Polkadot launches a capital markets division to attract Wall Street

Polkadot hits hard with the launch of Polkadot Capital Group, a division dedicated to the tokenization of traditional assets. Targeting Wall Street, this initiative could transform institutional finance through blockchain. Discover how Web3 is establishing itself as the new strategic horizon of global financial markets.

In brief

- Polkadot Capital Group aims to connect Wall Street to Web3 by tokenizing traditional assets for financial institutions.

- Polkadot Capital Group could boost demand for DOT and propel its price between $12 and $15 by the end of 2025.

- With the support of leaders like David Sedacca and growing interest in a Polkadot ETF, blockchain is establishing itself as a new major institutional player.

Why Polkadot Capital Group arrives at the right time for global finance

The timing of the launch of Polkadot Capital Group is no coincidence. It fits within a global dynamic where financial institutions seek to:

- Diversify their portfolios with digital assets;

- Reduce intermediation costs through blockchain;

- Access alternative yields via staking and DeFi;

- Comply with increasingly clear regulatory frameworks, notably in the United States.

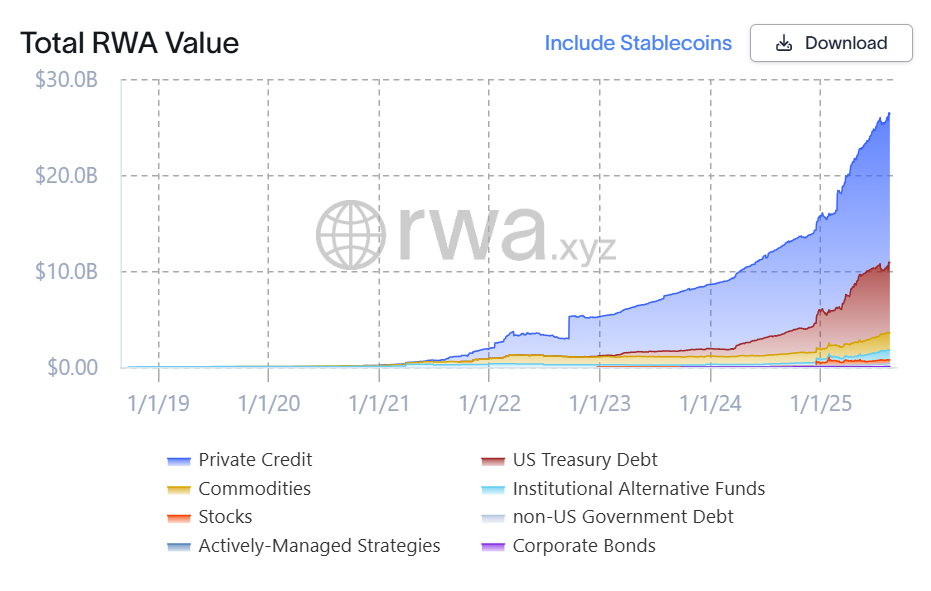

According to the latest estimates, the real-world asset (RWA) tokenization market exceeds 26 billion dollars, with exponential growth expected in the coming years.

The value of RWAs exceeds 26 billion dollars.

The value of RWAs exceeds 26 billion dollars.

How Polkadot wants to connect Wall Street to Web3

By launching a capital markets division, Polkadot aims to educate, support, and integrate financial institutions into its ecosystem. Thus, Polkadot Capital Group offers:

- The tokenization of real assets (real estate, bonds, funds);

- The integration of institutional staking;

- DeFi solutions for OTC desks and asset managers;

- Infrastructure for centralized and decentralized exchanges.

An initiative targeting banks and investment funds, family offices and allocators, VCs and wealth managers, and finally consulting firms and regulators.

At the helm of Polkadot Capital Group, David Sedacca embodies a pragmatic and educational vision. With experience in traditional finance and enterprise technologies, he wants to build a bridge of trust between institutions and Web3 .

Our mission: to provide clear, credible, and actionable education, data, and access to Polkadot so that institutions – especially in the United States – can confidently engage in Web3 and digital assets.

Can Dot benefit from institutional adoption and reach 15 dollars?

The arrival of Polkadot in the institutional arena opens new prospects with benefits for institutions, namely:

- Access to Web3 yields without compromising compliance;

- Reduction of transaction times and costs;

- Increased transparency thanks to blockchain technology;

- Flexibility in structuring financial products.

However, challenges remain to anticipate such as adaptation to Web3 technology standards, internal team training, and dialogue with regulators. Nevertheless, Polkadot Capital Group could stimulate institutional interest, strengthening demand for DOT. If adoption progresses, the crypto price could aim for $12 to $15 by the end of 2025.

Polkadot Capital Group therefore does not seek to replace Wall Street but to reinvent it. By offering concrete, compliant, and performant solutions, this division could well become the institutional blockchain hub in the years to come! Especially right now when Nasdaq and 21Shares are betting big on a Polkadot ETF . For players in finance and even crypto, it is time to choose: remain spectators or become pioneers of a new era.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP and the Future of Decentralized Governance in Global Finance

- XRP's role in cross-border payments highlights decentralized governance's impact on institutional agility and cost efficiency. - Ripple's 2025 SEC settlement and XRP Ledger upgrades (e.g., XLS-30 AMM) accelerated institutional adoption in high-cost corridors. - Banks like SBI and Santander leverage XRP to bypass pre-funding requirements, reducing settlement times from days to seconds. - XRP's $176B valuation reflects structural innovation, though risks include stablecoin competition and regulatory uncert

XRP Price Trajectory: How Legal Jurisdictional Clarity in France and Quebec is Reshaping Institutional Adoption and Market Stability

- French and Quebec civil law frameworks drive XRP's institutional adoption through enforceable transparency and real-time UBO registration. - Contrast with common law jurisdictions like Ontario highlights valuation risks due to self-reported disclosures and fragmented governance. - France’s 2019 PACTE Act and MiCA regulations, alongside Quebec’s ARLPE law, create stable environments for XRP’s cross-border utility and institutional trust. - Legal clarity in civil law jurisdictions reduces compliance burden

Decentralized Governance and Speculative Momentum: Bridging Traditional and Crypto Markets for Smarter Investments

- Traditional corporations like Microsoft and Amazon adopt AI-driven decentralized governance to enhance real-time risk oversight and stakeholder engagement. - Crypto ecosystems, including DAOs and Dogecoin, leverage token-based voting and community sentiment but face volatility and manipulation risks from large token holders. - Investors must balance exposure to decentralized models—combining AI-enhanced corporate governance with community-driven crypto assets—to navigate both innovation and instability.

XRPI and the Future of Institutional Crypto Exposure: How Decentralized Real Estate Valuation is Reshaping Risk Management

- XRP ETF (XRPI) bridges institutional crypto exposure with decentralized real estate tokenization via XRP Ledger (XRPL). - Institutions like MUFG tokenize ¥100B assets using XRPL's compliance tools, boosting market trust. - XRPL's XLS-30 amendment and cross-chain bridges enhance liquidity and risk management for tokenized real estate. - Regulatory shifts, like XRP's 2025 reclassification, drive $16T tokenized real estate market growth by 2030.