Glassnode: Bitcoin Whales Still in Strong Accumulation Zone, Falling Wedge Indicates Potential Bullish Reversal

PANews reported on April 19, according to Cointelegraph, Glassnode data indicates that Bitcoin whales are still in a strong accumulation zone. Large holders possessing 100-1,000 or more Bitcoins (whales and sharks) are absorbing Bitcoin at the fastest rate in history, with the group's absorption now exceeding 300% of Bitcoin's annual issuance. Meanwhile, the amount of Bitcoin held on exchanges continues to decline, with the annual absorption rate dropping to -200%, indicating that investors prefer long-term holding or self-custody.

In addition, addresses holding more than 10,000 BTC have a trend accumulation score of approximately 0.7, suggesting a strong accumulation state. Technical analysis shows that Bitcoin has broken through a months-long descending wedge pattern. If the current trend continues, the price could surpass $100,000 in May, with $88,800 being the key resistance level to reversing the market structure. If it fails to breach, bulls may struggle to maintain strong momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

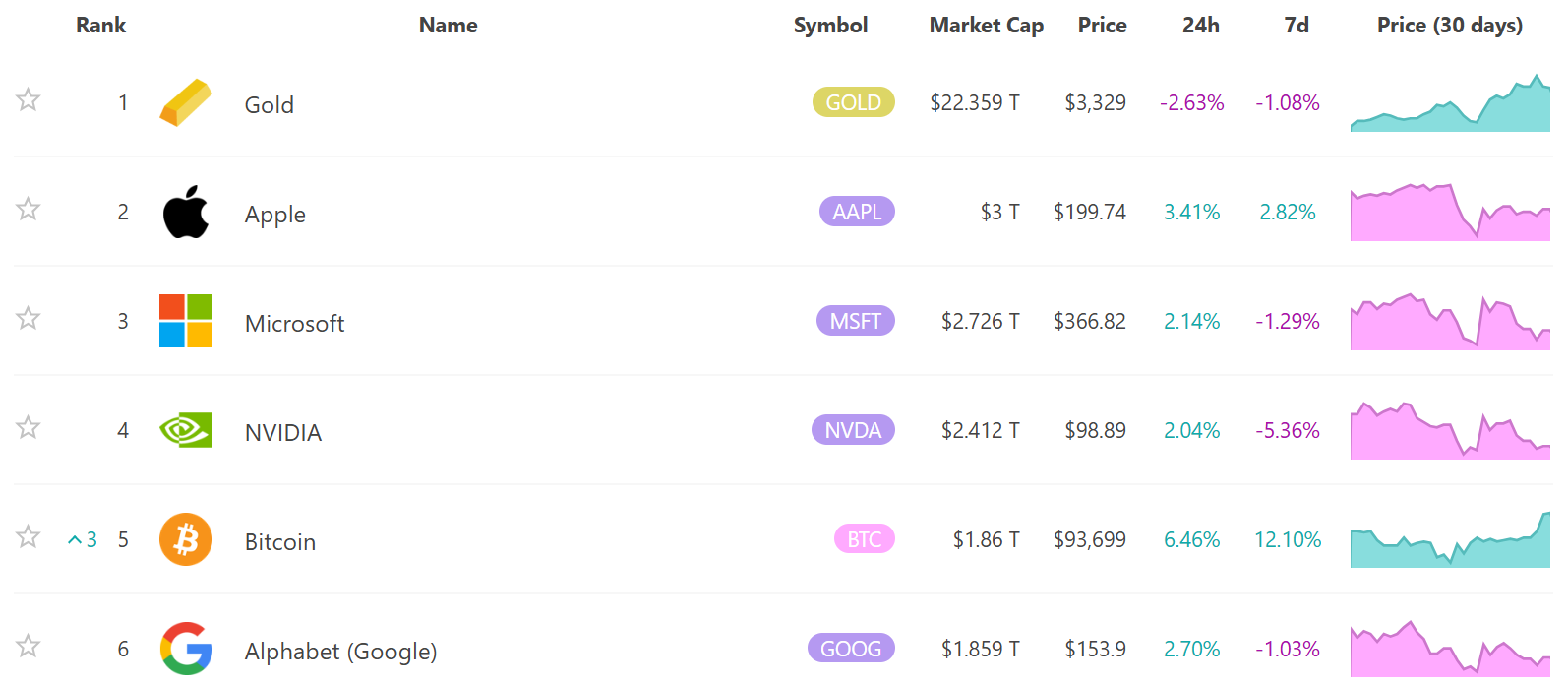

Bitcoin Rises to Fifth in Global Asset Market Value

The U.S. SEC Will Not Restart the Lawsuit Against Hex Founder

DWF Labs and Mask Network Reach Cooperation, MASK Surges Nearly 10%