Did Ethereum Price Avert A Full-Blown Crash?

While current scenario is all about recovery, whale sell-offs and ETF outflows had recently dragged Ethereum toward the critical $1,200 zone. Oversold RSI and futures long bias hint at a possible short-term Ethereum rebound. On-chain realized price crossover signals Ethereum may be forming a long-term bottom.

As the markets saw recovery over the past day, so has Ethereum price, climbing over $1500.

However, not long ago, ETH underwent intense bearish pressure that brought it near its crucial $1,200 support.

While it has since seen recovery, the top altcoin price decline was due to whale-led market selloff along with declining funds from Ethereum ETFs and general economic conditions.

Market experts recognize the $1,200 support area as a major point of interest. A deeper price rejection is possible if Ethereum cannot maintain positions above this critical area.

Whale Sell-Offs Add to Ethereum’s Downward Pressure

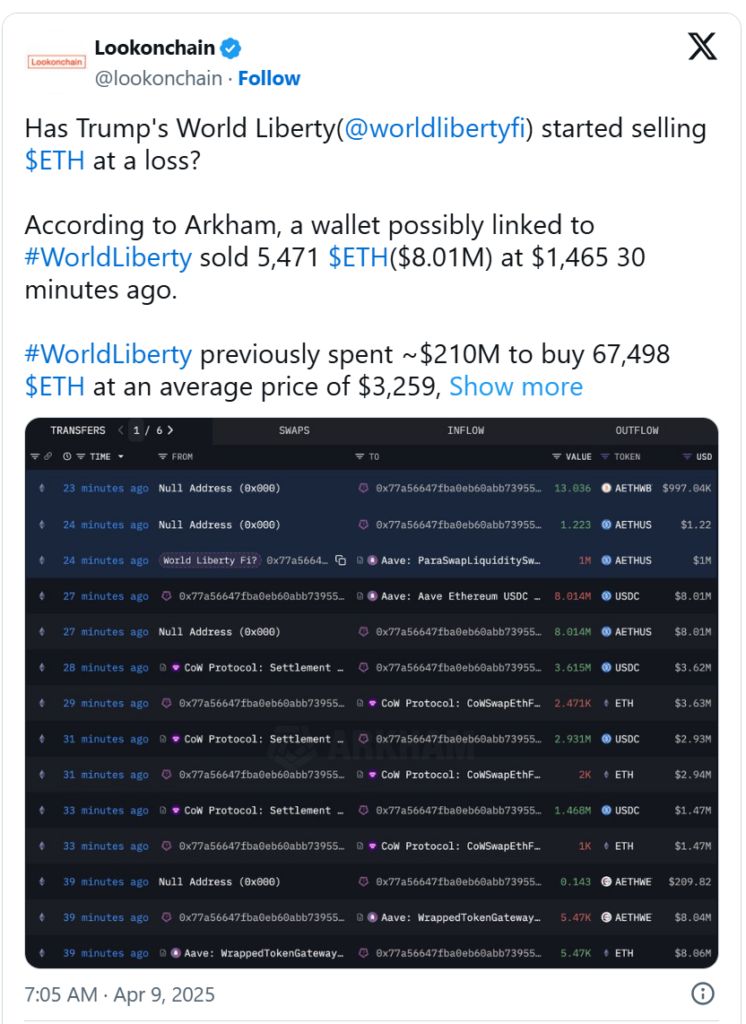

Whale activity played a significant role in Ethereum’s recent decline. According to LookOnChain, the World Liberty Financial Trust (WLFI) , linked to Donald Trump, liquidated 5,471 ETH at an average price of $1,465, totaling $8.01 million.

This large sell-off added to bearish market sentiment. Additionally, a dormant whale sold 500 ETH after nearly two years of inactivity, realizing a loss of $166,000.

These moves injected significant liquidity into the market, intensifying the downward pressure on Ethereum price.

Source: @lookonchain | X

Source: @lookonchain | X

Additionally, Ali Martinez noted that aggressive whale sell-offs have worsened the market’s downward momentum.

Large liquidations, especially at lower price levels, have made it harder for Ethereum to maintain upward momentum.

As ETH price approaches the $1,200 support zone, these sell-offs increase the chances of testing deeper levels before any potential recovery.

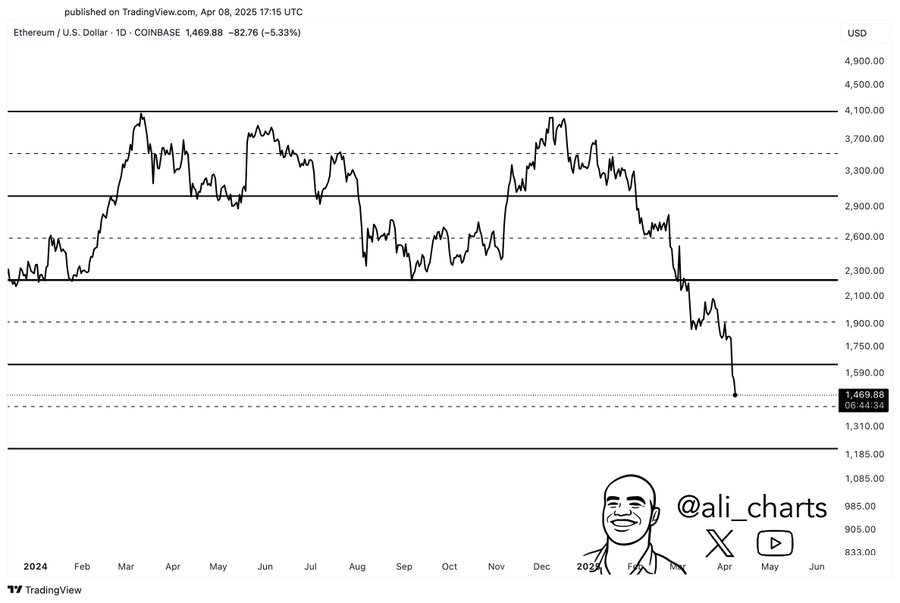

Source: Ali Martinez, X

Source: Ali Martinez, X

Ethereum ETFs Continue to Experience Outflows

Additionally, another factor keeping Ethereum price under pressure is the outflow from Ethereum-based investment products.

Data revealed that Ethereum Spot ETFs declined in the same week with an outflow of $3.29 million, mostly contributed by Fidelity.

This marks the sixth consecutive week of outflows, signaling decreased institutional interest in Ethereum.

Consequently, the outflows have added selling pressure, further weakening Ethereum’s support at higher levels.

Limited inflows into ETF therefore leave ETH exposed to bearish sentiments in the market.

Contributions from institutions are essential in determining Ethereum price, and current outflows indicate that risk-asset demand is declining.

If these outflows persist, however, it will be even more difficult for Ethereum price to regain the bullish trend.

Technical Indicators Point to Short-Term Relief

However, certain technical aspects point to the likelihood of a short-term bounce. The daily relative strength index indicated that ETH price was oversold, which set it up for a bullish turn.

The futures market also exhibited a similar pattern, with the longs to shorts ratio of 1.1782 as per the analysis of GrowThePie. Of the market participants, 54.09% hold long positions.

Although the funding rate for Ethereum futures has stabilized at 0.0046%, down from previous highs, bullish momentum remains cautious.

While the overall market structure favors sellers in the long term, the oversold RSI and divergence in futures data point to potential opportunities for short-term traders before the broader downtrend resumes.

Ethereum Price Forming a Long-Term Bottom?

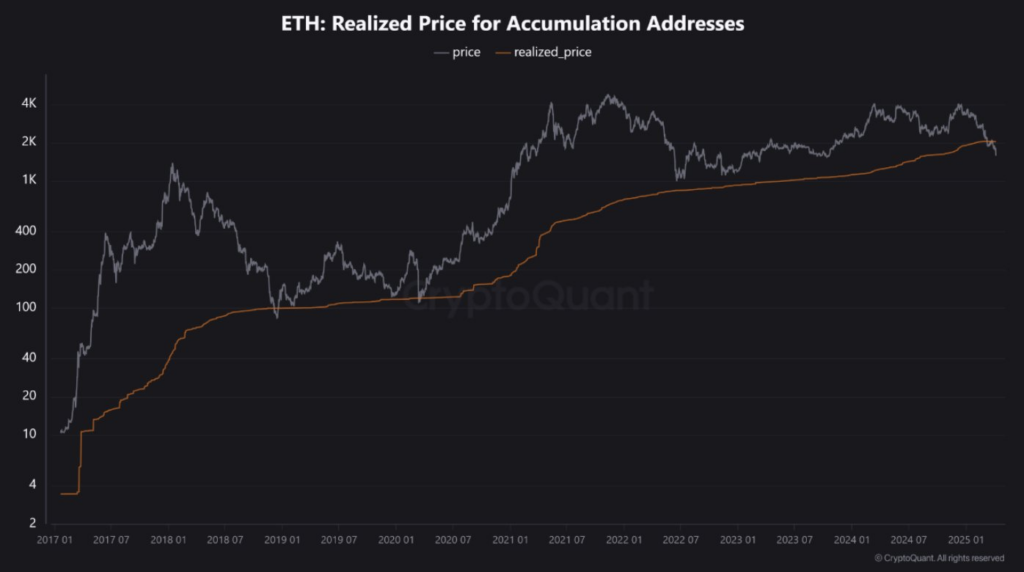

More so, on-chain data has a positive outlook for Ethereum, which might indicate that the current downtrend is establishing a long-term low.

CryptoQuant data showed the altcoin price has gone below the realized price, a trend that usually precedes the formation of the bottom.

Ethereum price trading beneath its realized value is usually followed by capitulation to clean out the weak holders. The move opened up the opportunity for accumulation in the future.

Source: CryptoQuant

Source: CryptoQuant

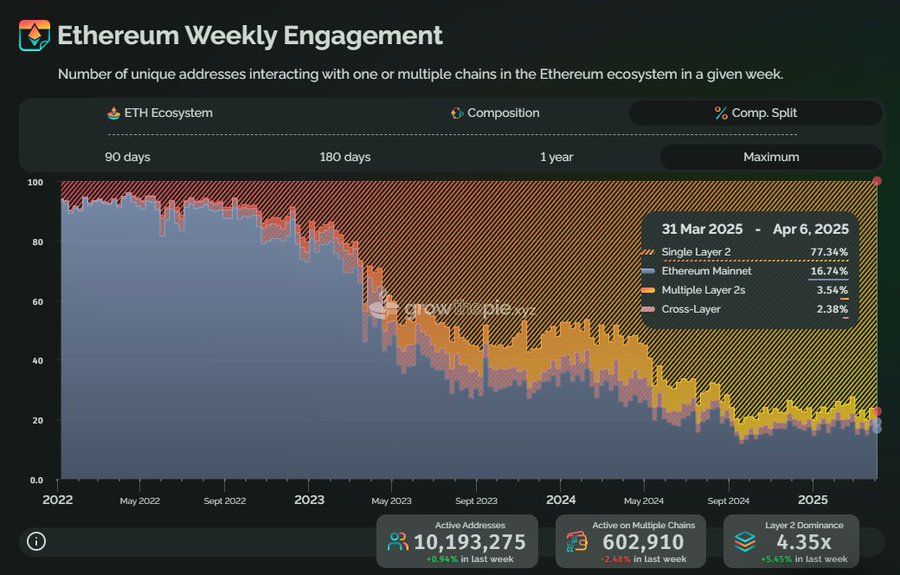

Network activity is still high, with an increase in the active addresses by 0.94% over the last week.

Additionally, Layer 2 has been growing steadily and has gained more dominance with an increase to 5.45%.

Source: GrowThePie

Source: GrowThePie

This means the strong foundation of Ethereum is well intact despite the price volatility.

The on-chain fundamentals give support to a long-term bounce-back potential that is often obscured by short-term price slumps.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SUI Token Surges as Analysts Highlight Promising Patterns and Predictions

In Brief SUI token demonstrates strong performance with significant recent price increases. Technical patterns suggest potential bullish trends and buying opportunities. Analysts project ambitious targets, including a possible rise to $10 or more.

STX Token Surges as New Financial Opportunities Emerge in the Stacks Ecosystem

In Brief The STX token has surged by 56%, reaching a two-month high. BitGo introduced sBTC to enhance Bitcoin's usability in decentralized finance. Liquidity in the Stacks ecosystem is increasing, attracting more users and developers.

U.S. stocks opened, S&P 500 rose 0.1%

Uniswap Web App Adds LP Rewards Function