Research Report | Detailed Analysis of Lorenzo Protocol & BANK Market Cap

View original

远山洞见2025/04/21 03:39

By:远山洞见

I. Project Introduction

Lorenzo is a DeFi protocol with a core goal of "unlocking Bitcoin liquidity," built on Babylon and positioned as Bitcoin's Liquidity Finance Layer. The project utilizes a CeDeFi architecture to stake native BTC and tokenize it, issuing tradable principal tokens stBTC and yield tokens YAT, realizing the first-ever "principal and interest separation" of BTC, injecting an efficient and secure yield asset structure into the Bitcoin ecosystem.

Unlike market projects based on encapsulated BTC like LRT, Lorenzo uses Babylon's native staking mechanism to provide shared security rewards for BTC, ensuring the yield is genuine, verifiable, and without bridging risks. Lorenzo also introduces a Staking Agent and SPT redemption ordering system, establishing a complete path for BTC issuance, trading, and settlement, and builds various principal and interest structured products to promote BTC as a composable financial asset.

Lorenzo's goal is not merely a "BTC interest tool," but to establish interest rate infrastructure for the Bitcoin ecosystem. Its stBTC can serve as a liquidity entry point, participating in lending, options, stablecoin, and other DeFi applications; while YAT serves as a yield certificate that can freely circulate, meeting the configuration needs of users with different risk appetites.

II. Project Highlights

1. Native BTC Staking Path, Industry Security Ceiling

Built on Babylon, Lorenzo enables BTC to participate in staking directly on the mainnet, avoiding cross-chain, encapsulation, or custody requirements, perfectly mitigating bridge risks and custody trust issues. Compared to repledge solutions based on encapsulated BTC like BounceBit and Solv, Lorenzo offers a truly native, verifiable BTC yield path, creating the security baseline for the BTC LRT track.

2. Pioneering BTC Principal and Interest Separation Model, Unlocking Liquidity Ceiling

Through the CeDeFi architecture, the project issues two types of tokens: stBTC (principal) + YAT (yield), for the first time introducing the "Pendle model" into the Bitcoin ecosystem. Users can hold stBTC with low risk or engage in high-yield speculation with YAT, transferable and combinable yields fully activate the financial attributes of BTC, moving from a store of value to a configurable interest-bearing asset.

3. CeDeFi Staking Agent Mechanism + SPT Queue Model, Ensuring Redemption Order

Lorenzo enables orderly unification of asset issuance and settlement through the "Staking Agent + SPT Queue Redemption" mechanism. Each redemption is based on the distribution of real returns, avoiding liquidity mismatches and Ponzi-like run risks while introducing agent governance and yield proofs to increase transparency and security, providing a solid financial foundation for BTC.

4. Multi-chain Integration + Strong Capital Endorsement, BTC DeFi Infrastructure-grade Entry

stBTC can already bridge to Bitlayer for lending mining and plans to integrate more downstream protocols to create a "liquidity passport" for BTC in DeFi scenarios. Backed by Babylon's core ecosystem and investment from Binance Labs, Lorenzo is poised to become the synthesis of BTC's Lido + Pendle, occupying the central starting point of the next wave of BTC financialization.

III. Market Cap Expectation

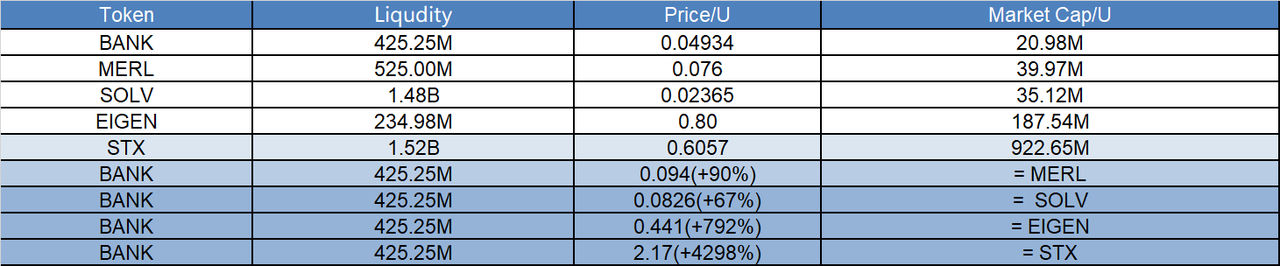

As the first native BTC liquidity protocol in the Babylon ecosystem, Lorenzo Protocol not only performs the triple functions of issuing, trading, and settling BTC liquidity staking assets but also establishes a complete interest rate market infrastructure through the structural design of stBTC + YAT. Currently, the circulating market cap of $BANK is only about 21 million USD, significantly lower than other Bitcoin ecosystem or repledge protocols. Coupled with investment support from Binance Labs and the expectation of Babylon mainnet launch, it has substantial value revaluation space.

From a comparable protocol perspective, BTC Layer2 projects like Stacks and Merlin Chain have established certain market cap anchoring capabilities; in the ETH ecosystem, the representative of the repledge track, EigenLayer, has a market cap of nearly 200 million USD, and Solv Protocol quickly surpassed 35 million USD around its mainnet launch, reflecting the high valuation elasticity of "asset staking + yield separation" protocols.

Considering Lorenzo's current situation and its binding to Babylon as the fundamental yield source advantage, if the market recovers, $BANK is expected to align with the valuation range of leading BTC LRT protocols or BTC L2 protocols in the medium term.

IV. Economic Model

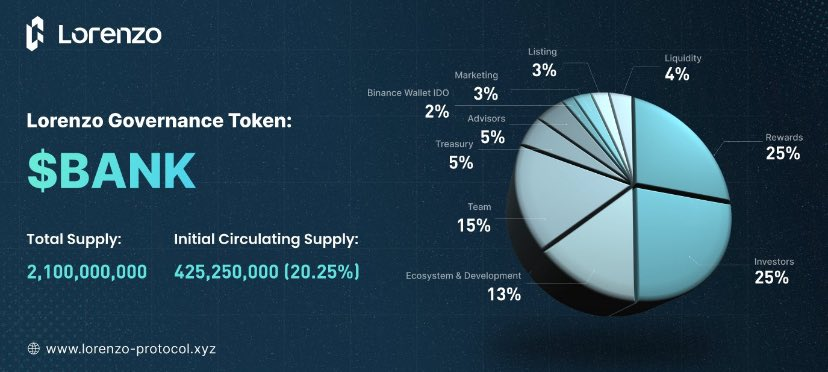

Total Supply of $BANK: 2,100,000,000; Initial Circulating Supply: 20.25%

Token Distribution as follows:

Incentive Reward: 25% for BTC staking incentives, stBTC/YAT liquidity rewards, PoS project collaboration, etc. 8% will be airdropped within 3 months after IDO

Investors: 25% allocated to strategic investors who supported Lorenzo's early development, with phased unlocking

Core Team: 15% allocated to key contributors towards Lorenzo's product and protocol construction, subject to a cliff and long-term linear release

Ecological Construction and Development: 13% for Babylon linkage, Bitlayer integration, stBTC multi-chain deployment, downstream collaborations, and other ecosystem expansions

Treasury: 5% as a long-term strategic reserve, for future incentives and security module

Advisors: 5% to reward supporters in technical, marketing, legal, and other fields

Liquidity Support: 4% for CEX/DEX listing market making and initial trading depth support

Marketing: 3% for IDO promotion, public chain activities, community expansion

Exchange Circulation: 3% for user incentives, airdrops, etc., during exchange listing

Binance Wallet IDO: 2% specifically reserved for Binance Wallet channel IDO tasks and user feedback

Token Utility:

1. Governance and Decision-Making

As the governance token of the Lorenzo protocol, BANK holders can participate in major protocol decisions, such as treasury strategy adjustments or new feature developments, enhancing community-driven ecological development.

2. Smart Savings and Yield

BANK tokens support smart savings vaults; users can deposit assets to obtain automated yields, suitable for investors seeking stable returns.

3. Dividends and Deflationary Incentives

Holding 200 BANK tokens can earn USDT dividends, while a trade-and-burn mechanism reduces token supply, pushing up long-term value. This design attracts users focused on yield and asset appreciation.

V. Team & Financing

Team Information:

The core team of Lorenzo Protocol consists of experienced members from Web3 finance, DeFi protocol development, and on-chain asset management. Project founder Matt Ye has years of experience in on-chain product development and architecture, having led the design of multiple blockchain infrastructures, aiming to promote the financialization of Bitcoin assets. Operations director Tad Tobar has deep experience in decentralized community building and governance models, leading Lorenzo's PoSQ incentive system and user growth strategy.

In Terms of Financing:

Lorenzo has secured early investment support from several well-known crypto capitals, including NGC Ventures, MH Ventures, ABCDE Capital, YZI Labs, 300DAO, and individual investor Shawn Chong, indicating high market attention and recognition for the "Bitcoin liquidity finance" track. Strong capital endorsements not only provide initial resource support for Lorenzo but also strategically enhance its deep integration within ecosystems such as Babylon and Bitlayer.

Investors include: YZi Labs (formerly Binance Labs), Animoca Brands, Shima Capital, Altos Ventures

VI. Potential Risk Tips

1. SPT Queue Mechanism May Affect Withdrawal Experience

In Lorenzo's redemption logic, users not only need to burn stBTC but also need corresponding SPT (Staking Proof Token) to retrieve BTC. If YAT market activity is insufficient or SPT linkage is inadequate, a queuing experience issue for "stBTC holders withdrawing" may arise, a potential pain point for users preferring flexible liquidity.

2. Value Capture Mechanism is Still Under Construction

While $BANK is designed as Lorenzo's governance, yield priority, and staking entry ticket, the trading depth and usage scope of stBTC and YAT are still in the expansion stage, and $BANK's value capture logic relies more on medium to long-term DeFi scenario realization. In the absence of a clear protocol buyback or burn rhythm, the short-term "valuation anchor" is relatively vague.

VII. Official Links

Website:

https://gomble.io/

Twitter:

https://lorenzo-protocol.xyz/

Telegram:

https://t.me/lorenzoprotocol

1

1

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Trump eases pressure on Powell, China tariffs; S&P 500, Dow, Nasdaq rise sharply

Portalcripto•2025/04/23 22:22

Former Goldman Sachs exec predicts Bitcoin rally on global liquidity and weak dollar

Portalcripto•2025/04/23 22:22

Bitcoin rally nears $100,000

Grafa•2025/04/23 21:00

Crypto Market Surges Amid Influential Institutional Moves

Theccpress•2025/04/23 20:55

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$93,761.07

+1.16%

Ethereum

ETH

$1,803.9

+3.49%

Tether USDt

USDT

$1

+0.01%

XRP

XRP

$2.23

+1.08%

BNB

BNB

$606.34

-1.10%

Solana

SOL

$151.23

+2.59%

USDC

USDC

$0.9999

-0.01%

Dogecoin

DOGE

$0.1787

+0.26%

Cardano

ADA

$0.6996

+4.51%

TRON

TRX

$0.2466

-0.27%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now