Is Bitcoin Bottom In? Crypto Analytics Firm Says a ‘Step Back’ for BTC Could Fuel the Next Leg Higher

The Bitcoin ( BTC ) bottom is in, according to the crypto analytics firm Swissblock.

The firm notes on the social media platform X that sometimes the top crypto asset just needs time to consolidate.

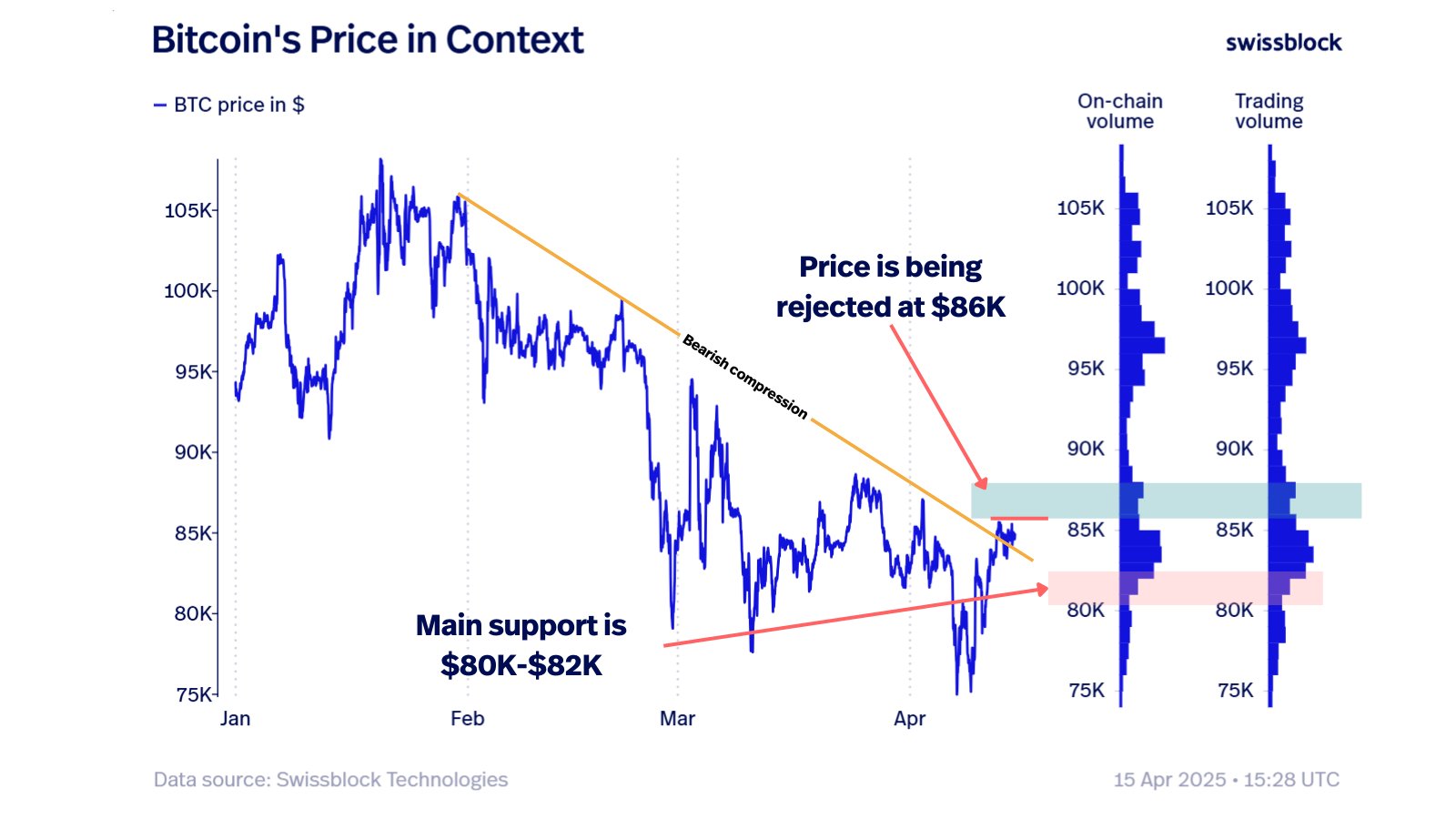

“For consolidation to continue, Bitcoin may need to revisit the $80,000–$82,000 zone. Rejections at $86,000 have been consistent, and the range is tightening.

A step back could be what fuels the next leg higher.”

Source: Swissblock/X

Source: Swissblock/X

Swissblock also notes that the trade war narrative is already priced into the markets, and indices are starting to bottom.

“This weekend, tariff exemptions for tech hit: microchips to cellphones, a lifeline for Apple Nvidia.

- ‘Green Monday’ hopes surged!

- But 24 hours later, Commerce Sec. Lutnick says it’s temporary, pending a sector-specific tariff regime.

- The good cop/bad cop routine rattled markets, but by Monday, volatility was muted.

Markets aren’t buying Trump’s bluff anymore, not with the same intensity.

- Volatility down, fear fading.

- The good cop/bad cop game signals a controlled retreat: trade war costs votes.

- Is this the start of a bottom for indices? Yes, it is.

Bitcoin’s bottom is in, final consolidation phase has started.

- A step back doesn’t imply collapse, it opens opportunity.”

BTC is trading at $85,101 at time of writing.

Follow us on X , Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC falls below $93,000

Solana Foundation to Implement New Policies for Validators Joining and Exiting Delegation Program

Canary Registers SEI ETF Supporting Staking

SOL Strategies Secures Up to $500 Million in Convertible Note Financing