Rare Altcoin Signal Brewing Since 2020 Foreshadowing Parabolic Expansion, According to Crypto Analyst

A crypto analyst known for his charts says that altcoins are flashing a very bullish signal that’s been five years in the making.

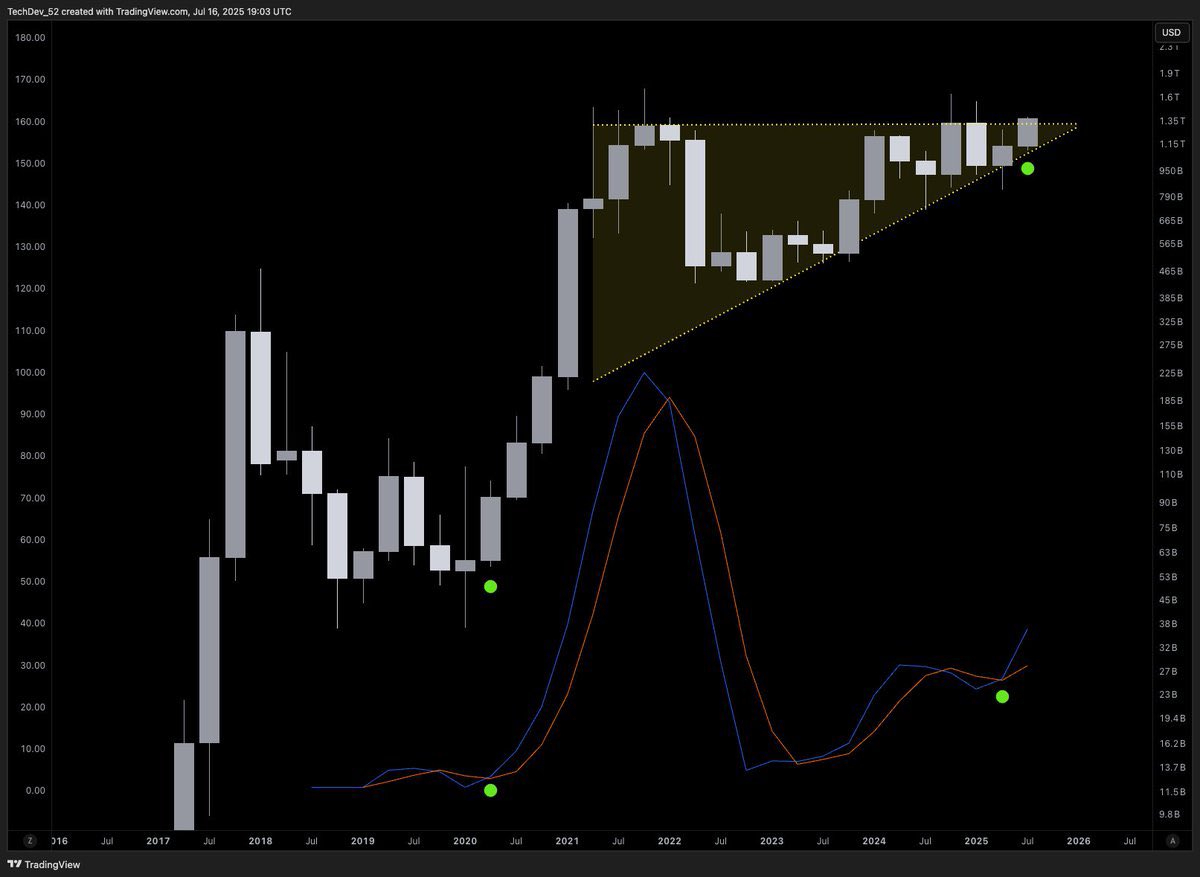

In a post on the social media platform X, pseudonymous analyst TechDev shares with his 535,000 followers a TOTAL3 chart, which measures the entire market cap of crypto assets excluding Bitcoin (BTC), Ethereum (ETH) and stablecoins.

Using three-month candles, TechDev’s analysis suggests that TOTAL3 is currently breaking out of a massive ascending triangle that started forming in late 2020.

“Macro altcoin expansion has triggered.

Not seen since late 2020.

But this one comes after a 4-year coil…the longest in history.”

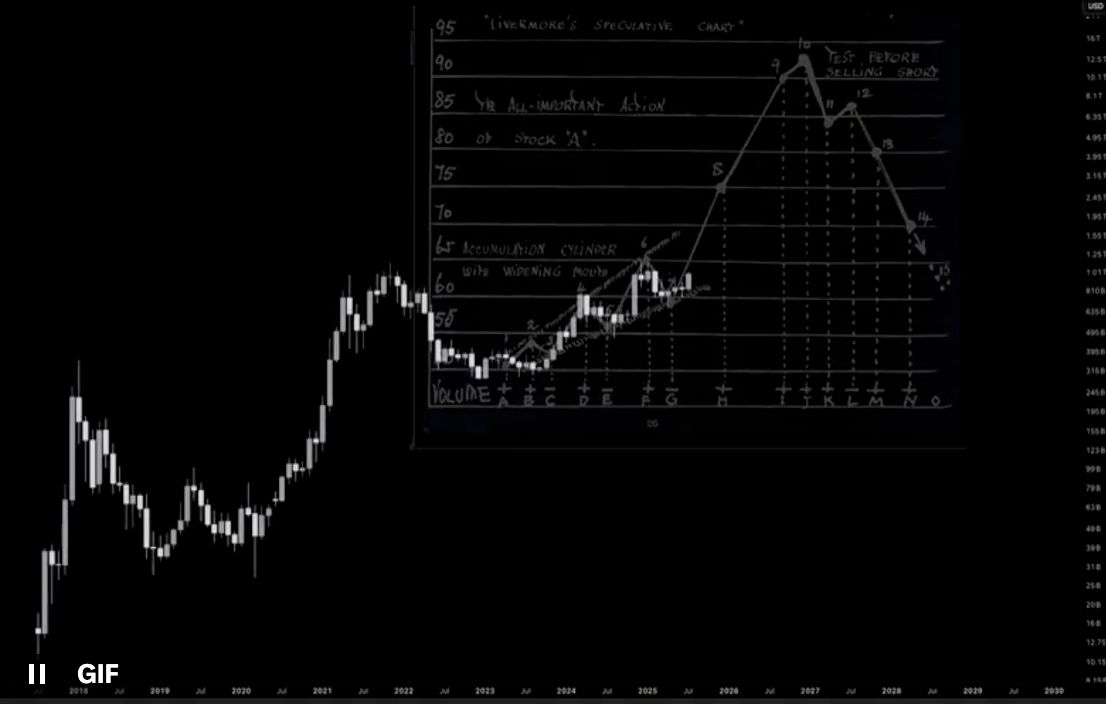

The analyst believes that the altcoin market is trading in line with what’s known as a Livermore Accumulation Cylinder, a pattern identified by trader Jesse Livermore, a pioneer of day trading prominent in the early 1900s.

Livermore Cylinders typically see price trade within an ascending megaphone pattern, making increasingly higher highs and higher lows before a final parabolic run well outside the upper resistance line of the range.

Says TechDev,

“It’s not complicated.

The entire alt market is in a Livermore cylinder.”

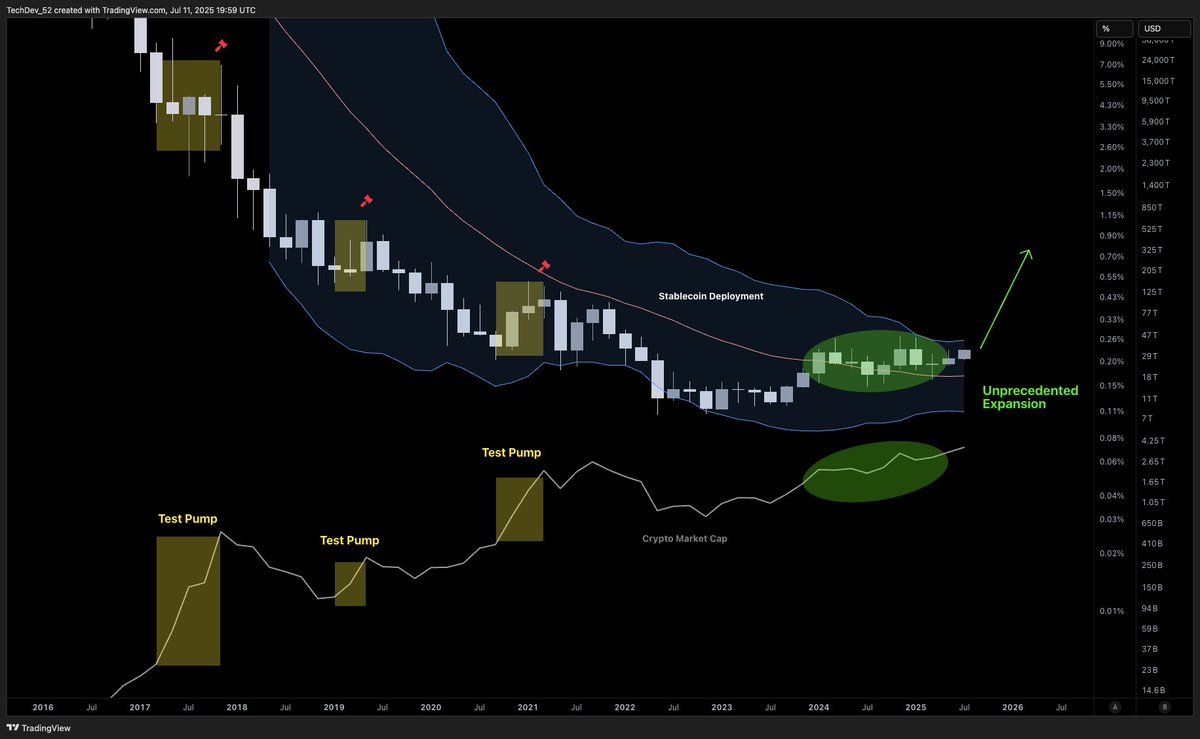

TechDev is also keeping an eye on stablecoins. He shares a chart showing the inverse of stablecoin dominance, or as he describes it, “stablecoin deployment.”

The analyst notes that as stablecoins get deployed, it boosts digital asset prices, but that stablecoin deployment has never truly entered an uptrend, only temporary consolidations.

“Most still don’t get it.

This is stablecoin deployment. When it rises, crypto rises.

But the moves associated with prior bull runs have only been countertrend moves.

This will be the first actual breakout.

It has no precedent.

All prior runs have objectively been test pumps.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Lido Faces Three-Year Low in Ethereum Staking Share

Bitcoin May Face Short-Term Dip Amid Bearish Divergence and CME Gap Below $115,000

U.S. Jobless Claims Drop to 217K, Beating Forecasts

U.S. initial jobless claims fall to 217K, below the expected 227K. What it means for the economy and crypto markets.Jobless Claims Surprise with Lower-Than-Expected NumbersWhat This Means for Financial and Crypto MarketsCrypto Traders Should Watch Closely