Fed Chair Contender Waller Backs July Rate Cut, Says It's Not About Politics

According to a report by Jinse Finance, Federal Reserve Governor Christopher Waller stated on Thursday local time that even if the June employment data remains robust, the Fed should still consider cutting interest rates at its July policy meeting. During a Q&A session following his speech at the Dallas Fed, Waller emphasized, “I have made my position clear—the current policy rate is too high, and we can discuss lowering the benchmark rate in July.” He believes that inflation has cooled significantly, the job market has stabilized, and recent price increases triggered by tariffs are limited to specific goods. He stated, “When inflation is trending downward, there is no need to maintain such a tight policy stance; this is the logical decision a central bank should make.” The significance of Waller’s remarks lies not only in their timing—coming just after the latest employment data showed continued labor market strength—but also because he is considered a leading candidate to become the next Fed Chair. U.S. President Trump has repeatedly criticized Jerome Powell and urged him to step down early, while Waller, known for his dovish stance, is seen as a potential successor. However, Waller made it clear on Thursday: “Although I am in the minority, I have clearly demonstrated the feasibility of a rate cut with sound economic logic. This has nothing to do with politics.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

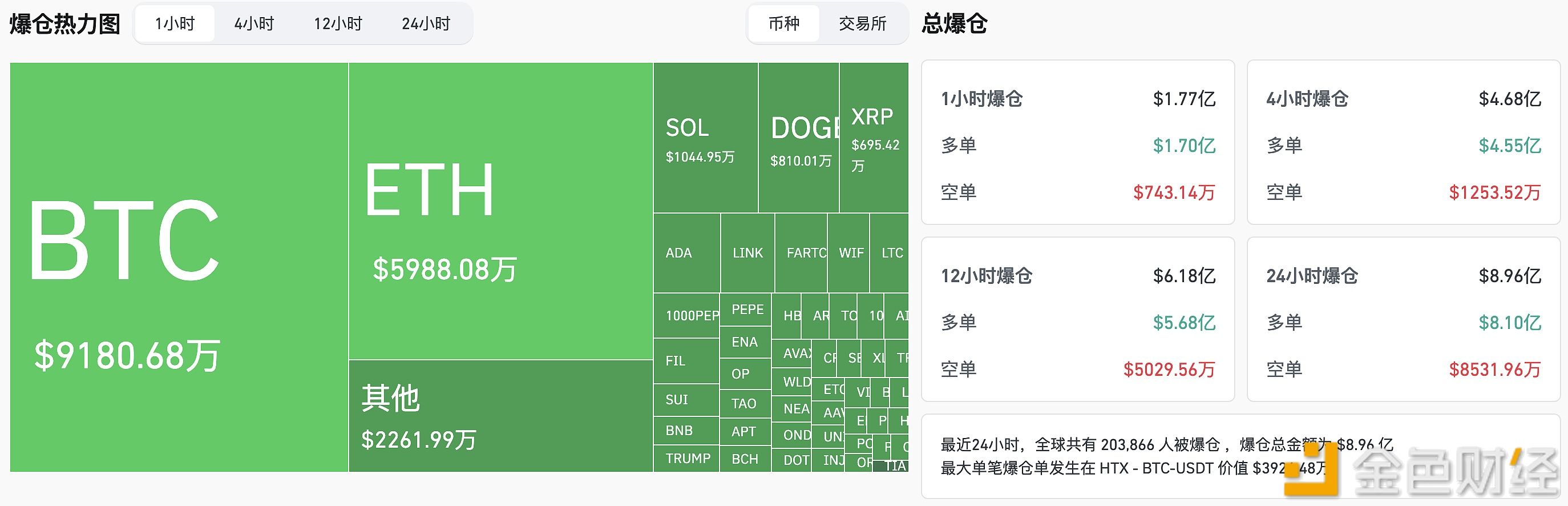

$177 Million Liquidated Across the Market in the Past Hour, Mostly Long Positions

US CFTC Acting Chair May Join MoonPay After Official Chair Confirmation

US Dollar Index rises 0.73% on the 25th