Market Drop After Trump's Tariff Announcement

On April 2, 2025, Donald Trump spoke from the Rose Garden of the White House to announce a series of unprecedented protectionist measures, as part of what he now calls the “Economic Liberation Day”. Staying true to his America First creed, the American president detailed a decree imposing massive tariffs aimed at re-industrializing the country and reducing its dependence on foreign imports. Unfortunately, the markets were not expecting what would follow…

Donald Trump announces a new wave of tariffs

In a nearly 45-minute speech on Wednesday, April 2 in the United States, Donald Trump announced a series of new tariffs as part of his “Liberation Day”. Here are the main points!

Base rate of 10% on all trading partners

All countries will be subject to a floor tariff of 10%. This rate may increase depending on the trade practices of each nation.

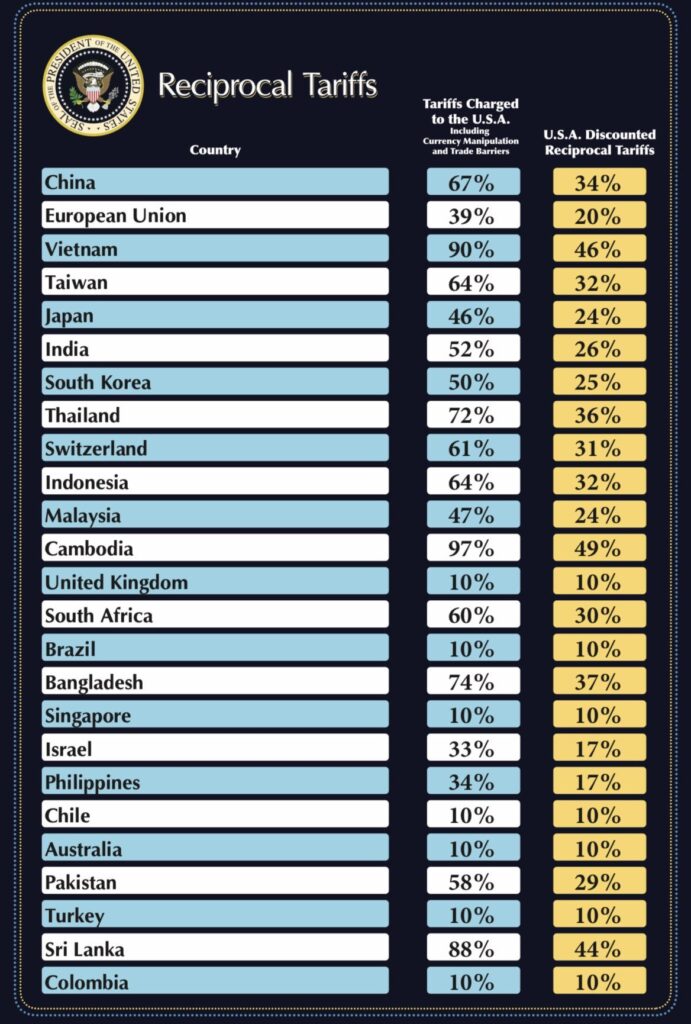

Specific tariffs by country:

- 20% on products imported from the European Union

- 34% on imports from China

- 46% on Vietnam

- 24% on Japan

Trump justifies these disparities by the accumulation of tariffs, non-monetary barriers, and other “forms of cheating” used by these countries.

Tariffs imposed by Donald Trump.

Tariffs imposed by Donald Trump.

Principle of partial reciprocity

“What they impose on us, we will impose on them half of it,” Donald Trump stated, acknowledging that reciprocity will not be total to avoid excessive tensions with certain partners.

25% tariff on foreign automotive imports

Starting this Thursday, April 3 at midnight, any imported car will be taxed at 25%. A measure aimed at forcing automakers to relocate their production.

Tacit ban on industrial relocation

The American president emphasized that “no company will be allowed to set up in other countries,” clearly targeting major American firms that have moved their production.

Donald Trump described this policy as “the declaration of economic independence of America,” stating that it would inaugurate a new golden age, marked by the return of factories, jobs, and lower prices for consumers. What will be the reaction of the stock markets?

Immediate reaction of the markets!

The stock markets reacted immediately to Donald Trump’s statements, with a significant drop in shares. The technology (XLK) and discretionary consumption (XLY) sectors were the hardest hit, recording a decline of about 3% in after-hours trading. Major stocks like Nvidia (NVDA) , Amazon (AMZN), and Tesla (TSLA) fell by more than 4%.

Trump’s announcement regarding the new tariffs marks a turning point in his protectionist policy, aimed at re-industrializing America. However, this offensive from Liberation Day has quickly shaken the markets, triggering significant declines in key sectors. The long-term impact on the global economy remains uncertain and could trigger a wave of panic .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Altcoin Bulls Hold Strong Despite Bearish Sentiment

While 90% turn bearish, altcoin believers say the best of the cycle is still ahead.Bullish Hope in a Bearish CrowdWhy the Altcoin Market Feels Weak Right NowThe Opportunity Behind the Fear

DWF Labs Partners: Hold USD1 to get Falcon Finance closed beta test qualification

DWF Labs Partner: $250 million liquidity fund currently has $184 million left

BNB breaks through $590