Mantra CEO says OM token recovery ‘primary concern’ but in early stages

Mantra CEO John Mullin addressed key concerns from the community following the sharp decline in the OM token during an Ask Me Anything (AMA) session hosted by Cointelegraph on April 14.

Mullin reassured users that Mantra and its partners are actively working to support the recovery of the Mantra (OM) token, though he noted that details around token buybacks and potential burns are still being developed.

“We’re still in the early stages of putting together this plan for potential buyback of tokens,” the CEO said, adding that the OM token recovery is Mantra’s “preeminent and primary concern right now.”

At the time of writing, OM traded at $0.73, slightly higher than its post-collapse low of $0.52 recorded on April 13 at around 7:30 pm UTC, according to data from CoinGecko.

“Baseless allegations”

In addition to denying reports claiming that key Mantra investors dumped the OM token pre-crash, the Mantra CEO also denied allegations that the Mantra team controls 90% of the token’s supply.

“I think it’s baseless. We posted a community transparency report last week, and it shows all the different wallets,” Mullin said, highlighting the “two sides” of Mantra’s tokenomics.

Source: Cointelegraph

Source: Cointelegraph

“You have the Ethereum side and you have the mainnet side,” Mullin noted, adding the Ethereum-based token is hard capped and has been around since August 2020.

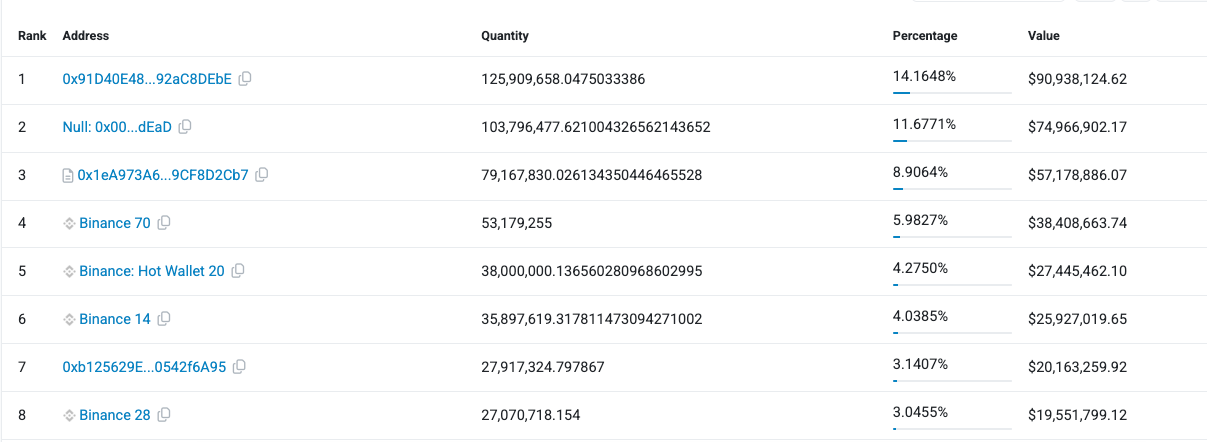

“The biggest holder of OM on exchange is Binance,” Mullin continued, referring the public to Etherscan records .

The top eight addresses of OM holdings. Source: Etherscan

The top eight addresses of OM holdings. Source: Etherscan

However, the top OM wallet is currently held by crypto exchange OKX, which controls 14% of the circulating supply, or roughly 130 million tokens.

What’s next for Mantra’s $109-million MEF fund?

Mullin also addressed the Mantra Ecosystem Fund (MEF), a $109-million fund launched on April 7 in collaboration with its major strategic investors, including Laser Digital and Shorooq.

Other investors in the fund also included Brevan Howard Digital, Valor Capital, Three Point Capital, Amber Group, Manifold, UoB Venture, Damac, Fuse, LVNA Capital, Forte and others.

Related: Mantra bounces 200% after OM price crash but poses LUNA-like ‘big scandal’ risk

According to Mullin, the fund does not solely consist of Mantra’s OM token and has “dollar commitments and dollar contributions.”

Investors in Mantra’s $109-million fund. Source: Mantra

Investors in Mantra’s $109-million fund. Source: Mantra

“We’ll continue to invest and support the ecosystem as part of this recovery plan,” the CEO stated.

End of the staking program on Binance

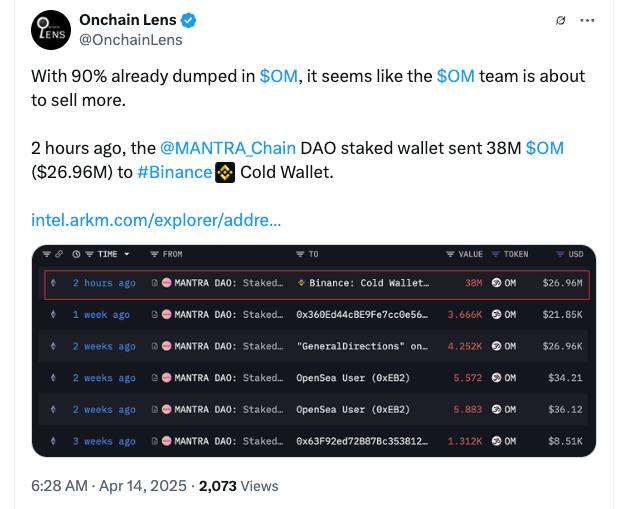

In the AMA, the Mantra CEO also said that a 38-million-OM transaction to the Binance cold wallet on April 14 is related to a staking program on Binance.

“It was actually Binance,” Mullin said, adding that Binance had OM tokens on its exchange that it was using as a staking program.

Source: Onchain Lens

Source: Onchain Lens

“So, they just returned them because the staking program ended,” he said.

Mullin also emphasized that many of the transactions that caught the community’s reactions post-crash involved collaterals by an unnamed exchange .

“Effectively, those tokens were being used as collateral on an exchange. Then, the exchange decided that it was not the position they wanted to maintain anymore, for whatever reason,” Mullin said, adding:

“So, what happened was basically the positions were taken over by the exchange that took the collateral and started selling, which caused a cascade of sell pressure and forced more liquidations.”

Mullin said Mantra remains committed to addressing the situation as transparently as possible.

“We’re not running from anything,” he said, adding that the incident was a “very unfortunate situation.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SUI Token Surges as Analysts Highlight Promising Patterns and Predictions

In Brief SUI token demonstrates strong performance with significant recent price increases. Technical patterns suggest potential bullish trends and buying opportunities. Analysts project ambitious targets, including a possible rise to $10 or more.

STX Token Surges as New Financial Opportunities Emerge in the Stacks Ecosystem

In Brief The STX token has surged by 56%, reaching a two-month high. BitGo introduced sBTC to enhance Bitcoin's usability in decentralized finance. Liquidity in the Stacks ecosystem is increasing, attracting more users and developers.

U.S. stocks opened, S&P 500 rose 0.1%

Uniswap Web App Adds LP Rewards Function