Bitcoin ETFs Face Heavy Sell-Off With $158 Million Exit

Bitcoin ETFs Extend Losing Streak With $158M Outflow As Ether ETFs Also Retreat

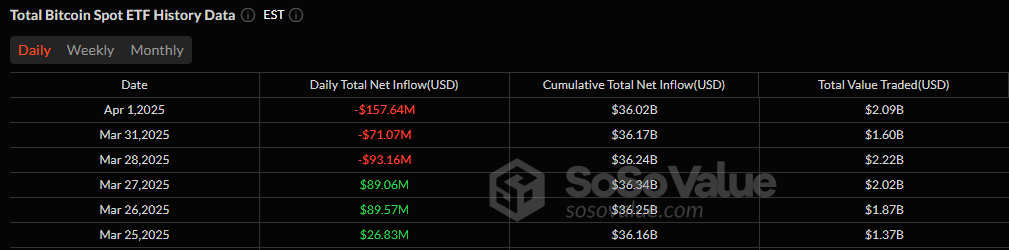

The bleeding continued for bitcoin ETFs on the first day of April, with a 3rd straight day of outflows. The hefty $157.64 million exit reinforced bearish sentiment in the crypto ETF space.

Ark 21shares’ ARKB led the sell-off with a substantial $87.37 million outflow, followed by Fidelity’s FBTC with $85.35 million in redemptions. Grayscale’s GBTC and Wisdomtree’s BTCW also recorded outflows of $10.07 million and $6.76 million, respectively.

Source: Sosovalue

Not all funds were in the red, though. Bitwise’s BITB pulled in $24.53 million, while Franklin’s EZBC added $7.39 million, but these inflows did little to counter the broader exodus. At the end of the trading day, bitcoin ETF net assets stood at $95.45 billion, with total trading volume surging to $2.09 billion.

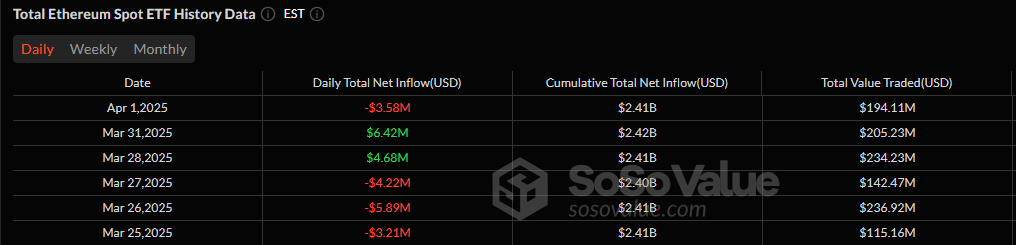

Ether ETFs, after two brief days of inflows, fell back into negative territory with a $3.58 million outflow. Grayscale’s ETH led the decline, losing $2.7 million, while Bitwise’s ETHW shed $2.6 million.

Source: Sosovalue

A modest $1.72 million inflow from 21shares’ CETH wasn’t enough to change the tide, as total net assets for ether ETFs settled at $6.54 billion, with daily trading volume reaching $194.11 million.

With crypto markets facing macroeconomic uncertainty and renewed investor caution, the ETF space continues to see capital flight. Bitcoin ETFs are now navigating a renewed sell-off, while ether ETFs struggle to break out of their long-term downtrend. The question remains: How long will the sell-off last?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chainlink Champions Stablecoin Boom with Integrated Blockchain Solutions

In Brief Nazarov predicts global stablecoin growth driven by U.S. regulations, emphasizing transparency. Chainlink uniquely integrates proof of reserve and blockchain connectivity, enhancing trust. Chainlink prepares for future compliance, offering a unified solution for complex transactions.

PEPE To Bounce Back? Familiar Fractal Signals Potential Major Rally Ahead

Popcat (POPCAT) To Rally Higher? Key Fractal Pattern Signals Major Upside Move

LINK Eyes Breakout as Bullish Divergence Hints at New Highs