Strategy buys 21K Bitcoin after raising $2.5B

Strategy, previously known as MicroStrategy, announced it purchased 21,021 Bitcoin (CRYPTO:BTC) at an average price of US$117,256 per coin after raising US$2.5 billion through its fourth preferred stock offering.

The preferred stock, identified as STRC, involved the sale of 28 million shares at US$90 each.

This offering was increased from an original target of US$500 million and is the largest initial public offering in the United States for 2025 to date based on gross proceeds.

With this purchase, Strategy's total Bitcoin holdings rose to 628,791 coins, according to BitcoinTreasuries.NET data.

The company has previously used various financial instruments such as equity, debt, and convertible notes to fund Bitcoin acquisitions, influencing over 160 publicly traded companies to hold cryptocurrency on their balance sheets.

STRC is set to begin trading on the Nasdaq, marking the first US exchange-listed perpetual preferred security tied to a Bitcoin treasury company that offers monthly board-adjusted dividends aimed at investors seeking income.

Other preferred instruments Strategy issued include Strike (STRK) with an 8% fixed dividend, Strife (STRF) with a 10% cumulative yield, and Stride (STRD) with a 10% non-cumulative dividend.

Following the announcement, Strategy’s stock (MSTR) closed down 2.26% but rose slightly by 0.52% in after-hours trading to US$396.7.

Overall in 2025, MSTR shares are up 31.55%, representing slower growth compared to a 358.55% increase seen in 2024.

The Bitcoin purchase comes just days before Strategy’s second-quarter earnings report, expected to provide further details on the impact of capital raises and crypto acquisitions on its financial position.

At the time of reporting, BTC price was $117,589.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

French AI start-up Mistral seeks funding at $10B valuation to compete with U.S., Chinese rivals

Share link:In this post: Mistral has announced its plan to raise $1B at a $10B valuation, up from €5.8B. The company’s revenue is on track to go beyond $100M annually. The raised funds may support its planned €8.5B data center project.

Florida leads U.S. solar boom with 3GW surge, beating California

Share link:In this post: Florida added over 3GW of utility-scale solar in one year, surpassing California. Florida Power & Light built more than 70% of the state’s new solar capacity. Trump’s new law cuts solar tax credits, hurting homeowners and developers.

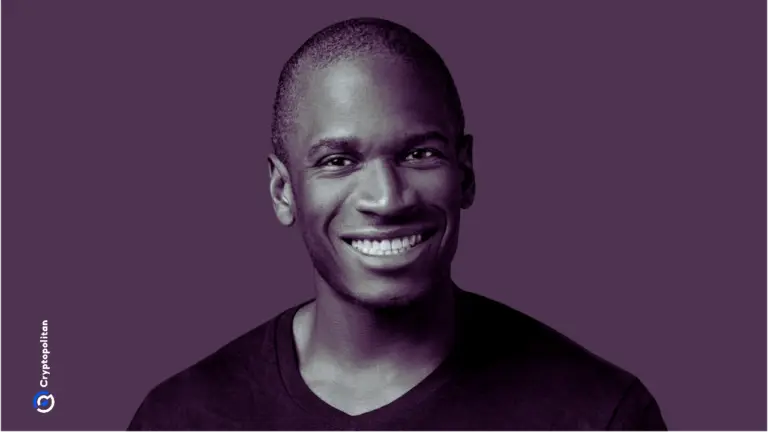

Arthur Hayes calls BTC at $100K, ETH at $3K after dumping $10M+ crypto

Share link:In this post: Arthur Hayes sold over $13 million in crypto, including ETH, ENA, and PEPE, within hours. He predicts Bitcoin will “test” $100K and Ethereum will dip to $3K due to macroeconomic pressures. The BitMEX founder cites weak U.S. job data and the upcoming tariff bill as key bearish indicators.

Anthropic restricts Claude API access for OpenAI

Share link:In this post: Anthropic cut OpenAI’s API access after discovering it was using Claude in violation of terms, allegedly to benchmark and fine-tune GPT-5 through unauthorized custom API integration. Anthropic will introduce weekly usage caps for Claude Code starting August 28, affecting all paid tiers, to reduce excessive background usage. High demand for Claude Code has strained Anthropic’s systems, causing multiple service outages in the past month.