- Major Bitcoin holders control 67.77% of the supply, showing long-term market confidence.

- Large Bitcoin holders continue to accumulate despite market volatility and corrections.

- Short-term holders face significant losses, resembling early bear market conditions.

Major Bitcoin holders control about 67.77% of the cryptocurrency’s supply, signaling strong confidence in the asset despite recent market volatility. These investors, holding between 10 and 10,000 BTC, have added over 53,600 BTC since March 22, reinforcing long-term bullish sentiment.

The substantial Bitcoin holders maintained their buying momentum during April despite market price variations. Strong institutional buying behaviour signals long-term investment motives, granting players better protection from market downturns. Short-term investors currently face accumulating losses, while long-term investors hold different investment strategies.

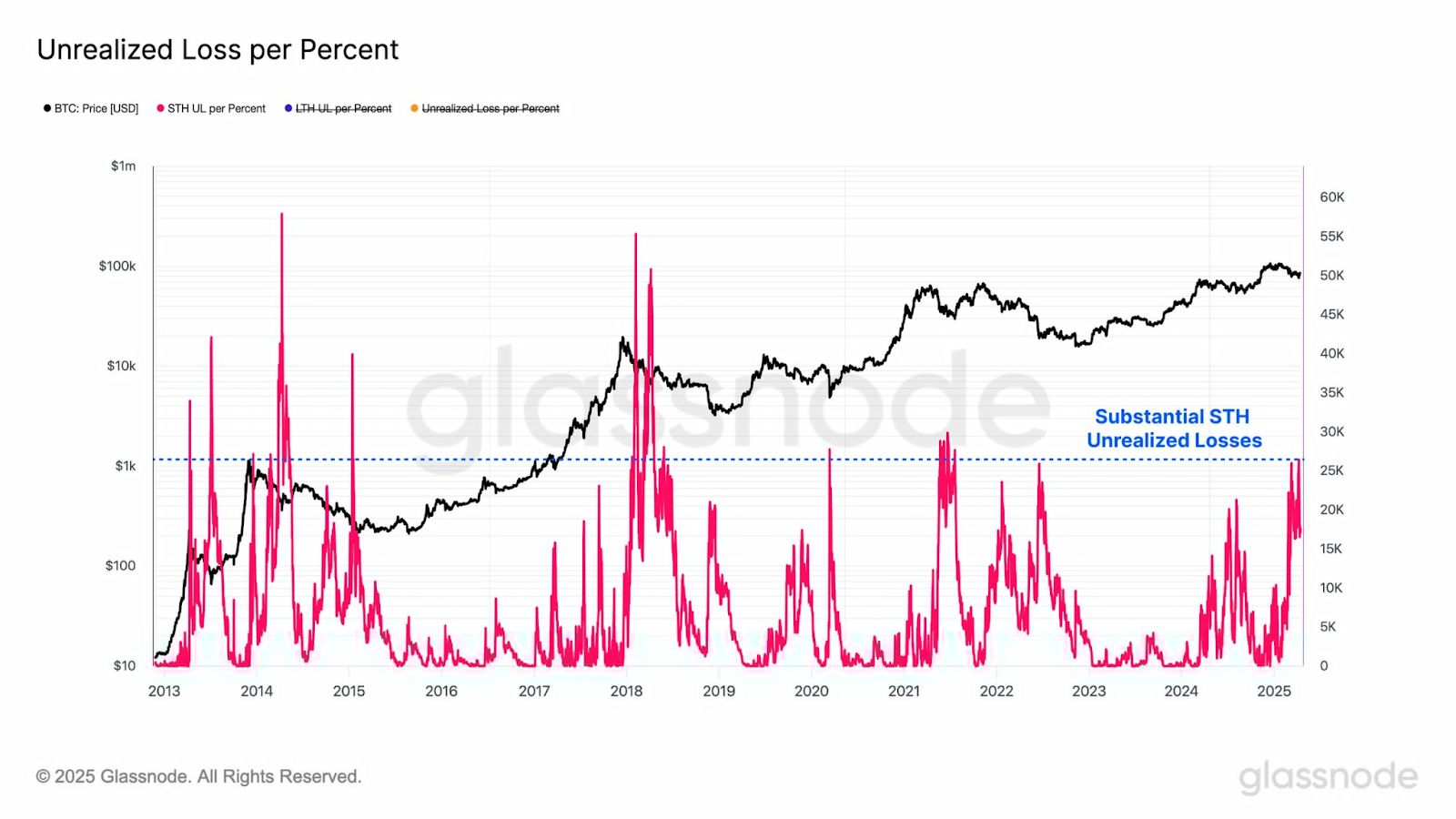

Short-Term Bitcoin Losses

Based on data from Glassnode, it reveals that investors holding Bitcoin only for short periods are now facing significant losses in value. The platform data demonstrates that the present market correction has reached similar depths as the early periods of bear markets, which occurred during previous Bitcoin cycles. Short-term investors have suffered considerable losses because of this correcting market movement.

Source: Glassnode

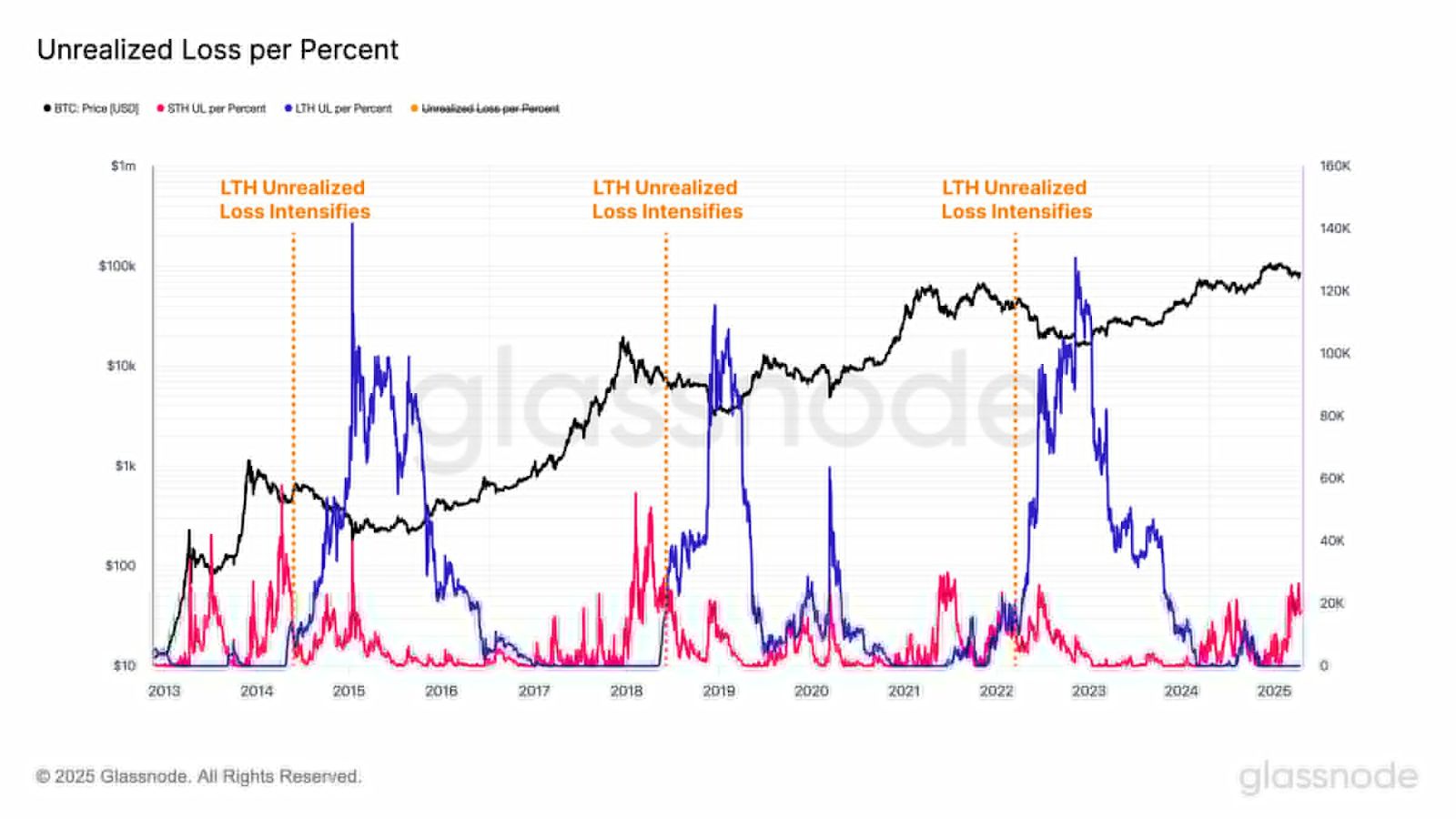

Source: Glassnode

Further, the data shows that long-term holders (LTHs) primarily remain profitable during this period. Investors with long-term investment strategies have managed better than those holding for short durations.

Related: Four Bullish Reasons That Could Soon Flip The Crypto Market

Several early Bitcoin buyers have transitioned to the LTH category, strengthening their ability to endure volatility. Historically, this transition into the long-term holder category led to bear market confirmations, but an official bear market is yet to occur.

Source: Glassnode

Source: Glassnode

Bitcoin’s Uncertain Market Outlook

Bitcoin’s market outlook remains uncertain for the coming years. Long-term holders may experience increased loss absorption, but a full bear market collapse seems unlikely. Although short-term holders becoming long-term holders could bring changes to the market, future stability remains undetermined, given the current unpredictable conditions.

The major holders are changing their strategies, and this is an upcoming signal in the market. The future of Bitcoin is governed by the actions of major holders and short-term traders who effectively mitigate these risks. The market remains on the lookout for more signs to determine if the existing market shift is just temporary hype or the onset of a longer bear trend.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.