Exciting Trends Emerge as Investors Anticipate Altcoin Season

In Brief Investor sentiment is optimistic about an upcoming altcoin season. Current technical signals suggest a potential bull market for Bitcoin. Concerns about fear levels persist among a significant portion of investors.

Recent uncertainties and fluctuations in the cryptocurrency market have led to a noticeable shift in investor expectations. Among South Korean investors, optimism for altcoins is increasing, while Bitcoin $93,030 continues to dominate the market. According to a survey conducted by CoinNess and Cratos with 2,000 participants, investors believe that a new altcoin season may begin during the summer months. However, the fear index remains high, indicating that overall investor sentiment in the market is cautious.

Eyes on the Third Quarter for Altcoin Rally

The survey reveals that 36% of investors predict the next altcoin season, or altcoin rally, will commence in the third quarter of the year (Q3). Meanwhile, 22% believe this season may extend into the fourth quarter, while 16.7% assert that the altcoin season has already begun. Conversely, 13.3% of participants foresee no rally in the altcoin market this year, and 11.3% believe that the altcoin season has already ended.

Although altcoin prices have not made significant jumps recently, investor expectations are leaning positively. Despite this optimism, 46% of survey participants express that they still feel fear or extreme fear. A neutral stance is held by 29.3%, while only 24.7% indicate they feel hopeful or extremely hopeful about the market. This reflects the ongoing uncertainty that short-term fluctuations have created in the market.

Altcoin Season Index Says “We’re Far from a Rally”

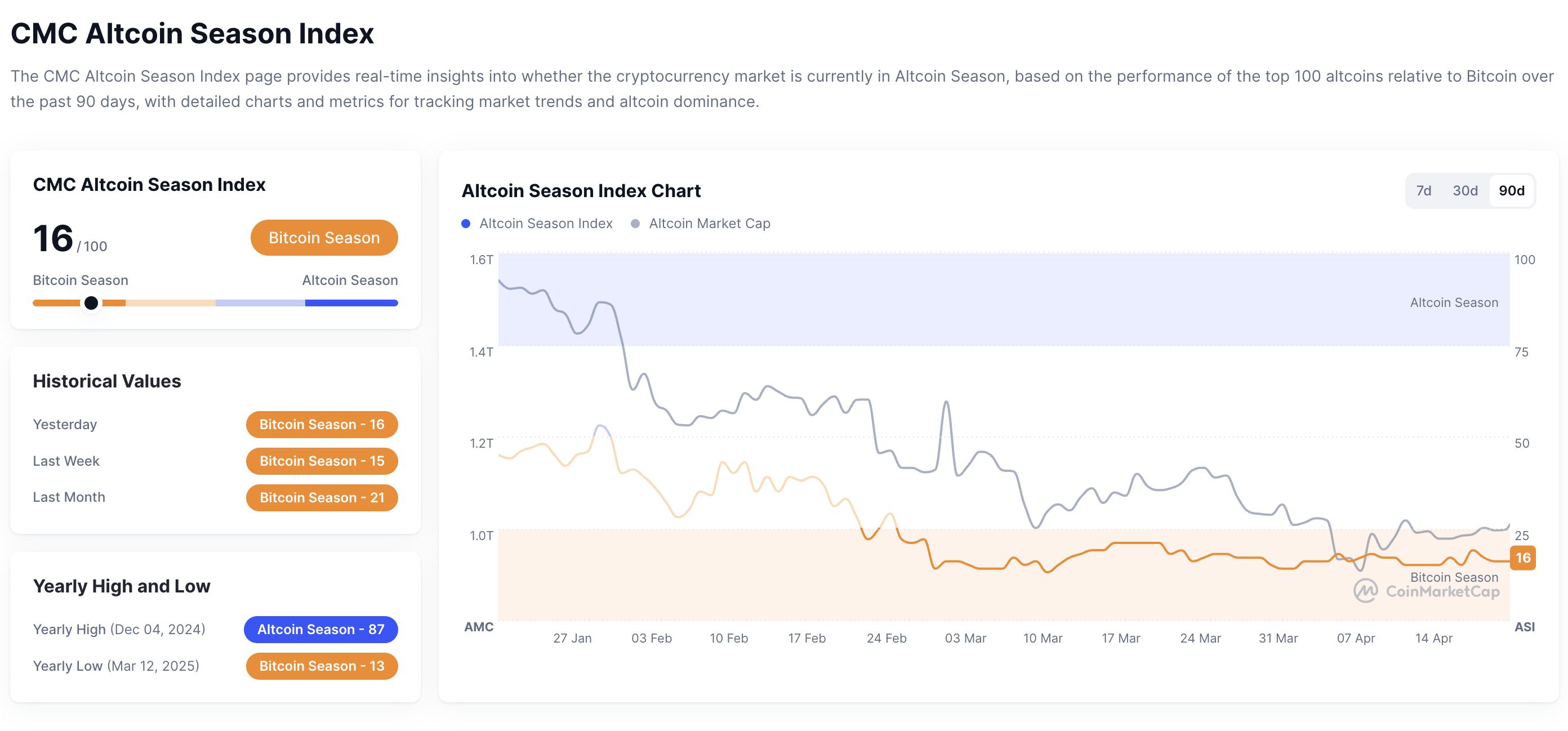

According to CoinMarketCap data, the Altcoin Season Index currently stands at only 16. This level is significantly below the threshold considered necessary for the beginning of an altcoin season, indicating Bitcoin’s continued dominance in the market. Following a brief selling pressure caused by tariffs imposed by President Trump, Bitcoin recovered from around $75,000 and has begun to rise again.

CMC Altcoin Season Index

CMC Altcoin Season Index

As of early 2024, after the rollout of Bitcoin ETFs, Bitcoin’s market dominance continues to remain above 60%. In contrast, altcoins represent less than 40% of the total market value. Despite Bitcoin’s rise, the struggle for altcoins to gain momentum is considered a significant indicator of market leadership.

Moreover, experienced cryptocurrency analyst Altcoin Gordon has suggested that an abundance of technical signals indicates a potential large bull market may be on the horizon. In this context, Bitcoin surpassing $87,000 and currently trading above the $88,000 threshold is interpreted as an important sign for the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SEC Drops Fraud Case Against HEX Founder Richard Heart

Cardano Surges 17%, Eyes Potential $5 Target

SOL Strategies Secures $500M for Solana Validator Expansion

Ubisoft and Immutable Launch ‘Might & Magic’ on Ethereum