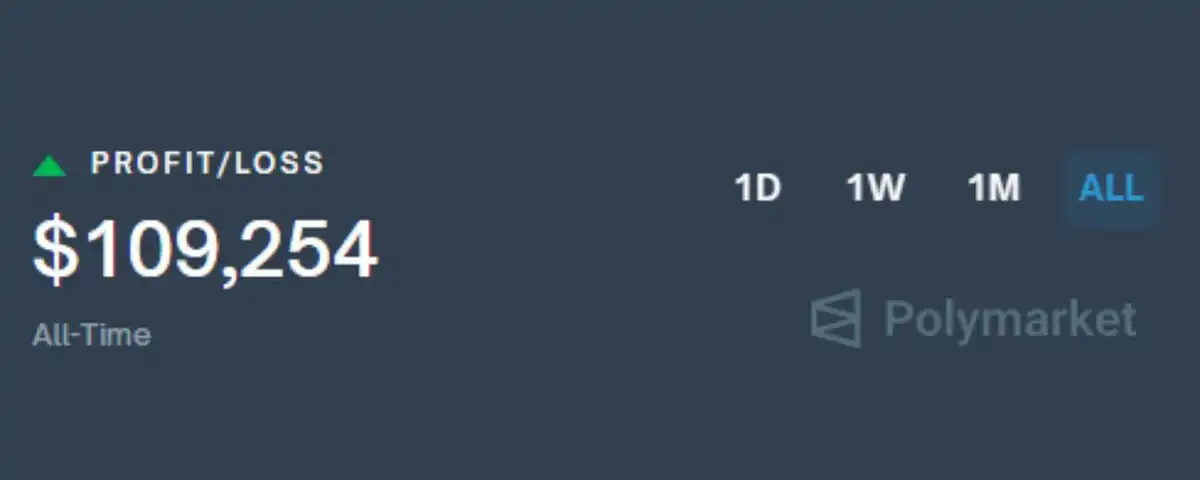

Making $100,000 in 3 Months on Polymarket: How Did They Do It?

Utilize prediction market price discrepancies for arbitrage, combining fast action and early exit strategies to earn risk-free profits

Original Article Title: How I Made $100k Arbitraging Between Prediction Markets (Full Guide)

Original Article Author: @PixOnChain, Crypto Researcher

Original Article Translation: Deep Translation

Editor's Note: This article details the author's strategy of earning $100k through arbitrage between prediction markets. The author took advantage of price discrepancies for the same event across different platforms to secure risk-free profits, focusing on pricing errors in multi-outcome markets. Core steps include identifying spreads, acting quickly, automating monitoring, and early exits to maximize APY. The author emphasizes the importance of small markets, volatility, and careful rule scrutiny, providing an efficient Web3 arbitrage guide.

Below is the original content (slightly rephrased for readability):

Most people gamble on prediction markets.

I make money through arbitrage.

Here is the specific strategy that allowed me to earn $100k from decentralized, inefficient prediction markets—completely unrelated to gambling.

Step One: Understand the Rules

Prediction markets allow you to bet on real-world outcomes.

· "Will Ethereum reach $5,000 by December?"

· "Will MrBeast run for president?"

· "Will Kanye West launch his own token?"

Each market has its own participant group.

Each group has its own biases.

This means that pricing for the same event on different platforms… will be different.

That's where the arbitrage opportunity lies.

If Platform A's "yes" price is 40 cents, and Platform B's "no" price is 55 cents…

No matter the outcome, you can lock in a 5-cent profit.

That's arbitrage.

But there's an even better opportunity…

Step Two: Find Your Edge

For me, multi-outcome markets have been very effective.

These markets are most prone to issues.

For example:

· Who will win the F1 this weekend?

· Which party will win in the UK general election?

· Who will be the next eliminated in the reality show?

More outcomes = higher complexity = more pricing errors.

In theory, the sum of probabilities for all outcomes should be 100%.

In reality? I often see the market sum up to 110%.

Why? Because most platforms embed hidden fees—the "overround."

Plus, many platforms let the crowd determine odds.

This leads to lucrative but inefficient arbitrage opportunities.

Step Three: How to Identify an Arbitrage Opportunity

The rules are as follows:

You find pricing for the same event on different platforms. Choose the lowest price for each outcome. If the sum is less than 1 dollar, you have found an arbitrage opportunity.

Let me show you a real example.

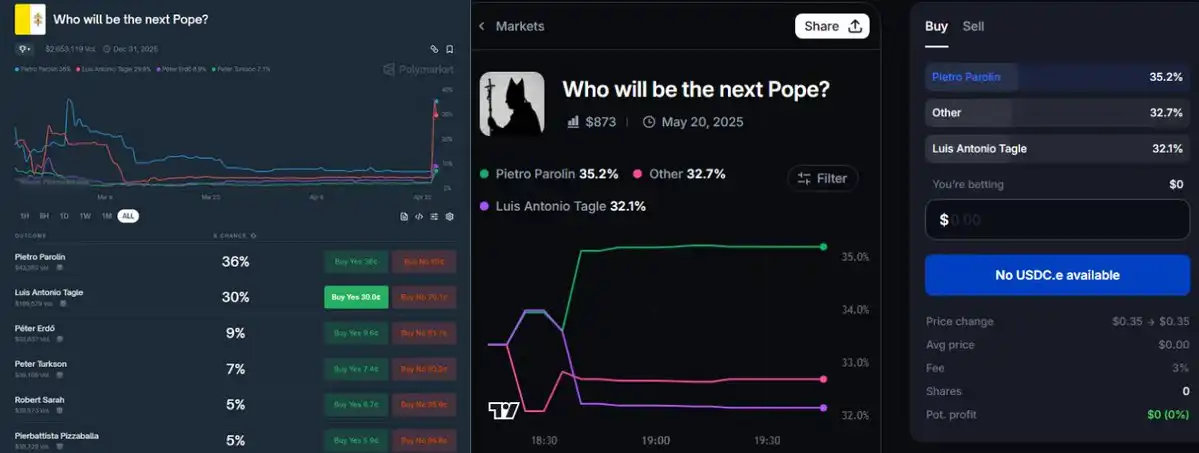

Market: Who will be the next Pope?

Two platforms are simultaneously running this market.

Prices are as follows:

Polymarket/Myriad

We select the lowest price for each outcome:

· Pietro Parolin: 35.2 cents (Myriad)

· Luis Antonio Tagle: 30 cents (Polymarket)

· Other: 32.7 cents (Myriad)

· Total: 97.9 cents

You buy all three outcomes.

One of them must win.

You are guaranteed to get back 1 dollar.

Profit: 2.1 cents per trade = a 2.1% risk-free return.

This is arbitrage.

You're not betting on who will become the Pope. You're betting on two platforms not being able to agree on the pricing of a potential candidate. When they disagree — you profit.

P.S. This isn't the best opportunity, just one I found today.

Myriad has low liquidity, but there are two platforms showing a similar spread.

If you monitor more markets, you'll find bigger opportunities.

I usually only enter when the Annual Percentage Yield (APY) is above 60% (APY = (spread / settlement days) × 365).

This market has a 2.1% spread, with a 29-day settlement:

(0.021 / 29) × 365 ≈ 26.4% APY

Not good enough for me.

Locking funds for a month for a 26% APY? Pass.

But if the same spread settles in 7 days?

That's over 100% APY — I'm in.

How do you find these high APY opportunities?

Step Four: Race Against Time

Predicting market arbitrage is a game of delay. Once prices diverge, you usually only have minutes, not hours.

· Someone posts a rumor.

· One market updates its price.

· Another market lags behind.

This delay is your entire advantage. If possible — automate this part.

At the start, I had tabs open for 7 platforms simultaneously. Refreshed like a madman. Used price alerts on Discord, Telegram, Twitter.

Sometimes, I could spot the spread just from muscle memory. The faster you act, the more you earn. Hesitate for 5 minutes, and the spread is gone.

The best spread I caught was 18%, and the trading volume was decent too.

Make sure you have enough liquidity available on each market to deploy and know all the fees involved.

Step Five: Early Exit

Most people will wait for the outcome to be revealed. I won't. I've already made most of my profit when the outcome is still unknown.

Assume I bought all outcomes at 94 cents. This locked in a 6 cent spread. One of the outcomes will pay out 1 dollar.

But I don't have to wait.

If the market tightens—those same shares can now be collectively sold for 98 cents or 99 cents—I exit.

This only works when all outcome prices remain stable.

If one outcome skyrockets and others plummet, there is no exit opportunity.

So I need to monitor the entire portfolio. I exit when the overall value goes up.

This can significantly increase your APY and allow you to rotate quickly between different markets.

Additional Tips

· Look for overlapping events (e.g., "Trump wins 2024 election" and "Republican victory")—hidden arbitrage opportunities are right there.

· Target small markets—more pricing errors, less competition.

· Use less popular platforms—bigger spreads, greater advantage + potential airdrop rewards.

· Carefully read settlement rules—one word can change the outcome.

· Always triple-check the order book and your buy-in price. Include all fees in your calculations.

It took me 2.5 months to earn $100,000.

Some weeks had no opportunities. Some weeks were non-stop busy.

Bigger market swings = larger spreads.

So if the market is quiet, don't fret, keep clicking. Another mispriced market will always come along.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Surpasses Google to Become World’s 5th Largest Asset

Compatible with Ethereum! Ant Digital Open Sources DTVM

BTC falls below $93,000