XRP Soars Amid Market Hype, But Key Indicator Predicts Trouble

Despite a recent price increase, XRP faces potential risks as technical indicators point to weakening momentum and reduced demand. A drop below $2 could signal further losses if support fails.

Ripple’s XRP has managed a 3% price increase over the past week, in line with the broader crypto market rally that has lifted several major coins.

However, despite the bullish momentum, a key technical indicator is flashing a warning signal that could undermine XRP’s recent gains.

XRP’s Rally on Thin Ice

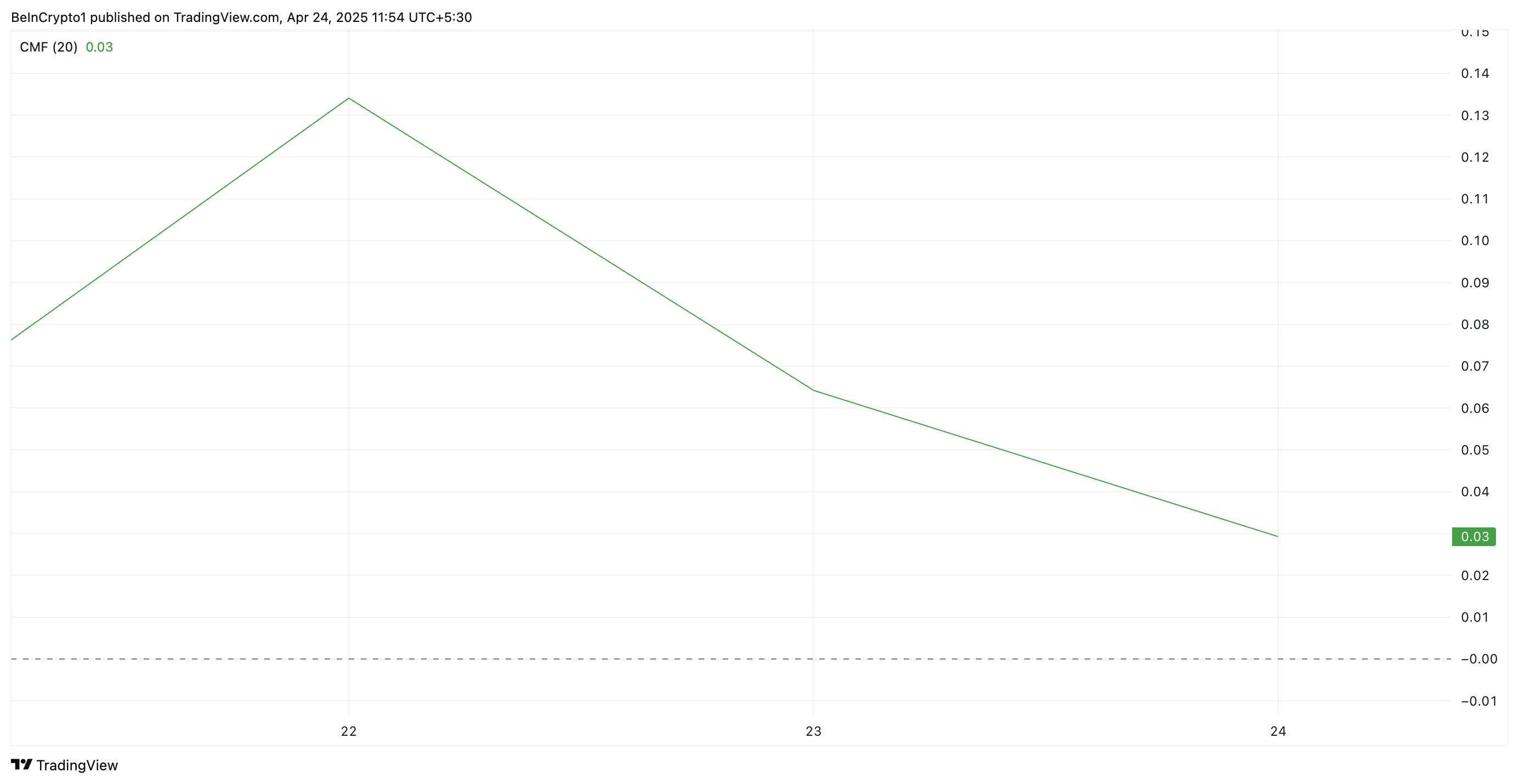

XRP’s Chaikin Money Flow (CMF)—an indicator that measures the volume-weighted flow of money into and out of an asset—has been trending downward even as the token’s price has continued to rise. This momentum indicator is currently at 0.03 and trending toward the center line.

XRP CMF. Source:

TradingView

XRP CMF. Source:

TradingView

The trend forms a bearish divergence between XRP’s price action and CMF, a warning sign of weakening momentum. Typically, the CMF tracks the flow of capital into an asset, so when it declines while prices rise, it suggests that the rally lacks solid support from sustained demand.

In other words, XRP traders may be buying based on short-term hype rather than long-term conviction. This means its recent gains are vulnerable to being erased, especially if broader market sentiment shifts or profit-taking sets in.

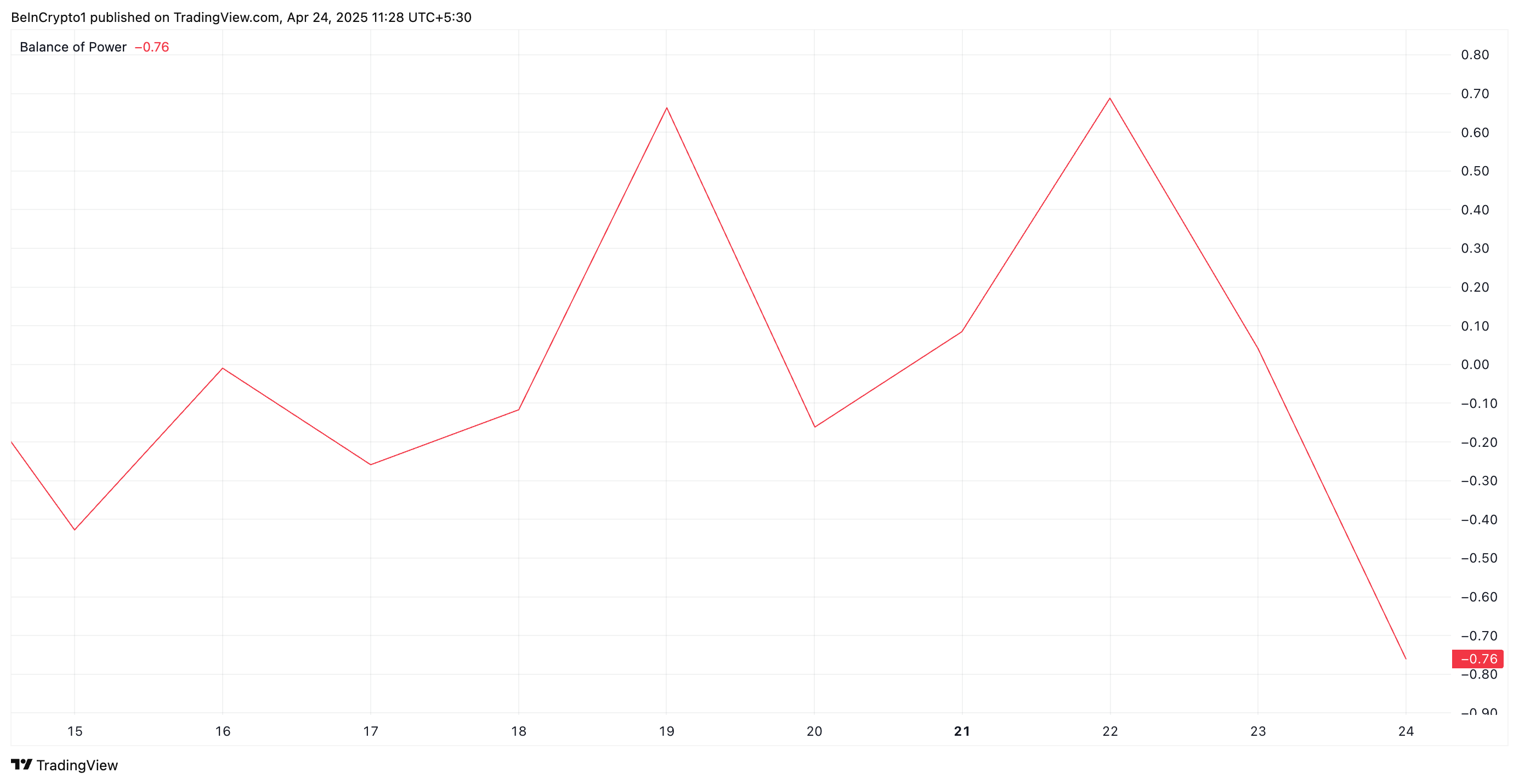

Further, the altcoin’s negative Balance of Power (BoP) supports this bearish outlook. As of this writing, the indicator is at -0.76, highlighting the weakening demand for XRP.

XRP BoP. Source:

TradingView

XRP BoP. Source:

TradingView

When an asset’s BoP is negative like this, sellers exert more influence over price action than buyers. It is a bearish signal that indicates further downside pressure on XRP if the trend continues.

XRP Faces Crucial Test at $2 Support

XRP currently trades at $2.18, holding above support formed at $2.03. If demand weakens further, XRP bulls might be unable to defend this support level, causing the altcoin to fall back below $2, to trade at $1.61.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, a resurgence in new demand for XRP will invalidate this bearish outlook. In that scenario, its price could rally to $2.29 and charge toward $2.50.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SUI Sees 43% Weekly Surge as Online Sentiment Aligns with Market Activity

S&P 500 jumps 1.6%, Nasdaq 2.2% as Big Tech leads rally on trade optimism

Share link:In this post: The S&P 500 rose 1.6% and the Nasdaq jumped 2.2% as tech stocks like Nvidia and Amazon rallied. China confirmed there are no trade talks happening with the U.S. and called for removal of tariffs. Trump said he’s open to less confrontation on trade, but no details or negotiations have been set.

Trump teases third term with 2028 hat. Just how far can he go?

Share link:In this post: Trump is now selling a “Trump 2028” hat, openly signaling interest in a third presidential term. The original product description hinted at rewriting the Constitution but was later changed. Trump told NBC News he’s considering legal ways to bypass the two-term limit, including running as vice president.

Stablecoins can expand to $1.6T by 2030, says Citigroup

Share link:In this post: Citigroup predicts $1.6T in stablecoin supply by 2030 in a base scenario and up to $3.7T in a bullish development. Stablecoins may replace cash reserves and some fintech apps. Blockchain may make a comeback for public spending, disbursements and transparent tracking.