Bitcoin-macro decoupling discussion yet 'premature'; 10Y Treasury yield signals murky outlook: analysts

Quick Take Bitcoin and other major cryptocurrencies fell on Wednesday following Trump’s additional tariff measures. Analysts said bitcoin is still highly correlated to U.S. macroeconomic situations, given its recent price movements. U.S. Treasury yields also rose considerably on Wednesday, which shows “shrinking appetite” for risk assets including crypto.

Bitcoin price fell again with most other major cryptocurrencies in Asia afternoon hours, as both crypto and TradFi traders become increasingly concerned about U.S. President Donald Trump's unwavering tariff measures and imminent impact.

As of 5:40 p.m. in Hong Kong on Wednesday, bitcoin fell 2.25% in the past 24 hours to trade at $77,289, The Block's bitcoin price page shows. The world's largest cryptocurrency has gone down to depths of around $74,775 earlier today but has since recovered under increased volatility.

Wednesday's slump took place as Trump's additional reciprocal tariffs went live, including a 104% tariff on China. Global equities felt the impact. Major Asian stock indices in Japan, South Korea, India and Taiwan saw declines on Wednesday and U.S. indices retreated Tuesday before the tariffs took effect. The Shanghai Composite, however, added 1.3% at close.

"As investors had been cautiously optimistic about a potential bottoming out of the recent selloff, this tariff hike has caught many off guard, forcing a reevaluation of their investment strategies and risk appetite," said Kevin Guo, director of HashKey Research.

Bitcoin experienced a bull run to $108,000 in the months following Donald Trump's election. However, his subsequent tariff policies extinguished that growth, resulting in around a 26% drop since his January inauguration.

Alongside bitcoin, ether lost 6.1% to trade at $1,475, while the top 30 cryptocurrencies in total are down 2.98%, according to the GMCI 30 Index .

Tied to macro

Analysts said bitcoin's latest price move shows that the cryptocurrency is still "deeply integrated" with the U.S. economy.

"Claims of bitcoin's decoupling from traditional markets seem premature to me," said OKX Global Chief Commercial Officer Lennix Lai. "While there are encouraging signs of weakening correlation with equities, bitcoin remains tied to global liquidity conditions — whilst gold remains as a hedge against geopolitical instability."

However, market experts expressed optimism that bitcoin has the potential to become the preeminent digital store of value in the future.

"Bitcoin has the opportunity to truly become digital gold once investors price in its long-term value, beyond its current status as a risk-on asset," Nick Ruck, director at LVRG Research said. "Currently, its fundamentals are largely driven by the trade effects of mining, such as tariffs on mining machine chips, although speculation plays a more significant role."

Meanwhile, Presto Research Analyst Rick Maeda suggested that the tariff-driven chaos could ultimately benefit bitcoin's long-term trajectory.

"Tariff implementation, while a concern, could mark a transition from uncertainty to clarity — potentially stabilizing risk sentiment," Maeda said. "If macro fears ease or tariffs catalyze negotiations, crypto could not only rebound but resume a structural uptrend."

US Treasury Yields

Following the latest Trump tariffs, the U.S. 10-year Treasury Yields ran up to a high of over 4.5% earlier today, while the 30-year Yield reached over 5%, according to CNBC's data . The 4.5% reflects a 45 basis point growth in the 10-year yield in less than one week.

U.S. Treasury yields reflect the return investors earn on government bonds. When yields rise, it indicates that bond prices are falling — often because investors are selling them.

The 10-year yield has currently backtracked to 4.33%, while the 30-year yield stands at 4.8%.

"The yield on the 10-year just hit 4.5%, and the yield on the 30-year just hit 5%," Peter Schiff, a renowned financial commentator, wrote on X. "Without an emergency rate cut tomorrow morning and the announcement of a massive QE program, tomorrow could be a 1987-style stock market crash."

A rising 10-year yield typically reflects one or more of several possible factors, including expectations of higher inflation, a stronger-than-expected economy, anticipation of prolonged periods of elevated interest rates, or growing concerns around fiscal stability, according to BTC Markets Analyst Rachael Lucas.

"But here’s the twist: right now, yields are rising while equities like the S&P 500 are falling," Lucas said. "That tells us this isn’t just about stronger growth. It’s about stress and a sign of tightening liquidity. Money is getting more expensive. Borrowing is costlier. Risk appetite is shrinking."

The crypto analyst said this points to "broader pressure" across markets.

"This is not the environment where speculative assets thrive … And that includes crypto," Lucas said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

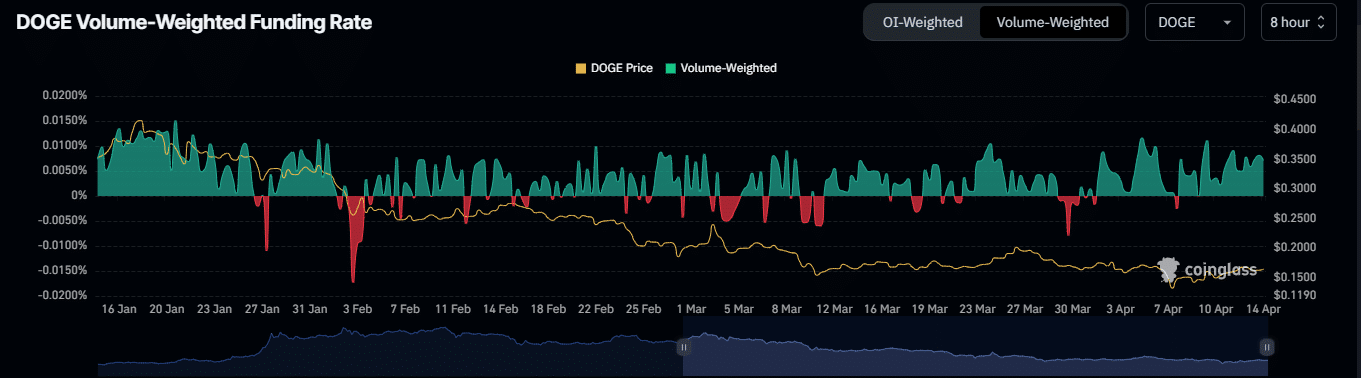

Potential Dogecoin Rally Ahead as Key Support Level and Increased Buying Interest Emerge

Market Insights: Short-Term Recovery Signals for BONK, ALCH, and Bitcoin

In Brief Analyst Pseudonym identifies recovery signals in BONK, ALCH, and Bitcoin. Short-term trading strategies recommended for cautious positions. Increasing interest in meme tokens amid market volatility.

Ethereum Price Fluctuations Ignite Technical Analysis and Strategic Forecasts

In Brief Ethereum's price fluctuations shift focus to technical indicators among market players. Analysts signal potential recovery and long-term growth opportunities for Ethereum. Competition from networks like Solana raises challenges for Ethereum's market position.

Market Turmoil: Investors React as OM Coin Crashes 90%

In Brief OM Coin experiences a dramatic 90% drop, alarming the crypto market. IP Coin's price decline raises investor concerns about potential panic sales. Support levels for IP Coin are being closely monitored following recent fluctuations.