HBAR Price Needs 22% Rise To Reach $0.20; TikTok Bid Could Make It Happen

Hedera’s potential partnership with TikTok has sparked investor optimism, signaling a possible 22% rally for HBAR toward $0.20. Rising inflows and bullish sentiment could help the altcoin overcome key resistance.

Hedera (HBAR) has faced a downtrend recently, with the crypto asset’s price failing to maintain support at $0.200. This failure to establish a solid base has led to a pullback.

However, key developments within the Hedera ecosystem and shifting investor sentiment could spark a potential price rally in the coming days.

HBAR Foundation Eyes TikTok

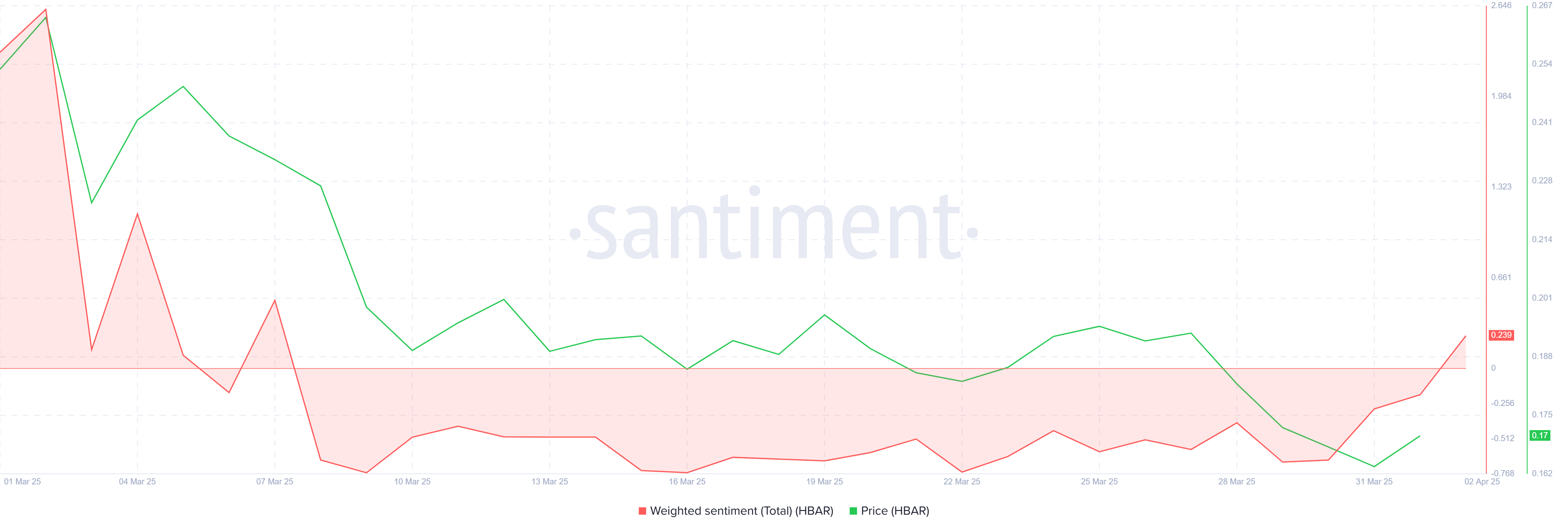

After nearly a month of bearish sentiment, investors are beginning to shift their stance towards bullishness. The Hedera Foundation’s recent move to team up with Zoopto for a late-stage bid to acquire TikTok has played a pivotal role in this shift. If the acquisition is approved, the partnership could expose HBAR to a massive audience due to TikTok’s extensive user base, potentially driving up demand and mainstream adoption.

The prospect of this collaboration has reignited interest among investors, sparking optimism about Hedera’s future growth potential. With TikTok’s wide-reaching influence, the strategic partnership could offer Hedera an edge in the competitive crypto market, encouraging further accumulation of HBAR tokens.

HBAR Investor Sentiment. Source:

Santiment

HBAR Investor Sentiment. Source:

Santiment

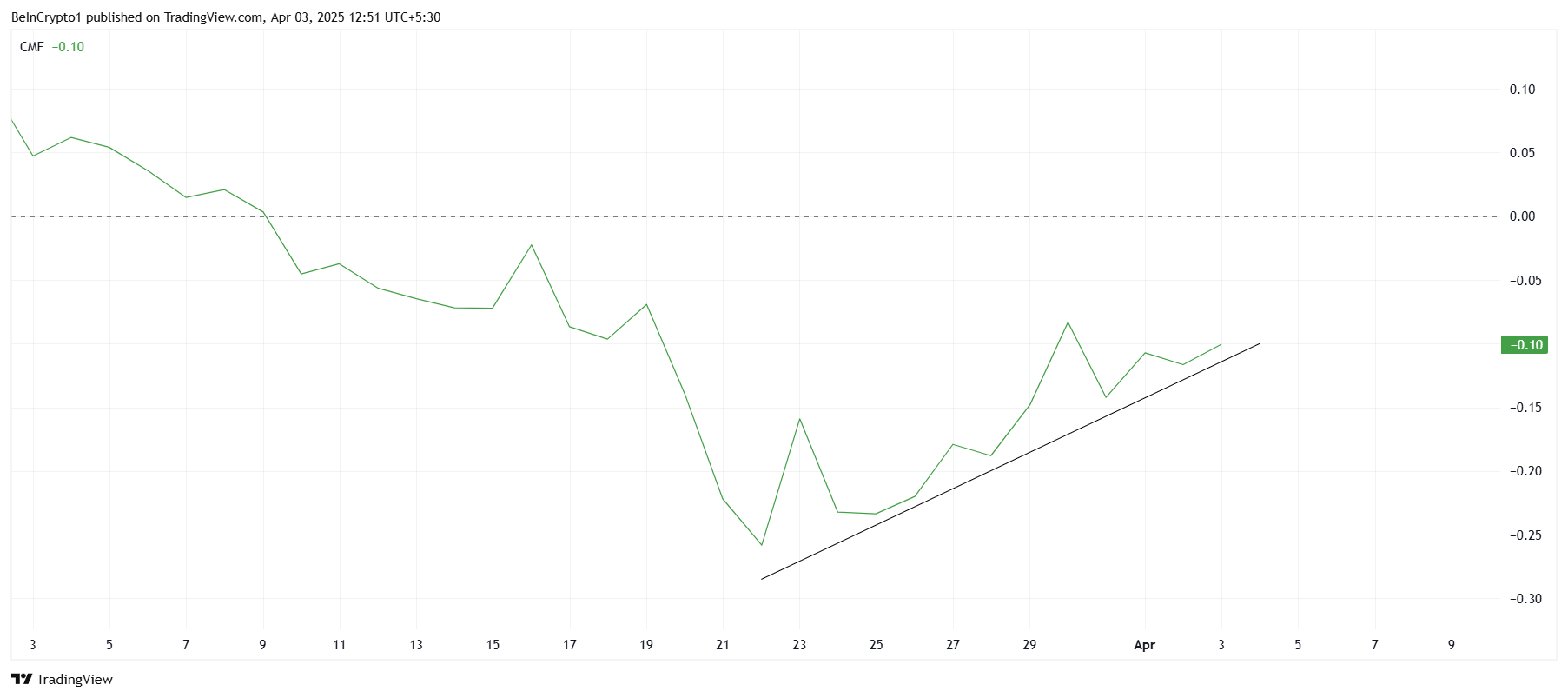

On the technical front, the Chaikin Money Flow (CMF) indicator is showing signs of recovery. The CMF has started to tick upwards, signaling a potential increase in inflows. While it hasn’t yet crossed above the zero line, the growing positive momentum indicates that more capital could be entering the market. Continued inflows could provide the necessary push for HBAR to break through key resistance levels.

The increase in capital flow suggests a strengthening of investor confidence. However, for a sustained rally, more substantial buying pressure will be required to move HBAR above its current price point. If this trend continues, HBAR may see a rise in both investor interest and market value in the near future.

HBAR CMF. Source:

TradingView

HBAR CMF. Source:

TradingView

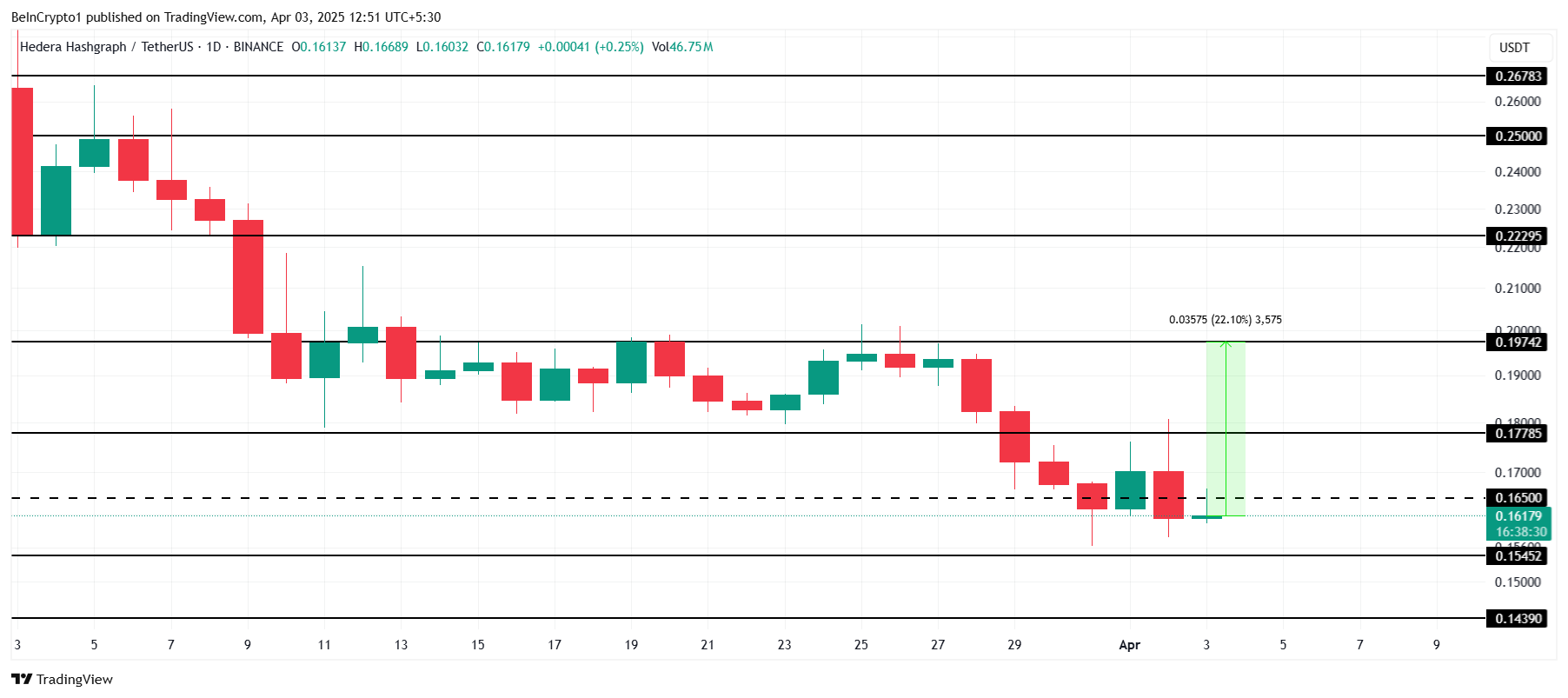

HBAR Price Finds Support

Currently, HBAR is priced at $0.161, just under the key resistance level of $0.165. The next significant resistance lies at $0.197, which has acted as a barrier to HBAR’s price recovery. With a 22% gap between the current price and this resistance, overcoming this hurdle could pave the way for a move toward $0.200.

Given the positive developments surrounding Hedera, it is plausible that HBAR could move toward these resistance levels. If the token can breach $0.165 and then $0.177, the path to $0.197 becomes much clearer. This would mark a critical point for HBAR as it seeks to regain lost ground.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

However, if investors decide to take profits and sell before further upward movement, HBAR could fail to breach the $0.177 resistance. Such a scenario could push the price back down towards $0.154 or $0.143, invalidating the bullish outlook and prolonging the consolidation phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BlackRock CEO warns: US$36 trillion in national debt could 'crush' the economy

US Democrats to hold hearing next week to discuss Stop Trump’s Cryptocurrency Act

Tether CEO denies IPO plans, says $515 billion valuation is “conservative”