Analysis: Mantra and Market Makers Inflate OM Token Liquidity by Exploiting Data Aggregator Verification Flaws

PANews April 18th news, according to Cryptoslate, the latest episode of "The Chopping Block" podcast discussed claims that Mantra and its associated market makers manipulated OM token liquidity metrics by exploiting a self-reporting system flaw of data aggregators. They distorted circulating supply and trading volume, creating a false appearance of market activity. The Mantra team collaborated with market makers to cycle tokens between controlled addresses and exchanges, simulating trading volume and inflating data without significant natural participation.

On-chain observers stated that less than 1% of OM tokens genuinely have liquid supply, yet they appear as a top 25 market cap asset. This strategy exploited verification process flaws in CoinGecko and CoinMarketCap, both of which rely on self-reported data from project teams, cross-referenced with exchange listings and superficial blockchain analysis. Malicious actors can allocate tokens to market makers to orchestrate seemingly natural trading activity, circumventing scrutiny even without retail participation. When a large OM holder sold off, the artificial liquidity collapsed, causing the price to drop by 90% within 90 minutes, leading to a market capitalization loss of billions of dollars and exposing the asset's trading depth fragility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

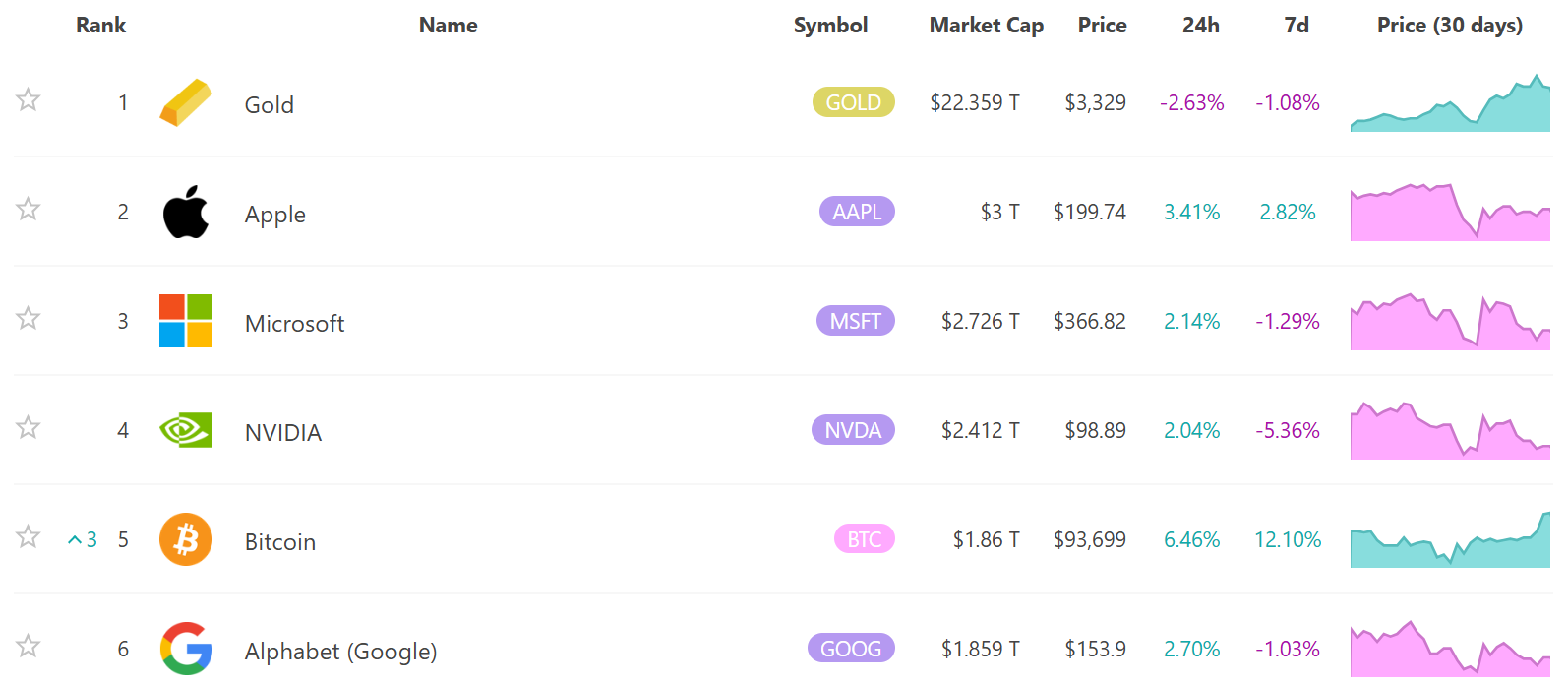

Bitcoin Rises to Fifth in Global Asset Market Value

The U.S. SEC Will Not Restart the Lawsuit Against Hex Founder

DWF Labs and Mask Network Reach Cooperation, MASK Surges Nearly 10%