Will Solana Price Hit $160 Soon?

Solana (SOL) is gaining fresh attention in the crypto market as price action heats up after an extended consolidation period. Following a slow bleed from its highs earlier this year, SOL is now attempting to reclaim key technical levels . The question on every investor’s mind is clear: is this the start of a bigger bullish breakout, or just a temporary bounce before more downside? Let’s dive into the daily and hourly charts to uncover what lies ahead for Solana.

Solana Price Prediction: Why Is Solana’s Price Climbing Right Now?

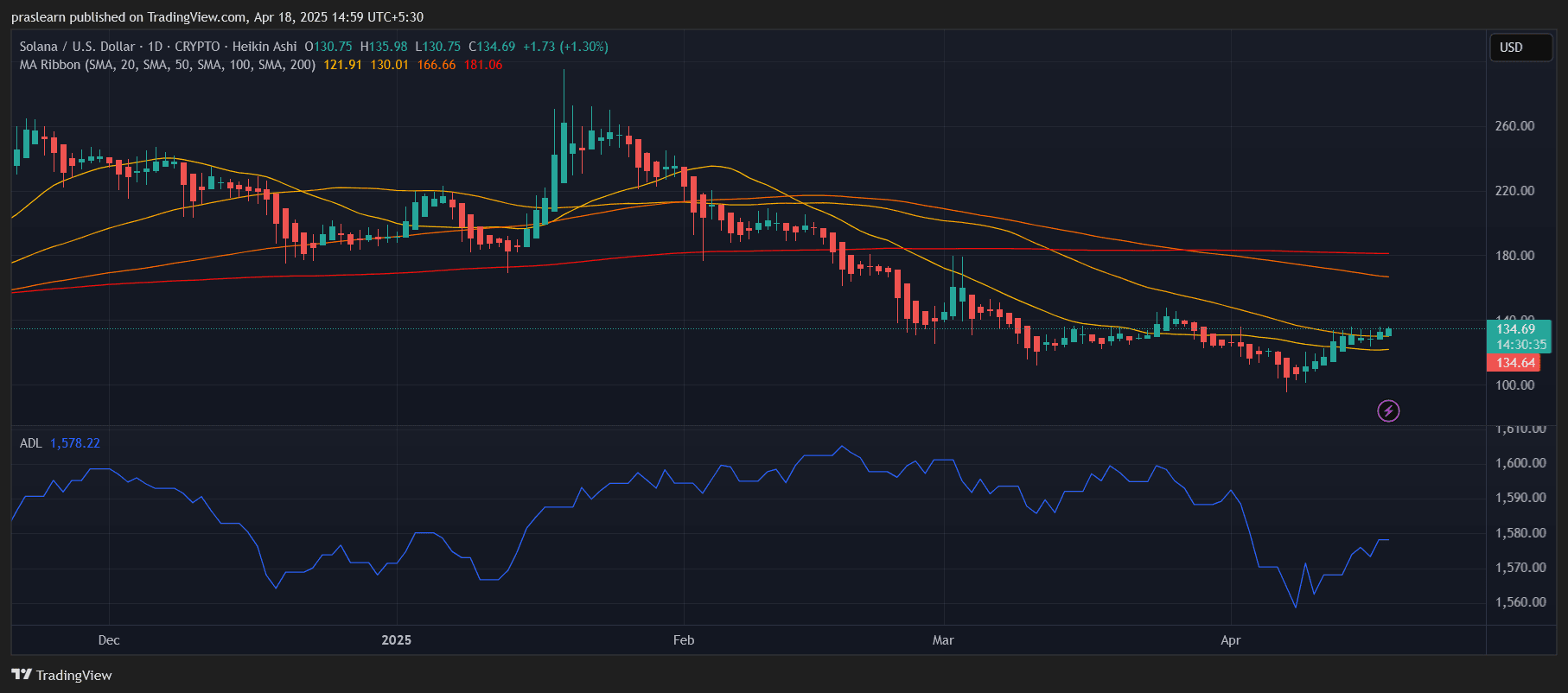

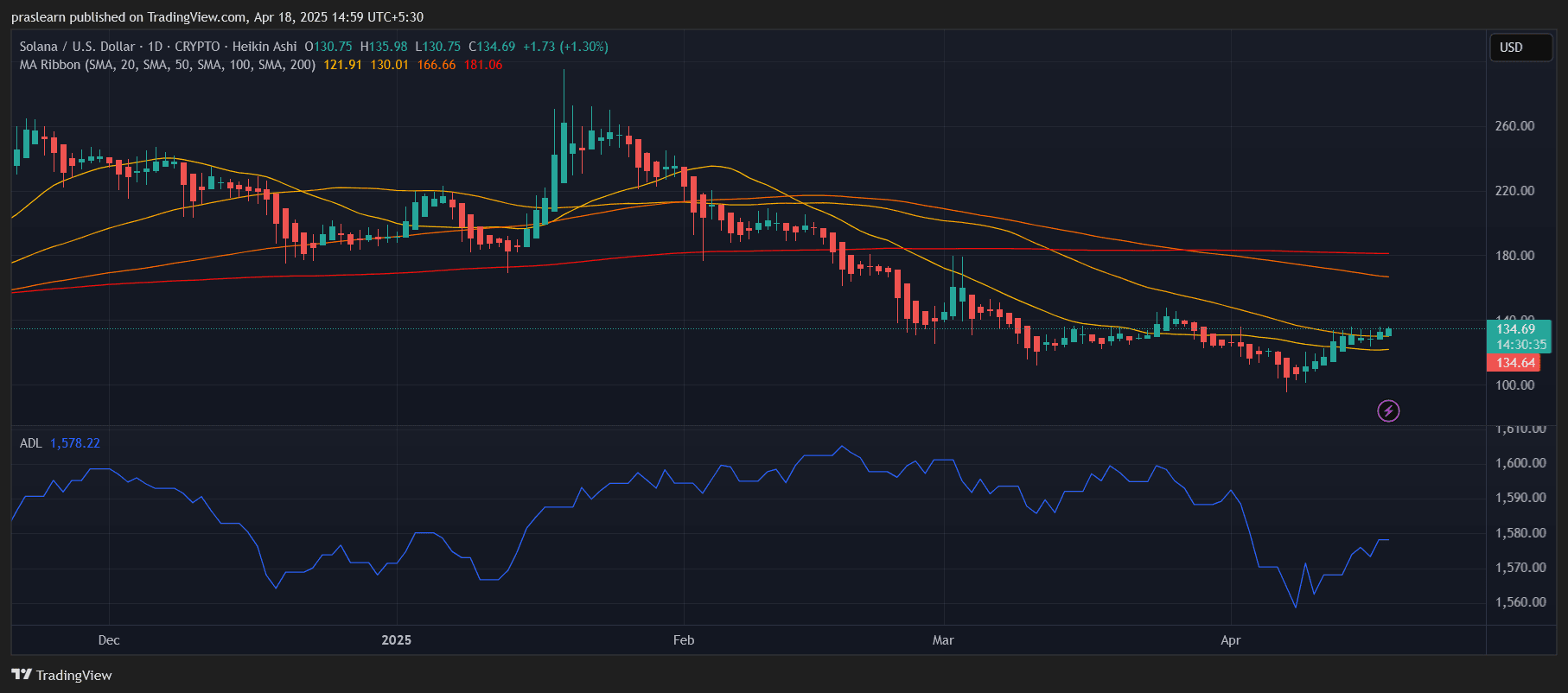

After weeks of stagnation near the $100 mark, Solana has finally started showing signs of strength. The move appears to be driven by a combination of factors: renewed buying interest in large-cap altcoins, market-wide recovery sentiment, and encouraging technical signals. On the daily chart, Solana has pushed past its 20-day and 50-day simple moving averages, closing at around $134.69. The Heikin Ashi candles are showing consecutive green bodies, signaling continuous buyer control, while the Accumulation/Distribution Line is slowly trending upward — a subtle but important signal that accumulation is taking place behind the scenes.

The larger crypto market has also shown signs of stabilizing, which gives SOL a more supportive environment to attempt a reversal. But it’s not just macro factors at play. The structure of the Solana chart suggests that the worst of the downtrend may be behind us — provided the next resistance zones are tackled with volume.

Daily Chart Analysis: A Crucial Turning Point?

SOL/USD Daily Chart- TradingView

SOL/USD Daily Chart- TradingView

Solana’s daily chart paints a cautiously optimistic picture . The price has managed to break above the cluster of moving averages that have suppressed rallies over the past month, including the 50-day and 100-day SMAs. These moving averages now sit below the current price, and could serve as support on any pullback. However, the real test lies ahead. The $140 level, which acted as a pivot zone in previous months, now presents itself as immediate resistance. A successful break and hold above this level could pave the way for a surge towards the $160 region — a level not seen since the early days of February.

The 200-day moving average, currently near $181, still looms overhead and acts as a longer-term trend barrier. Until SOL price can reclaim this level , the macro trend remains neutral to bearish. But the progress made in the last two weeks shows that bulls are starting to fight back. Volume remains moderate, and further confirmation is needed, but the ADL line ticking upwards is a sign that long-term holders are stepping in.

Hourly Chart Insight: Bullish Structure Forming

SOL/USD 1 Hr Chart- TradingView

SOL/USD 1 Hr Chart- TradingView

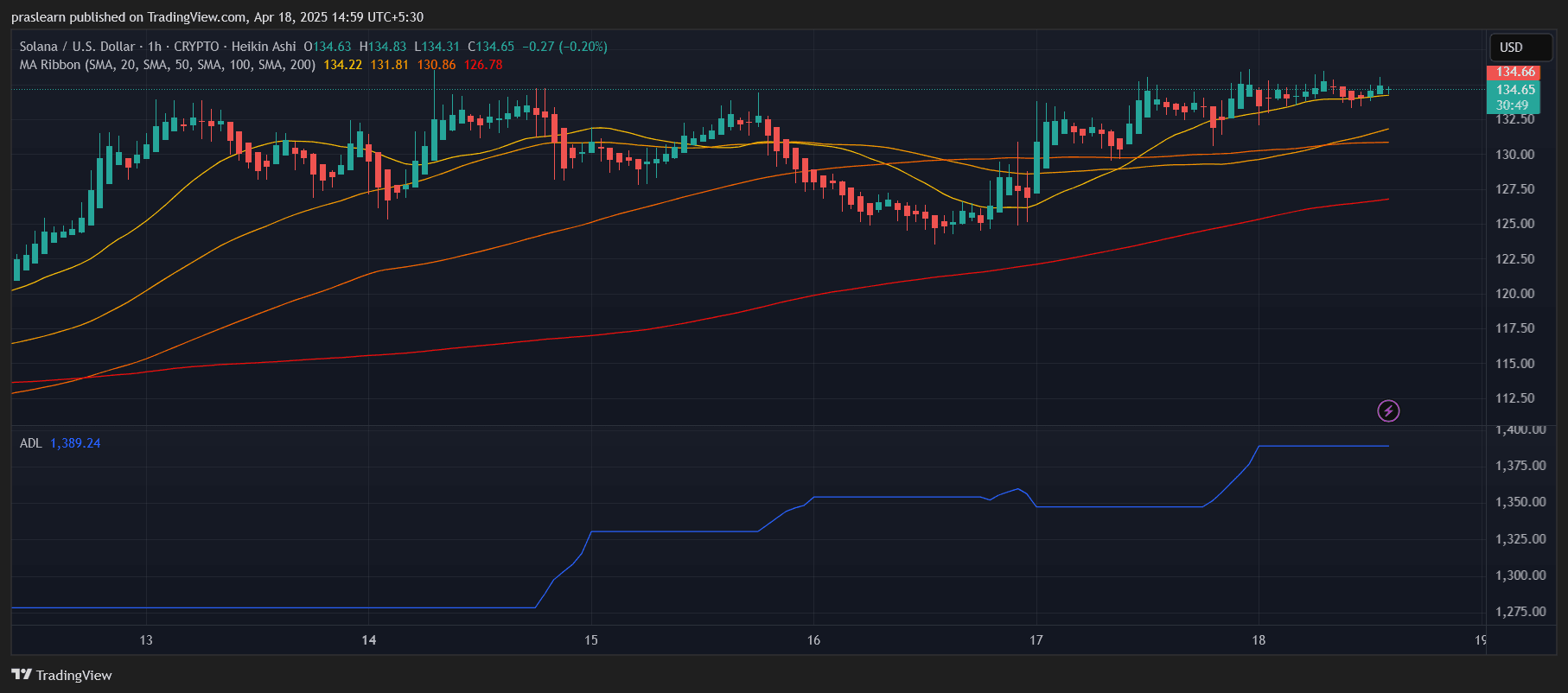

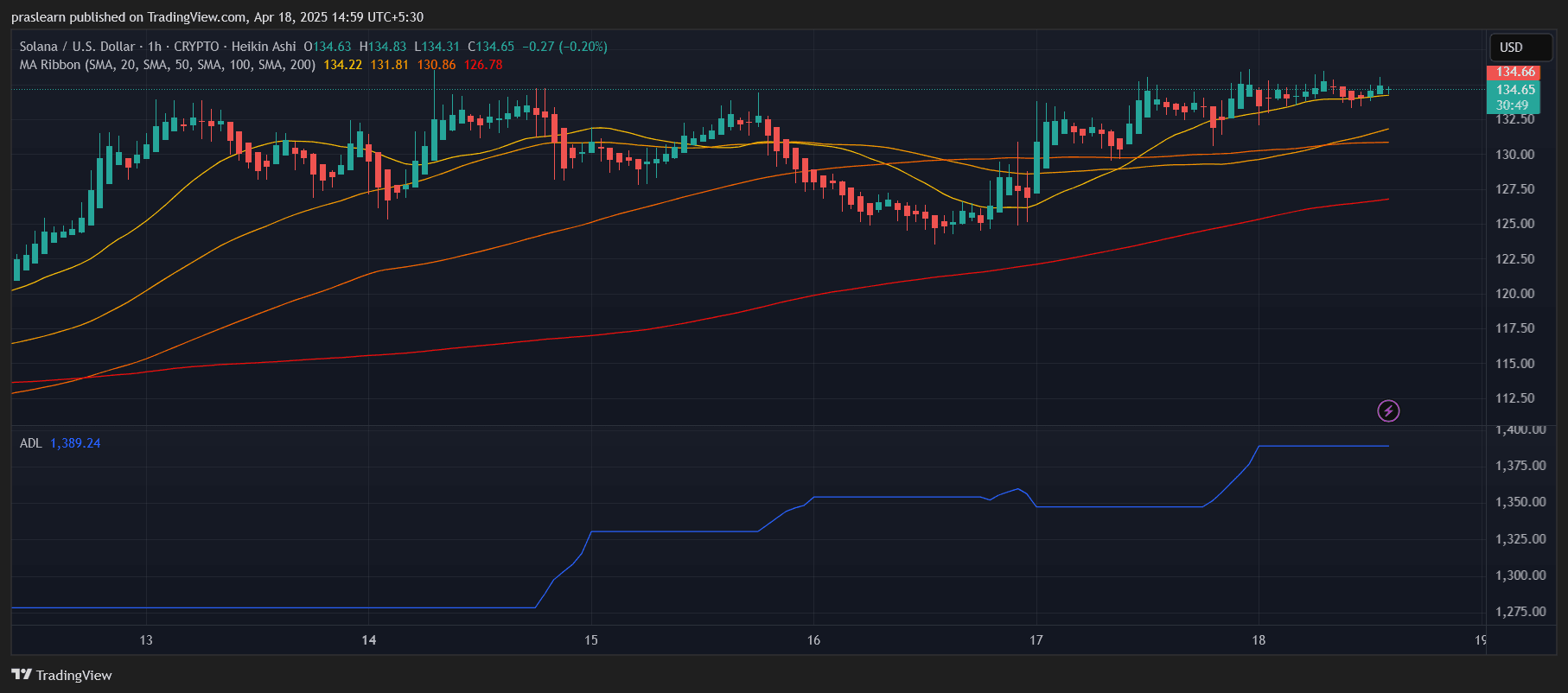

The hourly chart offers a closer view of the immediate price dynamics and confirms a short-term bullish structure. Since April 15, Solana price has been printing higher lows and higher highs, forming a mini ascending channel. Price is comfortably trading above all key intraday moving averages, including the 20, 50, and 100-hour SMAs, which are fanning out in a bullish alignment. This suggests that momentum is currently in favor of the buyers.

Despite a slight pullback seen in the last few hourly candles, Solana has managed to maintain its position near $134.65, showing resilience at this level. If this momentum continues, a test of $138 to $140 seems likely in the next 24 to 48 hours. The ADL on the hourly chart has also risen to 1,389.24, echoing accumulation signals seen on the daily timeframe. For short-term traders, a clean move above $136 with volume could be a solid long entry setup, while any drop below $132 might bring short-term weakness back into play.

Solana Price Prediction: Where Is Solana Price Headed Next?

Solana’s immediate trajectory depends on whether bulls can clear the $140 resistance level convincingly. If that level flips into support, the next upside target would be in the $160 to $165 range. This would mark a nearly 20 percent rally from current levels and would bring Solana closer to testing the 200-day SMA near $181. Such a move would also indicate a broader shift in sentiment and may trigger more institutional inflows.

On the flip side, if SOL price fails to sustain above $134–$135 and begins to lose momentum, a retracement toward the $120 zone is possible. This level has served as a strong base recently and could act as a launchpad if tested again. For the time being, the bias remains cautiously bullish as long as the price holds above $130. The current structure favors a potential breakout, but macro market conditions and Bitcoin’s movement will still influence Solana’s direction.

Final Thoughts: Breakout Brewing or Bull Trap?

Solana is in a make-or-break moment. Technically, the asset is showing clear signs of a shift in momentum, with both short-term and mid-term moving averages supporting the recent climb. The accumulation signals and rising ADL indicate that whales and institutions may be repositioning. While caution is warranted, especially with the 200-day SMA still above, the ingredients for a bullish breakout are in place.

Traders and investors should keep a close eye on the $135–$140 zone. If Solana price clears this range with strong volume, it could become one of the standout altcoin performers of the month. Otherwise, a healthy retest of $120 might be needed before any sustained move higher. Either way, Solana’s chart is no longer sleeping — and the next few days could define its Q2 trajectory.

Solana (SOL) is gaining fresh attention in the crypto market as price action heats up after an extended consolidation period. Following a slow bleed from its highs earlier this year, SOL is now attempting to reclaim key technical levels . The question on every investor’s mind is clear: is this the start of a bigger bullish breakout, or just a temporary bounce before more downside? Let’s dive into the daily and hourly charts to uncover what lies ahead for Solana.

Solana Price Prediction: Why Is Solana’s Price Climbing Right Now?

After weeks of stagnation near the $100 mark, Solana has finally started showing signs of strength. The move appears to be driven by a combination of factors: renewed buying interest in large-cap altcoins, market-wide recovery sentiment, and encouraging technical signals. On the daily chart, Solana has pushed past its 20-day and 50-day simple moving averages, closing at around $134.69. The Heikin Ashi candles are showing consecutive green bodies, signaling continuous buyer control, while the Accumulation/Distribution Line is slowly trending upward — a subtle but important signal that accumulation is taking place behind the scenes.

The larger crypto market has also shown signs of stabilizing, which gives SOL a more supportive environment to attempt a reversal. But it’s not just macro factors at play. The structure of the Solana chart suggests that the worst of the downtrend may be behind us — provided the next resistance zones are tackled with volume.

Daily Chart Analysis: A Crucial Turning Point?

SOL/USD Daily Chart- TradingView

SOL/USD Daily Chart- TradingView

Solana’s daily chart paints a cautiously optimistic picture . The price has managed to break above the cluster of moving averages that have suppressed rallies over the past month, including the 50-day and 100-day SMAs. These moving averages now sit below the current price, and could serve as support on any pullback. However, the real test lies ahead. The $140 level, which acted as a pivot zone in previous months, now presents itself as immediate resistance. A successful break and hold above this level could pave the way for a surge towards the $160 region — a level not seen since the early days of February.

The 200-day moving average, currently near $181, still looms overhead and acts as a longer-term trend barrier. Until SOL price can reclaim this level , the macro trend remains neutral to bearish. But the progress made in the last two weeks shows that bulls are starting to fight back. Volume remains moderate, and further confirmation is needed, but the ADL line ticking upwards is a sign that long-term holders are stepping in.

Hourly Chart Insight: Bullish Structure Forming

SOL/USD 1 Hr Chart- TradingView

SOL/USD 1 Hr Chart- TradingView

The hourly chart offers a closer view of the immediate price dynamics and confirms a short-term bullish structure. Since April 15, Solana price has been printing higher lows and higher highs, forming a mini ascending channel. Price is comfortably trading above all key intraday moving averages, including the 20, 50, and 100-hour SMAs, which are fanning out in a bullish alignment. This suggests that momentum is currently in favor of the buyers.

Despite a slight pullback seen in the last few hourly candles, Solana has managed to maintain its position near $134.65, showing resilience at this level. If this momentum continues, a test of $138 to $140 seems likely in the next 24 to 48 hours. The ADL on the hourly chart has also risen to 1,389.24, echoing accumulation signals seen on the daily timeframe. For short-term traders, a clean move above $136 with volume could be a solid long entry setup, while any drop below $132 might bring short-term weakness back into play.

Solana Price Prediction: Where Is Solana Price Headed Next?

Solana’s immediate trajectory depends on whether bulls can clear the $140 resistance level convincingly. If that level flips into support, the next upside target would be in the $160 to $165 range. This would mark a nearly 20 percent rally from current levels and would bring Solana closer to testing the 200-day SMA near $181. Such a move would also indicate a broader shift in sentiment and may trigger more institutional inflows.

On the flip side, if SOL price fails to sustain above $134–$135 and begins to lose momentum, a retracement toward the $120 zone is possible. This level has served as a strong base recently and could act as a launchpad if tested again. For the time being, the bias remains cautiously bullish as long as the price holds above $130. The current structure favors a potential breakout, but macro market conditions and Bitcoin’s movement will still influence Solana’s direction.

Final Thoughts: Breakout Brewing or Bull Trap?

Solana is in a make-or-break moment. Technically, the asset is showing clear signs of a shift in momentum, with both short-term and mid-term moving averages supporting the recent climb. The accumulation signals and rising ADL indicate that whales and institutions may be repositioning. While caution is warranted, especially with the 200-day SMA still above, the ingredients for a bullish breakout are in place.

Traders and investors should keep a close eye on the $135–$140 zone. If Solana price clears this range with strong volume, it could become one of the standout altcoin performers of the month. Otherwise, a healthy retest of $120 might be needed before any sustained move higher. Either way, Solana’s chart is no longer sleeping — and the next few days could define its Q2 trajectory.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Buyer Battles Begin as BlockDAG Offers 25M BDAG Daily! LINK Price Prediction Leans Toward $25 & TRX Crypto Shows Strength

Catch the next big crypto as LINK price prediction targets $25, TRX crypto shows strength & BlockDAG drops Buyer Battles offering 25M BDAG daily fueling buying frenzy.Chainlink Price Prediction Targets $25 BreakoutTRX Crypto Draws Volume After USDT Mint & ETF HypeBlockDAG Launches Daily Buyer BattlesStrong Moves Are Happening Live

Digital Commodity Capital Adds XRP to Its Portfolio, Bolstering Institutional Interest

BlockDAG Drops Price Pre-Reveal as Fartcoin Gains Traction

XRP Price Target Debated; SHIB Burns and Unstaked Gains