Investors Keep an Eye on Pi Coin’s Potential Amid Key Unlock Events

In Brief Pi Coin faced a 2% decline ahead of significant coin unlocks. Large-scale transactions indicate potential interest from big investors. Long-term projections suggest significant upside potential for Pi Coin.

The primary asset of Pi Network, Pi Coin, has slipped to $0.63 with a 2% decline ahead of the scheduled unlocking of 4.9 million coins on April 22. Since reaching its local peak in February, the price has faced a substantial retracement and has been confined within a sideways range in recent weeks. The $0.70 level has emerged as a strong resistance point, repeatedly tested but yet to be breached. If the price surpasses this threshold, it could gain momentum toward $0.80 and beyond.

Whale Purchases Draw Attention to Scheduled Unlocks

Despite the planned coin unlocks and stagnant price movement, Pi Coin continues to attract the interest of large-scale investors. Recently, a transfer of approximately $4.82 million worth of 7.5 million Pi Coins to a private wallet from the OKX exchange has drawn attention, following similar large transactions. This wallet has accumulated a total of 48 million Pi Coins, with a current market value of around $31 million.

Such high-volume transactions are often interpreted by market participants as indicators of a potential upswing. The strategic moves of institutional or large individual investors are seen as significant developments before key events. However, the daily unlocking of millions of coins creates an oversupply that exerts serious pressure on the price.

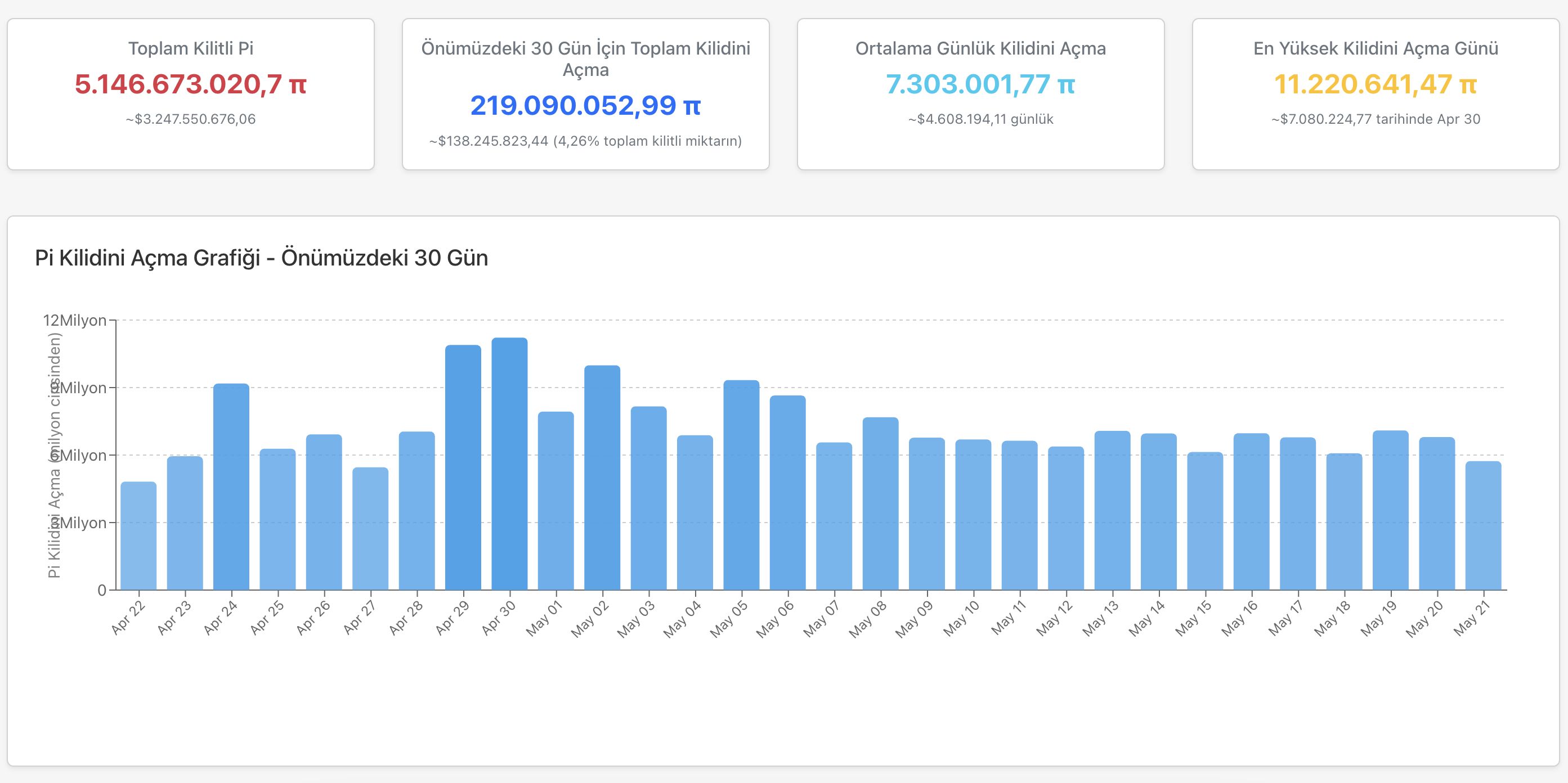

Scheduled Unlocks in Pi Coin

Scheduled Unlocks in Pi Coin

Long-Term Projections for Pi Coin Show Potential Upswing

While Pi Coin currently faces selling pressure in the short term, long-term projections paint a more optimistic picture. According to CoinCodex’s forecast for the end of April, the altcoin ‘s price could fluctuate between $0.63 and $2.16. Should this prediction materialize, investors could find a potential return opportunity of up to 238% at the extreme end.

The high projections are linked to factors such as the likelihood of listings on major exchanges and ecosystem expansion. Community support and a long-term roadmap also contribute to these expectations. Nevertheless, the realization of these scenarios depends on market conditions evolving favorably.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BlackRock Invests $84 Million in Bitcoin

Bitcoin and Gold Rise Amid US Dollar Weakness

Bitcoin’s Rising Role Amid US Dollar Concerns

Metaplanet CEO Defends Bitcoin Strategy Amid Price Concerns