CoinGecko Q1 2025 Study Bitcoin BTC Outperformed Altcoins in Q1 — How to Adjust for Q2

- The crypto market declined by $633 in Q1 of 2025, and the trading volume decreased in both CEXs and DEXs.

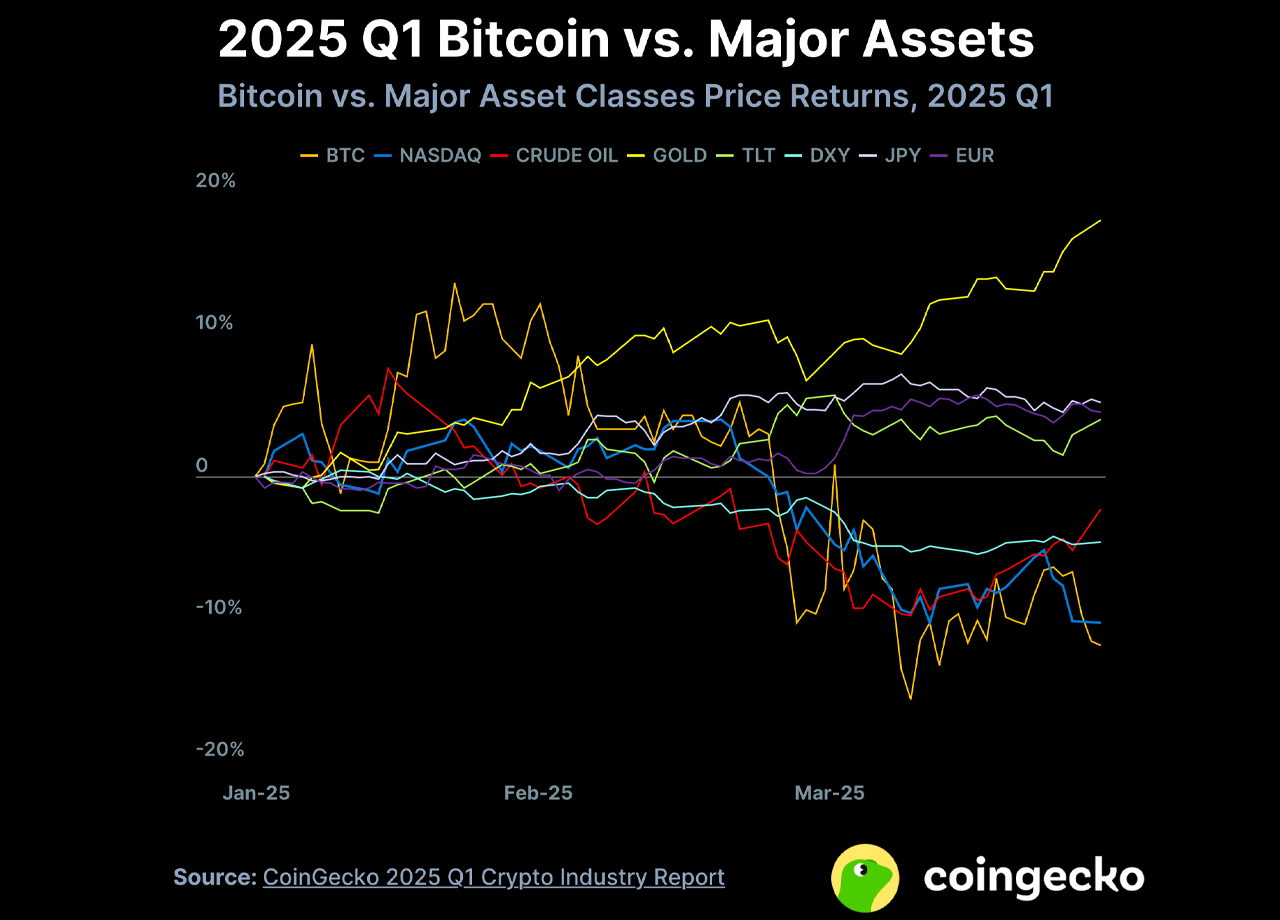

- Bitcoin dominance increased to 59.1%, but the asset still lagged behind gold and US bonds in terms of quarterly performances.

The crypto market kicked off 2025 in a bullish run but posted significant losses by the close of the first quarter. Data from the most recent CoinGecko quarterly report shows that market capitalization reduced by 18.6%, declining by $633.5 billion.

Bitcoin was the best-performing token in the category. Its market share hit 59.1%, the highest since early 2021, while investors fled riskier tokens like TerraUSD and Luna. Bitcoin donated 10.3% of its market share in the previous year, while Ethereum dropped to a low market share of 7.9% which was its lowest in five years.

On the other hand, Bitcoin surged past $100,000 in January and came down to $82,514 as of Q1 end, an 11.8% decline. However, BTC surpassed the Nasdaq Composite, which decreased by 10.3% during the same period of time. However, it underperformed gold, which rose 18%, and the US treasuries, which were boosted by conflict and changes in monetary policy.

Moreover, Ethereum (ETH), which had registered an excellent performance in 2024, lost all the rate of the period. However, the total value locked for the decentralized finance (DeFi) space across multiple chains slid to $128.6 billion, decreasing 27.5%. Ethereum’s contribution to DeFi TVL was reduced to 56.6%, while other chains like Berachain started to emerge with $5.2 billion in TVL.

Memecoins Collapse After LIBRA Scandal

Q1 also witnessed the crash of the meme token market, especially after the LIBRA token. Supported by Argentina’s President Javier Milei, LIBRA sank by 94 % in just several hours cumulatively after insiders drained $107 million in liquidity. It wiped out $4 billion in market capitalization and led to a collapse in memecoin production across the industry.

The report found that new tokens added to Pump.fun on Solana dropped by 56.3% from the January high to around 31,000 by the end of the quarter. The percentage of tokens that actually “graduate” attaining long-term value dropped to 0.7%, which is half as much as in January.

However, speculative traders remained eager to look for opportunities in the markets. One trader was said to have invested only $2,000 and rode PEPE to $43 million but managed to exit early after the memecoin declined over 70% from its highs, getting out with $10 million.

Centralized and Decentralized Trading Slide

Spot trading volume on centralized exchanges (CEXs) declined by 16.3% quarterly, reaching $5.4 trillion. Nonetheless, Binance again retained the highest share at a rate of 40.7%, but it dropped in March. Among the top ten CEXs, HTX was the only one that showed an increase, 11.4%, to be exact. On the other hand, Bybit, which experienced a security breach in February, had its trading volume cut in half.

Among DEXs, Solana dominated trading volumes with 39.6% in Q1. But the very next month, it slipped to the second but was on the top again for a little while in March. Despite being the most popular network for DEXs, SOL experienced a 20% decline in its TVL along with other altcoins.

Even positive developments came with major trade-offs. Bitcoin ETFs saw about $1 billion in inflows, while Bitcoin assets under management declined by approximately $9 billion because of declining prices.

Recommended for you:

- Buy Bitcoin Guide

- Bitcoin Wallet Tutorial

- Check 24-hour Bitcoin Price

- More Bitcoin News

- What is Bitcoin?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aptos Powers Digital Wallet for Expo 2025 in Osaka, Japan

Why Ethereum Price is Up Today— Key Reasons Behind It

Falcon Finance Integrates $sUSDf With Pendle for Enhanced Onchain Yield Generation

US stocks erase Monday losses after Bessent calls China trade situation ‘unsustainable’

While Treasury Secretary Scott Bessent expects de-escalation in the future, he said negotiations have not yet started