Wells Fargo: U.S. Importers Forced to Bear Trump Tariff Costs, Early Signs of Passing on to Consumers Emerge

According to a report by Jinse Finance, Wells Fargo economists Sarah House and Nicole Cervi pointed out that the rise in U.S. import prices indicates that foreign exporters are not bearing the higher tariff costs. Data released on Thursday showed that non-fuel import prices rose 1.2% year-on-year in June. They emphasized that import price data does not include tariffs, so if exporters were absorbing the higher tariff costs imposed by Trump on goods, import prices should have fallen accordingly. They warned, "Since import prices have not declined, domestic companies are being forced to bear the higher tariff costs and have begun to pass them on to consumers."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AAVE surpasses 320 dollars

James Wynn: Missed the Shorting Opportunity, Will Wait Until the PUMP Fully Bottoms Out Before Considering Entry

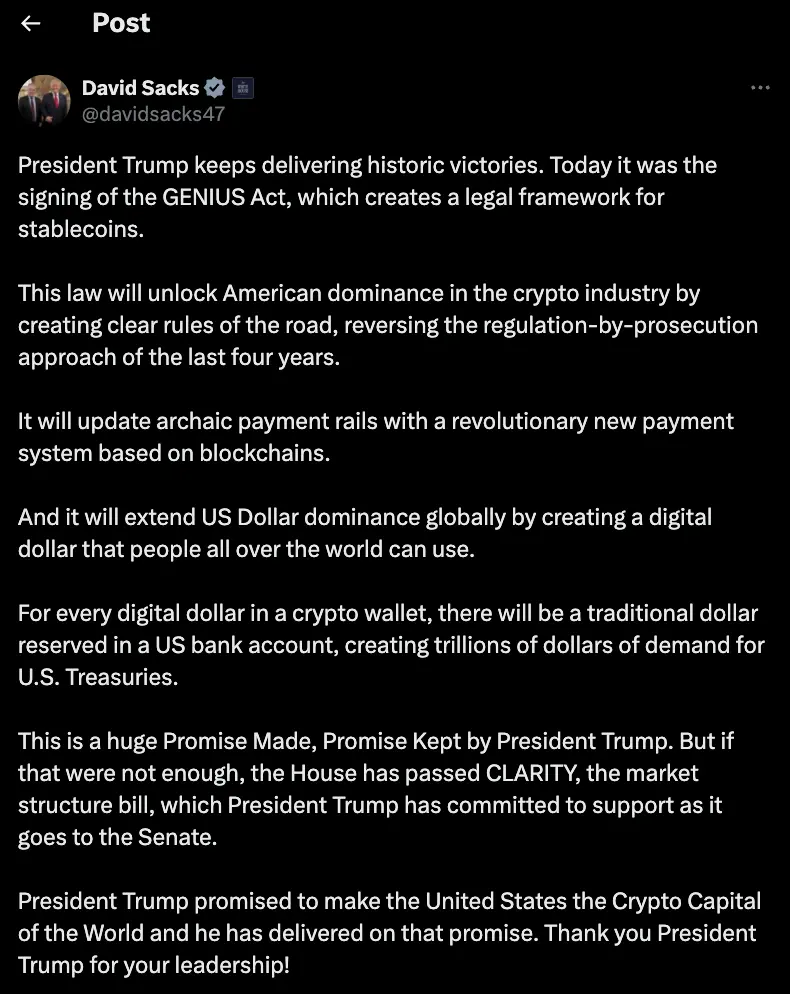

Crypto Czar David Sacks: The GENIUS Act Advances Digital Dollar and Stablecoin Legislation