Platform Token Valuation Revolution: Examining the Long-Term Game of Exchange Ecosystem Through GT Market Cap's Quiet Rise

1. 2025年加密货币市场经历结构性震荡,比特币高位波动,中小市值资产承压,市场流动性向头部资产集中。 2. Gate.io平台币GT市值攀升至全球第32位,报价稳定于22美元上方,成为少数实现逆周期增长的平台币,反映出市场对GT生态价值的重估。 3. GT的市场表现突出,180天内涨幅148.29%,远超BNB和OKB,显示出增长动能、通缩效率和用户增长红利方面的优势。 4. GT的竞争优势在于生态赋能和战略纵深,包括通缩模型、战略布局和估值洼地与增长确定性,Gate.io通过深度通缩、场景创新、合规布局构建差异化优势。 5. 平台币竞争本质是生态战争,GT作为生态价值聚合器,随着Gate.io向Web3基础设施服务商转型,GT或将成为连接交易、资产管理与链上应用的核心纽带。

Source: Cointelegraph Chinese

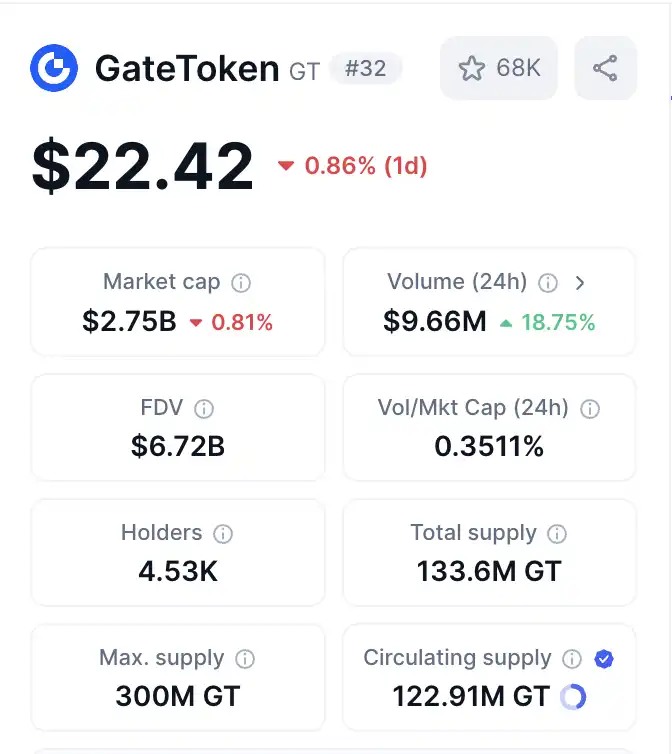

The cryptocurrency market in 2025 is showing significant "structural turbulence": Bitcoin maintains high volatility under institutional fund custody, while mid-to-small-cap assets are generally under pressure, and market liquidity is concentrating towards top assets. In this context, platform tokens, as the core value carriers of exchanges' ecosystems, are experiencing further differentiation within the race. According to the latest data from April 2025, Gate.io's platform token GT has climbed to the 32nd spot in the global cryptocurrency market cap, with a price stable above $22, becoming one of the few platform token representatives achieving "counter-cyclical growth." This phenomenon not only reflects the market's reassessment of GT's ecosystem value but also reveals a profound transformation in the logic of exchange competition — shifting from mere traffic competition to the efficiency of capturing ecosystem value.

When horizontally comparing the market performance of mainstream platform tokens, GT's "low-key rise" is particularly noteworthy. As of April 2025, its circulating market cap has surpassed several traditional financial derivative tokens, and among the top 50 cryptocurrencies globally, GT is the only platform token to achieve synchronized growth in "trading volume, number of users, and burn volume" for three consecutive quarters. Behind this "resilience against the trend" lies the deep synergy between exchange ecosystem development and tokenomics.

1. Data Mining: Where Does GT's Outperformance Come From?

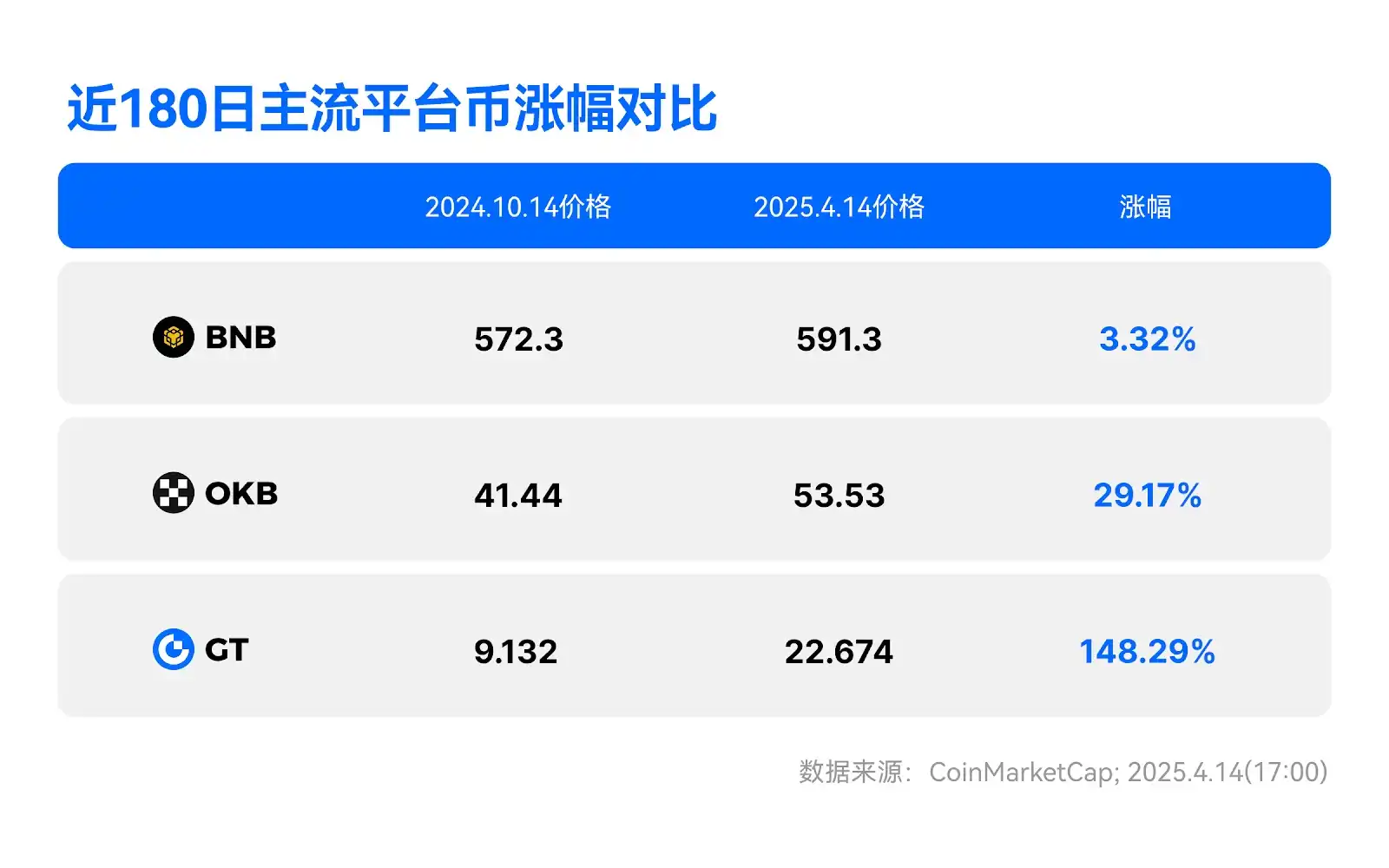

The value performance of platform tokens fundamentally reflects the comprehensive competitiveness of exchanges. Looking at the price increase data from the past nearly 180 days, GT's 148.29% increase far exceeds BNB (3.32%) and OKB (29.17%), revealing three core trends:

1. Difference in Growth Momentum: Top platform tokens (like BNB) have a relatively stable growth trend due to their mature ecosystems, while GT, relying on Gate.io's "high-growth ecosystem," is still in an accelerated phase of value realization.

2. Comparison of Deflation Efficiency: As of Q1 2025, GT's cumulative burn amount has reached 177 million tokens (about 60% of the total supply), much higher than the average annual burn rate of most platform tokens (usually less than 20%). This "better-than-expected deflation" directly boosts GT's scarcity premium.

3. User Growth Dividend: Gate.io's user base has exceeded 22 million (growing 234% in 2024), with a trading volume of $3.8 trillion (growing 120% annually), significantly outpacing the industry average growth rate, providing continuous support to GT's demand side.

Of particular note is that GT's market cap/trading volume ratio is significantly lower than that of top platform coins like BNB, indicating that there is still substantial room for valuation improvement—if Gate.io maintains its current growth trajectory, GT's market cap benchmarking potential may be further unleashed.

II. GT's Competitive Advantages Compared to Other Platform Coins: Ecosystem Empowerment and Strategic Depth

In the platform coin arena, GT exhibits a markedly different development path compared to BNB and OKB. BNB, as an industry leader, derives its value primarily from the Binance ecosystem's economies of scale; OKB relies on the technical iterations of OKX Chain. Meanwhile, GT's strong performance is rooted in the "trinity" value system constructed by Gate.io: deflationary impetus, scenario penetration, and strategic foresight.

1. Deflationary Model: From "Passive Burn" to "Active Value Management"

GT adopts a "Profit Buyback + Targeted Burn" dual-track mechanism:

· Rigid Deflation: 20% of the platform's net profit in Q1 2025 is used for GT repurchase and burn, with an expected circulation reduction of over 12 million tokens within the year;

· Scenario Consumption: GT, as the native token of Gate Chain, continues to be consumed in DeFi, NFT cross-chain, and other scenarios, further reducing circulation.

In comparison, the deflationary designs of most platform coins rely solely on fee offsets, lacking diverse consumption scenarios, which limits long-term deflation efficiency.

2. Strategic Layout: Dual Drivers of Compliance and Globalization

Gate.io's strategic focus by 2025 is clearly defined:

· Compliance: It has obtained the EU MiCA license, received principle approval for VASP in the Middle East, with a reserve ratio exceeding 128% (ranking third globally), significantly reducing policy risks;

· Globalization: Sponsoring the F1 Red Bull Racing Team, expanding into Latin America and Southeast Asian markets, achieving a more balanced user geographic distribution;

· Product Innovation: Targeting a 10% market share in derivatives, launching an AI trading assistant and the MEME innovation zone.

3. Valuation Discount and Growth Certainty

· Gate.io's spot trading volume has already ranked among the global top three, yet its platform coin market cap is only 1/15th that of BNB. If Gate.io's derivative market share increases from 5% to 10%, GT's market cap could see a revaluation potential of 2-3 times.

· The deflation rate of GT (annualized around 8%) far exceeds the industry average (2%-3%), while the demand generated by ecosystem expansion forms continuous buying pressure. This "supply reduction and demand increase" mismatch makes it more defensive in a volatile market.

These measures not only enhance the platform's countercyclicality but also inject long-term growth expectations into GT.

III. Conclusion: The Essence of Platform Token Competition is Ecosystem Warfare

The competition in the current platform token race has shifted from "traffic scale" to "ecosystem quality." The counter-trend growth of GT has verified the differential advantage built by Gate.io through deep deflation, scenario innovation, and compliance layout. For investors, the value of GT's dollar-cost averaging lies not only in short-term price increases but also in its positioning as an "ecosystem value aggregator"—as Gate.io transitions to a Web3 infrastructure service provider, GT may become the core link connecting trading, asset management, and on-chain applications.

In the future, platform token competition will focus more on the efficiency of capturing real value and global compliance capabilities. Although market volatility risks always exist, GT's performance in the deflation model, ecosystem expansion, and strategic execution has outlined a clear path for its value growth.

This article is contributed content and does not represent the views of BlockBeats

Original Article Link

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A whale borrowed 10.2 million USDT through Aave and used it to increase its holdings by 109.2 WBTC

Buffett's Berkshire Hathaway holds more U.S. debt than the Fed

Nasdaq 100 futures surge 3%