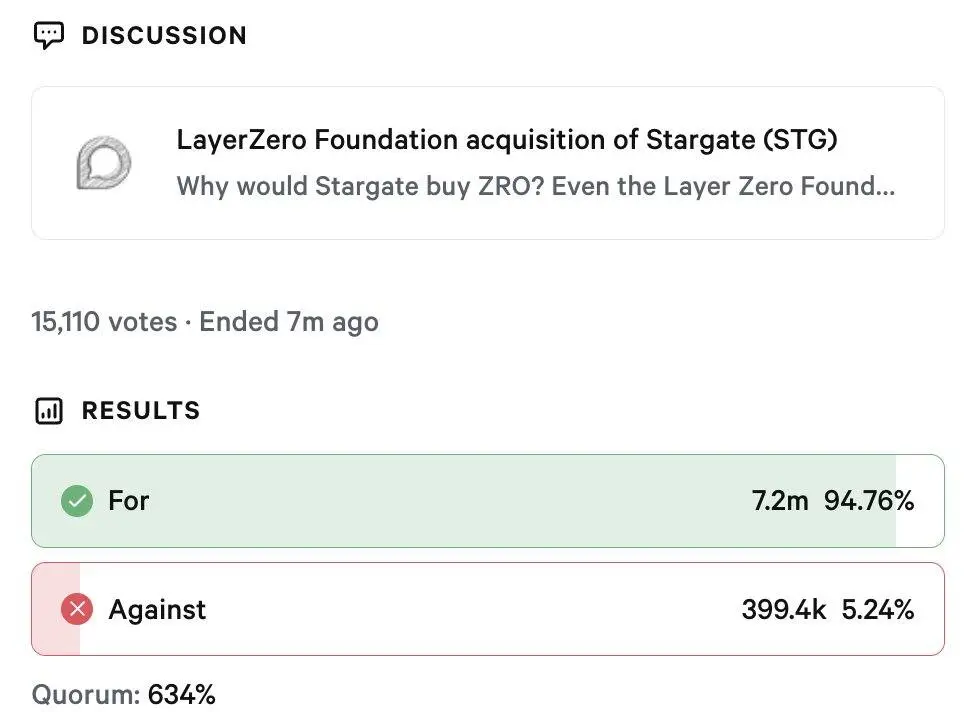

LayerZero wins Stargate takeover with 94% DAO approval in rare $120 million deal

Share link:In this post: LayerZero announced its acquisition of Stargate Finance in a $120 million deal. The deal will bring Stargate under LayerZero’s ecosystem, with ZRO becoming the sole token. ZRO and STG are down today despite the deal, as holders hope for a resurgence.

Why emerging markets will beat developed economies in 2025

Share link:In this post: Emerging markets are projected to outperform developed economies due to looser U.S. monetary policy, tighter fiscal control in EMs, and increasing investor flows. Fed rate cut expectations are boosting EM appeal, with funds like iShares Core MSCI EM ETF attracting billions since April. Strong fundamentals support EM assets, including lower inflation surprises, attractive equity valuations, and selective currency strength like the Brazilian real.

US Fed Signals Rate Cut: Crypto Shorts Liquidated