Concerns about the US dollar are intensifying, and the demand for hedging against the depreciation of the US dollar has surged to a 5-year high

Due to the potential weakening of American economic exceptionalism and the dollar by Trump's tariff policy, demand for hedging against potential depreciation of the dollar has surged to a five-year high. Institutional data shows that the three-month risk reversal index measuring the dollar against 12 major currencies (i.e., the spread between call and put options) has dropped to its lowest level since March 2020 when the global pandemic was at its worst.

This indicator fell below zero for the first time in five years last Friday, indicating that demand for put options benefiting from a weaker dollar is greater than demand for call options benefiting from a stronger dollar. "The market's aversion to holding dollars still dominates," said Chris Weston, research director at Pepperstone Group Ltd. in Melbourne. "The questions people are raising about the dollar are not an overnight issue but potentially significant structural changes."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

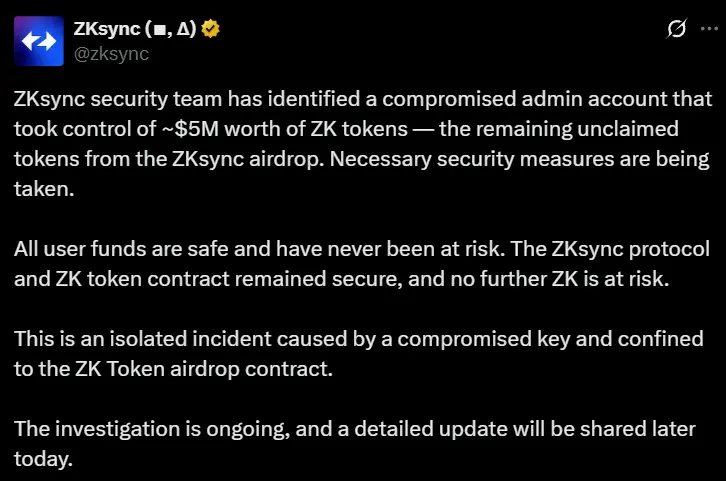

ZKsync confirms airdrop contract admin key leak resulting in approximately $5 million in ZK being stolen and sold

Bitget collaborates with Barcelona star Raphinha to launch a new advertisement