World Liberty Financial: Big Loss On Ethereum, 67,498 ETH At Risk

WLFI is losing money on its Ethereum holdings as the price selloff grows. Although selloff chances are high, WLFI is highly pro-crypto. Ethereum price rebound is imminent after latest bottom set-up.

US President Donald Trump’s World Liberty Financial (WLFI) recorded huge losses in Ethereum (ETH) holdings.

This move has sparked the possibility of a sell-off as Ethereum faces market headwinds.

Ethereum, the market’s leading altcoin, has seen its price drop below $2,000. The price is now trading near $1600, up over 11% on the daily chart.

Trump WLFI’s ETH Acquisition and Losses

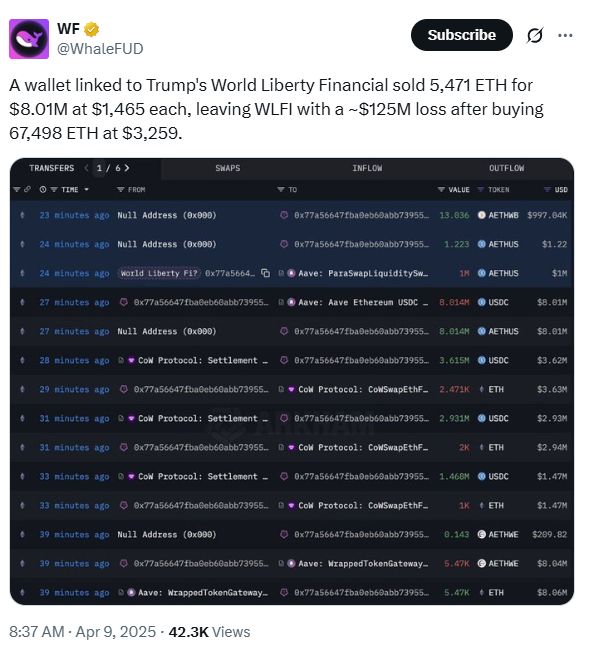

A market analyst known as WF on X pointed out that a wallet linked to WLFI recently sold 5,471 ETH.

These coins translate to $8.01 million, each priced at $1,465. This transaction has left the Trump-backed World Liberty Financial with approximately $125 million in losses.

The crypto investment platform had bought 67,498 ETH at $3,259, which translated to $219.9 million.

Some market participants see WLFI’s recent ETH sales as a reevaluation of strategies as ETH faces market headwinds.

Image Source: Whale FUD on X

Image Source: Whale FUD on X

As a result, they claim WLFI could diversify its portfolio soon. Others think the platform could be chasing liquidity.

Selling at a loss is usually not a good sign, especially when WLFI bought the ETH coins at a high price.

This is a classic example of how emotion and panic drive poor decisions. In crypto, timing is important, and the market typically rewards patience, not panic.

However, a realized loss of approximately $125 million could offset capital gains from other transactions.

WLFI’s crypto portfolio includes stETH, Tron, WHITE, Movement, and Ondo.

Last month, WLFI purchased $21.5 million worth of Ethereum, Wrapped Bitcoin, and Movement Network tokens despite losing $110 million.

These acquisitions suggest confidence in the crypto market’s long-term potential.

Furthermore, recent reports revealed that the platform is staking a substantial amount of its ETH holdings. This highlights its push into the Decentralized Finance (DeFi) sector.

Ethereum Liquidations and Sentiment Shift

The price of Ethereum gained nearly 12% in the past 24 hours as the market showed signs of recovery post a broader market liquidation.

CoinGlass data showed that liquidation across different exchanges amounted to $459.1 million in the last 24 hours.

Ethereum led the altcoins with a total liquidation of $128.51 million. Long position traders saw a liquidation worth $ 84.71 million, while short positions accounted for $43.81 million.

This is because the price of ETH had dropped to $1,448, though it had since recovered to $1643.84 at the time of writing.

The absence of consistent buying interest in Ethereum follows consistent outflows from ETH Exchange-Traded Funds (ETFs).

Will Ethereum Price Survive this Trend?

Ethereum price had failed to stay above the $1,500 support zone, raising questions about its future potential.

At this point, however, it was seen breaking past the $1,600 resistance, and fears that the altcoin could start another decline may not come true after all.

However, Ethereum fell below its realized price. Historically, dips below the realized price are usually followed by accumulation and long-term appreciation.

In the March 2020 market crash, Ethereum fell below its realized price, reaching a low of $109.

Ethereum’s price rallied past $4,000 the following year, marking one of its strongest bull runs.

Hence, if history repeats in this cycle, ETH could easily hit new all-time highs. Moreover, momentum indicators and chart structures suggest the possibility of a long-term reversal for Ethereum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin ETFs Experience Influx Amid Positive Sentiment Shift in Crypto Market

Pi Network Price Consolidation Holds Key to Possible Breakout Above $0.68

ARK Invest’s Bitcoin Forecast: Exploring Potential Paths to $2.4 Million Amid Adoption Concerns