Bank of America: The US Dollar Poised for a Summer Rally as the Fed Resists Rate Cuts

According to a report by Jinse Finance, Bank of America stated that if the Federal Reserve continues to hold rates steady and institutional investors slow down their selling of the US dollar, the dollar may experience a summer rally. "We remain bearish on the dollar in the medium term, but the risk of a summer rally is rising," wrote a team of FX strategists led by Adarsh Sinha in a research note. The Bloomberg Dollar Spot Index has risen 1.6% so far this month, rebounding from six consecutive months of selling. The bank's technical and quantitative indicators suggest a risk of reversal in dollar selling, and the strategists also believe that persistent inflation and resilient growth will keep the Fed from cutting rates in the near term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

James Wynn: Missed the Shorting Opportunity, Will Wait Until the PUMP Fully Bottoms Out Before Considering Entry

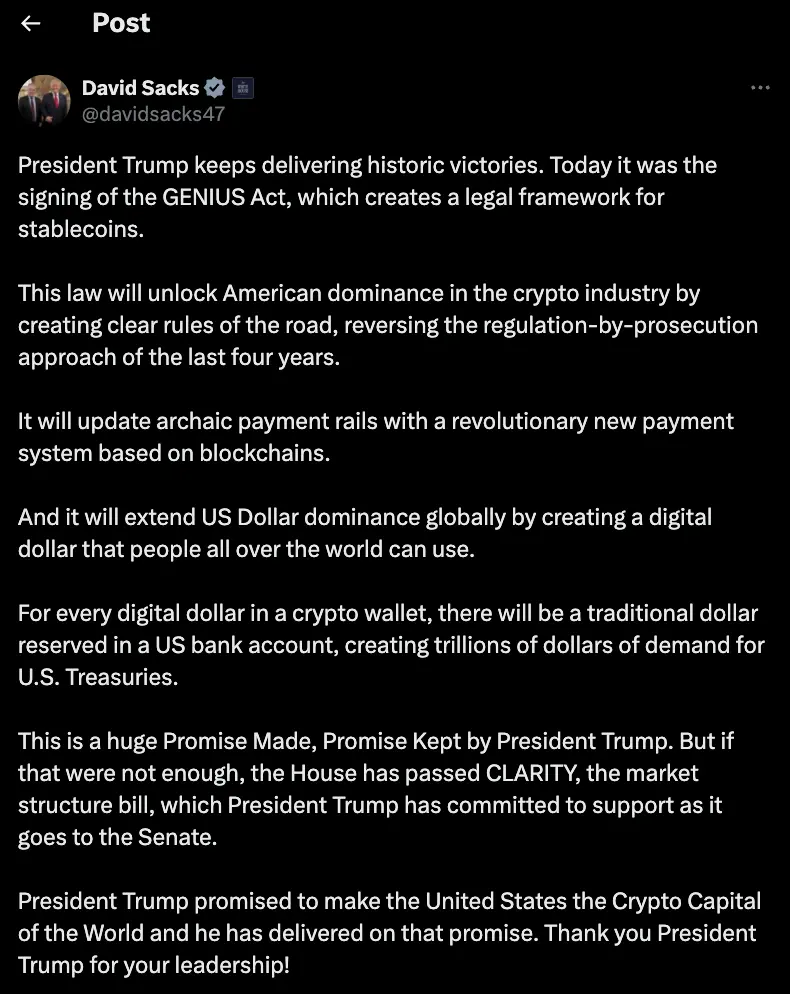

Crypto Czar David Sacks: The GENIUS Act Advances Digital Dollar and Stablecoin Legislation

21Shares Files Applications with US SEC for Two New Cryptocurrency Index ETFs