South Korea may open up local crypto market to foreign investors if AML strengthens: report

Quick Take South Korea’s FSC indicated it might ease restrictions regarding foreign investors trading on local exchanges if AML capabilities improve. Unlocking the local market to foreign investors would further boost the USD stablecoin market and revitalize the South Korean crypto industry, one analyst said.

South Korea's top financial regulator said it could possibly open the doors for foreigners to invest in the local cryptocurrency market under the condition that domestic exchanges equip sufficient anti-money laundering capabilities.

Kim Sung-jin, the head of the virtual asset division under the Financial Services Commission, spoke during a Wednesday seminar at the National Assembly that he "agrees with" the direction that foreign investors should be allowed to access the domestic crypto market, local news outlet Bloter reported . Kim reportedly added that the commission will consider ways to attract global investors into the local market — and that current conditions could change if exchanges qualify regarding AML capabilities.

Foreign investors are currently restricted from trading on South Korean crypto exchanges, as local rules require strict know-your-customer standards on service providers. Local exchange users who want to trade cash-to-crypto need to use local bank accounts registered under their real names. "Korea imposes capital account restrictions — control over portfolio investments," said Peter Chung, Head of Research at Presto Research. "Allowing foreigners to trade crypto on Korean exchanges would mute such restrictions."

South Korea appears to be re-evaluating its long-standing capital controls to keep pace with the global trend of crypto innovation being led by the U.S. administration under President Trump. Chung told The Block that South Korea's potential unlocking of the local crypto market could bring more vitality to its crypto industry, as well as spur further growth of the USD stablecoin market. This would also eliminate the Kimchi Premium , which is the discrepancy between the price of cryptocurrencies on local exchanges and elsewhere, as global liquidity is restricted from entering the market.

Chung added that South Korean regulators currently view that local exchanges are not yet equipped to handle AML duties sufficiently, which is implied in the FSC official's latest comments. Prior to enforcing KYC requirements and establishing the country's first-ever crypto legal framework, the FSC put an AML measure in place in March 2022 by adopting the Travel Rule . The rule, aligned with the Financial Action Task Force's recommendation, mandates that exchanges collect and store information about the sender and recipient of crypto transactions above the amount of one million won ($681.38). Major Korean exchanges recently notified that they will apply the Travel Rule on transactions below the threshold.

Earlier this year, the Financial Intelligence Unit of South Korea imposed a penalty on Upbit , the largest cryptocurrency exchange in the country, for allegedly supporting transactions with dozens of unregistered foreign exchanges. The penalty, however, has been halted after a Seoul court granted Upbit's injunction.

South Korea is home to one of the largest cryptocurrency markets in the world — which is also known as being altcoin-heavy. In March, Upbit had over $85 billion in monthly trade volume.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

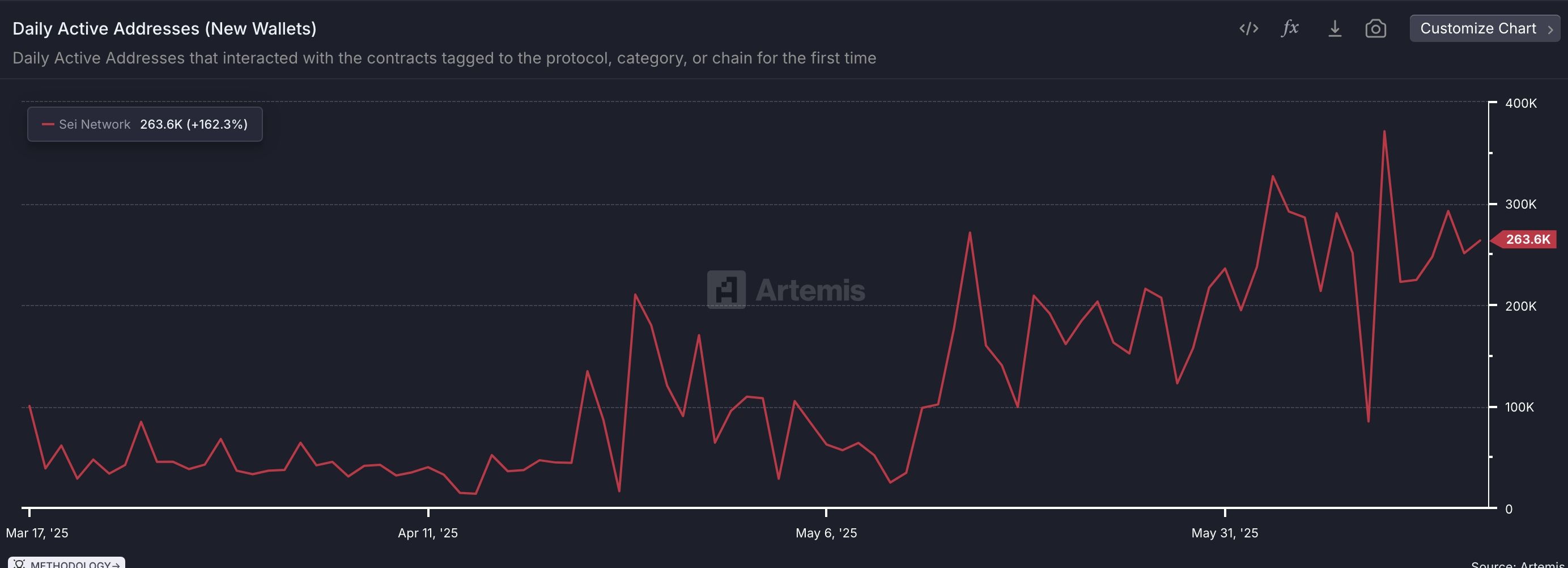

Sei price may crash 22% and then rebound

XRP price prediction: analyst sees 500% breakout as charts mirror 2017 rally

Hyperliquid price forecast: HYPE pauses price discovery after its ATH

$1B in Dogecoin Volume: Get Ready for the Next Big Swing