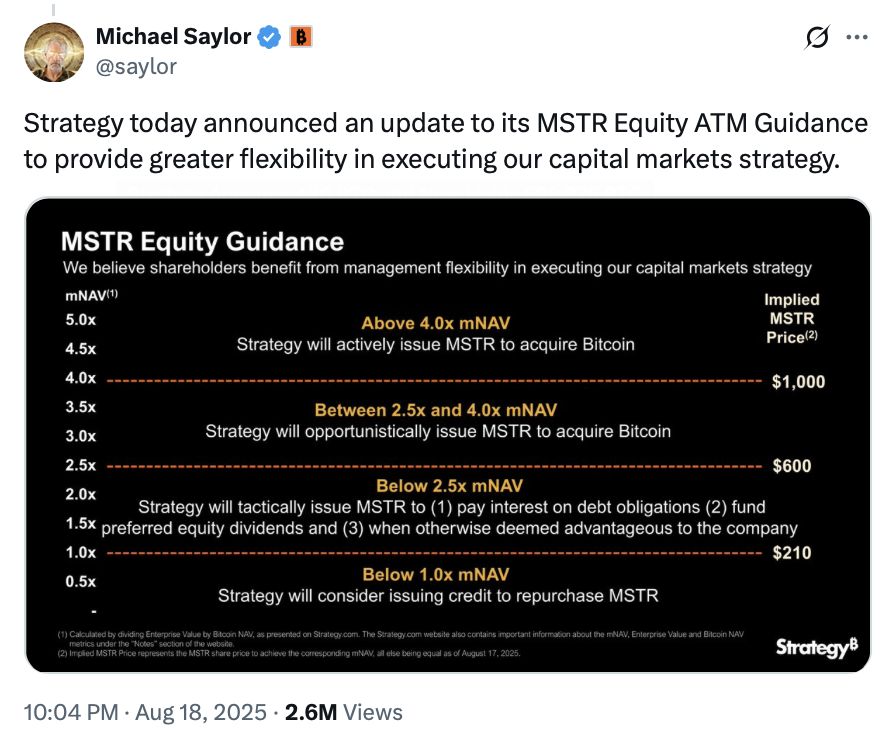

Strategy’s updated MSTR equity guidance lowers the mNAV threshold for tactical share issuance, allowing the company to issue shares below 2.5× mNAV to cover debt, dividends, or opportunistically buy Bitcoin; markets reacted with an ~8% MSTR drop amid an 8.6% BTC pullback.

-

MSTR equity guidance now allows share issuance below 2.5× mNAV for tactical uses.

-

Market reaction: MSTR stock fell ~8% while Bitcoin slipped 8.6% from its recent high.

-

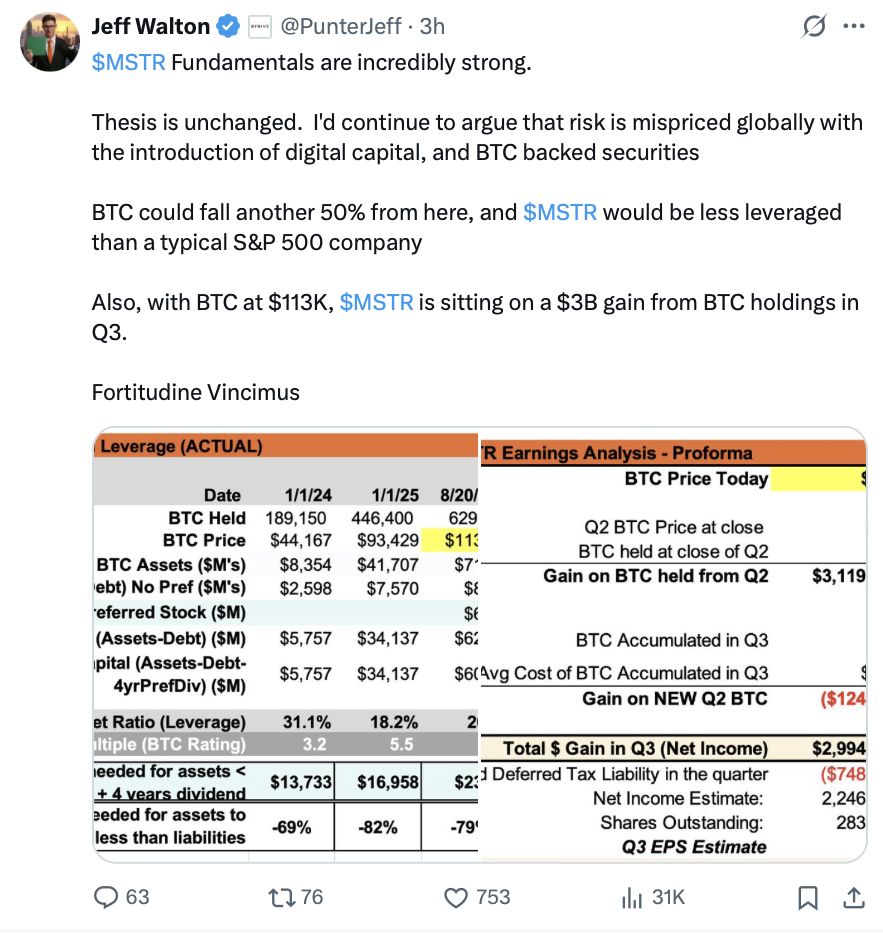

Data: Strategy holds 629,376 BTC (SaylorTracker), MSTR mNAV at ~1.55 at publication.

MSTR equity guidance update pushes MSTR lower — read the full analysis and investor takeaways from COINOTAG.

Strategy’s stock price taps its lowest point since April amid controversy over equity guidance changes and a broader downturn among Bitcoin treasury companies.

Michael Saylor’s Strategy (MSTR) has dropped to its lowest level in nearly four months amid a broader decline in crypto treasury firms and a Bitcoin dip, after Saylor indicated the company would lower restrictions on issuing more shares.

The stock price has fallen 8% since Monday, coinciding with an 8.6% decline in Bitcoin (BTC) since last Thursday’s local high of $124,128. Strategy’s updated equity guidance has been central to market moves.

Source: Michael Saylor

What changed in Strategy’s MSTR equity guidance?

Strategy updated its MSTR Equity ATM Guidance to permit tactical issuance when MSTR trades below 2.5× mNAV. The explicit change broadens permitted uses to include covering debt interest, funding preferred equity dividends, and other actions “when otherwise deemed advantageous to the company.”

How does the new guidance alter issuance mechanics?

Previously, Strategy framed share issuance below 2.5× mNAV more narrowly, tied to debt and preferred dividend coverage. The revised guidance expands discretion, creating a pathway for additional capital actions and potential BTC purchases without the prior constraint.

Source: Jeff Walton

How did markets react to the guidance update?

Markets priced in heightened dilution risk and strategic uncertainty. MSTR dropped approximately 8% since the announcement. The decline aligned with a broader pullback in Bitcoin and similar BTC treasury stocks.

Over the past month MSTR is down 21.04%, trading around $336.57 — levels last seen on April 17 when Bitcoin was roughly $84,030.

Which Bitcoin treasury stocks also fell recently?

Other firms holding public BTC also showed declines: MARA down ~19.44%, COIN down ~26.97%, and RIOT down ~14.69% over the past month. These figures reflect investor sensitivity to both BTC price moves and balance-sheet strategy.

Why does mNAV matter for MSTR investors?

mNAV measures the market price relative to the company’s Bitcoin holdings. When MSTR trades below a multiple of its NAV, dilution via share issuance can materially affect per-share BTC exposure and investor returns.

Strategy’s reported mNAV was ~1.55 at publication, a level that informed much of the shareholder debate following the guidance change.

How should investors interpret Saylor’s public statements?

Michael Saylor communicated the guidance update via X and accompanying charts, framing it as greater capital markets flexibility. Reactions ranged from accusations of reversing prior commitments to interpretations that the change could facilitate additional BTC purchases.

Plain-text references and data sources cited in this report include SaylorTracker, Strategy filings and public X posts from Michael Saylor.

Summary table: Recent stock moves (1 month)

| MSTR | -21.04% | Guidance change, mNAV ~1.55 |

| MARA | -19.44% | BTC exposure, mining sector pressure |

| COIN | -26.97% | Crypto market volatility, revenue concerns |

| RIOT | -14.69% | Mining shares fell with BTC |

Frequently Asked Questions

Will Strategy use the new guidance to buy more Bitcoin?

The guidance allows opportunistic actions, including potential BTC purchases, but the company has not provided a commitment to buy immediately. Market participants remain divided on intent and timing.

Does the guidance increase dilution risk for shareholders?

Yes. Expanding permissible issuance below 2.5× mNAV raises dilution risk, which can reduce per-share Bitcoin exposure if new shares are issued without proportional BTC acquisition.

Key Takeaways

- Guidance broadened: Strategy can issue shares below 2.5× mNAV for more tactical uses.

- Market impact: MSTR fell ~8% on the announcement; BTC pulled back ~8.6% from recent highs.

- Investor action: Monitor mNAV, company filings, and Saylor’s public statements for concrete issuance plans.

Conclusion

Strategy’s revised MSTR equity guidance changes the operational threshold for issuing shares, increasing flexibility but also investor concern over dilution. Front-loaded data points — mNAV ~1.55, 629,376 BTC held (SaylorTracker) — are key to interpreting next moves. Investors should track official Strategy disclosures and BTC price action for clarity and reassess positions accordingly. COINOTAG will monitor updates.

Published by COINOTAG — Updated: 2025-08-20