Unveiling the Crypto VC Network: Who Is Joining Forces to Build the Next Unicorn?

Top Funds Cohort Investment Drives Startups' Success Rate Soaring

Original Article Title: Networks in Crypto VC

Original Author: @Decentralisedco, Web3 Consulting Firm

Original Translation: 律动小 deep

Editor's Note: The article explores the network relationships in crypto venture capital, analyzing how VCs choose co-investors and historical investment patterns. Researchers revealed which funds frequently co-invest, how their investments perform, and how large funds support their portfolio companies through follow-on funding. The article emphasizes that understanding VC networks and co-investment habits can help founders optimize their fundraising strategy, while pointing out that capital is increasingly concentrating in a few top funds, co-investment relies more on partner relationships than fund brands, and the future may evolve towards private equity.

The following is the original content (slightly restructured for better readability):

We studied how crypto venture capital selects co-investors and the historical patterns in their investment strategies. The tools mentioned in the article can be accessed here.

As an asset class, venture capital follows an extreme power law distribution. However, the extent of this phenomenon has not been fully researched as we are always caught up in chasing the latest market narrative. As a founder, understanding which VCs frequently co-invest can save time and optimize your fundraising strategy. Each transaction is like a fingerprint, and once we visualize them as graphs, the underlying story can be revealed.

In other words, we can track the nodes responsible for a majority of the funding in the cryptocurrency space. We try to find the "ports" in the modern trading network, similar to merchants from a millennium ago.

We believe there are two reasons why this is an interesting experiment:

1. We operate a somewhat "fight club" like VC network. No one is really throwing punches (at least not yet), but we also don't talk about it much publicly. This VC network includes about 80 funds. Across the entire crypto VC space, around 240 funds have invested over $500,000 in seed-stage rounds. This means we directly engage with about 1/3 of the funds, and nearly 2/3 of the funds read our content. This coverage exceeds my expectations, but that's the current state of affairs.

Nevertheless, tracking who actually invests where remains quite challenging. Sending founder updates to each fund would turn into noise. The emergence of this tracking tool is to filter out which funds have invested in which areas and with whom they co-invest.

2. For a founder, understanding capital flows is just the first step. More importantly, it is crucial to comprehend how these funds have performed and with whom they typically co-invest. To figure this out, we calculated the historical probability of a fund's portfolio companies receiving follow-on funding post their investment, although data tends to become murky in later stages (such as Series B) as companies often opt for token issuance rather than traditional equity financing.

Assisting founders in identifying active investors in cryptocurrency venture capital is the first step. The next is understanding which funding sources have shown better performance. Once we have this data, we can explore which co-investments by funds can lead to the best outcomes. Of course, this is not rocket science. No one can guarantee a Series A funding with just one check, just like no one can guarantee marriage after the first date. However, understanding the landscape you are stepping into, be it in dating or risk financing, can be highly beneficial.

Building Success

We used some basic logic to identify funds in the portfolio that have participated in the most follow-on funding rounds. If a fund's multiple companies receive funding post-seed round, they have likely done something right. Venture capital sees an increase in investment value when a company raises the next round at a higher valuation. Therefore, follow-on funding is a good indicator of performance.

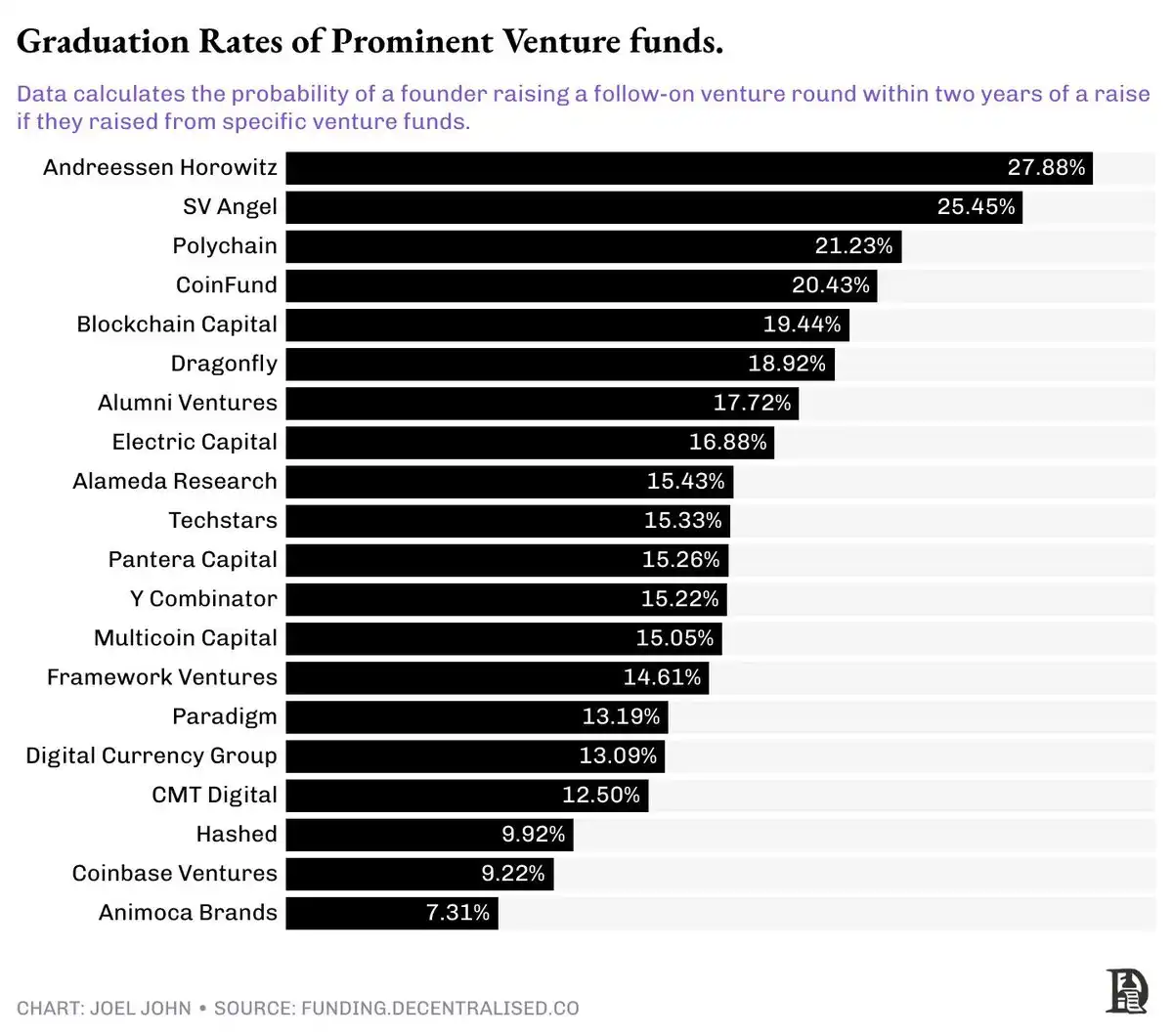

We selected the top 20 funds in the portfolio with the most follow-on funding rounds and then calculated the total number of companies they invested in at the seed stage. You can effectively calculate the founder's probability of receiving follow-on funding from this. If a fund invested in 100 companies at the seed stage, out of which 30 received follow-on funding within two years, we would calculate the follow-on funding "graduation probability" as 30%.

The limitation here is that we set a strict two-year time filter. Typically, startups may choose not to raise funds at all or may do so much later.

Even among the top 20 ranked funds, the power law distribution is quite extreme. For instance, receiving funding from A16z means you have a 1/3 chance of raising another round within two years. In other words, for every three startups backed by A16z, one will proceed to a Series A round. Considering the probability on the other end is 1/16, this is quite a high graduation rate.

For funds closer to the 20th rank (in this top 20 follow-on funding list), the probability of their portfolio companies receiving follow-on funding is 7%. These numbers might seem similar, but for context, a 1/3 probability is like rolling a die and getting a number less than 3, while a 1/14 probability is roughly equivalent to the chance of having twins. These are vastly different outcomes, both literally and probabilistically.

Joking aside, this illustrates the level of concentration within cryptocurrency venture capital funds. Some venture funds may even strategize follow-on funding for their portfolio companies as they also have growth-stage funds. Therefore, they will invest in the same company in both the seed round and Series A. When a venture fund doubles down on an investment in the same company, it often sends a strong signal to later-stage investors. In other words, whether a venture firm internally has a growth-stage fund significantly impacts the company's likelihood of success in the coming years.

In the long run, cryptocurrency venture capital may evolve into private equity investments for revenue-generating projects.

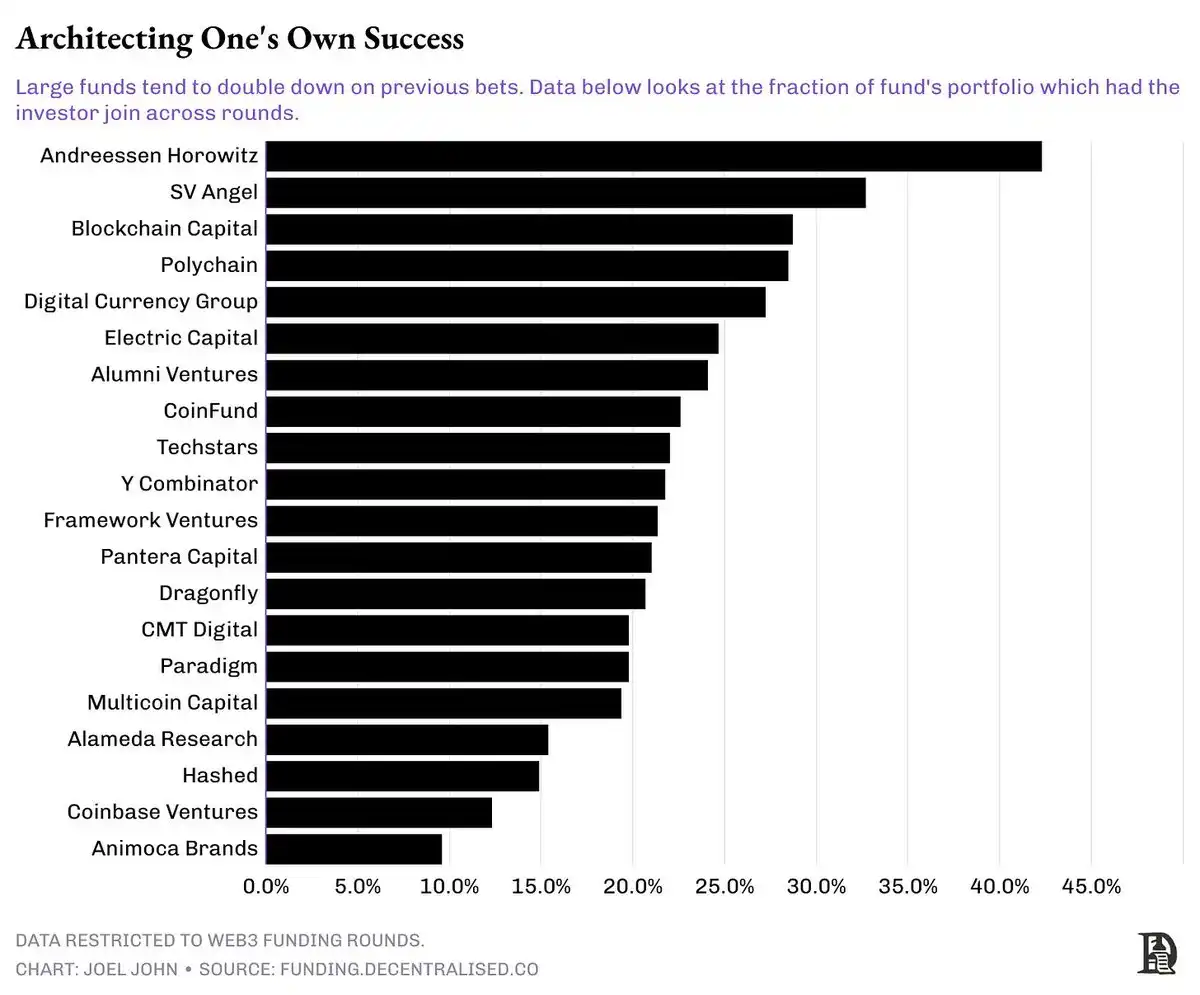

We have a theoretical argument for this transition. But what do the data actually show? To investigate this, we looked at the number of startups in our investor group that received follow-on funding. We then calculated the percentage of companies where the same venture fund participated again in subsequent funding rounds.

In other words, if a company received seed funding from A16z, what is the probability that A16z will reinvest in their Series A?

A pattern quickly emerged. Larger funds managing over $1 billion tend to engage in follow-on investments more frequently. For example, 44% of startups in A16z's portfolio had A16z participate in follow-on rounds when they raised additional funding. Blockchain Capital, DCG, and Polychain made follow-on investments in a quarter of the companies that received follow-on funding in their portfolios.

In other words, who you raise from in the seed or pre-seed round is much more critical than you might think, as these investors often tend to consistently support their companies.

Habitual Co-Investment

These patterns are the result of post hoc observations. We are not implying that companies funded by non-top-tier VCs are destined to fail. The ultimate goal of all economic activity is either growth or profit creation. Startups that can achieve both functions will see their valuations rise over time. However, increasing the probability of success certainly helps. If you cannot secure funding from these top 20 funds, one way to improve the odds is through their networks. In other words, connect to these hubs of capital.

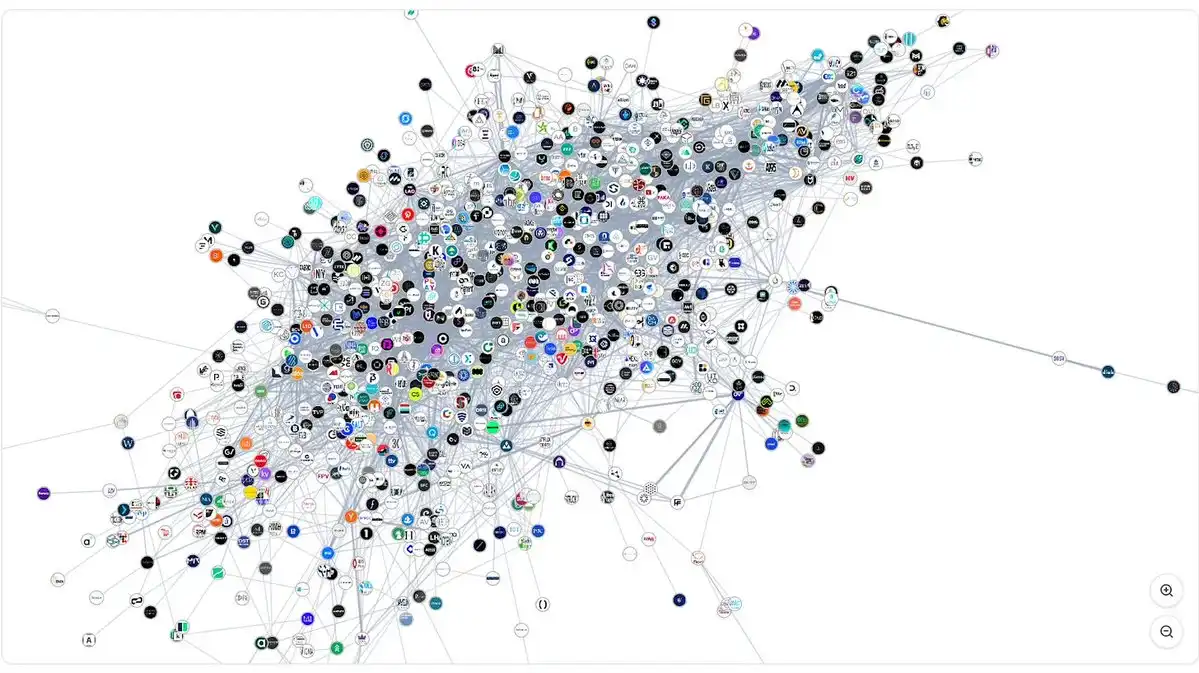

The image below shows the network relationships of all venture capitalists in the cryptocurrency space over the past decade. There are 1000 investors sharing approximately 22,000 connections. When one investor co-invests with another, a connection is formed. It may look crowded, even like too many options.

However, this includes funds that have already closed, never returned capital, or are no longer investing.

I know, it's messy.

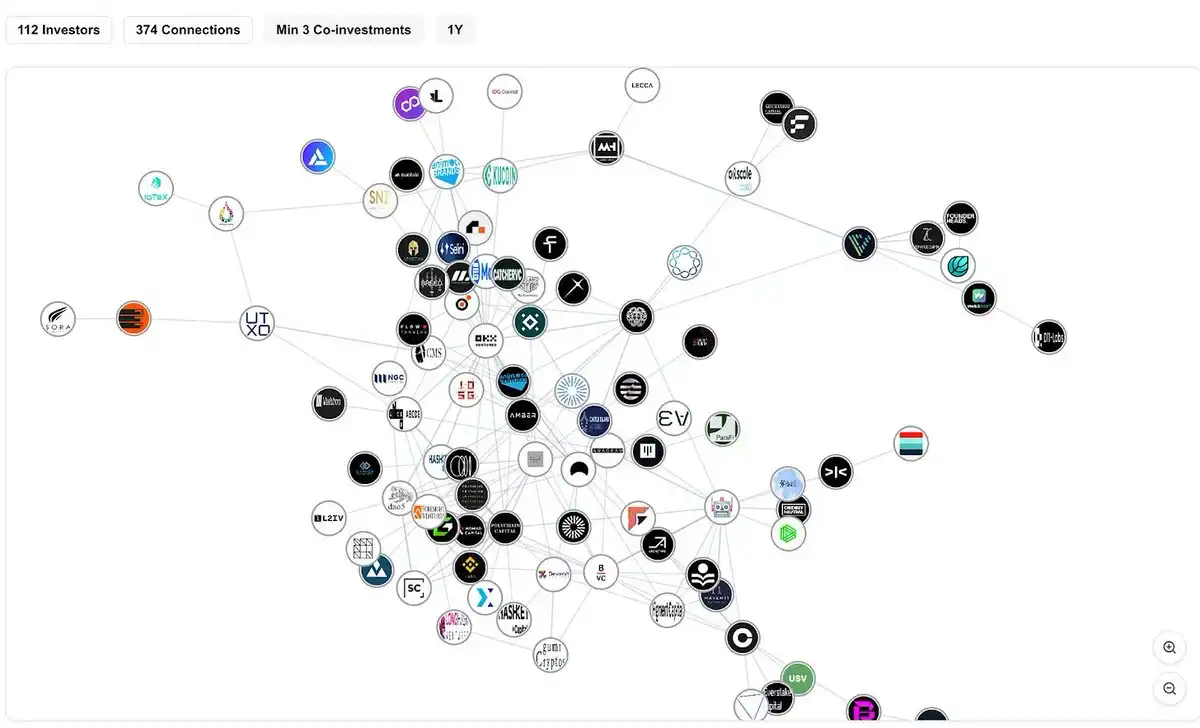

The following image provides a clearer view of the future direction of our market. If you are a founder looking to raise a Series A round with a fund size of over $2 million, there are approximately 50 funds. The investor network participating in these rounds consists of around 112 funds. These funds are increasingly inclined towards consolidation, showing a stronger preference for co-investing with specific partners.

Seed Round to Series A Investor Ocean

It appears that over time, funds have developed a habit of co-investing. This means that when one fund invests in an entity, it often brings along another peer fund, either due to complementary skills (such as technical expertise or marketing assistance) or based on partner relationships. To understand how these relationships work, we began exploring the co-investment patterns between funds over the past year.

For example, in the past year:

· Polychain and Nomad Capital had 9 shared co-investments.

· Bankless and Robot Ventures had 9 shared co-investments.

· Binance and Polychain had 7 shared co-investments.

· Binance also had 7 shared co-investments with HackVC.

· OKX and Animoca had 7 shared co-investments.

Larger funds are becoming increasingly selective about co-investors.

· For example, out of Paradigm's 10 investments last year, Robot Ventures participated in 3.

· In its total of 13 investments, DragonFly shared 3 rounds with Robot Ventures and Founders Fund.

· Similarly, Founders Fund had 3 co-investments with Dragonfly out of its total of 9 investments.

In other words, we are transitioning to an era where a small number of funds are making large investments, there are fewer co-investors, and these co-investors are often well-established, reputable funds.

Entering the Matrix

Another way of analyzing data is by studying the behavior of the most active investors. The matrix above considers the most frequently investing funds since 2020 and how their relationships unfold. You will notice that joint investments between accelerators (such as Y Combinator or Outlier Venture) and exchanges (such as Coinbase Ventures) are rare.

On the other hand, you will also find that exchanges typically have their own preferences. For example, OKX Ventures and Animoca Brands have a high degree of joint investments. Coinbase Ventures has over 30 joint investments with Polychain and 24 with Pantera.

What we observe are three structural tendencies:

1. Despite a high investment frequency, joint investments between accelerators and exchanges or large funds are scarce, possibly due to different stage preferences.

2. Major exchanges show a strong preference for growth-stage venture funds. Currently, Pantera and Polychain lead in this aspect.

3. Exchanges tend to collaborate with local players. OKX Ventures and Coinbase exhibit distinct joint investment preferences, highlighting the global nature of Web3 capital allocation.

So, as venture funds consolidate, where does the next marginal capital come from? I have noticed an interesting pattern: corporate ventures have their own clusters. For instance, Goldman Sachs has had 2 joint investment rounds historically with PayPal Ventures and Kraken. Coinbase Ventures has 37 joint investments with Polychain, 32 with Pantera, and 24 with Electric Capital.

Unlike venture capital, corporate pools of capital typically target growth-stage companies with significant product-market fit. Therefore, as early-stage risk financing declines, the behavior of this pool of capital still needs to be observed.

The Evolving Network

Excerpt from "Squares and Towers"

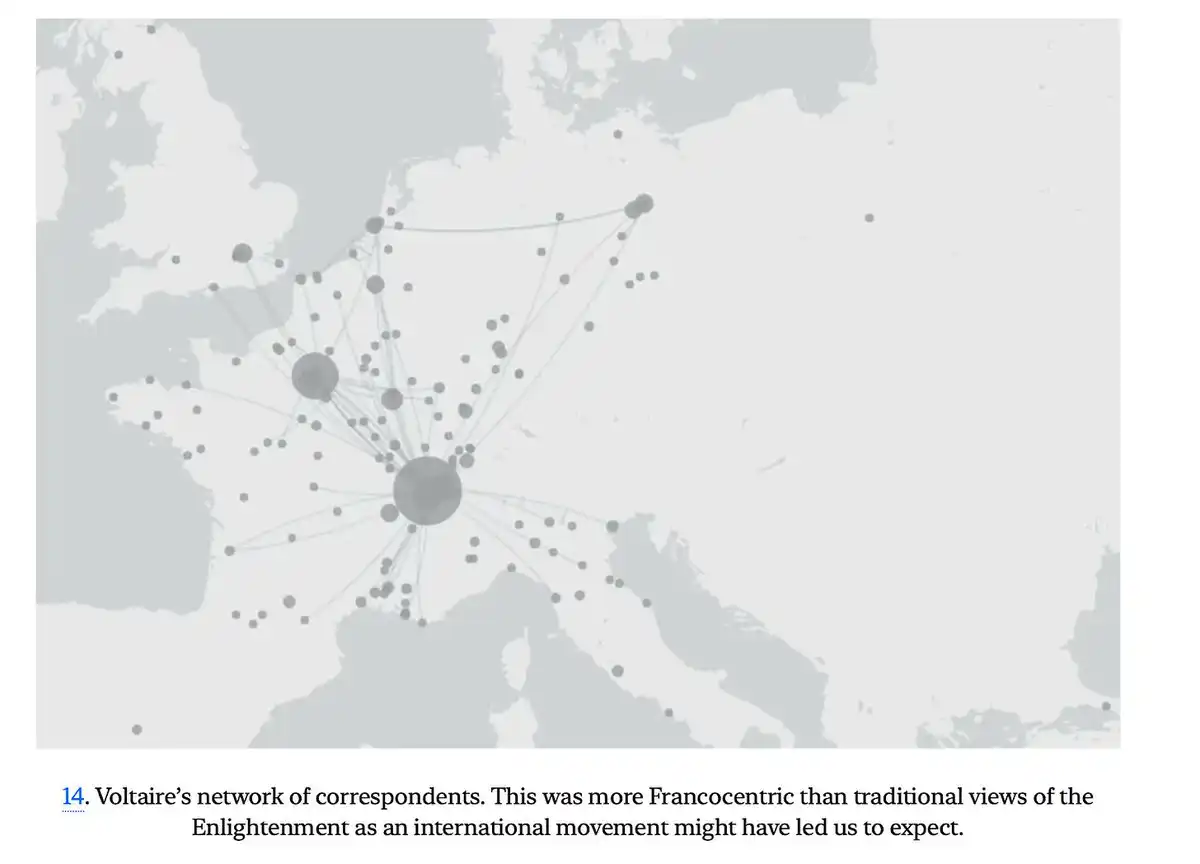

A few years ago, after reading Niall Ferguson's "The Square and the Tower," I became interested in exploring the relationship networks within cryptocurrency. This book revealed how the spread of ideas, products, and even diseases is tied to networks. It wasn't until a few weeks ago when we built a funding dashboard that I realized visualizing the connected network of cryptocurrency capital sources was possible.

I believe that such a dataset and the economic interactions between these entities could be used to design (and execute) mergers and token M&A. We are internally exploring both of these. They could also be used for business development and partnership initiatives. We are still researching how to allow specific companies access to this dataset.

But let's get back to the point at hand.

Can networks really help funds achieve alpha returns?

The answer is somewhat complex.

The ability for a fund to select the right team and provide substantial capital will become increasingly important, surpassing its connections with other funds. However, what truly matters are the personal relationships between General Partners (GPs) and other co-investors. Venture capital doesn't share deal flow with brands; they share it with people. When a partner switches funds, these relationships simply transfer to the new fund.

I have an intuition about this, but the means to validate this argument are limited. Luckily, a study in 2024 examined the performance of the top 100 VCs over time. In fact, they looked at 38,000 funding rounds involving 11,084 companies, even breaking down the market by seasonality. Their key points can be summarized as follows:

1. Past co-investments do not necessarily imply future collaborations. If previous investments failed, a fund may choose not to work with another fund again.

2. During boom times, co-investments often increase as funds seek to deploy capital more aggressively. VCs rely more on social signals during a boom, reducing due diligence. In bear markets, funds are cautious in deployment, usually investing solo due to lower valuations.

3. Funds select partners based on complementary skills. Therefore, having investors with the same expertise crowded in a round typically spells trouble.

As I mentioned before, ultimately, co-investments happen at the partner level, not at the fund level. Throughout my career, I have seen individuals switch between different institutions. The goal is often to work with the same person, regardless of which fund they join. In an age where AI is taking over human jobs, knowing that relationships are still the bedrock of early-stage venture capital is reassuring.

There is still much work to be done on how cryptocurrency venture capital networks are formed. For example, I am interested in studying the preferences of hedge funds in capital allocation, or how late-stage cryptocurrency deployment evolves with market seasonality, or how M&A and private equity play into this. The answers are in our data today, but it will take time to pose the right questions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A whale borrowed 10.2 million USDT through Aave and used it to increase its holdings by 109.2 WBTC

Buffett's Berkshire Hathaway holds more U.S. debt than the Fed

Nasdaq 100 futures surge 3%