Trump Urges FED To Act Quickly On Inflation

Donald Trump has renewed his attacks against Jerome Powell, the Chairman of the Federal Reserve. The latter accuses him of not acting quickly enough to lower interest rates. Amid political tension, this criticism reignites the debate over the FED’s independence and its growing influence on financial markets.

In Brief

- Donald Trump accuses Jerome Powell of being too slow to lower interest rates.

- Rick Scott, Florida Senator, publicly supports Trump’s criticisms.

- These attacks call into question the Fed’s tradition of independence.

- Powell reaffirms the Fed’s independence during a speech in Chicago on April 16.

- A rate cut is now expected for June 2025, with a 65% probability.

Donald Trump lashes out at Jerome Powell

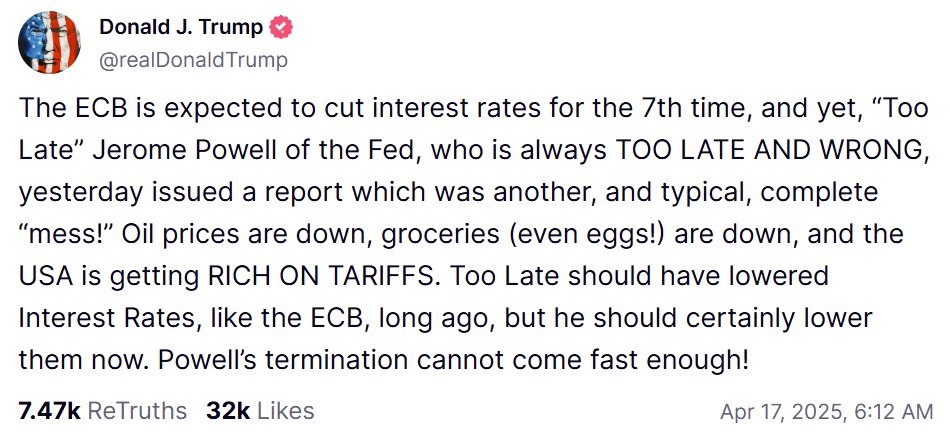

On April 17, 2025, Trump posted on Truth Social that Powell’s inaction will harm the American economy, especially with inflation decreasing. He expressed his displeasure by stating: “The end of Powell can’t come soon enough,” highlighting his dissatisfaction with FED policy, which has just painted a bleak picture of the economy .

Donald Trump’s message on Jerome Powell’s management

Donald Trump’s message on Jerome Powell’s management

Trump’s remarks were supported by Florida Senator Rick Scott, who also criticized Powell’s leadership, calling for a change at the head of the FED. This public attack breaks a decades-long tradition aimed at protecting the Federal Reserve from political interference, highlighting the growing political stakes around monetary policy decisions.

Towards a shift in direction at the FED?

Jerome Powell, on his part, has repeatedly defended the independence of the Federal Reserve . During a speech at the Economic Club of Chicago on April 16, Powell reaffirmed that the FED’s independence is enshrined in law and that he intends to complete his term, which expires in May 2026. However, the growing political pressure from Trump and other Republican figures could complicate matters for Powell.

Although the FED meeting in May is expected to maintain a wait-and-see approach, the probability of a rate cut in June has risen to over 65%! Reflecting the market’s growing anticipation. As inflation moderates and global trade tensions persist, Trump’s calls for bolder monetary action will likely continue to influence discussions on the direction of the Federal Reserve.

While tensions between Donald Trump and Jerome Powell are at their peak, Powell’s leadership of the Federal Reserve appears increasingly contested. FED monetary decisions will continue to influence financial markets, and the political climate could shape the future of upcoming American economic policies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US stocks erase Monday losses after Bessent calls China trade situation ‘unsustainable’

While Treasury Secretary Scott Bessent expects de-escalation in the future, he said negotiations have not yet started

Small-cap stocks are adding Solana exposure

Struggling stocks revive fortunes with Solana treasury buys

Total cryptocurrency market value exceeds $3 trillion

OpenAI's goal of reorganizing as a for-profit company hits roadblock