After El Salvador's President Nayib Bukele signed it, which U.S. states have been **"good, good"** in advancing Bitcoin strategic reserve legislation?

Arizona sets the benchmark for states, with Texas, Alabama, and others following closely behind.

On April 29, two bills known as the "Arizona Strategic Bitcoin Reserve Act" successfully passed the final vote in the House of Representatives and are now awaiting signature from Democratic Governor Katie Hobbs. Arizona has become the first state in the U.S. to require public funds to invest in Bitcoin. The SB 1373 bill proposes to establish a Digital Asset Strategic Reserve Fund managed by the state treasurer, which can invest up to 10% of its funds each fiscal year in digital assets such as Bitcoin. The SB 1025 bill allows the state treasury and retirement systems to invest up to 10% of available funds in virtual currency, with a focus on Bitcoin.

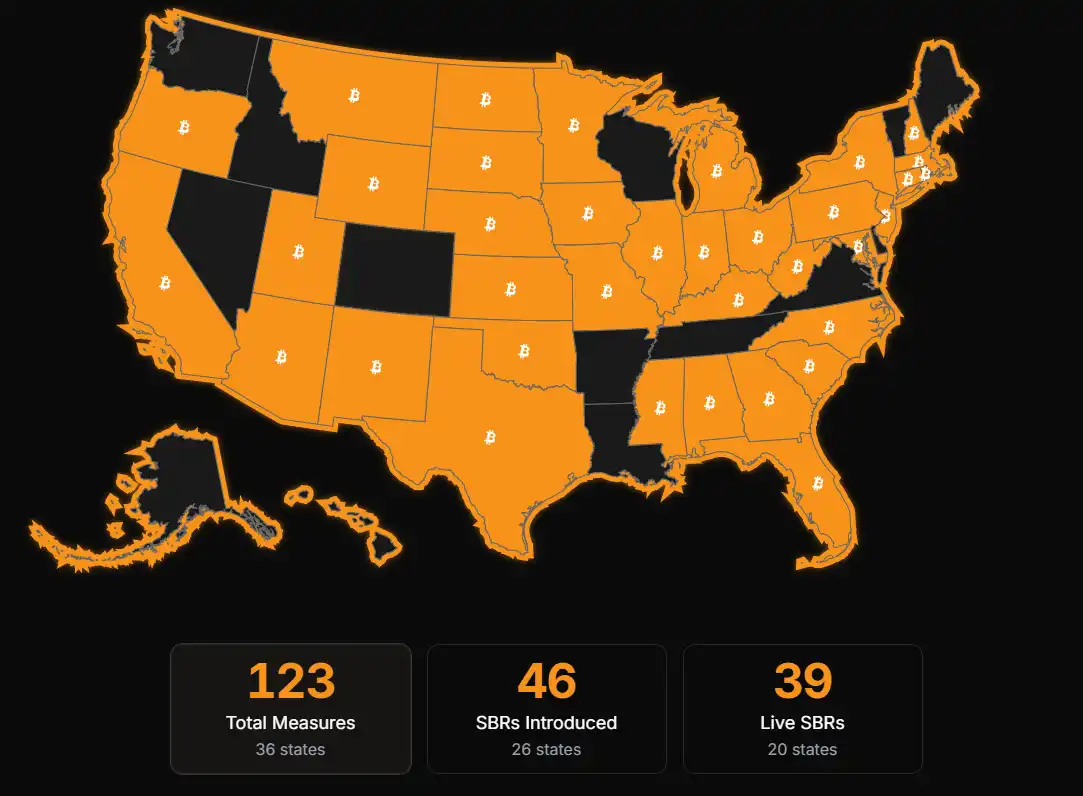

At the federal level, in March, Trump signed an executive order calling for the establishment of a strategic Bitcoin reserve and digital asset inventory. Arizona's state government incorporating cryptocurrency into public financial management reflects the increasing mainstream acceptance of digital assets. According to the Bitcoin Laws tracking website, 26 states in the U.S. have proposed bills to create Bitcoin reserves. Below is the progress of bills in states other than Arizona.

States with Clear Support

In addition to Arizona, which has already passed the bills, legislative agendas in Texas, Alabama, and Minnesota are also steadily progressing regarding Bitcoin reserve legislation.

Texas

Texas has shown bipartisan support for Bitcoin reserve legislation. The Senate has passed the "Strategic Bitcoin Reserve Act" (SB-21), allowing the use of public funds to purchase Bitcoin and other high-market-value cryptocurrencies, with a target holding size of $500 billion, and plans to allocate $2.5 billion from the Economic Stabilization Fund. In addition, the House's HB4258 bill further authorizes local governments to invest in cryptocurrency, demonstrating the comprehensiveness of its legislative framework. The bill has now been submitted to the Government Efficiency Delivery Committee of the state. If the bill successfully passes both houses of the legislature, it will become law on September 1 this year.

Texas has shown early support for cryptocurrency. In 2021, the Texas Legislature established the "Texas Blockchain Workgroup," focusing on blockchain development and attracting a large number of Bitcoin mining companies to settle in Texas with its abundant and cheap energy. For example, Riot Blockchain's Whinstone facility in Rockdale has become the largest single Bitcoin mining center in North America.

Lieutenant Governor Dan Patrick has stated, "Bitcoin is digital gold, and its limited supply and decentralized nature will be a key asset for Texas in the future." According to Bitcoin Magazine, Texas currently has 8 bills related to Bitcoin or cryptocurrency under consideration. Among these eight bills, HB4258 is the fifth to be submitted for committee consideration. Four of the bills, including HB4258, HB1598, SB21, and SB778, all require Texas to establish a strategic Bitcoin reserve.

Alabama

Alabama Republican Senator April Weaver submitted Senate Bill 283 (SB 283) at the beginning of April, following House Bill 482 (HB 482) introduced since March 2025, setting a threshold of "market cap of 750 billion USD" (currently only Bitcoin meets), indirectly pegging Bitcoin as a reserve asset. Additionally, the cryptocurrency must be directly managed by the state treasurer and is not allowed to exceed 10% of the state's budget. If this bill passes, it will take effect on October 1, 2025.

Minnesota

Minnesota Republican House Representative B. Olson submitted House File 2946 (HF 2946) on April 1, 2025, known as the Minnesota Bitcoin Act, with a corresponding Senate File 2661 introduced since March 2025. Both bills are identical, allowing the state investment board to allocate public funds to Bitcoin, accepting BTC as payment for taxes and government transactions, and amending 12 existing laws, including tax codes, retirement plans, and investment regulations to integrate cryptocurrency. If this bill passes, it will take effect on January 1, 2026.

Steady Progress States

New Hampshire

New Hampshire's bill, HB302, was introduced by Republican Representative Keith Ammon and has bipartisan support. The bill allows the state treasurer to invest up to 5% of state public funds (based on general funds, revenue stabilization funds, etc.) in eligible digital assets or precious metals (such as gold, silver), initially proposed at 10% but later reduced to 5% due to security considerations. On April 10, 2025, the bill passed the House floor vote with 192 in favor and 179 against. State Treasurer Monica Meza-Peña stated that if the bill takes effect, pilot investments will be initiated, with an initial scale potentially reaching $180 million.

Ohio

Senator Sandra O'Brien introduced the Ohio Bitcoin Reserve Act SB57 on January 28, 2025, authorizing the state treasury to directly invest in Bitcoin, stipulating a minimum five-year Bitcoin holding period, and requiring state institutions to accept cryptocurrency payments. It also allows state residents, institutions, and universities to donate Bitcoin to the reserve fund. Submitted to the Senate Financial Institutions and Technology Committee on January 29, the bill is currently under committee review with no further progress.

Utah

In early 2025, Utah State Representative Jordan Teuscher introduced a bill titled HB0230, the "Blockchain and Digital Innovation Amendment," on January 21. The bill initially allowed the State Treasurer to invest up to 10% of public funds in digital assets, including Bitcoin, non-fungible tokens (NFTs), and stablecoins, subject to regulatory approval, market capitalization, and liquidity requirements. On March 10, 2025, the Utah State Senate passed HB0230, but removed the key provision allowing the state to invest in Bitcoin, instead providing residents with rights to custody protection of digital assets, mining, running nodes, and participating in staking.

The provision for the state's direct investment in Bitcoin was removed, reflecting legislators' concerns about market risks. Senator Kirk A. Cullimore stated during a meeting on March 7 that the removal of the reserve provision was due to "many concerns about the early adoption of these policies." As of now, Utah has not established a state-level Bitcoin reserve but has shifted legislative focus to regulatory oversight and innovation protection for digital assets.

Florida

Florida's HB 487 bill was introduced in February 2025, allowing the State Chief Financial Officer and State Board of Administration to invest up to 10% of public funds, including the General Revenue Fund and the Budget Stabilization Fund, in Bitcoin. On April 10, with unanimous support (no opposing votes) from the House Insurance and Banking Subcommittee, it moved to review by the Government Operations Subcommittee. It is currently in the Government Operations Subcommittee review stage with no further progress reported.

In addition, Bitcoin reserve bills are being proposed or advanced in Iowa, Missouri, Georgia, Illinois, Kansas, Kentucky, Maryland, Massachusetts, Michigan, New Mexico, North Carolina, Rhode Island, West Virginia, and 13 other states, and have not been explicitly rejected or tabled.

States with Rejected Bills

Oklahoma

Oklahoma's Cody Mennard introduced the HB1203 bill on January 15, 2025, aiming to allow the state's reserve and retirement funds to invest up to 5% in Bitcoin and other digital assets. The bill passed the House with a vote of 77-15 on March 25 and was sent to the Senate. However, on April 15, it was rejected by the Senate Tax and Revenue Committee with a 6-5 vote, resulting in the failure of the bill, and there are currently no signs of further advancement.

Montana

In Montana, legislators introduced House Bill 429 on January 31, 2025, proposing to allow the state to invest up to $50 million in Bitcoin, digital assets, stablecoins, and precious metals as part of the state's financial diversification strategy. However, the bill was rejected in the House on February 21 by a vote of 59 to 41, failing to pass the first round of voting with no indication of being revived. Montana's legislative effort for a Bitcoin reserve has come to a close.

Pennsylvania

In Pennsylvania, Representatives Mike Cabell and Aaron Kaufer introduced House Bill 2664 on November 14, 2024, which would allow the state treasurer to invest up to 10% of Pennsylvania's General Fund, Rainy Day Fund, and State Investment Fund in Bitcoin and cryptocurrency-based exchange-traded products, potentially involving investments of up to $970 million. However, as of a report on March 2, 2025, the bill was "effectively dead" in the legislative process, failing to advance further with no current signs of a reintroduction.

North Dakota

In North Dakota, Representatives Nathan Toman, Josh Christy, and Senator Jeff Barta jointly introduced the Strategic Bitcoin Reserve Bill on January 11, 2025, aiming to allow the state to invest in Bitcoin, although specific investment proportions and details were not specified. However, the bill has not continued to progress, resulting in legislative failure, and there are no signs of a potential revival, marking the end of North Dakota's legislative efforts for a Bitcoin reserve.

South Dakota

Legislators in South Dakota postponed a bill on February 25, 2025, that would have potentially allowed the state to adopt Bitcoin as a strategic reserve asset. The bill's specific details were not clear, but it aimed to enable the state to invest in Bitcoin. The reason for the postponement was cited as the high volatility of Bitcoin prices. The bill has now been terminated with no further progression anticipated.

Wyoming

On January 18, 2025, a bill was introduced in Wyoming, with Senator Cynthia Lummis supporting the introduction of House Bill 0201 on January 18, 2025. The bill would allow the state treasurer to invest in Bitcoin, up to a maximum of 3%, including the General Fund, Permanent Mineral Trust Fund, and Permanent Land Fund. Investments could be made through direct purchases or using regulated Bitcoin exchange-traded products, with annual reporting requirements for transparency. However, the bill has not made further progress and has been categorized as a failed initiative, marking the end of the legislative effort.

The breakthrough in Arizona has set a benchmark for all U.S. states. States like Texas and Alabama are quickly following suit by enacting legislation to incorporate Bitcoin into the public financial framework, aiming to diversify asset risks and seize the opportunity in the digital economy. States that had previously rejected establishing a Bitcoin reserve due to concerns such as the high volatility of cryptocurrency and regulatory challenges, as well as other states currently in the process of advancing similar legislation, may also change course following Arizona's pioneering move. Despite facing multiple challenges, Bitcoin's positioning as "digital gold" is gradually being solidified through local legislation. Whether it can become a mainstream reserve asset remains to be seen, but it is undeniable that cryptocurrency is increasingly being embraced by the mainstream, and the road ahead will only get wider.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UAE to use AI system that may cut lawmaking time by 70%

Tornado Cash freed from US sanctions after Texas court ruling

South Korea to Launch Spot Bitcoin ETF This Year

South Korea’s ruling People Power Party has confirmed that the trading of spot digital asset ETFs will be permitted by the end of this year, according to local media outlet Edaily. For the first time, this development will allow domestic investors to gain exposure to major cryptocurrencies like Bitcoin and Ethereum through exchange-traded funds.

AUSTRAC Warns Inactive Crypto Exchanges of Deregistration

The Australian Transaction Reports and Analysis Centre (AUSTRAC) has raised fresh concerns about the integrity of the country’s crypto landscape, revealing that several cryptocurrency exchange providers remain on the official register despite no longer being operational. These dormant platforms now risk deregistration unless they voluntarily withdraw.