Bitcoin Eyes Potential Breakout Above $90K Amid Support at $83K and Long-Term Optimism

-

Bitcoin’s current trading landscape signifies a critical juncture, with market watchers split on whether the cryptocurrency is experiencing a typical correction or entering a prolonged bear phase.

-

Market analysts are observing Bitcoin’s upward momentum alongside increased derivatives activity, suggesting a strong likelihood of breaking through the $90,000 resistance threshold soon.

-

Noteworthy predictions from influential figures like Arthur Hayes and Robert Kiyosaki estimate Bitcoin could soar to between $180,000 and $200,000 by the end of 2025, reflecting their confidence in its long-term trajectory.

The current state of Bitcoin’s price signals an important turning point, as analysts predict a possible move above $90K amidst varying market sentiments.

The Current Bitcoin Landscape: Correction vs. Bear Market

The Easter Sunday price point of $84,600 for Bitcoin marks a significant milestone, particularly as it stands as the highest level for this date in 17 years, according to a report from DocumentingBTC. This milestone exemplifies Bitcoin’s remarkable growth from its inception in 2009-2010, where it traded at virtually zero, to its present valuation. Bitcoin’s resilience continues to be a focal point for investors, highlighting its sustained adoption rate over the years.

Recent data indicates that Bitcoin dominance (BTC.D) has surged to a 4-year high. This rise, however, has led to mixed opinions among experts regarding the potential for an upcoming altcoin season.

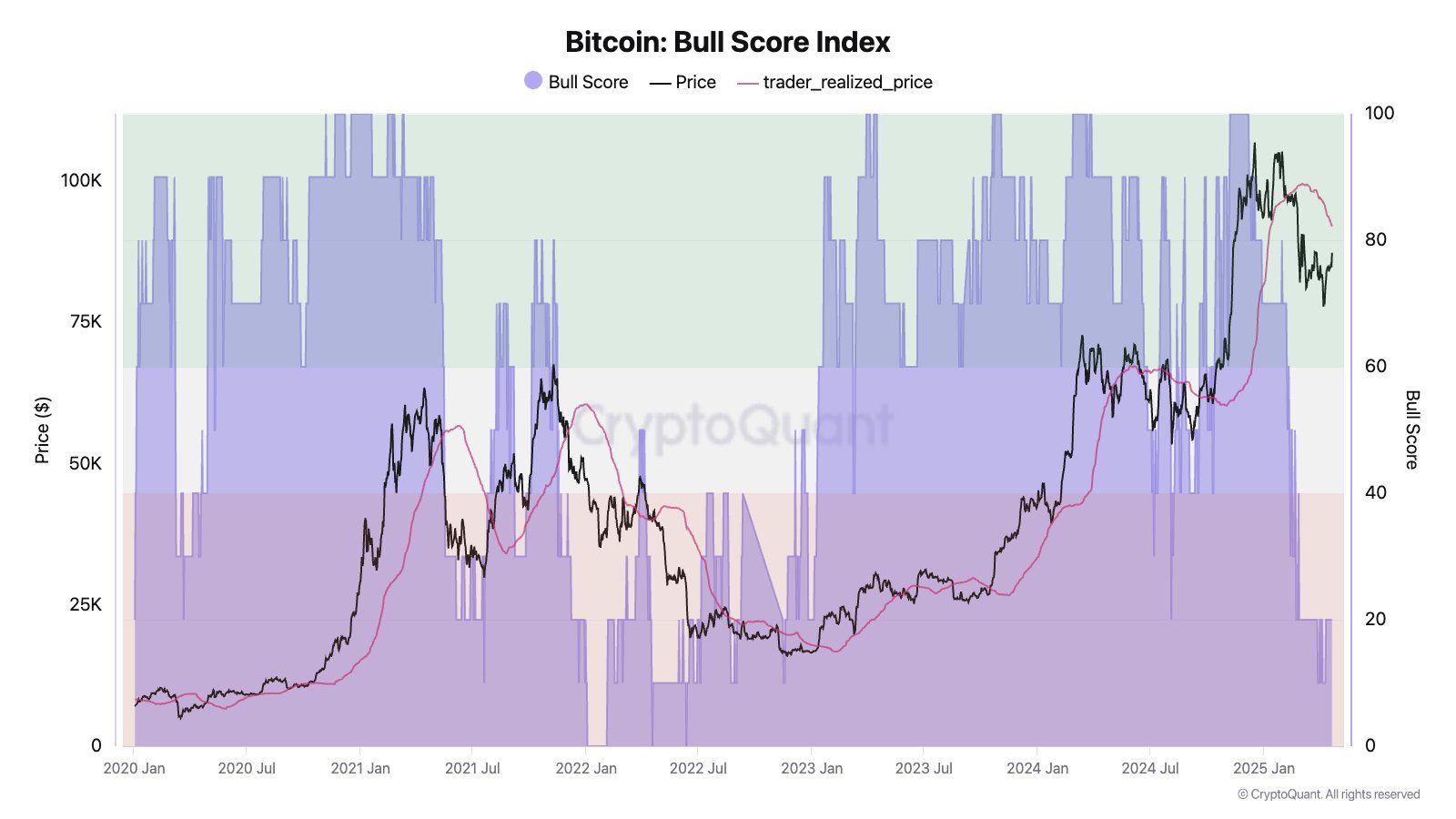

Insights from Julio Moreno, Head of Research at CryptoQuant, noted that Bitcoin is currently facing price resistance between $91,000 and $92,000. He mentions this aligns with the realized price for traders, stating that during bull markets, this realized price generally acts as support, while in bear markets, it serves as a resistance level. Currently, the market sentiment is more aligned with a bearish scenario.

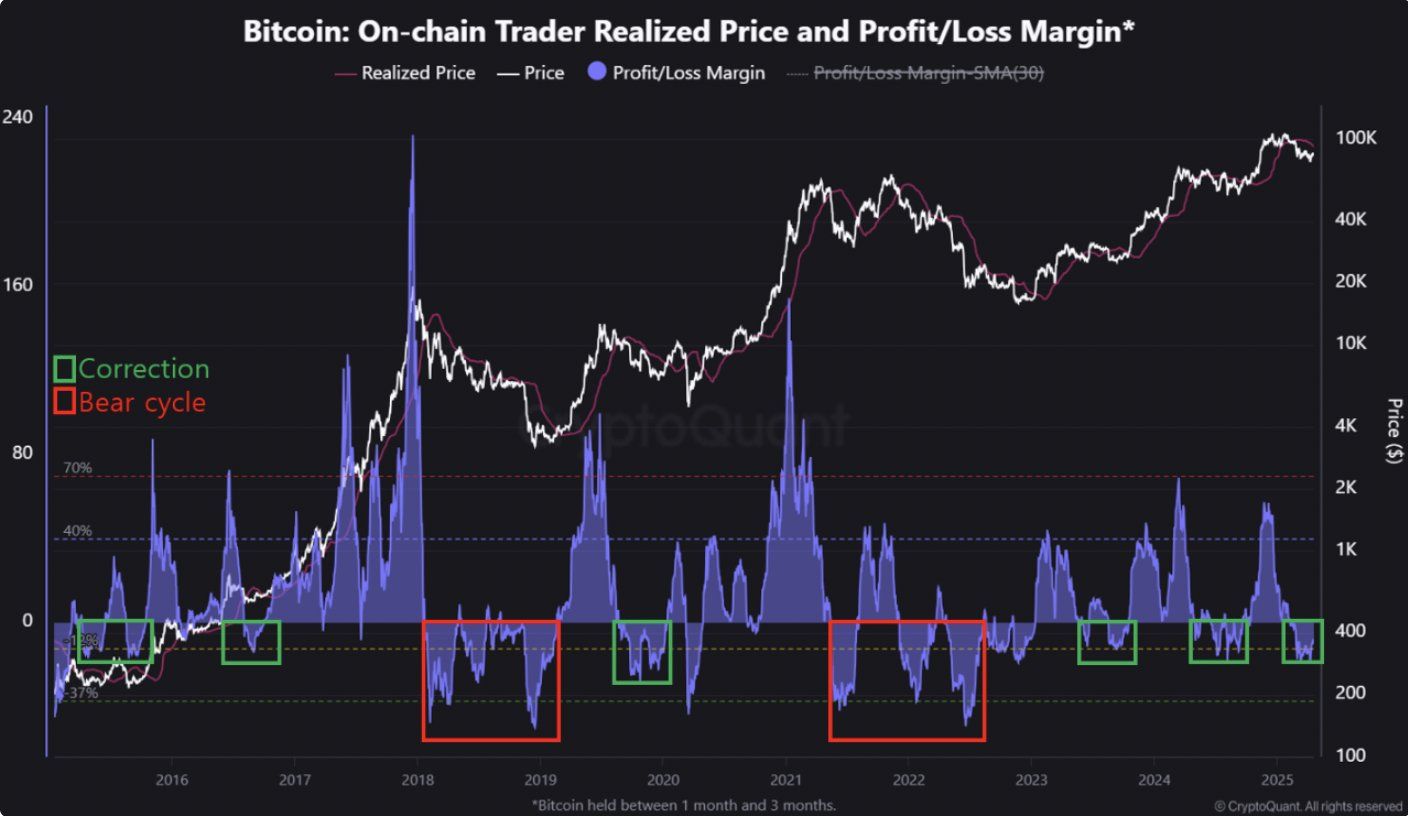

Furthermore, a recent analysis from CryptoQuant suggests that Bitcoin is likely undergoing a typical market correction rather than embarking on a new bear market cycle, as indicated by the $88,178 price point, which stays well above significant support levels.

This view is further complicated by market analysts like Mark Cullen, who caution about the importance of the $83,000 support level. Should Bitcoin’s price dip below this threshold, it may provoke a notable bearish reaction among investors.

Cullen remarked, “Bitcoin $90,000 liquidity still calling. But, I think the $83,000 level isn’t safe; those lows from last Sunday and Wednesday are likely to get run first.”

A recent report from COINOTAG underlines that Bitcoin is gearing up for a potential breakout above $90,000, spurred by the increasing momentum in the derivatives market. If breached, this key resistance could usher in a new bullish trend, primarily driven by proactive dip buyers and derivatives traders.

Long-Term Prospects: The Path Ahead for Bitcoin

As we look toward the future, the consensus among market experts remains favorable for Bitcoin’s growth trajectory.

Arthur Hayes, notable co-founder of BitMEX, projected via social media, “Seriously fam, this might be the last chance you have to buy $BTC < $100,000.” His insights reflect a growing belief that Bitcoin could soon breach important psychological price barriers.

Moreover, financial educator Robert Kiyosaki has echoed similar sentiments, asserting that Bitcoin’s value may climb to between $180,000 and $200,000 by 2025. His assertion highlights the potential for substantial gains driven by Bitcoin’s historical recovery patterns.

Recent historical performance strengthens this optimism. Following a significant drop to $27,931 on Easter Sunday 2023, Bitcoin’s subsequent ascent to $84,600 stands testament to its resilience. Analysts believe that such corrections are essential for long-term growth, consolidating investors’ confidence in Bitcoin’s stability and potential.

The Fear and Greed Index appears to be another critical factor influencing investor behavior. A heightened index value, indicating increased greed, often correlates with bullish market sentiment, which could propel Bitcoin toward surpassing the $90,000 threshold.

Conclusion

In summary, while Bitcoin grapples with immediate price resistance and critical support levels, the overarching long-term outlook remains optimistic, bolstered by historical resilience and informed projections from industry experts. As market dynamics continue to evolve, investors are advised to remain vigilant and monitor key price patterns that may influence Bitcoin’s future trajectory.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano Expected to Pump Over 10x in the Altseason, How High Can ADA Go This Bull Cycle

Ripple Rules Out 2025 IPO as Company Maintains Solid Financial Position

Google Chrome’s success ‘impossible to recreate,’ exec testifies in DOJ antitrust trial

Share link:In this post: Parisa Tabriz believes Google Chrome would decline in another company’s hands, saying it would be hard to disentangle Google from the search engine’s success. Google plans to infuse artificial intelligence into Chrome to make it more agentic. OpenAI showed interest in buying Google Chrome.

SEC Commissioner Hester Peirce calls for better crypto regulation

Share link:In this post: SEC Commissioner Hester Peirce has called for better crypto regulation in the United States. Peirce mentioned that financial firms have been approaching crypto in a way like playing “the floor is lava” children’s game. SEC commissioners want flexible regulation as SEC chairman Paul Atkins wants clear regulations for digital assets.