Bitcoin’s Low Volatility and Hash Ribbon Signal Suggest Potential for Price Surge

-

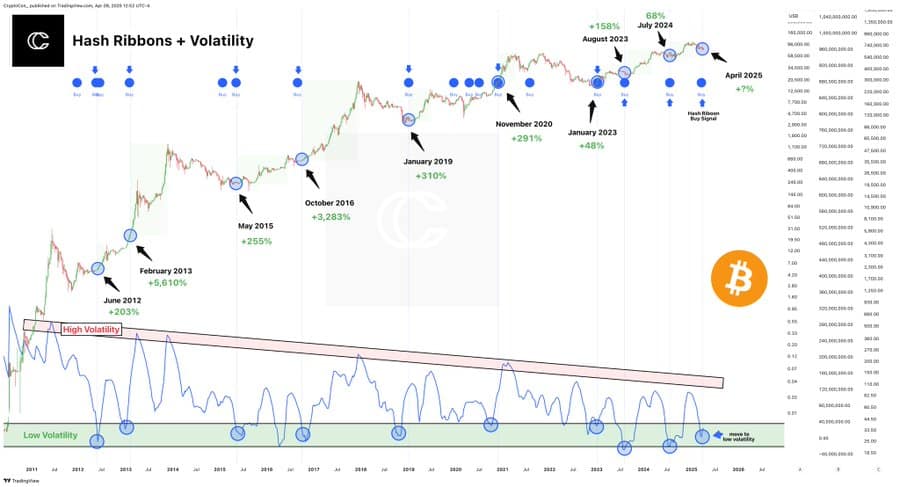

Bitcoin’s recent low volatility and the Hash Ribbon buy signal indicate a potential for a substantial price rally in the near future.

-

The cryptocurrency market is watching closely as Bitcoin’s volatility has reached historic lows—often seen as a precursor to bullish trends.

-

“The Hash Ribbons buy signal is a reliable indicator that has never failed to precede Bitcoin rallies,” noted a source from COINOTAG.

Bitcoin’s low volatility and the Hash Ribbon buy signal suggest a significant price surge could be imminent, highlighting the strength of the crypto market.

The Future Looks Bright: Understanding Bitcoin’s Low Volatility

As Bitcoin encounters a phase of unprecedented low volatility, many investors are wondering what this means for its value. Typically, such calm periods are not a sign of weakness; rather, they often serve as a breeding ground for momentum. Historical data has shown that Bitcoin rallies usually follow these points of calm, with previous low-volatility phases leading to substantial price increases.

For instance, several cycles throughout 2012, 2015, and most recently in 2023, have illustrated that a tight price range can be transformed into a dramatic spike. Interestingly, this can reflect both the maturation of Bitcoin and its increasing correlation with traditional markets, suggesting a broader acceptance of digital assets as a legitimate investment class.

Hash Ribbons: A Trusted Indicator for Bitcoin’s Future

Another factor contributing to the bullish sentiment surrounding Bitcoin is the emergence of the Hash Ribbons buy signal, a technical indicator that has showcased a 100% success rate in forecasting market shifts. This indicator appears specifically when there is a reset in Bitcoin’s mining difficulty following a miner capitulation, suggesting potential resurgence in network strength.

With Bitcoin currently experiencing a Hash Ribbon buy signal alongside its low volatility, analysts are cautious but optimistic. Historical precedents indicate that moments like these almost routinely result in significant price increases, reminiscent of surges seen in 2013, 2016, and 2020.

Source: X

Historical Patterns and Market Psychology

It’s essential to recognize that while skepticism can be healthy, the prevailing data does not lie. The convergence of low volatility and a Hash Ribbons buy signal has consistently resulted in substantial price movements upward. Currently, none of the historical indicators point toward an impending market peak; Bitcoin remains far from the high-volatility zones often experienced at market tops.

This implies that rather than being cautious, investors might want to consider the implications of the current signals. Given the bullish indicators, coupled with the absence of a macroeconomic downturn, Bitcoin could be primed for another significant price surge.

Conclusion

In summary, as Bitcoin navigates through this phase of low volatility, aided by the Hash Ribbons buy signal, the landscape appears optimistic for potential growth. Cryptocurrency investors should pay close attention to these indicators, as history has suggested they herald exciting price movements ahead. The combined data points continue to present a compelling case for Bitcoin’s resilience and potential for future gains.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Shiba Inu (SHIB) Can Still Add Zero, XRP Above $2: But It's Not Enough, Bitcoin (BTC) Death Cross Cancelled?

Bitcoin Price Hits $83K as Stagflation Fears Drive Investors Toward Inflation-Proof Assets: What’s Next?

If Ethena (ENA) Keeps Following This Pattern, A Bullish Reversal Could Be on the Horizon

Jasmycoin (JASMY) Soars With Key MA Breakout – Can Vechain (VET) Do the Same?