Mantra Issues Statement After OM 92% Crash on April 13, Outlines Next Steps

Key Points

- Mantra addressed the recent unusual OM market activity, which triggered controversial discussions in the industry.

- On April 13, OM’s price declined by over 90% in about an hour.

Today, the team at Mantra released an official statement following the recent events that led to a 92% price crash for OM in approximately an hour on April 13.

Mantra’s investigation highlights three essential issues:

- Key factors leading to OM’s price decline

- Verifiable data confirming the current OM token circulation supply

- Measures to strengthen market resilience

On that day, the project was accused of being a scam, while Binance was also attacked by some voices in the industry and issued its own official investigation results.

Mantra is an L1 blockchain for institutions and developers offering a permissionless blockchain for permissioned apps.

Mantra’s Investigation Results on OM’s Recent Price Crash

The team at Mantra began its notice by saying that it remains committed to taking all necessary measures during the market turmoil, highlighting that the project’s team did not sell any tokens during this time.

1. Market Conditions During April 13

Mantra noted that on April 13, at 18:28 (UTC), OM recorded an expected price decline of 92% in about an hour.

They noted that the price moves triggered questions within the community, saying that it acknowledges holders’ concerns.

Forced Liquidations and Market Reactions

The team behind Mantra noted that significant amounts of OM were moved onto the exchange as collateral, while there were forced OM position closures during a period with low market activity (at around 2 AM, Hong Kong time).

These forced liquidations triggered the following market reactions:

- Initial liquidations led to downward price pressure

- The price crash led to automated liquidations across exchanges for leveraged positions using OM as collateral

- Liquidations and their effects triggered more selling pressure for OM

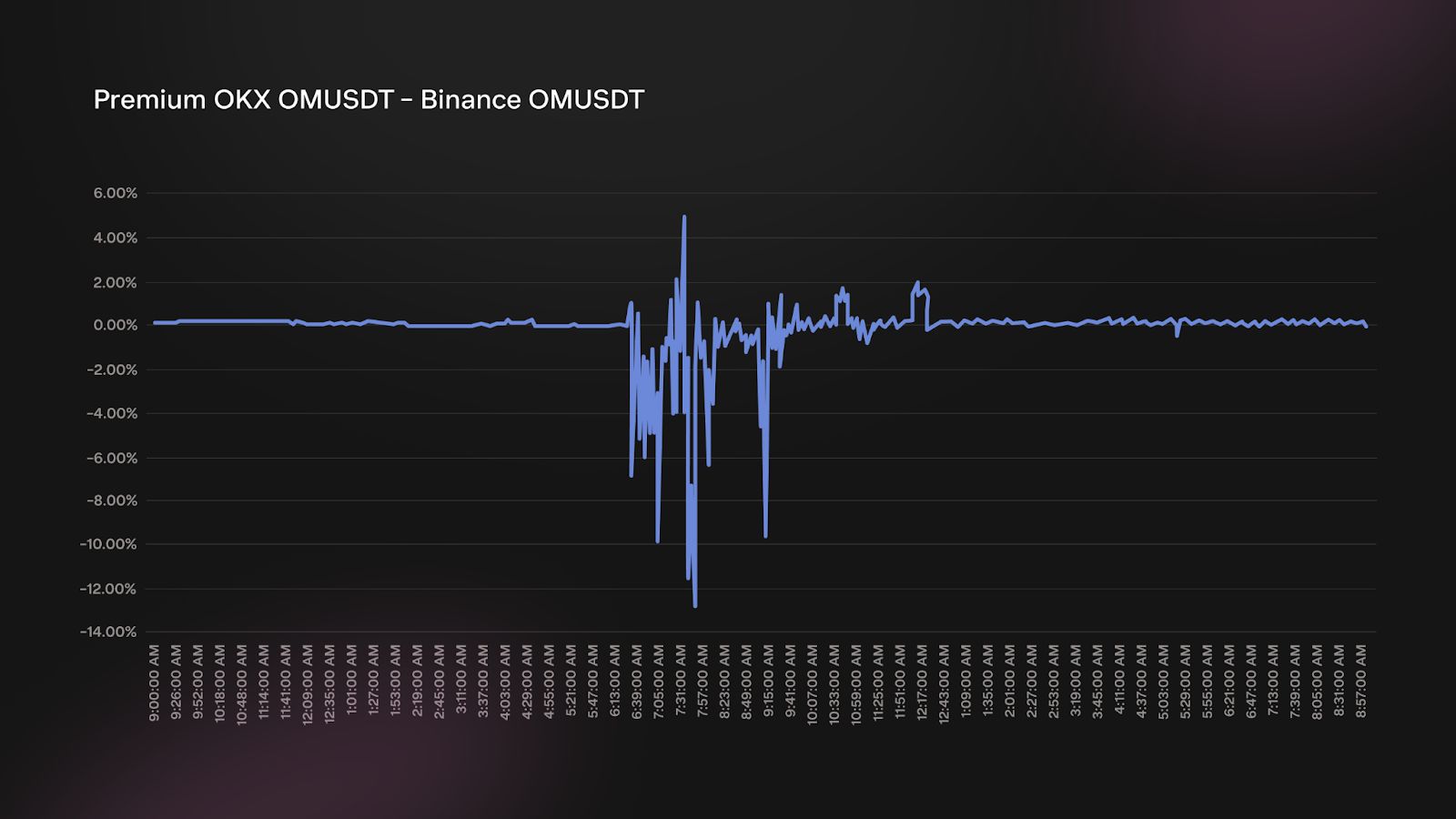

Binance – OKX OM Spot Price Divergence

The team at Mantra also noted that around 18:00 (UTC), there was a divergence on OM’s spot price on Binance and OKX exchanges, leading to a self-reinforcing market cycle, negatively affecting OM’s price.

They cited data from Dom, an on-chain analyst, to highlight the events.

The analyst’s data highlights that forced liquidations came from OKX at about 18:30 (UTC).

The team at Mantra also highlighted that they haven’t sold any OM tokens during the market distress period, noting that a high number of OM traders were liquidated by centralized exchanges.

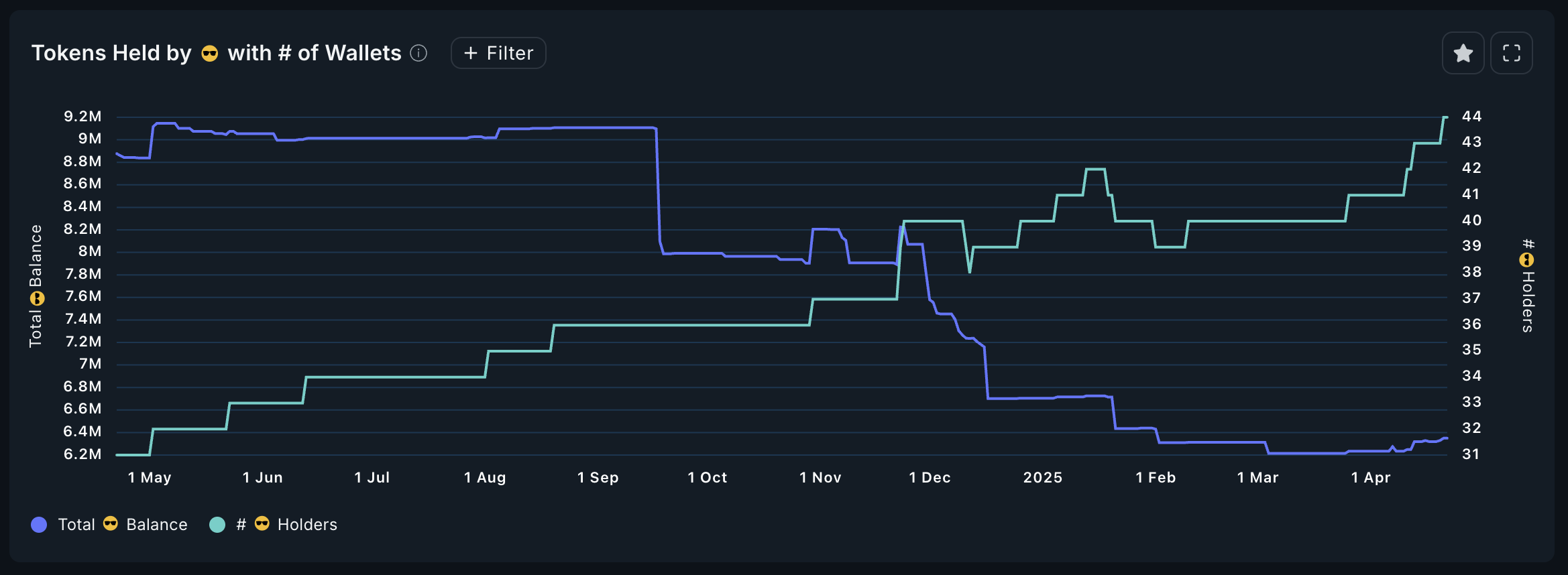

2. OM Circulating Supply

According to the Mantra team, 100% of the Mainnet OM team and advisory allocation are locked. They noted that ERC-20 tokens are in public circulation, outside of the team’s control.

They released details on legacy ERC-20 OM tokens fully circulating, Mantra Mainnet OM tokens in limited circulation, and a combined supply snapshot.

Legacy ERC-20 OM Tokens

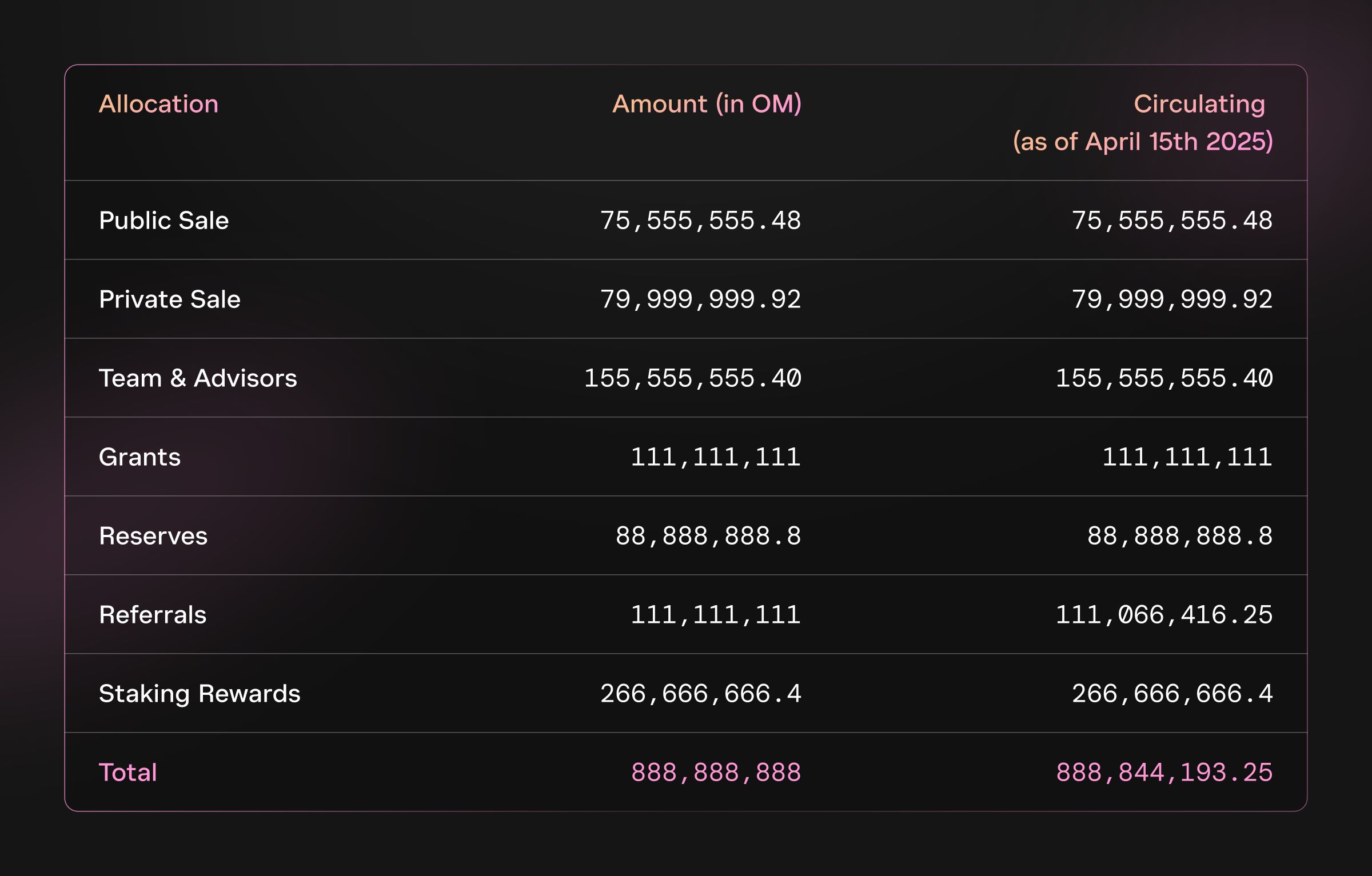

- The original OM (ERC-20) was launched in August 2020, with a fixed total supply of 888,88 million tokens.

- As of April 15, 2025, 99,99% of OM tokens are in public circulation, held by over 123,000 wallets.

- Key allocations from the original ERC-20 OM tokens have been fully distributed, and the market activity around them is driven by holders/external trading.

A chart provided by the team also offers in-depth details on public and private sales, grants, reserves, rewards, team, and advisors’ allocations.

Mantra Mainnet OM Tokens

- Mantra chain launched in October 2024, introducing an additional 888,88 million OM coins minted natively on the new blockchain, together with an inflation mechanism.

- Currently, 77,5 million OM from the Mantra chain are in circulation, held by over 200,000 Mainnet OM wallets.

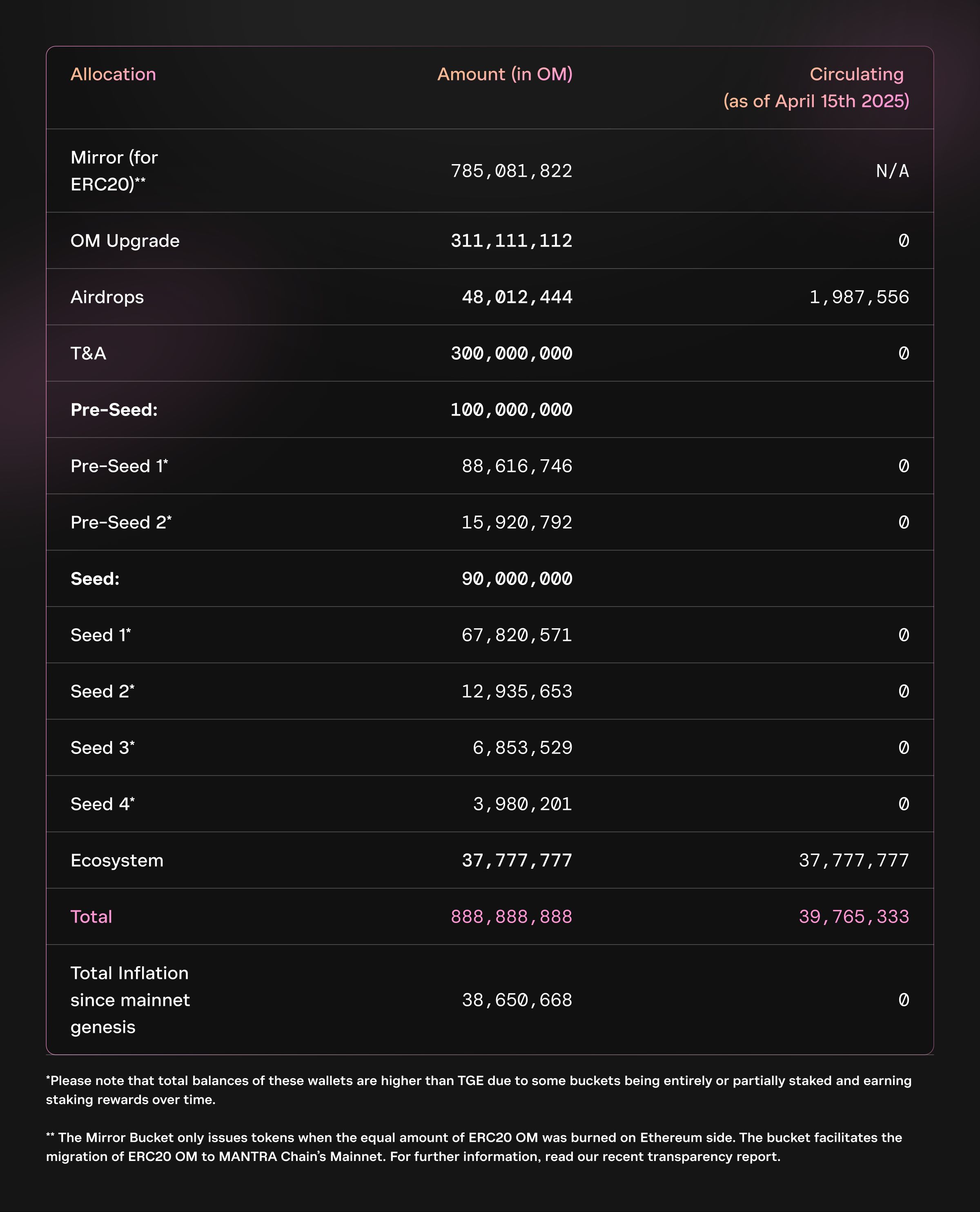

The team shared a chart offering in-depth data about OM amounts for the OM upgrade, airdrops, seeds, and ecosystem.

Combined Supply Snapshot

The Mantra team noted that the total OM supply stands at 1.81 billion tokens, split 50-50 between legacy ERC-20 and the Mainnet OM tokens.

Other details reveal that:

- 52,2% of OM, or over 969 million, is currently circulating.

- 92% of the circulating supply is from the fully liquid ERC-20 tokens

- 8% of the circulating supply originates from the Mainnet OM.

They also highlighted that the April 13 incident involved almost exclusively the ERC-20 OM tokens, which virtually represent the entire liquid market.

3. Upcoming Mantra Measures

The team at Mantra provided key actions to be taken following the event:

- Releasing details of the OM token support plan, including a token buyback and supply burn program

- Mantra CEO, John Patrick Mullin’s public commitment to burn his team allocation

- Releasing a Dashboard with live balances of tokenomics for increased market transparency

- Inviting centralized partner exchanges to collaborate on offering more clarity on trading activities

On April 14, Bn provided an official statement on OM’s price crash, while the exchange’s founder, CZ, also addressed the matter.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump’s Embrace of DeFi: Exploring Potential Impacts on Ondo Finance and the Financial Landscape