Mantra Co-Founder Reveals: $5 Billion OM Token Crash, Truly Becoming "Luna 2.0"?

Even though I have not done any negligence or malicious act, I still feel responsible.

Guest: JP Mullin, Co-Founder of Mantra

Original Article Translation: zhouzhou, BlockBeats

Editor's Note: The podcast discussed Mantra's Co-Founder JP Mullin's explanation of the OM token's collapse. He expressed a sense of responsibility for the losses incurred by investors and the community, despite no malicious intent. JP pledged to provide full transparency and introduce a buyback and burn plan to support investors. He emphasized the importance of transparency and ongoing communication, stating his commitment to fully address the current situation and restore the project's health. He thanked supporters and promised to enhance future engagement and commitment to the community to ensure better development and responsiveness to investors' needs.

The following is the original content (slightly reorganized for readability):

JP Mullin: Putting aside market cap, I am not happy about this at all. This is an unprecedented event, and many people have lost money and been hurt as a result. I am also hurt by it, I feel our community is hurt, our holders are hurt, our investors are hurt. Even though I have not done anything wrong, no negligence or malice, I still feel responsible.

Host: I am a bit curious, you mentioned investors are hurt, but if the current trading price is 70 cents, I wonder if they really have incurred losses?

JP Mullin: I think they haven't actually incurred losses yet. And it is precisely because of this that those investors holding circulating tokens have not sold to this day.

Host: I am Host Akuzhman, and recently there have been many events in the crypto community. This weekend, the entire community was focused on a real asset class blockchain project's token crash.

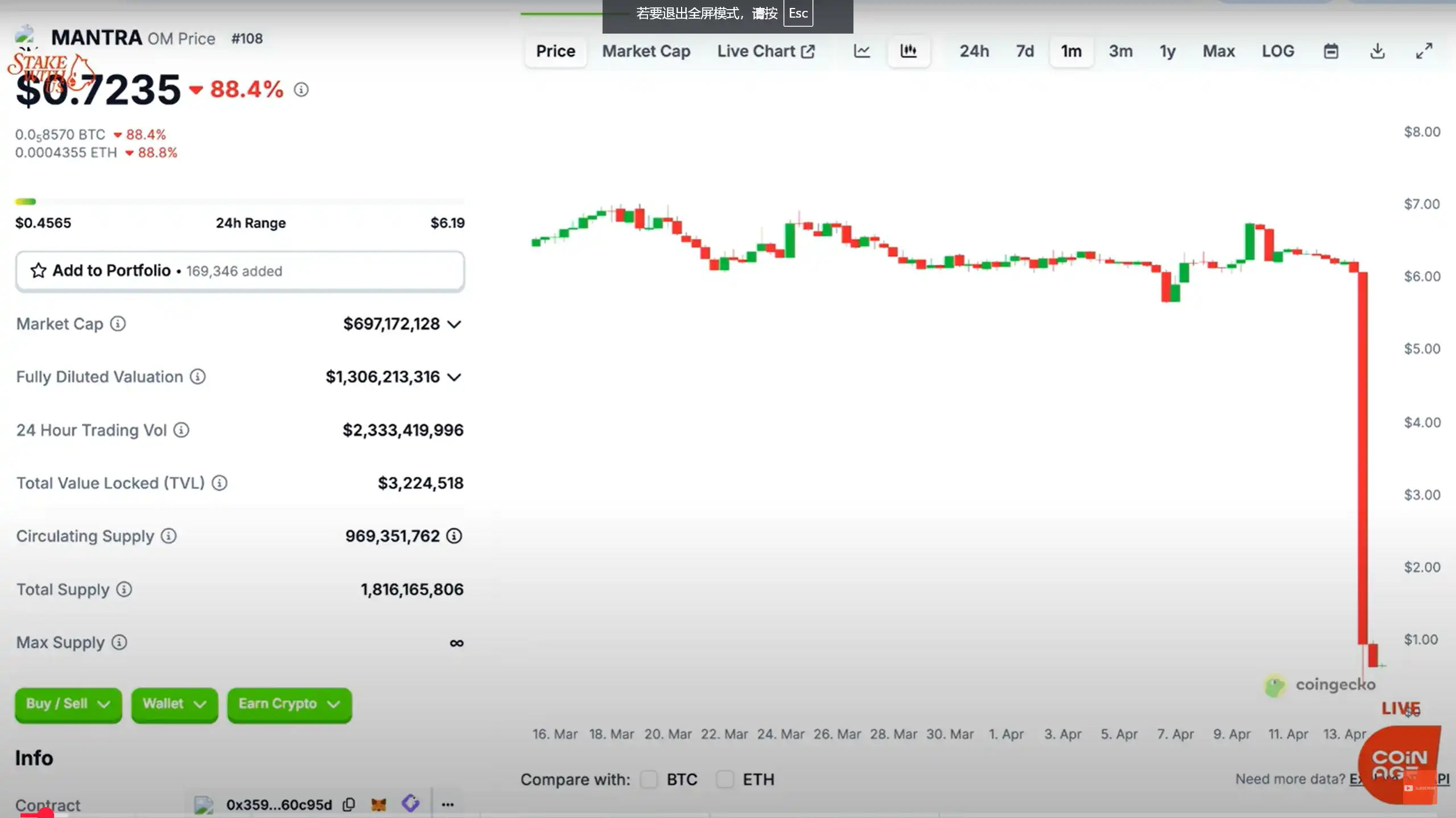

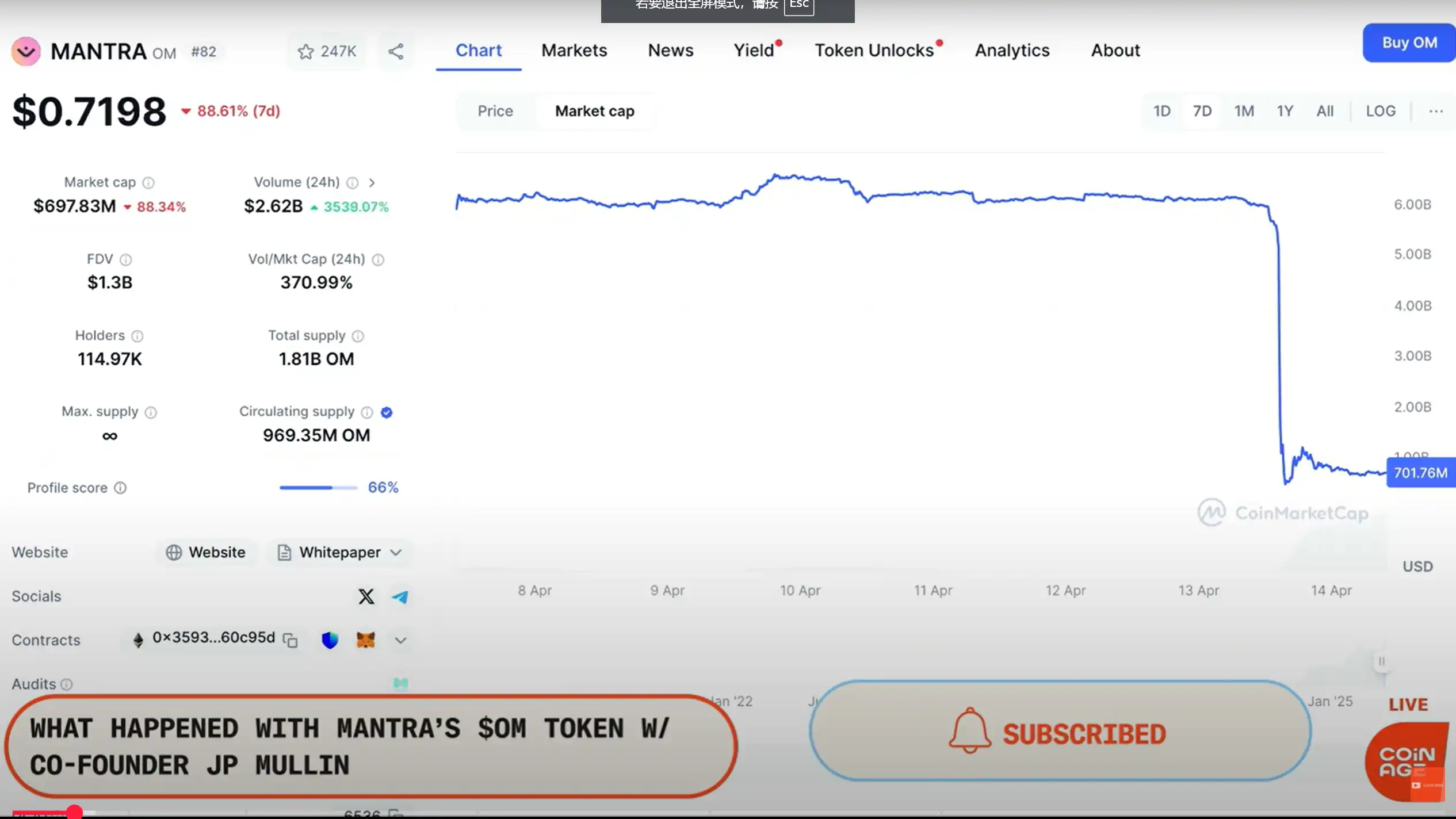

The charts we are seeing now show that the OM token plummeted over 80% in a single day, with a market cap evaporating by approximately $5 billion (at least on paper).

Many are asking what exactly happened, hoping that today we can find some answers. We also want to thank Mantra's Co-Founder for addressing these questions, welcoming John Patrick Mullin, known as JP.

JP Mullin: I am also very grateful for the opportunity you have given me to talk about this event and how we plan to respond next.

Host: What has happened in the past 24 hours since you noticed this incident? How has this period been for you?

JP Mullin Reacts to OM Collapse

JP Mullin: This day has been very difficult for me, for the team, and for the community, but most importantly, it has been particularly hard for the community. Perhaps I can walk you through the whole incident from start to finish, break it down a bit, and explain our current situation.

Last week, I was in Paris attending Paris Blockchain Week. Paris time on Saturday, I boarded a flight to Seoul, South Korea, and now I am in a hotel in Seoul. Today, we had an artist-focused summit here, and I also participated, and we can talk about that later. Basically, I went to bed around midnight local time. At that time, I sent out a tweet saying I was on a plane and that there was no WiFi on the plane, so everyone thought I was in transit.

But in reality, I was just asleep because it was already late at night. Then, around 5 a.m., I was woken up by a call from the hotel. Our team couldn't reach me and called the hotel front desk. So, as soon as I woke up, I was bombarded with a bunch of messages: the token had crashed, something had happened, and so on. We immediately started checking to ensure that it was not a chain attack, token theft, or similar issue.

Settlement Triggered Token Collapse?

After that, following communications with some key partners, investors, and exchanges, we quickly found that the issue was on the centralized exchange side— there was a large-scale liquidation operation. The reason was that someone had used Om token as collateral for leveraged positions, and there were also many direct long positions using Om. These positions were forcibly liquidated in a short period, and it happened to be late Sunday night in Asia, with very poor liquidity.

Meanwhile, I was still in deep sleep, and these positions were quickly liquidated, causing a price crash, which in turn triggered more liquidations and selling, ultimately leading to this large-scale drop.

So, I woke up in this state, and later, we immediately issued a statement saying we were investigating the matter and committed to maintaining communication and transparency. We have contacted all investors, partners, exchanges, and community members, providing a clear explanation of what happened, what measures we will take, and addressing any questions people may have, as the situation is indeed very complex right now.

Host: Let's make sure everyone understands that—we actually didn't have much communication before the show, just a brief coordination. So, like everyone else, I'm just starting to grasp what exactly happened.

But what surprises me is that you and your project Mantra have actually been around for quite a while. So, can we start by discussing the period before this recent crash? Because many people may still not fully grasp what you are doing. You are working on a Layer 1 protocol pegged to real-world assets, and the project's headquarters should be in Dubai, where you spend most of your time, in the UAE.

The core of your project is to tokenize real-world assets. However, even before you launched the mainnet last year, the OM token had been in existence for a few years as an ERC-20 token on Ethereum, right? So, can we start from the beginning and see how this project has evolved to its current state? Because I see that your token is actually circulating on several chains. I'm also quite curious about which exchange you mentioned earlier was selling? If it wasn't your investors, and the tokens weren't sold by you, then who caused this sell-off? Do you have any further insights?

Mantra's Establishment, Token Design, and Bridging

JP Mullin: Let me start from the establishment of Mantra so that you can better understand the relationship between these two tokens: one being the early ERC-20 version and the other being the later mainnet coin.

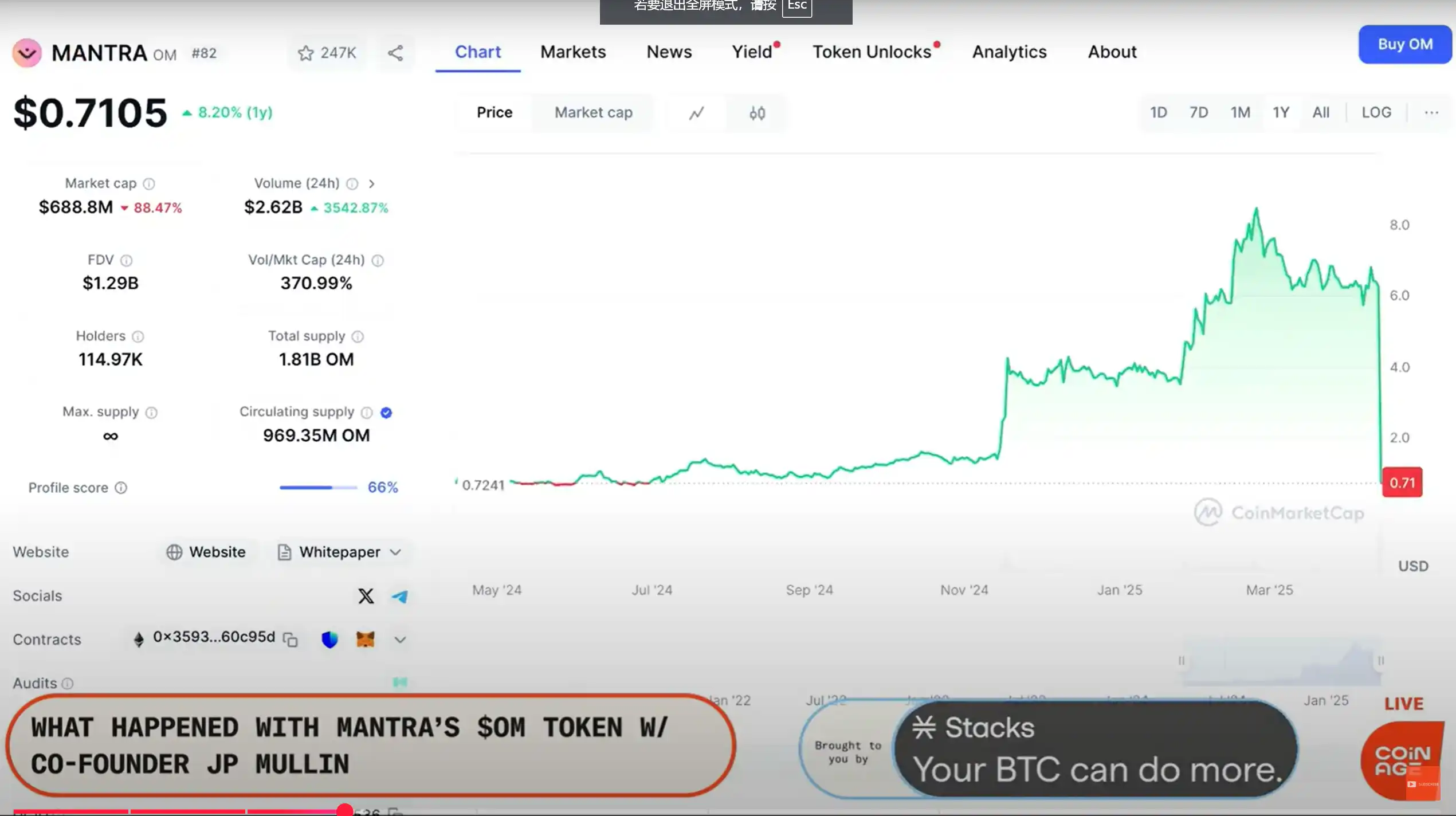

Mantra was founded in early 2020, during the pandemic. We launched the ERC version of Om on August 18, 2020. So, up to now, the whole project has been around for almost five years. In March 2021, we launched on Bybit. At that time, we started as a DeFi protocol and also developed some early products. We seized the opportunity of the first DeFi Summer, initially seeing good growth, but later, like the overall market, we experienced a continuous decline.

By 2023, our situation was already quite challenging. For example, in October 2023, our token price once dropped to $0.017. Then, towards the end of 2023 and the beginning of 2024, I started meeting with some of our current key partners, including Shorooq—a fund based in the UAE, and Laser Digital, the crypto arm of Nomura Securities. They helped us bring in some institutional funds and further drove us to develop the concept of a "regulated DeFi protocol."

At that time, we were still going through the licensing process with the Dubai regulatory authority VARA. Earlier this year, we actually obtained the world's first official license for a DeFi protocol. Our new Layer 1 chain is designed for the tokenization of real-world assets, incorporating a compliance framework, permission management, identity layer, and other features.

Around that time (late 2023 to early 2024), we started thinking about integrating the token models. Initially, we intended for these two token systems to operate independently: one based on the Ethereum Mantra ERC token and the other the AUM token on our planned new Omega chain.

However, we later took this matter to a community vote, and the community expressed a desire for us to concentrate resources on supporting one token rather than two. So, based on the voting results, we merged these two paths and began focusing on developing an institution-grade real-world asset tokenization business in the UAE.

In the past month, we have actually announced several significant partnerships, such as partnerships in real estate with Mag and the Damac Group. At the same time, we officially obtained VARA's compliance license and launched our own chain at the end of last year.

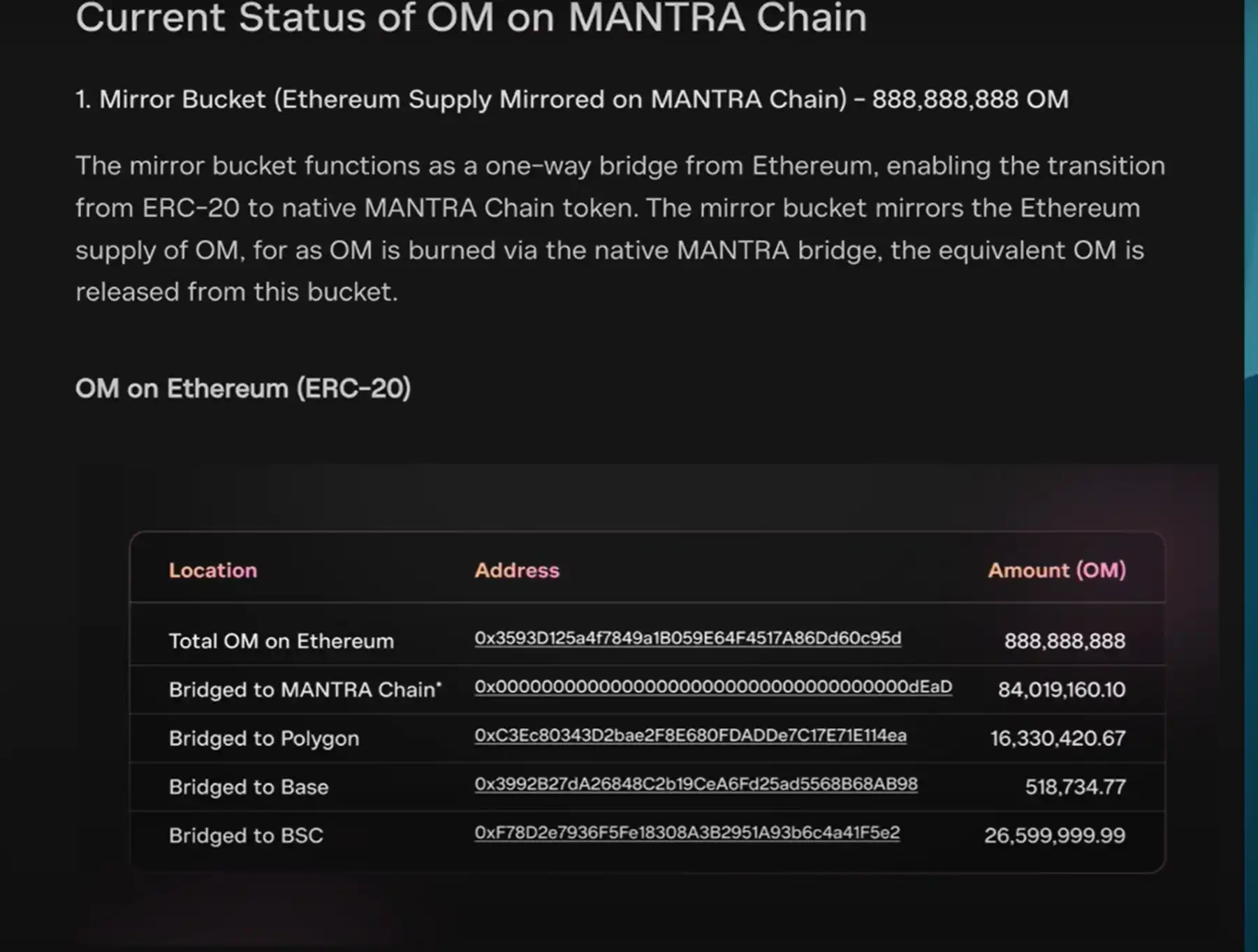

Upon launching the chain, we also initiated the cross-chain bridging process. By the time of our mainnet launch, approximately 95% to 96% of the ERC token was already in circulation, which is now around 98%. This ERC token has a fixed supply of 8 million, all of which can be verified on Etherscan, with wallet addresses and distribution details clearly visible, much of it in exchange wallets and some in tagged wallets.

As for the tokens on the mainnet, most are still locked and held in third-party institutions, such as compliance custodians like Anchorage, along with a mandatory vesting mechanism.

Just last week, we released a transparency report in response to everyone's concerns about the token details. Moving forward, we will continue to provide more transparent information about wallets and distribution.

Currently, the ERC token has already been bridged to multiple chains, such as Polygon (via the Polygon POS Bridge), Binance Smart Chain (the OM version on BSC), and even the Base version.

However, all of these are still part of the original ERC total supply of 8 million, with no new supply added, simply circulating on other chains through bridging.

Host: I find this part quite interesting. You "mirrored" the tokens from the old chain to the new chain, meaning if someone wants to transfer the tokens from the old chain to the new chain, they must first burn the old tokens, and then exchange them for the new ones, right?

These designs are among the important decisions that long-standing projects need to make during their evolution process. Now that everyone has understood Mantra's background and the situation of its tokens distributed across multiple chains.

Let's get back to the core of this event. Yesterday, you mentioned that someone may have built a large leveraged position with OM on a certain exchange and was subsequently liquidated. This process led to a significant amount of tokens being dumped on the market, causing a price crash.

So, I have a few questions: First, have you further investigated who conducted this operation? Second, which exchange did this happen on? Third, did you receive any notice before the liquidation occurred?

JP Mullin: In fact, we had been communicating with some exchanges before, asking questions like: "When were these tokens listed?" "Do you know who the owners of these wallets are?" "Are these from the team? Liquidity providers?" and so on.

Regarding this event, we have actually been discussing these issues with some exchanges over the past few months, not just in the last 24 hours. We monitor which tokens flow into exchanges and whether they came in as collateral. But these tokens all came from clean wallets—clean wallets being those that transferred from other exchanges, have no historical activity, and are not linked to wallets we are familiar with.

I personally label all wallets I know on Etherscan so I can track them at any time. But the wallets involved this time were all clean, untagged, brand new wallets. In other words, they were not directly associated with the team or entities we are familiar with.

We do know that some exchanges played a role in this event, but I cannot name names at the moment. We are currently evaluating with institutional investors and partners whether there are legal means we can use to protect our community and investors because we believe they have indeed been harmed and treated unfairly in this event.

Clearly, this occurred in a low-liquidity environment, in the late hours of Sunday, with massive forced liquidations. We have not contacted the investors who were liquidated yet, but we have been in communication with some institutional partners, such as Cheroke and Laser.

Host: It is worth noting that both Cheroke and Laser have publicly stated that they were not the main sellers in this sale. So when you mentioned earlier that this event occurred during a low liquidity period, the "inactive hours" of the weekend, in fact, this is often one of the reasons why projects collaborate with market makers—to stabilize the market in such circumstances. Can you disclose which market makers you collaborated with? And how did they respond to this event? After all, theoretically, this is when market makers should step in.

JP Mullin: We do have multiple market makers, and they are also our investors. We work with some large trading firms that are both investors and OM holders, and they have loan agreements with us.

However, to be honest, I don't believe their positions were sufficient to handle this extreme situation. From what we understand at the moment, the magnitude of this forced sale could be as high as several billion dollars, but we do not have exact figures yet, and this is part of what we are currently investigating further. As soon as we get more information, we will disclose it as soon as possible.

Host: The position you mentioned earlier was approximately around a hundred million dollars, is that the ballpark figure?

JP Mullin: We believe that is roughly the range, indeed a very large position. OM is a token with a market value of several billion dollars, with many long-term large investors who use these tokens to support other collateral positions and as part of leverage operations.

And all this happened very quickly—I remember going to bed at midnight and waking up at five in the morning, and this event had already happened an hour or two ago. We were passively reacting in a state of almost complete ignorance.

This is also why we have always emphasized that this is an unprecedented, sudden, and rapid event. We are now working hard to understand more details and then share them with everyone as transparently as possible.

Host: I agree this is indeed a very rare situation, especially occurring during a weekend's low liquidity period. It is evident from the price chart as well. What I am particularly curious about is, now that the community is discussing on-chain transparency, people will ask, if it was not your core investor, then who could have built up a hundred million dollar position? This type of large-scale liquidation event is clearly unlikely to occur entirely within the realm of on-chain transparency, and many things may involve off-chain operations.

As a project founder, I know these decisions are all very complex, and you must make decisions among many trade-offs. You have to find a way to get the token listed on centralized exchanges, collaborate with market makers, and worry about them not "stabbing you in the back" at a critical moment.

So, why don't we start talking about from 2024: What decisions have you made in pushing the project online? For example, do you have an OTC agreement? What is the structure of these agreements like? And how did you step by step get to the current situation? Because we all know that many tokens have been circulating in the market even before the official launch of the project, has all of this foreshadowed today's events?

What Was the Situation Before the Project Officially Launched?

JP Mullin: We actually conducted two rounds of mainnet token financing, and all of these situations have been outlined in the transparency report we mentioned earlier. These tokens are currently still held in custody on the Anchorage platform in a locked state.

The first round started last October, with a 12-month plus 24-month lock-up period, and the release time for the other round is also approaching, with a 12-month lock-up period.

In addition, we also had some investors who purchased ERC-based tokens through OTC means, such as long-time investors like Shorooq and Laser. Their wallet addresses are public, and everyone can verify that they have not sold any tokens to date. These tokens were originally designed with an 18-month vesting period and are still in ongoing vesting.

Our first fundraising was probably completed around February or March last year, and these tokens have been in circulation for a long time now. However, on-chain, it can be seen that indeed no one has sold. We have a group of very long-term, value-aligned investors, and I am truly grateful for their consistent support in this event, and we will continue to support them as well.

So, regarding those external accusations of "someone selling coins in secret," we completely deny them.

Host: Regarding the "accusations" you just mentioned, I would like to clarify what exactly we are talking about. Because I have not seen anyone publicly accusing you, and as a journalist, I must be very cautious.

I don't believe that everything that happens in the crypto community can be simply defined as an "exit scam," just like the Terra incident; I don't think that was an exit scam either. Many times, the issues that occur are not due to malicious fraud, and what we are discussing now is not those meme coin projects.

We are now discussing your team's construction of a Layer 1 blockchain related to real-world assets, and you have also collaborated with many major institutions, such as your previous mention of engagement with other projects in Dubai.

So I think it is necessary to talk about where you think the breakdown occurred in the whole event. If you are intending to seriously develop a genuine and useful project, where do you think the mistake was made? From what you mentioned earlier, it seems like you were implying an issue with a specific exchange.

Additionally, from a digital perspective, the $100 million position you mentioned is basically equivalent to the entire day's trading volume over many days. Such a scale of settlement is, to be honest, very intense.

Where Was the Breakdown?

JP Mullin: I am not implying that it was just one person operating, to be honest, we believe it was the result of a group, multiple people acting together. We do believe that the core of the event took place on a specific exchange, but currently, we are collaborating with all exchanges to investigate, hoping to gather as much information as possible.

This is truly an unprecedented event, very saddening for our community, and we will do our utmost to address this issue. I have also participated in many AMAs and Spaces in these recent days, hoping everyone knows that we are not shirking responsibility.

Next, we will take some measures, and currently, the most important thing is to address the issue of public opinion and community communication. We also attended an RWA-based summit in Korea this morning; I was there in person because I want to convey to everyone that we have not absconded or evaded.

Our project has been ongoing for five years, and we will continue, not just for five years, but possibly even longer.

Buyback and Burn Plan Preview

Next, what we need to do is how to restore the confidence of our community and token holders. We are actively considering launching a buyback plan. At the same time, we are considering whether to burn some of the future token supply. If these two measures can be implemented together, we hope to announce a plan to the public as soon as possible.

Aside from this buyback support plan, we also hope to provide as much detailed information and transparent on-chain data as possible, using facts and evidence to prove that what we say is true, allowing the community to verify our statements and see that we are indeed handling this matter responsibly.

Host: There is a very practical question, now that the number of your token holders has actually increased after the event—the scenario where many people bought in after the drop. So now, you plan a buyback, and everyone will also be concerned: How much funding do you have on hand to execute this plan? Could you share your current financial situation?

JP Mullin: I would like to emphasize a few things. Our current operational status is completely healthy, we have ample funds, and our business is fully solvent. In addition to existing investors, we have also received support from many new investors who have offered to provide funding, participate in buyback programs, engage in long-term OTC trades, and more.

We are actively evaluating these options and will soon roll out a comprehensive solution. During this period, business will proceed as usual, and we will keep communication channels open for updates. From a financial perspective, we currently have no issues and will continue to move forward.

Transparency, Investors, and Market Makers

Host: You just mentioned "long-term OTC trades," which I think is also worth everyone's attention. Because in the token trading structure, OTC is actually a common but not very transparent method.

You previously mentioned that tokens held by investors like Laser Digital and Shrooks are locked up, and they have publicly stated that they have not sold any, but OTC trades involve the project team privately selling tokens to others, possibly below market price.

These tokens might later enter the market, and the market may perceive it as the "project team dumping tokens." So I'd like to ask, has your project done a lot of OTC trades before the current situation? Are the volumes significant?

JP Mullin: We have indeed engaged in OTC trades with institutional investors, high-net-worth individuals, and family offices. However, these are all long-term locked-up deals, and in fact, none of them have been unlocked yet.

We have imposed many restrictions in these agreements, such as clauses prohibiting resale or transfer on the secondary market. We have always strived to ensure that investors are aligned with us, for example, that they do not hedge, do not engage in short-term trading, but are long-term bullish holders of the project. We do not want any unnecessary selling pressure to appear on the spot or perpetual markets.

Furthermore, we also value the overall health of the secondary market. So we will handle all such trades through channels officially approved by us. We do collaborate with some brokers, and sometimes they will inform us of institutions looking to buy or sell, and we will coordinate to ensure that these trades are conducted with our knowledge and supervision, ensuring that the market operates in a healthy manner.

Host: I understand you have control mechanisms, but going back to that question: this matter seems to have already stirred up the market. And I have looked at your token distribution table, the early ERC-20 version of the token actually has a substantial amount that can be mapped to your mainnet's new coin. So in this situation, isn't it still challenging to control the circulating token supply? It's not surprising that someone can establish what seems to be a valuable position on-chain but, in reality, has poor liquidity, right?

JP Mullin: It's not as difficult as you might think. Based on the data I saw earlier today, over 100 million OM tokens have already been bridged from Ethereum to the mainnet. So yes, indeed, a significant amount of tokens have entered the market.

But let's be clear: we have not sold these "highly liquid" tokens on the market. What we have sold is the portion that is locked up long-term and cannot easily circulate.

Host: I understand that your team does not sell these circulating tokens, but the existing old coins in the market can still be used by some to build positions. So when an exchange sees someone using these tokens as collateral, taking a large position, they may worry: "These coins may seem valuable on the books, but in reality, not many people are willing to buy or the liquidity is poor." As a result, they may liquidate forcefully. Is this the core issue behind this event?

JP Mullin: Why do these tokens appear valuable on the books but are actually worth less? Is it due to a liquidity issue? The concern here is not about locked tokens being used as collateral, but rather about those freely circulating tokens being taken to exchanges.

I think major exchanges all have their own risk control mechanisms. Of course, we have indeed communicated with some exchanges, but this kind of settlement should be between the exchange and the investor.

Usually, such events do not happen overnight but involve an ongoing communication process. I was not involved in the specific conversation this time, so I can't comment on the details, but from what we have seen, the liquidation action this time was very aggressive and rapid, so we are paying close attention to this matter and considering all possible legal measures.

We are also collaborating with investors to evaluate all feasible options.

Host: I also want to talk about the token plan you announced earlier because this event actually occurred shortly after the end of your airdrop, and at that time you were also preventing a Sybil attack—where someone creates numerous fake wallets to claim multiple airdrops.

As the founder, how do you view the relationship between this incident and the timing of the liquidation? Has this already exposed some warning signs, such as some tokens being distributed mistakenly to the wrong hands?

JP Mullin: To be honest, I think this was just an unfortunate coincidence. We did the first 10% airdrop a few weeks ago, which was actually delayed from before.

Let me give a brief overview of our overall tokenomics: In February 2024, we announced our first airdrop plan, where we distributed 50 million tokens, valued at approximately between 5 to 10 million US dollars. Later, this number surged to a market cap of 4 to 5 billion US dollars.

This also means that a portion of the tokens were distributed through zero-cost airdrops, which was understandably concerning for early users who had purchased tokens. So, we made adjustments to the vesting rules to try to balance both sides' interests. Nonetheless, we proceeded with the first round of airdrop.

Simultaneously, we implemented a substantial witching attack filter on airdrop addresses. We indeed found a significant amount of malicious activities, such as tens of thousands of addresses attempting to exploit the airdrop, which clearly was not what we wished to see. We aimed to protect those community members who genuinely spent money to support the project.

In March, we made filtering decisions, and this airdrop was completed approximately one to two weeks ago, distributing the first 10%.

Host: So, I want to add, why did you choose to protect the cost basis of those who genuinely purchased the tokens? Logically, it's to prevent those who didn't spend money from impacting them, right?

JP Mullin: Yes, I think this is crucial—if someone is willing to use their hard-earned money to support your project, to support your token, I genuinely feel that it's my responsibility.

As a founder, this is not only my fiduciary duty but also a responsibility I wholeheartedly want to undertake.

When we discovered people exploiting vulnerabilities to exploit the airdrop, seizing resources, and then dumping those tokens directly to the real holders who have been with us, it damages our project itself. I cannot allow such a thing to happen.

Of course, that does not mean we don't welcome everyone to participate in the airdrop. In fact, after our airdrop, there were over 200,000 wallet addresses participating in the event on the mainnet.

These are genuine users who passed through our anti-witching attack mechanism, did genuine transfers, and are still holding the tokens—we must protect these individuals.

Furthermore, we are not just protecting these addresses on the mainnet; we also have tens of thousands of original holders on Ethereum, excluding wallet addresses on exchanges. So, overall, the number of users involved is substantial, and I take this matter very seriously.

Host: Since you mentioned that you take this responsibility seriously, as a founder, there are actually two key tasks: first, to ensure that the lock-up mechanism is clear and enforced. Because some projects don't even have a lock-up mechanism.

The second task is what you mentioned earlier about the token price constantly rising. In fact, we have seen this in the past as well. This situation often occurs when market liquidity is poor, and some market makers use very little capital to continuously drive up the price.

Your project is quite unique. On the one hand, you have an existing token, and on the other hand, you have launched a new L1 mainnet, and you also allow users to swap between the two tokens.

As the founder, when you see these things happening, do you feel nervous? You have also said that you don't want anyone to buy in at a high point. If there isn't enough real trading volume or activity in the market to support this price increase, it can easily lead to an artificially inflated price.

Looking at the entire crypto space, many founders and market makers are actually gambling when they collaborate—gambling that your team's future can drive up the token demand to surpass the existing and future unlocked supply. Especially for projects like yours that have an airdrop + unlock mechanism in their original design.

So, how do you see this game? In the context of this event, how much responsibility do you think a founder should bear?

JP Mullin: Let me explain a bit about some of the adjustments we made to the tokenomics for this token. That way, you can have a clearer picture of the entire background.

When we modified the vesting mechanism for this airdrop, we also adjusted the team's token release schedule. The team's tokens are currently locked in Anchorage, and we have already disclosed the wallet address, which is also stated in our published transparency report.

At the same time, as part of the new airdrop rules, we extended the lock-up period for team and advisor tokens to one of the longest in the industry—specifically, a 30-month cliff (no release during this period) + 30-month linear release.

You see, I actually received the original ERC version of the token a long time ago, but I returned all those tokens and then set a new unlocking period. So now, I have to lock up my tokens for another six years, on top of the four and a half years I have already spent building the Mantra project. We are in this for the long haul.

I will accompany this project through its ups and downs. This is not the first time we have experienced turmoil. Of course, I take responsibility for this event. This situation is indeed something we have never encountered before. I believe there was some malicious behavior involved, and we are currently investigating what exactly happened.

The reason why I am willing to sit here for this interview, why I went to South Korea to attend the summit, and why I have been communicating as openly and transparently as possible is all because—this project is really important to me, and the community means everything to me.

We will continue to do what needs to be done and support the community's progress. Whether in good times or bad, I have to shoulder it. It is indeed one of the most difficult times for us right now, but we will continue to move forward, building on the solid foundation we have and continuing to walk together with our strong partners.

Host: I would like to ask further, the "malicious behavior" you mentioned is new information to me. Can you explain? Because it sounds more like someone holding a large amount of tokens and then being liquidated, which to me might just be market behavior and not necessarily constitute "malice," right?

JP Mullin: I would say, the timing of this event is very suspicious, and the whole process is too "neat," not something that seems random. You're unlikely to see such a large "waterfall liquidation" suddenly overnight. That's why we need to investigate seriously and find out what really happened behind the scenes.

Generally speaking, this kind of situation is not likely to happen in an "instant." You know, if you've experienced being liquidated due to additional margin calls or loans— if you have been in communication with the exchange or the lending party, proactively reaching out, providing additional collateral, or seeking solutions, they wouldn't just directly liquidate you, especially not all at once for a position worth hundreds of millions of dollars.

That is a very large position, and it must be managed very carefully. Our current feeling is that this matter has not been handled properly, so we are investigating what really happened because this incident has indeed hurt many people.

Host: I also agree with your point, but this is precisely what everyone is concerned about, especially the relationship between market makers and the communication between you. From the perspective of us external observers, we can only rely on speculation. As the head of the project, you are the most likely person to know the truth. So the core question is: how did such a thing happen?

Many people say that this logic is actually not difficult to understand—like the liquidation example you mentioned: If the price of a token is not formed naturally by supply and demand but artificially inflated by some participants, then when the price corrects, the exchange may think: this price is not real, there is no real buying interest, and once there's no one to catch the fall, it will collapse rapidly.

From this perspective, the triggering of liquidation is actually "reasonable." As the founder of the project, I guess you should have been involved in discussions about the token, circulation, which exchanges it is listed on, distribution of trading volume, and so on, at least you should understand how these relationships work, right?

JP Mullin: To some extent, yes. We did have some exchanges reach out to us proactively, asking us, "What's the deal with these tokens? Where did they come from? Why are these tokens being used as collateral?"

They would send me a wallet address, and this address was funds moved from a wallet newly created on another exchange, completely looking like a foreign new address.

I couldn't make a judgement call, didn't have specific info on where these tokens were coming from, especially if they were coming from a centralized exchange. Clearly, we work with multiple market makers who are also our investors, and I'd be more than happy to tell you who they are: Including Laser, Amber, and Manifold Trading. These are all our investment partners.

I can state categorically that we have not engaged in any form of wash trading with market makers. We simply don't have the capital to do so, and the funds raised by Mantra over the past 12 to 16 months are limited; this isn't something we would do, and I'm happy to make that statement publicly.

As far as the value of the token, feel free to comment on that, whether it's fair or not, that's for the market to determine. I hope that eventually, a fair market value will be achieved, which is also the case for the project we are building.

Over the past 12 to 15 months, we have indeed garnered a lot of attention, and the execution has been strong. We have made many major announcements and received a lot of support, including from institutional investors, real estate developers, and web2 partners like Google.

So from a due diligence perspective, we have passed all reviews. We are a regulated project, and we have shown all our compliance to regulators and partners, maintaining transparency and communication with regulatory bodies.

Host: If this is a project approved by Vera, I'm curious if you have had discussions with them about the events that took place?

JP Mullin: We certainly reached out to them immediately. So, we have been staying in touch with them. Overall, everyone wants to figure out what exactly happened. We commit to transparency and showcasing every fact and detail as much as possible.

Aside from the recovery plan, the next step is to present a detailed postmortem, as openly as possible with all the facts and details, including public wallets and so on. We will make public everything we know to regain community trust and be able to articulate our perspective clearly on-chain.

Shrug has already announced their wallet, Laser has also announced their wallet, and we have also published our wallet address. We will continue to release more information, striving to be as transparent as possible. We are not avoiding this issue; we are right here.

How will the Om token develop?

Host: I'd like to continue discussing the issue of transparency. As I mentioned earlier, Sheriff has released their report and stated that the tokens sold off were not theirs. Speaking of transparency, where do we go from here? What is Mantra's direction? How will the Om token develop? Because, as you said, there are many questions surrounding these issues.

Prior to this incident, while preparing for this conversation, I came across a Twitter discussion where someone mentioned the issue of transparency. You responded by saying that in terms of supply, we have discussed the issue of the vicious cycle of this airdrop.

At that time, you essentially responded, "I'm not doing any form of shilling, I'm not saying this is a bad investment, nor am I saying this is a good investment. We've been transparent from the start, and we recently released another report for the community." I'm a bit curious to understand which report you were referring to?

I'm not sure if you were referring to the part about the vicious cycle, but the main issue is whether it was about the transparency of the supply dynamics. I even saw Binance recently mention a warning about the listing of the OM token due to concerns about the increase in supply. I'm wondering if you were referring to this issue.

I'm referring to the transparency report you previously showcased, where different categories were listed. I'd be happy to provide a link; this report was released about a week ago.

As you mentioned, throughout Mantra's history, we have been providing updates on the issuance and supply of the OM token. This has been ongoing since last year when we merged ERC tokens with new chain tokens through governance votes and approval from the ERC20Mantra community, all of which have been validated. Over the past few months, we have continued to provide updates, even though these links are not available now, but I'm happy to provide them.

You can see the process of these changes. We have a close collaboration with Binance and other exchanges, and whenever there is a change in tokenomics, we immediately communicate with them. If there are any economic changes, we will publicly release them through validated governance proposals or media articles, and we will also directly share this information with Binance and other exchanges.

I know Binance is definitely aware of this change, and as such, many exchanges have already decided to support this change, with Binance being one of them. We have already been in contact with them regarding this change, and they are aware of the token supply change; this is not something new and happened back in October.

It does strike me as a bit odd, especially the idea you proposed of a "one-to-one ratio mirror burn." Has there been any discussion about potentially converting some tokens if the existing token supply is too large? As we discussed before, the OM token's supply is already substantial.

I am currently reviewing the proposal, and many people have mentioned that this proposal may be of that nature. I recall you mentioned it has 91 votes. I remember you saying that when we were doing this, many people were saying we were done for. As a leader of Mantra, could you discuss the decision-making process behind this? And would you reconsider and make a different decision?

JP Mullin: I will not change the decision. In fact, if that proposal had not been approved at the time, we would not even have Mantra's Layer 1 chain.

Initially, we planned to use Mantra's ERC token, and we planned to build a completely independent L1 chain that would conduct some form of airdrop to give back to OM holders, creating a new token called Omega AUM.

We had discussions with investors and core team members at the end of 2023 and the beginning of 2024 when almost no one had heard of Mantra.

Indeed, our token had dropped by 95%, and many thought we were done for, right? Then we had this almost impossible recovery, supported by the repricing of the OM token, the launch of Mantra's chain, with the goal of supporting RWAs. These different narratives and the efforts we put in together ultimately led to today's achievements.

Regarding this "mere bucket," in fact, when we were creating this new supply for the chain, everything was transparent, and everyone supporting this project was fully aware of the situation. From the release of proposal one, we have been consistently communicating this information.

The mere bucket is actually a bridge between the ERC token and the mainnet token; we effectively mirrored the existing ERC token's supply, and it is verifiable on the chain. When people send ERC tokens over, those tokens are sent to a burn address, and approximately 100 million tokens have already been burned.

The entire process involves the exchange of one-to-one ratio of the redeemable tokens, and you can even see it on Bybit, where they have both the ERC version of OM and the Mantra chain version of OM. You can deposit ERC version OM and withdraw Mantra chain version OM, and vice versa.

We have set a threshold of 30,000 tokens, and when you send tokens through the bridge, this amount will be automatically filled within a few minutes. Once the validation is sent to the burn address, new tokens are minted. If the quantity exceeds 30,000 tokens, we require a manual processing step, approved and sent through a multisig wallet, which may take up to 24 hours to ensure all is secure, as it involves significant fund movement.

Even though I forget the price of OM at the time of launch, there were still hundreds of million or more tokens locked in this bridging wallet. We want to ensure this does not become a target for an attack. We also want to ensure people can correctly bridge their tokens to the mainnet tokens, which is where all new activity starts and where our future lies.

Host: Looking back now at this 90% drop and considering those who might have entered the market at a much higher price, the current price is significantly lower than their initial investment. If that's the case, as you mentioned, they might have lost their hard-earned money. Do you feel you and your team have been transparent enough? Did you warn everyone that these things could happen?

JP Mullin: I do feel like we've always strived to maintain transparency. I don't think the issue lies with transparency. I do hope to continue being as transparent as possible, allowing everyone to see that in fact, no tokens have been sold, neither by us nor by investors.

Host: I don't think people necessarily blame you for selling tokens. What's peculiar is, I know you're not in the US, but the U.S. Securities and Exchange Commission (SEC) recently released their stand on transparency. Specifically, they pointed out that if you're involved in cryptocurrency trading, you need to disclose who the market makers are, disclose the agreements you've signed, disclose who may hold tokens, and how the supply has changed; basically, these are their requirements.

So if we were to start over now, considering OM is now trading at $0.70, having previously been close to $7, now down to a thousandth of its former price, what would you do differently? If you want to talk about this transparency of agreements, especially given the cost basis of these large market makers or investors, this could put significant pressure on the supply. So if you were to engage with new people now, what would you disclose?

JP Mullin: I believe the best thing we can do right now is to release as much on-chain information as possible, showing the status of the token, what exactly has occurred.

Host: This is about off-chain content, such as those protocols and off-exchange transactions; my question is, what does it mean?

JP Mullin: I think the off-chain part is relatively open, including the ownership plan that we made public from the beginning.

So, obviously, we are willing to provide as much information as possible related to any protocol involving the token association. We are fully committed to doing this. You know, I will support this point, we will publish, but cannot do everything.

I think right now, investors will want to know what exactly happened. I am glad you raised questions about both the on-chain and off-chain aspects. We are fully committed to providing as much information as possible, and I make this commitment.

Mantra Future Roadmap

Host: What to do next is undoubtedly a big question, and obviously, this is why many people are paying attention to our conversation right now.

I want to give you an opportunity to talk about your upcoming plans and the roadmap you intend to take because frankly, I have not heard of Mantra before this, perhaps because you are over there, and we are over here, and there is indeed a difference between New York and the global crypto user. At least I have not heard much about you.

But now, considering this on-chain real-world asset, you mentioned that your funds are not substantial. So, when you talk about the buyback plan and the plan to recover, I would say, even you might agree, it is almost impossible to return to those previous levels now. But how do you see the plan to return to that level, and what assets can you operate with now?

JP Mullin: Of course, you know, this situation has happened before. We have dropped more than 95% in the past, and everyone thought we were done when we had just launched, but we came back successfully. We know we will have such a recovery again.

From a founder's perspective, I am willing to do whatever it takes to ensure that the community is well taken care of. This is more important to me than anything, and we need to take action in this difficult time, get back on track, and support our community.

We do have strong long-term institutional partners, as I mentioned, our company has financial backing, business remains healthy, and we will continue to move forward and execute our plans. Post-event, we see very strong institutional interest, and it's really great to see that.

We are committed to doing everything we can to execute the buyback plan, starting with my personal founder's token, which I have restaked. At this stage, I am not focused on financial gain; to be honest, I was not in it for financial purposes from the beginning. So, I want to make sure that we can reboot this project and continue moving forward.

We will work with our partners such as Subaru, Laser, etc., to develop a reasonable buyback plan and at the same time create a burn mechanism to show everyone what is happening and destroy any unnecessary supply. I have discussed this with our investors, and they have also committed to helping and supporting this plan.

Host: These points you mentioned, I want to confirm the normalcy of these processes, the settlement issue you mentioned. If there is investor interest or institutional demand, they might get involved at this time. So, you are saying that these conversations have not happened, right?

I mean, as of now, regarding the demand situation, the institutional support you talked about and the investors' support, we are now in a situation of a 90% drop, right?

JP Mullin: This indeed happened very quickly, almost overnight. It was on a Sunday evening, and the situation was sudden; we didn't have much time to react. I was asleep at the time.

So, we have obviously been working with the token-holding partners, who will continue to support the project, and there is also funding support. But we have also attracted many new investors who have shown interest in the project and will continue to support it, demonstrating their willingness to stay engaged.

So, seeing the addition of these new investors makes me feel good; everyone understands that we have done a lot of work already, and this is not the first time we have faced such a challenge. We are ready to rise again.

Host: Speaking of the personal impact on you, I also wanted to ask, you mentioned you have been working on this project for a while, and I have seen your past interviews, from talking about Home to the mainnet launch last year.

For you personally, going through all this, how do you view this process? I have interviewed many founders before, including Do Kwon from Terra after the crash and SBF from FTX after the collapse. I have also interviewed many other project founders.

For you, having gone through these ups and downs, do you feel some sort of release? Of course, I know today you don't sound relieved. But looking at the token's volatility, maybe the price is now at a lower level. Like you said, you have experienced a similar crash before, do you also have a bit of a "maybe we should be at this point" kind of thought?

JP Mullin: I don't think so. You know, aside from market value, this is not something I would feel relieved about. Unprecedented events occurred, many people lost money, were harmed, and I don't find any comfort in that.

I feel very discouraged, and today has been extremely difficult for me. I feel sad for our community, I feel sad for those who suffered losses, I feel sad for our team, some foreign investors, it's really bad. To be honest, I feel very sad.

So, this is not something I would feel any relief about. I feel bad, but I promise to do everything I can, to spend every minute fixing all this, doing the right thing, I stand behind these words. I believe those who have seen us over the past five years will support me on this. You know, I will keep my promise and do everything I can to support this project, take responsibility, and not evade.

Host: You mentioned you feel bad, and I actually want to figure out which part makes you feel bad. Obviously, the price drop is one thing, but it sounds like you're saying it's not your fault. So, if there's a specific part that makes you feel bad, apart from the price, what exactly is it?

Because it sounds like you're saying you didn't sell, and neither did your investors. So, from an external perspective, especially for those not in the Mantra ecosystem, do you feel you did something wrong?

JP Mullin: What makes me sad is that those who believed in this project, believed in this token, ended up losing money. They didn't participate in this event, and then they woke up to an 80%, 90% token drop. That's really bad, and I feel sorry for those who supported us.

Host: Part of the responsibility lies with you, right? I think if I could clarify one last thing, it is what exactly is making you feel bad? Is it about something you did?

JP Mullin: They believed in me, they believed in this project, and as a result, they lost money in the process. Like I said, it makes me feel as a responsible founder, I have a duty to take care of the token holders and our supporters. I can't avoid it, I just feel sorry for them, frankly, I don't know what else to say.

I feel very sad. I feel that our community has been hurt, our token holders have been hurt, our foundation has been hurt. I feel responsible, even though I haven't done anything negligent or malicious, but I still feel a great sense of responsibility.

Host: I'm curious, if your investors got hurt, I wonder if they really suffered losses, even though the token's current trading price is $0.7.

JP Mullin: I believe they did not suffer losses, which is also why those investors holding liquidity tokens have not sold any liquidity tokens to this day.

Host: So maybe they weren't affected too much, and it's the ones who came in later that were more impacted, as you said. That's why we're having these conversations, to chat with you. Perhaps if we had talked earlier, maybe more people would have understood the true nature of the project. Again, I'm just starting to understand what you are doing and how it relates to real-world assets; obviously, this is a very hot area.

It sounds like you have been enduring for a long time, dealing with what's coming next. So, that last sentence, what would you like to say to those holding this token?

JP Mullin: First, I want to thank you for giving us the opportunity to come out and share our position. Again, we will develop a plan to ensure full transparency, openly discussing what happened and where things went wrong.

So, everyone can follow my personal Twitter as well as our company's Twitter account, where all this information will be released. We will also roll out our buyback and burn plan in the next few days to ensure that we make every effort to support the investors. We will maintain ongoing communication with the community. I reiterate once again, friends from the community, we will do everything possible to correct this situation.

Thank you to those who support us and actively reach out to us, we are very grateful. This means a lot to us. For those who are currently skeptical of us, we will continue to work as hard as we can and will emerge stronger than ever.

Host: I am very grateful. I think sometimes people are unwilling to maintain transparency, unwilling to let everyone know the latest. And this situation is relatively unique, especially the events that took place over the weekend. Therefore, I think letting people know what you know is precisely the transparency expected in this field.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Experts Anticipate a Surge for SUI Cryptocurrency Based on Positive Indicators

In Brief SUI cryptocurrency shows optimism through positive technical indicators. Experts believe SUI is poised for a potential upward movement. Institutional predictions suggest significant price levels could be reached for SUI.

Massive OM Token Burn Sparks Investor Debate and Market Tension

In Brief Mullin announced a significant burn of 300 million OM tokens to reduce supply. Investor confidence is shaken as whale movements raise concerns about potential sell-offs. Market sentiment remains crucial as analysts call for additional measures for recovery.

Who is Patrice Evra, French football legend, set to speak at Token 2049 Dubai?

Elon Musk Takes Dig at Crypto Scammers Posing as “Hot Girls”