5 Bullish Bitcoin Charts Predict BTC Could Reach $100K by May

- Bitcoin has broken key resistance levels with bullish on-chain indicators, positioning it to potentially hit $100,000 soon.

- Technical patterns like double bottom and falling wedge breakouts suggest strong momentum and higher targets above $100K.

Bitcoin price has reversed from its 20-day-long bearish trend starting from April 2025. The U-turn has pushed its price beyond the $95,000 level, along with the 12% gain in the last week. All these setups are hinting at even a $100k price level soon. Many on-chain indicators are bullish, with recent indications of 87.3% of Bitcoin’s circulating supply on April 23 surging from its 82.7% during early March, as per Glassnode .

The accumulation phase indicates that holders are now back in profit, which often leads to stronger market confidence. When the percentage of supply in profit stays consistently above 90%, historical data suggests markets can move into a euphoric state. With numbers now approaching that level, positive sentiment is firmly in place.

A strong push above the $94,000–$95,000 zone remains crucial. This range is now acting as a cap on Bitcoin’s upward movement. Once breached, analysts expect the full projected move to $100,000 to come swiftly, driven by both technical and liquidity factors.

Breakout Structures Point to $100K Target

Technical signals also favor an upward move. Bitcoin’s daily chart has completed a classic double bottom, with a neckline breakout at $87,668. This structure targets a measured move that could take BTC above $100,500 . Supporting indicators such as the relative strength index remain in bullish zones, allowing room for further growth.

The 50-day and 200-day exponential moving averages have shifted to act as support. This technical transition is viewed as a strong base for additional price momentum. Buyers appear to remain in control, with volume staying consistent after the breakout, forming a steady backdrop for further gains.

Over the shorter term, the hourly chart shows Bitcoin consolidating inside a bull pennant—a pattern that typically signals a pause before the next move upward. The price target from this setup reaches near $100,900, indicating that despite short-term hesitation, longer-term direction remains positive.

Liquidity, Volume, and Market Pressure Create a Bullish Backdrop

The breakout above the falling wedge pattern on the three-day chart adds even more technical conviction. Bitcoin surpassed a significant resistance level around $94,000 and now trades above the 50-3D EMA. The upward move was also accompanied by a spike in volume, which often reflects increased buyer commitment and market interest.

The target from the wedge pattern reaches up to $102,270, reinforcing the idea that there is still room for higher prices. Volume acceleration during this breakout also signals that market participants view this level as a launchpad, not a ceiling.

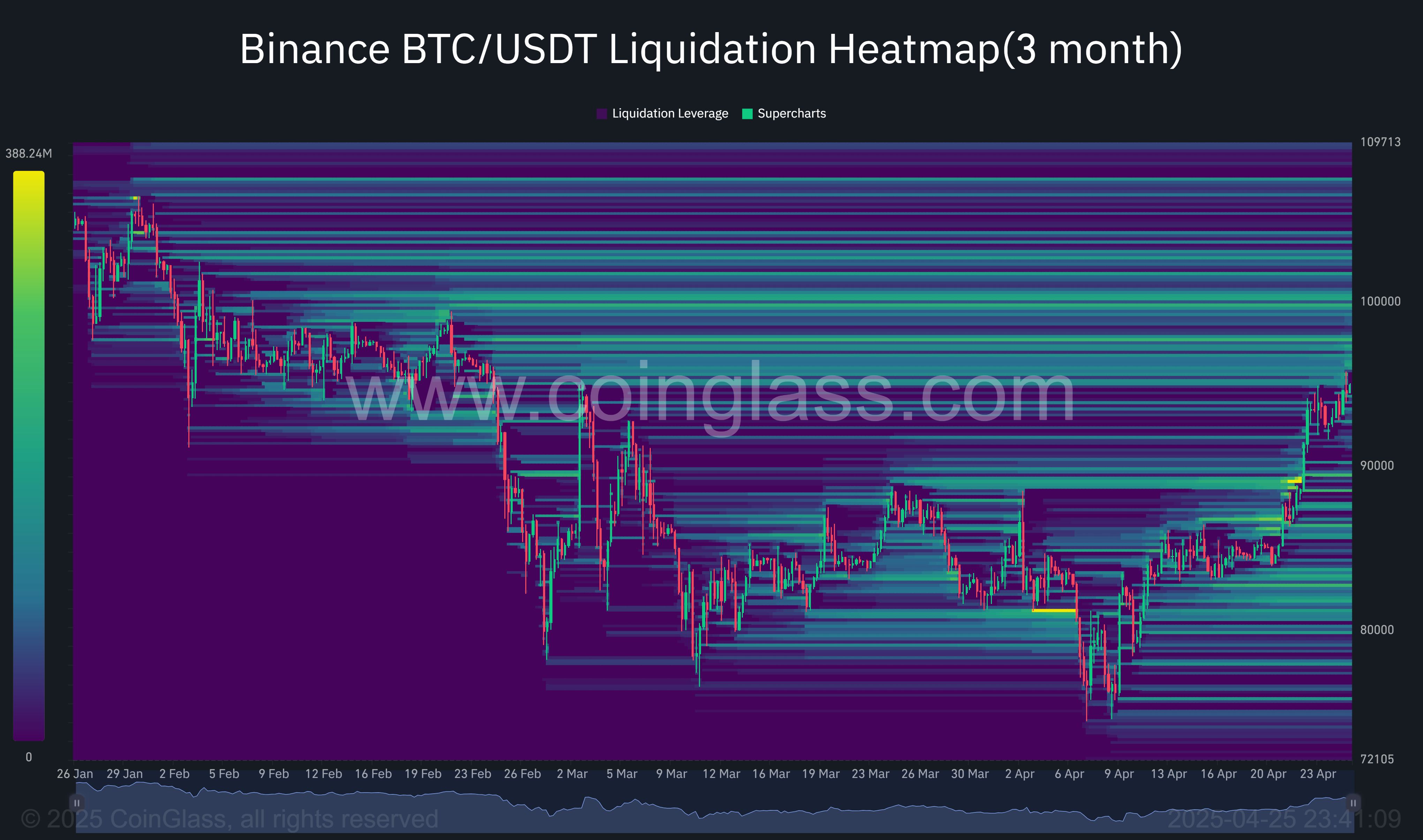

Another layer of support for a bullish outlook comes from liquidation data . Analysis shows a concentration of short liquidations around the $100,000 mark. These levels often act like price magnets. As market makers look for liquidity, such clusters can pull prices toward them, triggering further upward movement.

Recommended for you:

- Buy Bitcoin Guide

- Bitcoin Wallet Tutorial

- Check 24-hour Bitcoin Price

- More Bitcoin News

- What is Bitcoin?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VIRTUAL breaks through $1.5, with a 24-hour increase of 41.5%

100 days after Trump took office, the crypto market has evaporated $537 billion in market value

Bitcoin’s march towards $100K: Is the landmark closer than anticipated?

Breaking Down Bitcoin's Momentum: The Crucial $96K Reclamation for a Potential Rally