XRP leads modest global crypto fund weekly inflows of $6 million amid 'signs of recovery': CoinShares

Quick Take Global crypto funds recorded minor net inflows of $6 million last week, with XRP investment products overcoming outflows from Bitcoin and Ethereum ETPs, according to asset manager CoinShares. Sentiment toward the asset class remains mixed but is showing “signs of recovery,” Head of Research James Butterfill said.

Global crypto investment products run by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares registered modest net inflows of $6 million last week, according to CoinShares data.

"While the week began with minor inflows, stronger-than-expected U.S. retail sales figures mid-week likely triggered outflows of $146 million" — reflecting mixed investor sentiment but showing "signs of recovery," CoinShares Head of Research James Butterfill wrote in a Tuesday report.

Weekly crypto asset flows. Images: CoinShares .

In a shift from the dominant trend, XRP-based investment products outperformed both their Bitcoin and Ethereum counterparts, adding $37.7 million to a year-to-date total now just $1 million behind global Ethereum funds at $214 million — despite a slight price drop for XRP in the past seven days.

Last week, analysts at Kaiko cited superior market liquidity and the launch of a leveraged investment products as positioning XRP ahead of other assets when it comes to spot ETF approval in the U.S. by the Securities and Exchange Commission.

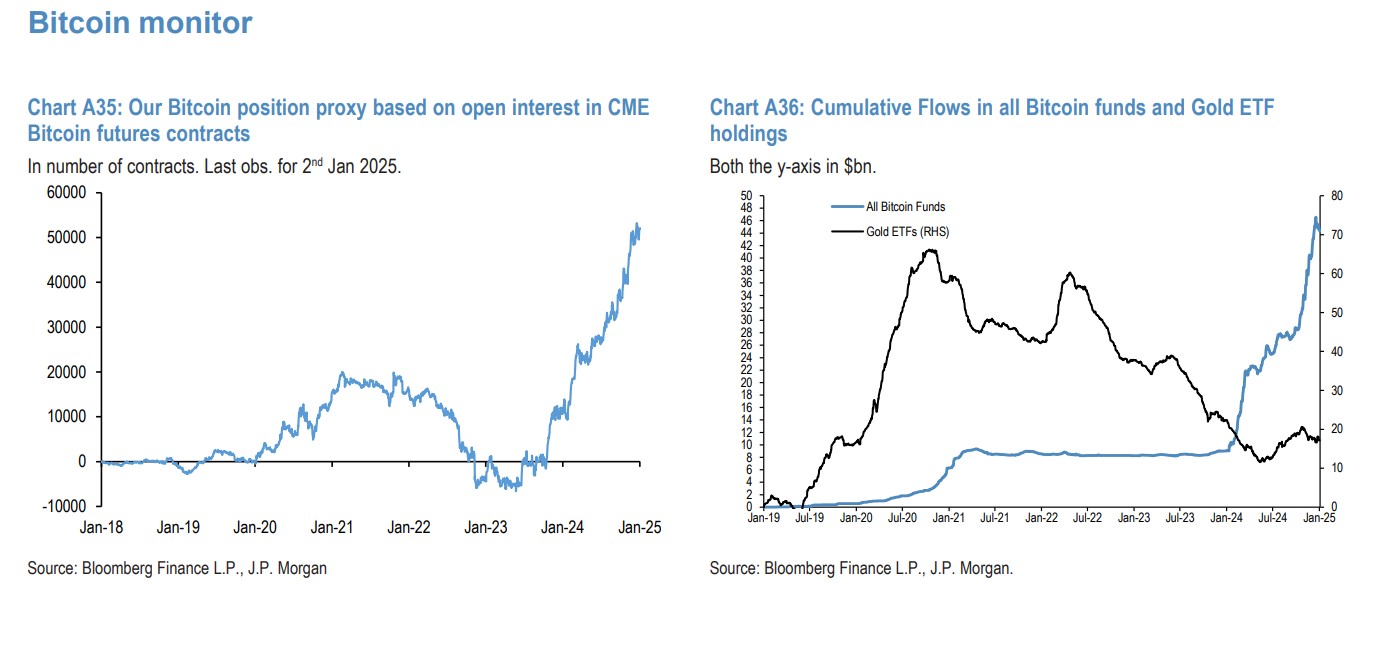

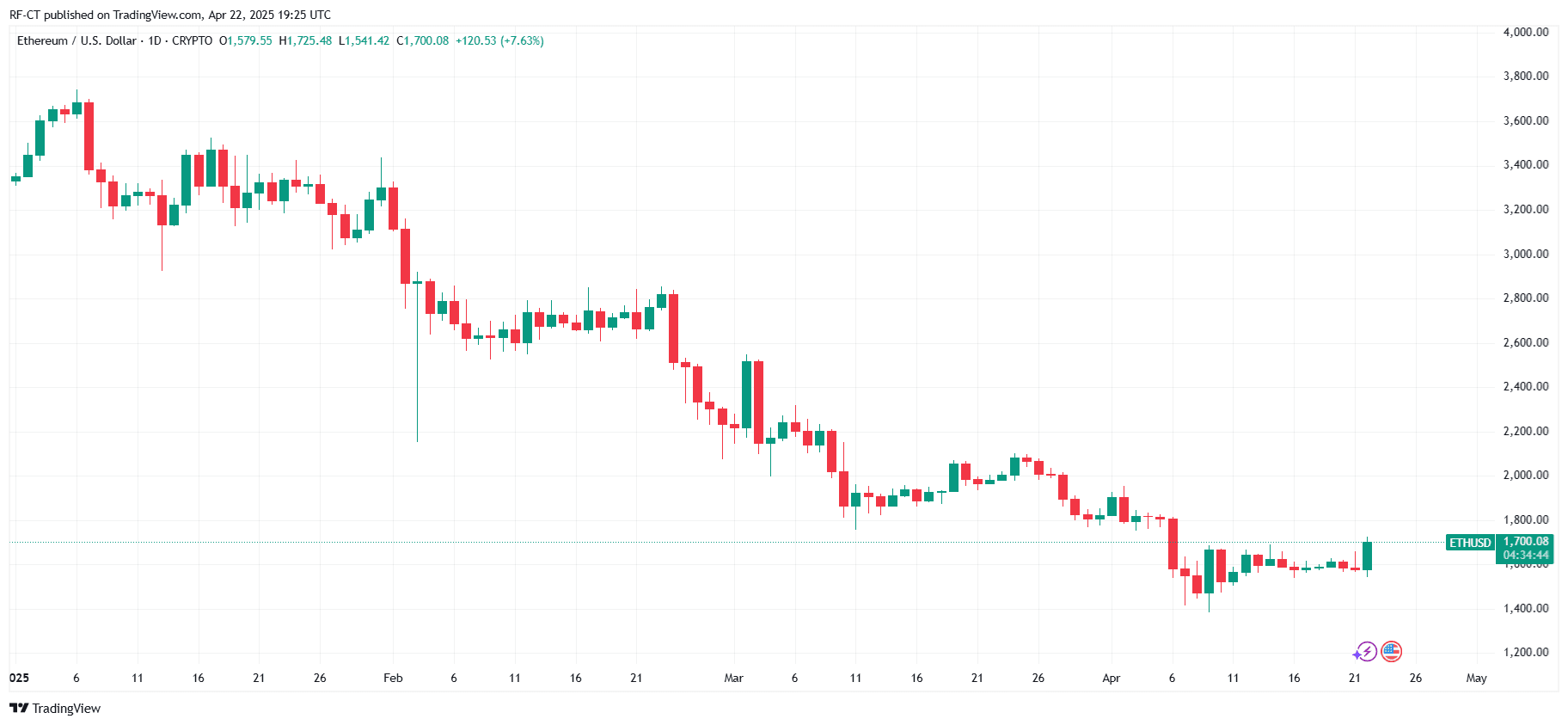

Ethereum investment products, on the other hand, saw $26.7 million in net outflows last week, while $6 million exited Bitcoin funds globally. "Short Bitcoin investment products also saw outflows of $1.2 million, marking the 7th week of outflows totalling $36 million representing 40% of total assets under management," Butterfill noted.

The change in trend was also reflected by Switzerland-based crypto investment products leading the net inflows, adding $43.7 million, followed by Germany and Canada, with $22.3 million and $9.4 million, respectively. Meanwhile, U.S.-based funds, usually the dominant market in the overall global flow direction, slumped to net weekly outflows of $71 million as the Trump tariff turmoil continued to weigh on global markets.

Crypto decoupling?

Despite those concerns, there have since been, perhaps premature, hopes of a decoupling from traditional markets in recent days as bitcoin and the broader crypto market moved alongside gold toward the upside last week and into Monday while the Nasdaq and S&P 500 have continued to register losses.

Gold briefly hit an all-time high of around $3,500 per ounce on Tuesday morning, having gained 8% over the last week. Bitcoin is up approximately 5.7% during the same period to $88,411, according to The Block's Bitcoin price page , and the GMCI 30 index of leading cryptocurrencies is up around 2.2%. In contrast, the Nasdaq and S&P 500 fell 7.3% and 5.2%, respectively, during the past week.

"Bitcoin's performance suggests more investors might be getting comfortable with viewing it as a form of 'digital gold' that can perform independently from equities and act as a risk-off asset during periods of uncertainty," Hashdex Head of Global Market Insights Gerry O'Shea told The Block. "Gold is now trading at its nominal all-time high — which could foreshadow strong performance from bitcoin if investors' appetite for risk-off assets increases — while global liquidity is increasing and the U.S. regulatory environment is rapidly improving."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto News Today: Top 3 Altcoins Making Headlines Right Now

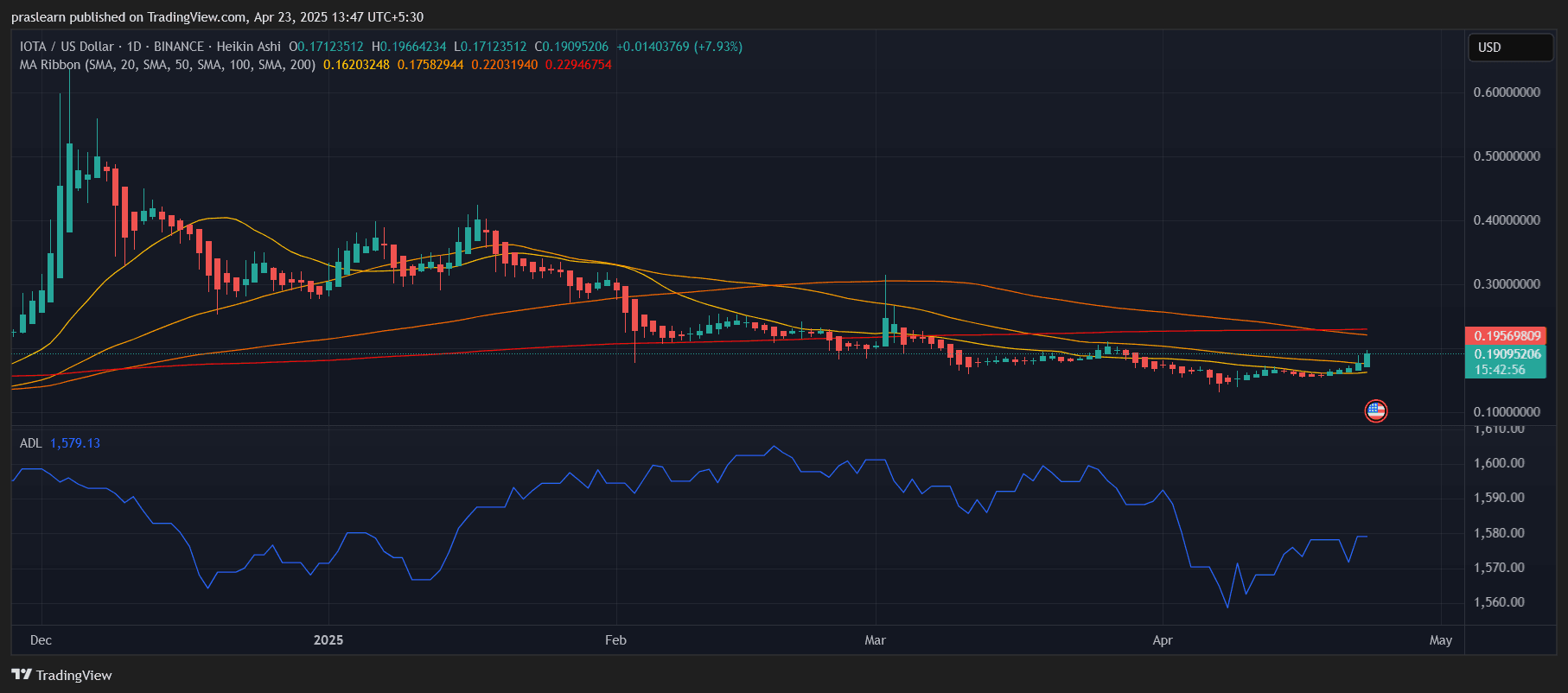

This IOTA Price Rally Could Shock Everyone

MANTRA founder’s 150M OM burn proposal gets 81% support: can it spark a recovery?

Bitcoin Price May Explode Past $200K on ETF and Institutional Demand