Saylor hints at new Bitcoin purchase as holdings surpass 500,000 BTC

Key Takeaways

- Strategy purchased 6,911 BTC for $584.1 million increasing total holdings to 506,137 BTC.

- The company plans a $42 billion capital raise to further expand their Bitcoin acquisitions.

Michael Saylor, Executive Chairman of Strategy, has hinted at an impending Bitcoin acquisition following a recent purchase that pushed the company’s total holdings beyond 500,000 BTC.

On March 30, Saylor shared Strategy’s Bitcoin portfolio tracker on X with the caption, “Needs even more Orange,” suggesting the company remains committed to expanding its Bitcoin reserves.

These posts have historically preceded new Bitcoin acquisition announcements within the following week.

On Monday, Strategy announced that it had added 6,911 BTC , worth approximately $584 million, to its holdings. The purchase was made at an average price of $84,529 per Bitcoin between March 17 and March 23.

With this latest acquisition, the Nasdaq-listed company has increased its Bitcoin holdings to 506,137 BTC, valued at over $42 billion at current market prices, making it the first publicly traded firm to surpass 500,000 BTC.

Strategy acquired its Bitcoin at an average price of $66,608 per BTC, with total costs amounting to approximately $33.7 billion, including fees and expenses, according to data from SaylorTracker.

Despite recent price fluctuations, the company still holds $8.3 billion in unrealized gains.

Bitcoin is currently trading at $83,000, showing a slight recovery after dipping to $82,100 on Saturday, per TradingView .

Strategy’s STRF Perpetual Preferred Stock Offering

On March 21, Strategy announced the pricing of its 10.00% Series A Perpetual Strife Preferred Stock (STRF) offering .

The company increased the stock offering from $500 million to $722.5 million, aiming to raise approximately $711 million in net proceeds to fund further Bitcoin acquisitions and support operations.

The offering was scheduled to settle on March 25, subject to customary closing conditions. This move is part of the company’s “21/21 plan,” which targets a total capital raise of $42 billion for Bitcoin acquisitions.

Strategy has previously used portions of the net proceeds from the STRK and MSTR stock offerings to finance its Bitcoin plan.

Earlier this month, the company sold 13,100 STRK shares for approximately $1.1 million, with $20.99 billion worth of STRK shares still available for issuance and sale under the program.

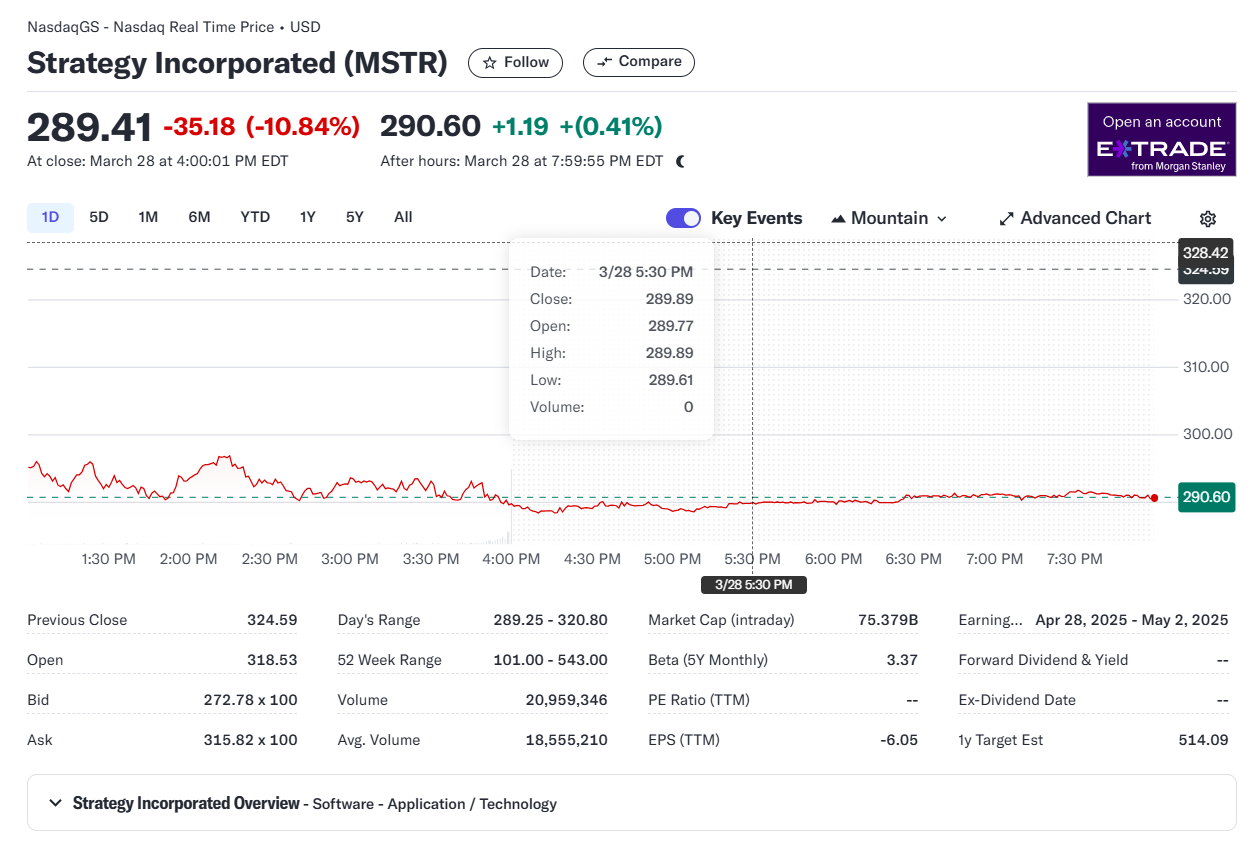

Strategy’s stock, MSTR, closed down nearly 11% on Friday at $289, according to Yahoo Finance data.

Although the stock has surged by approximately 70% in the past year, its performance year-to-date has been negative.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Invest $30K Today, Get $705K at Listing? Arctic Pablo’s Avalon Stage Could Make You Rich While Fartboy and Daddy Tate Also Surging

Explore Arctic Pablo Coin’s epic meme coin presale at $0.00034 with 2252.94% ROI, plus latest updates on Fartboy & Daddy Tate. Don’t miss this crypto trio!Arctic Pablo Coin’s Legendary Path: A Meme Coin Presale Blending Myth with MoonshotsFartboy Rallies Meme Army with Twitter Battle and Celebrity TagDaddy Tate Fires Up Chart as Burn Rate Spikes Ahead of July HalvingFinal Verdict: The Wealth Path Begins with Arctic Pablo Coin

SEC Delays Ruling on Franklin Templeton XRP ETF 🚨

SEC pushes decision on Franklin Templeton spot XRP ETF to July 22, opening a comment period. Major delay sparks fresh debate.What’s the Update on Franklin Templeton’s XRP ETF?Why the Delay MattersWhat Happens Next

Dogecoin Eyes $0.65 in Bullish Breakout

Dogecoin shows strong bullish signs with a potential rally toward $0.6533 and even $1.25 in sight.Price Targets: $0.6533 First, Then $1.25?What’s Fueling the Optimism?

Texas Governor Awaits Deadline on Bitcoin Reserve Bill