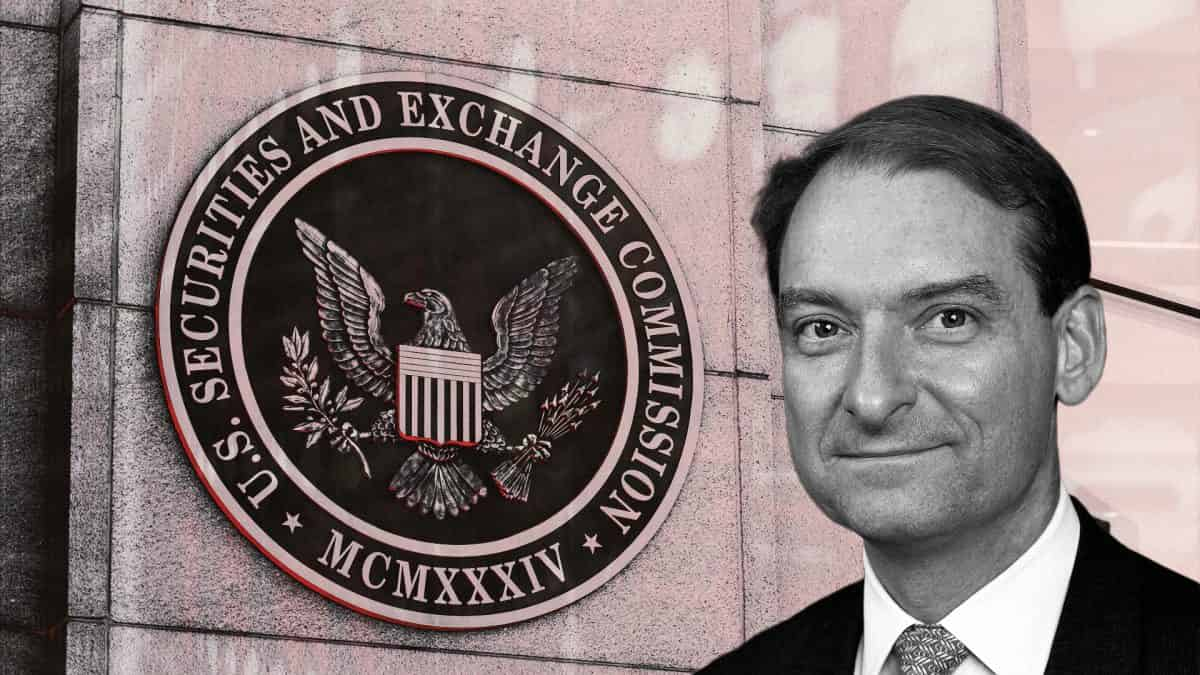

Senate banking panel votes to advance Trump's nomination of Paul Atkins to chair the SEC

Quick Take President Donald Trump tapped Atkins in December to lead the SEC. Atkins founded the consulting firm Patomak Global Partners in 2009. The firm has clients including banks, crypto exchanges and DeFi platforms.

The U.S. Senate Banking Committee voted to advance President Donald Trump's nomination of Paul Atkins to lead the U.S. Securities and Exchange Commission as the agency quickly adopts a friendlier approach to crypto.

That panel voted 13 to 11 on Thursday morning to move forward with Atkins' nomination, with all Democrats on the committee opposed. The panel also considered nominations for Jonathan Gould to be Comptroller of the Currency, Luke Pettit for assistant secretary of the Treasury, and Marcus Molinaro to be Federal Transit Administrator—all of which were advanced.

"Paul Atkins, a former SEC commissioner, will promote capital formation and provide much needed clarity for digital assets," said Senate Banking Committee Chair Tim Scott, R-S.C. "Under his leadership, the SEC will return to its core mission and will ensure our markets remain the envy of the world."

President Trump tapped Atkins in December to lead the SEC. Atkins founded the consulting firm Patomak Global Partners in 2009, and the firm has clients including banks, crypto exchanges and DeFi platforms, according to its website. Atkins was appointed by former President George W. Bush as an SEC commissioner from 2002 to 2008.

The SEC is, and has already, taken a new and different approach to regulating crypto after former Chair Gary Gensler took a more wary viewpoint of the digital asset industry. Since Gensler's exit in January, the SEC has rescinded controversial crypto accounting guidance, dropped enforcement actions against major crypto industry players and created a crypto task force.

During a hearing to discuss the nominations last week, Atkins said he would make creating a regulatory framework for digital assets a "top priority" in prepared testimony. During that hearing, Atkins received pushback from top Democrat Sen. Elizabeth Warren, D-Mass., over his ties to collapsed crypto exchange FTX and President Trump's possible conflicts of interest with the rise of his memecoin.

According to multiple news reports, including The Wall Street Journal , FTX was a client of Patomak Global Partners and signed on as an adviser to FTX in early 2022. FTX filed for bankruptcy in late 2022 and the exchange's CEO, Sam Bankman-Fried, was found guilty in November 2023 of seven criminal counts.

"He [Atkins] has spent his post-government career helping billionaire scammers like CEO Sam Bankman-Fried get even richer," Warren said on Thursday.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TradFi's deep liquidity issue is crypto's silent structural risk

Fidelity files for Solana ETF with staking option in US

Chamath projects $600 billion hit to US economy from tariffs, interest rate cuts

Ethereum Maintains Support, Attracts Institutions Despite ETF Outflows