Schwab Considers Spot Bitcoin Trading Services Amid Growing Investor Interest and Evolving Regulatory Landscape

-

Charles Schwab is poised to make significant strides in the cryptocurrency sector, with plans to introduce spot Bitcoin trading services for clients by April 2026.

-

Rick Wurster, CEO of Charles Schwab, is optimistic about the digital asset market, pointing to a remarkable 400% increase in traffic on their crypto website as an indicator of growing investor interest.

-

Wurster commented, “Our expectation is that with the changing regulatory environment, we are hopeful and likely to be able to launch direct spot crypto,” highlighting a pivotal shift for traditional financial institutions.

Charles Schwab sets sights on launching spot Bitcoin trading by April 2026, reflecting growing investor demand and evolving regulations in the digital asset landscape.

Schwab’s Strategic Entry into the Digital Asset Market

Since taking over in 2025, Rick Wurster has been vocal about his intent to elevate Schwab’s presence in the cryptocurrency sector. The CEO’s outlook became particularly optimistic following his remarks on the anticipated regulatory landscape that could facilitate Schwab’s entry into direct cryptocurrency trading.

In a noteworthy interview with Yahoo Finance in November 2024, Wurster indicated the company was keen on expanding its offerings to clients interested in trading digital assets. “We are particularly excited to serve our customers directly with crypto,” he stated, emphasizing that a favorable regulatory environment is essential for their plans.

Regulatory Catalysts and Market Sentiment

Wurster’s expectations for a more conducive regulatory environment stem from the political climate in the United States. After the recent re-election of Donald Trump, he suggested that the trajectory for regulatory approval of cryptocurrency trading appears promising. Such developments could facilitate Schwab’s ambition to launch their services within the next year.

Interestingly, Wurster confessed during a candid moment that he did not invest in cryptocurrency early on, a sentiment many investors can relate to as the asset class continues to deliver remarkable returns. His comments underscore a pivoting perspective from traditional financial leaders embracing digital assets.

Partnerships Driving Innovation

In January 2025, Schwab further solidified its commitment to integrating digital assets by partnering with the Trump Media and Technology Group (TMTG). This collaboration aims to deliver customized exchange-traded funds and cryptocurrency services through the forthcoming “Truth.Fi” platform, which seeks to merge digital assets with traditional banking.

TMTG’s CEO, Devin Nunes, articulated their vision by stating that Truth.Fi is designed to provide alternatives to individuals concerned about unfair banking practices and issues like “censorship, debanking, and privacy violations.” This partnership marks a significant step in Schwab’s evolving strategy to engage with the changing landscape of financial services.

Future Outlook for Schwab and Digital Assets

The actions taken by Charles Schwab signal a broader trend within the financial sector, where traditional institutions are increasingly looking to adapt to consumer interests in cryptocurrencies. As investor traffic grows and regulatory landscapes evolve, Schwab appears poised for a significant entry into the crypto trading arena.

In a market characterized by rapid change, Schwab’s plans to offer direct spot trading could set a precedent for other financial institutions. This shift illustrates how traditional finance is progressively evolving to accommodate the digital age, thereby fostering greater investor confidence and engagement in the cryptocurrency market.

Conclusion

As Charles Schwab embarks on its strategy to incorporate spot Bitcoin trading by 2026, the implications for both investors and the broader financial services industry could be profound. The move not only reflects a shift towards digital asset adoption but also emphasizes the increasing acceptance of cryptocurrency within traditional finance. With regulatory clarity on the horizon, Schwab’s initiative could pave the way for more comprehensive cryptocurrency financial products in the future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

S&P 500 jumps 1.6%, Nasdaq 2.2% as Big Tech leads rally on trade optimism

Share link:In this post: The S&P 500 rose 1.6% and the Nasdaq jumped 2.2% as tech stocks like Nvidia and Amazon rallied. China confirmed there are no trade talks happening with the U.S. and called for removal of tariffs. Trump said he’s open to less confrontation on trade, but no details or negotiations have been set.

Trump teases third term with 2028 hat. Just how far can he go?

Share link:In this post: Trump is now selling a “Trump 2028” hat, openly signaling interest in a third presidential term. The original product description hinted at rewriting the Constitution but was later changed. Trump told NBC News he’s considering legal ways to bypass the two-term limit, including running as vice president.

Stablecoins can expand to $1.6T by 2030, says Citigroup

Share link:In this post: Citigroup predicts $1.6T in stablecoin supply by 2030 in a base scenario and up to $3.7T in a bullish development. Stablecoins may replace cash reserves and some fintech apps. Blockchain may make a comeback for public spending, disbursements and transparent tracking.

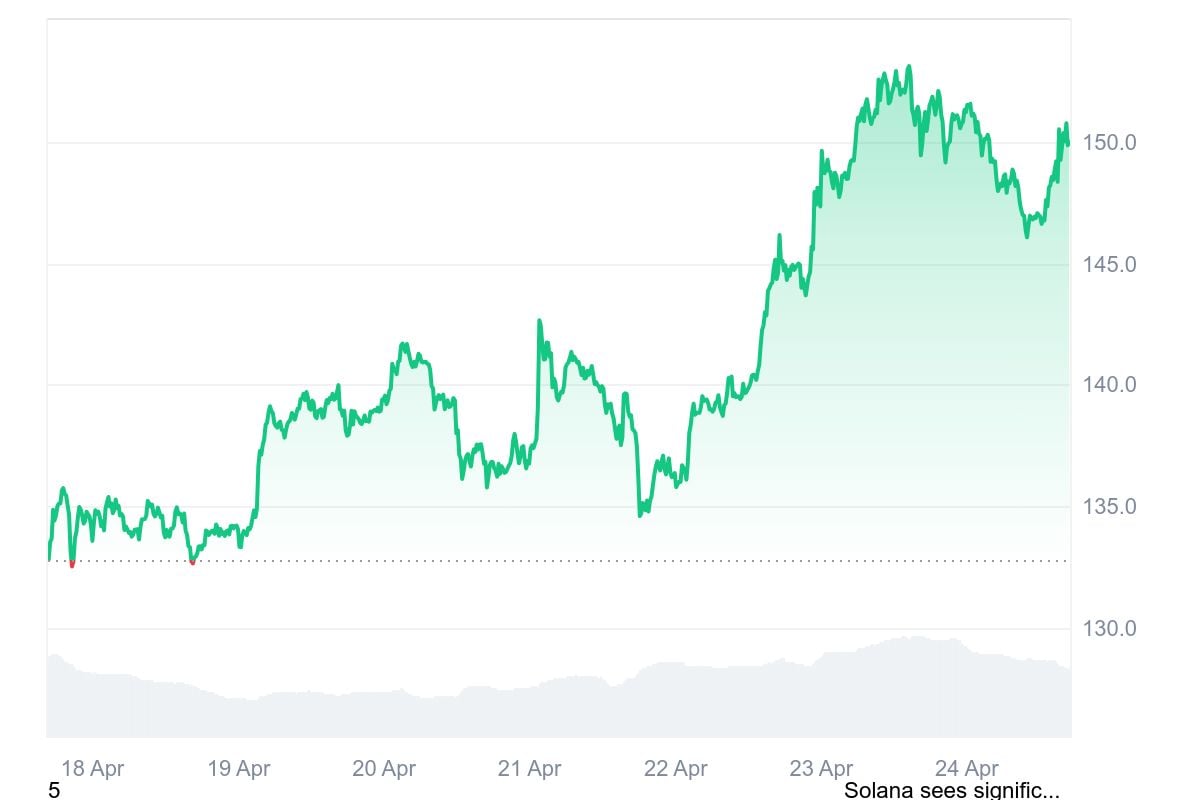

Solana Sell-off Risk Fades as SOL Price Reclaims Key Resistance Level