Trump Family-Backed Thumzup to Acquire Dogecoin Mining Company

Trump family-backed, cryptocurrency treasury firm Thumzup Media is planning to acquire Dogecoin mining firm Dogehash, the companies announced Tuesday.

Under the all-stock deal, Dogehash shareholders will swap their holdings for a combined 30.7 million shares of Thumzup stock, the companies said in a joint statement. The miner will be renamed Degohash Technologies Holdings and trade on the Nasdaq Stock Market under the ticker "XDOG.”

The acquisition target's mining technology will be integrated with Thumzup, with the goal of offering competitive mining opportunities to miners within the Dogecoin ecosystem.

“Beyond expanding our digital asset treasury, we see opportunities to align Dogecoin’s fast, low-cost settlement layer to go beyond a mining operation and build a vertically integrated ecosystem that combines scalable infrastructure, renewable-powered production, and utility-driven applications of Dogecoin,” Thumzup CEO Robert Steele told Decrypt on Tuesday.

The agreement comes a few weeks after Thumzup raised $50 million to expand its crypto-led corporate strategy by buying mining rigs and accumulating digital assets for its corporate treasury, among other moves.

It is one of several publicly traded firms that has gone all-in on digital assets in recent years, emulating the corporate playbook of Michael Saylor's software firm Strategy.

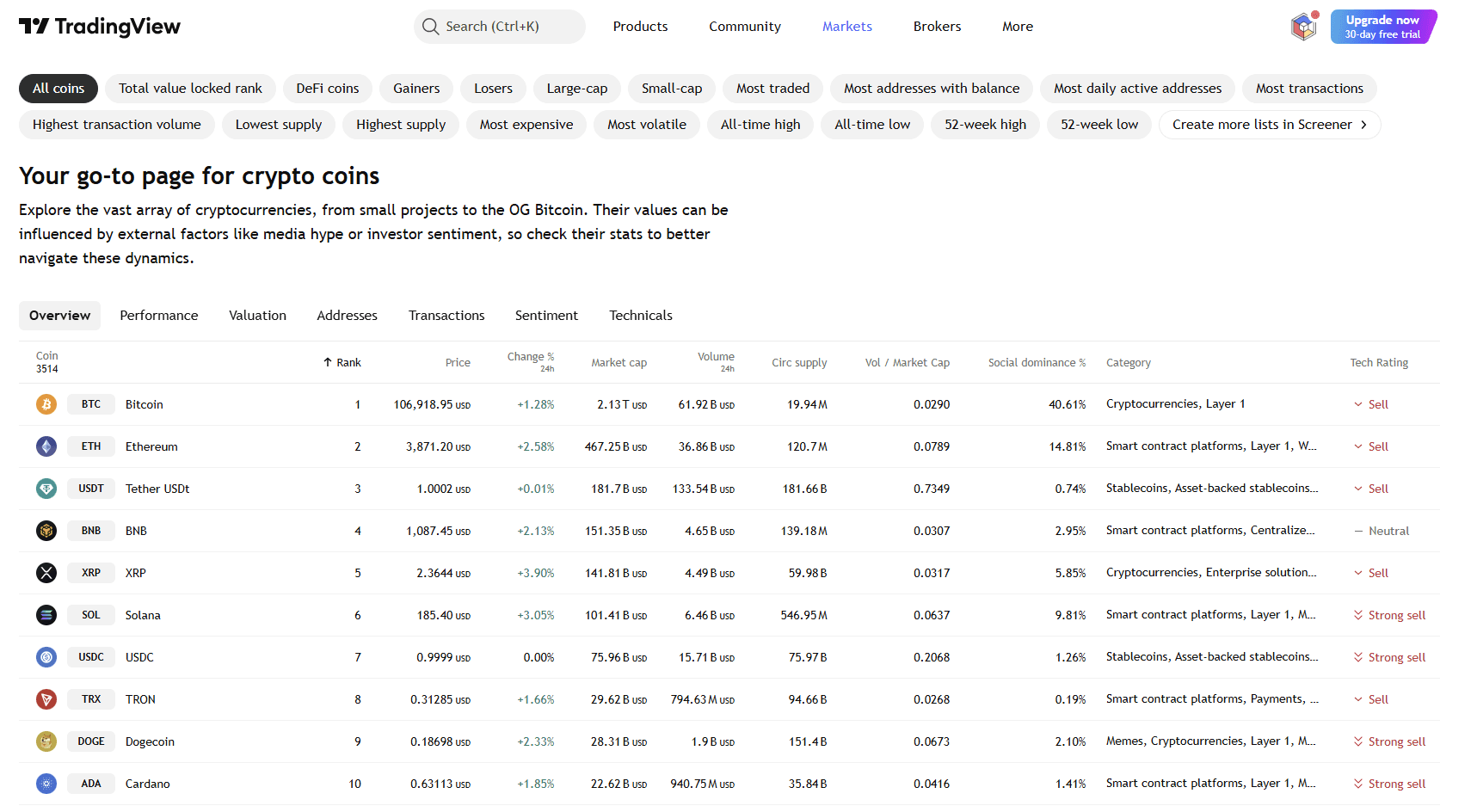

A number of public companies, including American Bitcoin and Kindly MD have snapped up hundreds of millions , of dollars in Bitcoin over the past year. Meanwhile, Bitmine Immersion and Sharplink Gaming, have poured billions into Ethereum over the past few weeks, pumping the token to within striking distance of its record price.

Other altcoins are also being snapped up in the digital assets treasury boom, including XRP and Solana.

Founded in 2020, Thumzup is an online marketing firm that pays social media users to promote brands to their followers. It pivoted to a crypto-focused corporate strategy earlier this year, amassing Bitcoin for its treasury and enabling BTC payments for its users.

Thumzup shares were trading at $5.03 as of the closing bell on Tuesday, down 41% over the past 24 hours but up 52% year-to-date, according to Yahoo Finance data.

Upon the deal's closing, Thumzup and Dogehash will make a bid to become a leading Dogecoin mining platform. Their goal is to provide more robust yields for the memecoin's miners, according to the companies’ statement.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin and Ethereum ETFs see significant outflows, but the market remains resilient.

Despite ETF outflows reaching $598 million, bitcoin remains above $107,000, and ethereum is up by 2%. Experts are divided on the market’s strong performance amid wallet security warnings.

Bitcoin falls below $110,000, is the market turning bearish?

Even Tom Lee has stated that the crypto treasury bubble may have already burst.

Bitcoin holds $105K as US bank stocks recover, Trump truce lifts sentiment

Ripple’s $1B buy-back plan fails to lift price: Can XRP still rebound?