MANTRA Crashes 90%, Founder Points to CEX Liquidations

MANTRA (OM), the native token of the MANTRA blockchain—designed to tokenize real-world assets with built-in regulatory compliance—suffered a dramatic collapse on Sunday, losing over 90% of its value in just a few hours.

Sponsored

The sharp downturn wiped more than $5.25 billion from its market capitalization, marking one of the most severe single-day drops in crypto this year.

MANTRA (OM) Price Takes Sudden Nosedive

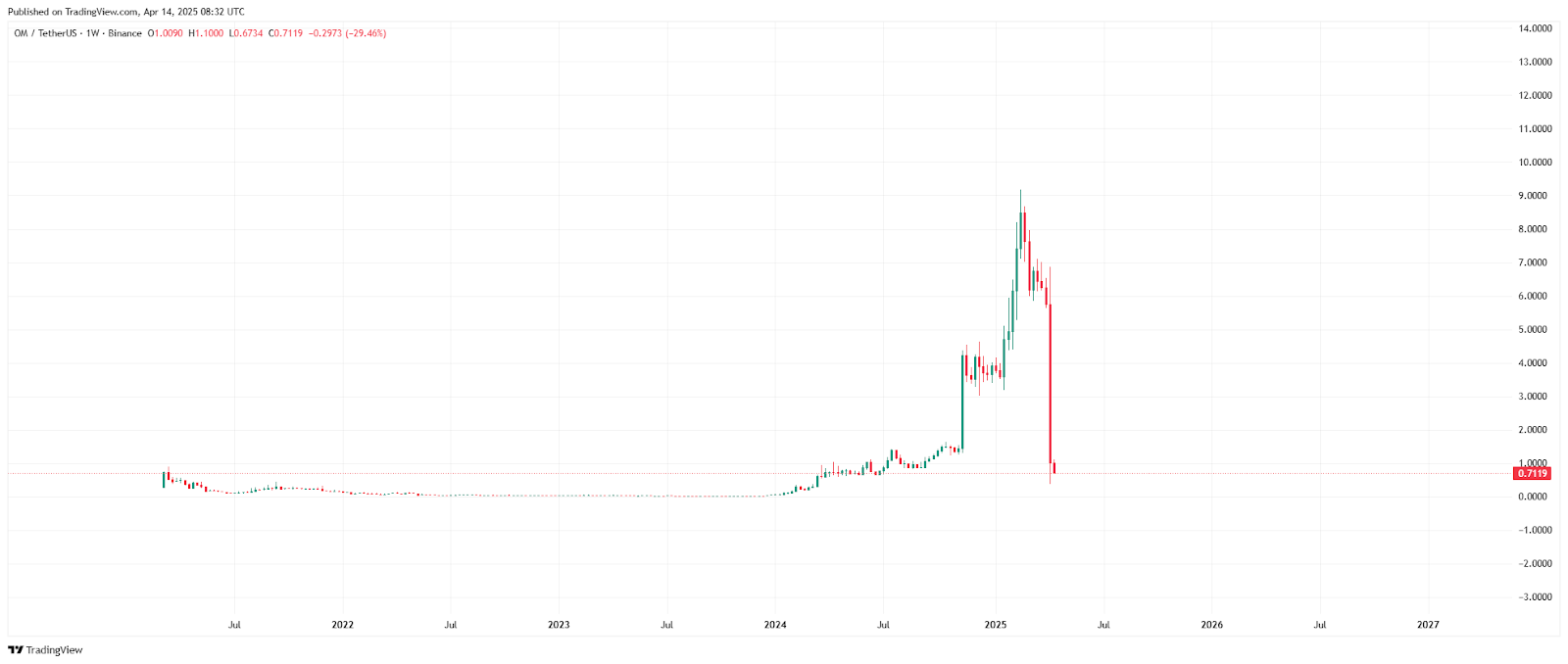

On Sunday, April 13, MANTRA (OM) plummeted from $6.3 to $0.42, losing over 94% of its market value within hours.

MANTRA (OM) price crashed on April 13. Source: Tradingview

MANTRA (OM) price crashed on April 13. Source: Tradingview

While the crash itself was severe, the underlying cause was not a failure of the project or its team, MANTRA’s team stated on Sunday.

CEO John Patrick Mullin said the steep price drop resulted from “reckless forced closures” by centralized exchanges during low-liquidity hours, rather than internal selling.

Mullin emphasized that OM tokens remain locked and the project’s tokenomics are unchanged.

“Tokens remain locked and subject to the published vesting periods. OM’s tokenomics remain intact, as shared last week in our latest token report. Our token wallet addresses are online and visible.”

CEX Liquidations Are not Unusual

According to CoinGlass data, the sudden crash of MANTRA (OM) triggered more than $71.8 million in liquidations over the past 24 hours.

CEX liquidations are not unusual in crypto, especially when leveraged positions are closed during low-liquidity periods. This often results in sudden and extreme price fluctuations.

While such sharp declines are rare, they are not without precedent—other tokens have suffered similar crashes during market downturns, often exacerbated by forced liquidations and margin trading.

MANTRA’s Push into Real-World Assets Faces Setback

The recent sharp price drop comes just months after MANTRA made a major move into real-world asset (RWA) tokenization, including a $1 billion partnership with Dubai-based conglomerate DAMAC.

In February, the project also obtained a VARA license to legally operate in the United Arab Emirates, aiming to meet growing demand for blockchain-powered real estate investment solutions.

Last year, a Hong Kong court ordered six individuals associated with MANTRA DAO to disclose financial records after a lawsuit alleged they had misused DAO assets. The defendants argued that the assets belong to token holders, not to them personally.

Why This Matters

The crash highlights the vulnerability of crypto projects to external market forces. For MANTRA, this setback challenges its position in the RWA tokenization space and could have broader implications for blockchain-based RWA investment solutions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

5 Cardano Rivals to Watch as Founder Predicts Ethereum Will Die by 2040

Resilient Long-Term Bitcoin Holders Confidently Add 635K BTC Since January Amid Market Shifts

Top Searched Crypto Projects of Today

Ubisoft + blockchain = Might&Magic goes crypto