Key Market Intelligence on April 21st, how much did you miss out on?

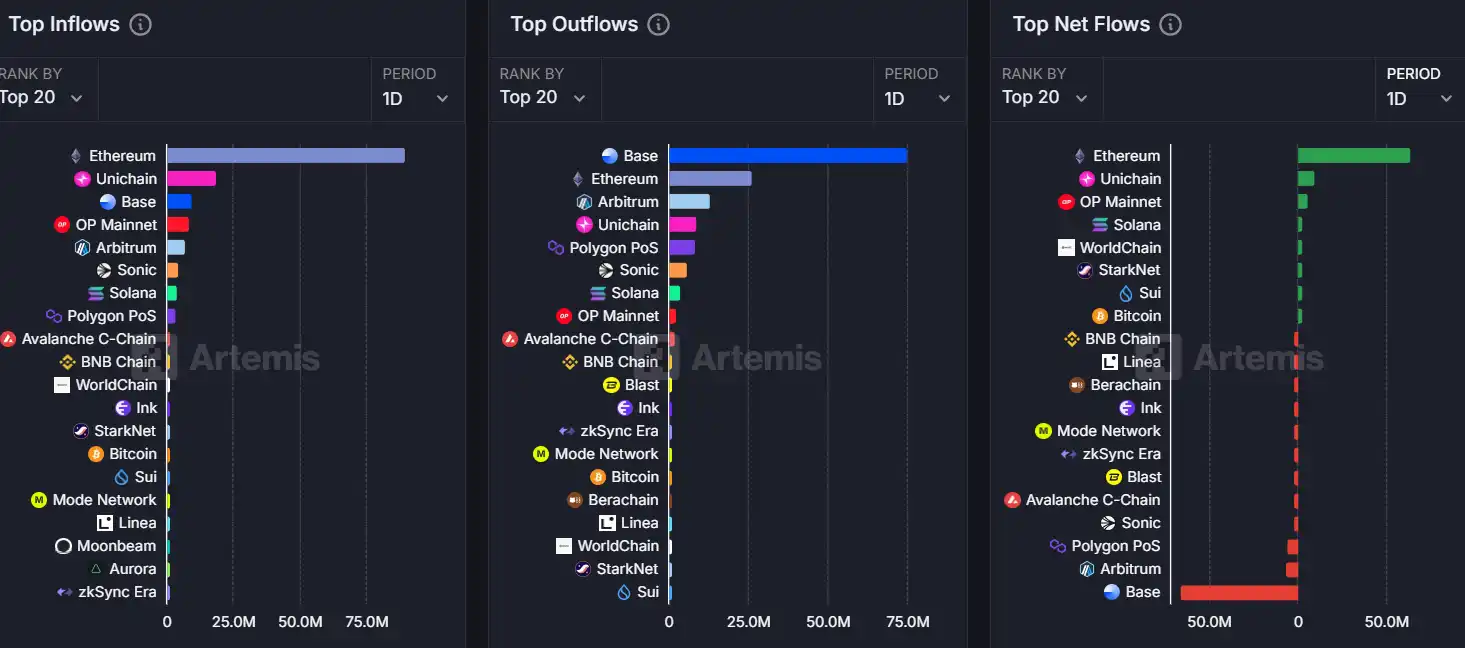

1. On-chain Funds: $63.5M Inflow to Ethereum; $65.3M Outflow from Base 2. Largest Price Swings: $MAGIC, $AERGO 3. Top News: Circle to Launch New Payment and Cross-Border Remittance Network, Aiming to Compete with Visa and Mastercard

Top News

2.pump.fun Platform Sees Three Consecutive Weeks of Token Graduation Rate Increase

3.LUCE Surges Over 80% Briefly Before Pullback, Market Cap Currently at $13.88 Million

5.US Dollar Index Falls Below 98 Mark for the First Time Since March 2022

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

TAO: Today's discussion about TAO mainly focused on its significant price surge and its potential as a leading cryptocurrency, with many users expressing optimism about its future growth. Key topics included TAO's recent breakthrough of resistance levels, the impact of Raoul Pal's interview on its valuation, and the increasing interest in the Bittensor subnet. The overall market sentiment is very positive, with many viewpoints predicting TAO's continued rise and comparing its potential to that of Bitcoin. The discussion also highlighted the importance of TAO at the intersection of artificial intelligence and cryptocurrency, with multiple tweets noting its outperformance compared to other crypto assets.

VOXEL: VOXEL became a hot topic today due to its significant price surge, reportedly exceeding 200% in the past 24 hours. This surge in trading volume and price is attributed to a market-making bot malfunction on the Bitget platform, leading to abnormal trading activity. It is reported that some users took advantage of this loophole to gain substantial profits, and Bitget has announced it will conduct an investigation and may possibly roll back some trades. This event has sparked discussions about the platform's risk management and market-making mechanism, and has been compared to past issues with other exchanges.

Featured Articles

1.《Without Interest Rate Perpetuals, Will DeFi Ever Be Complete?》

DeFi lacks interest rate perpetual contracts similar to those on CME, leading to high interest rate volatility and risk exposure. Introducing interest rate perpetuals can help both borrowers and lenders lock in interest rates, engage in arbitrage and risk management, and facilitate the integration of DeFi and TradFi, enhancing market efficiency and stability.

2.《Zora's Coin Issuance Bureau: A Transformation Story from NFT Freshness to Social Madness》

This story is much more stimulating than the average project. It involves not only the capital game of the Coinbase-backed troops but also a magical plot where officials personally engage in "Token Werewolf." It even makes the entire industry ponder: Are we witnessing a blockchain renaissance where every tweet can turn into a coin-pumping battlefield, or are we just watching the roaring of the rug pull harvester?

On-chain Data

On-chain Fund Flow on April 21

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CloneX NFTs Hit a Wall as Images Vanish From OpenSea

SUI Jumps 73% After Grayscale and Mastercard Boost

SUI gains 73% in a week, driven by a Grayscale Trust listing and a strategic partnership with Mastercard.SUI Skyrockets After Major Institutional MovesMastercard Partnership Fuels Adoption HopesWhat’s Next for SUI?

Whale Buys Back 8K ETH, Nets $159K in 10 Days

Whale repurchases 8,012 ETH at $1,779, repays debt, and earns $159K from ETH trading over 10 days.Whale Re-Enters ETH With $14M BuybackSmart Debt Management and Strategic TimingProfit Through Precision

Solana Price Eyes $162, Cardano Slides Again, While Unstaked Presale Goes Viral in April 2025

Explore a timely comparison of Cardano, Solana, and Unstaked ($UNSD) focusing on real-time utility, price levels, and presale potential. Find out what crypto to invest in for both short-term strategy and long-term value.Cardano Slides Back Into Multi-Year RangeSolana Faces Crucial Test Near Largest Supply ClusterUnstaked Is More Than Hype: A Real Use Case in a Meme-Driven MarketUtility, Timing, and the Case for $UNSD